Target Circle Bonus

I’m a big Target fan. Their prices are competitive enough, the shopping carts roll very smoothly, employees and fellow shoppers are generally courteous, and I don’t feel like I need a shower after visiting. Likewise, I’ve found Target’s online shopping experience a pleasure. One angle I’ve enjoyed is the periodic Target Circle Bonus. This play has become even more intriguing since I’ve gone deeper with the Red Card, progressing from the debit to the Mastercard credit version. I’ve just now gotten around to optimally combining those two items. Today, I’ll explain what a Target Circle Bonus is and how I now maximize the offer.

Target Circle Bonus, Explained

Every so often, Target offers a Circle member a bonus reward for shopping, creatively named a Target Circle Bonus. First, members activate the offer in their online Circle accounts. Then, members shop at Target to satisfy the bonus requirements. The bonus variations make it fun. Some past examples we’ve received:

- Make three purchases of $60 or more, earn a $25 bonus

- Make two purchases of $100 or more, earn a $15 bonus

- Other examples here

After the purchase tracks, a Circle member receives the bonus earnings in their wallet. Conveniently, this bonus is added to any preexisting Target Circle earnings.

I’ve enjoyed using my Target Mastercard for 5% off all Target purchases. These savings stack with a Target Circle Bonus and other plays. But only recently have I truly maximized this stack on minimum purchases. To illustrate, I’ll share a recent example.

The Optimal Stack

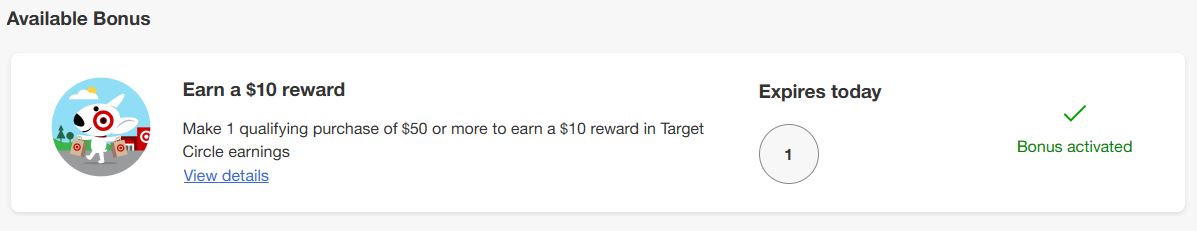

The Offer

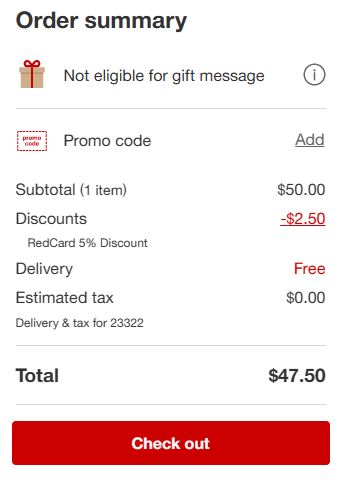

I recently received the above bonus offer. Making one purchase of $50 or more to earn $10 in rewards is a simple, solid return. I wanted to make an exact purchase of $50 to trigger the bonus. Plus, I planned to use my Red Card to incorporate the 5% off, bringing the total to $47.50.

The Conundrum

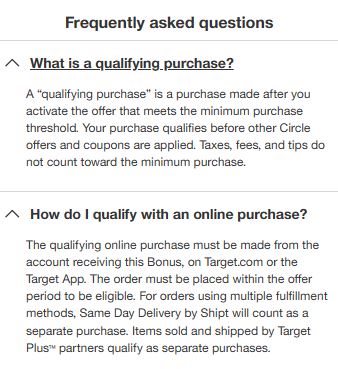

But I know that Target offers have some of the more stringent terms and conditions out there. Potential pitfalls are everywhere – myriad exclusions and different verbiage which can lead to many questions. Does the bonus offer take into account the order subtotal before the 5% off, or is it after those savings? Target sort of answers that here:

That said, I still wasn’t convinced. Target states, “your purchase qualifies before other Circle offers and coupons are applied.” But the 5% off with Red Card is considered a “discount” rather than a Circle offer or coupon (pictured below). Helpfully, an MtM Diamond member shared an experience reflecting the subtotal is what Target considers for the bonus. I decided to give it a try.

The Experiment

I decided to buy a $50 Google Play eGift Card. Indeed, I knew that third-party eGift cards had previously triggered Target Circle Bonuses. I was confident my experiment wouldn’t fail due to such an item. The 5% off provided the Target Red Card “discount” as usual, bringing the total to $47.50. I completed the order and subsequently received an app notification advising that I had met the Target Circle Bonus requirements. The $10 bonus reward was added to my Target Circle earnings balance. I received $60 in Target merch for $47.50 in spend, just over a 20% savings. Target uses the subtotal prior to 5% Red Card savings (and other offers and coupons) to determine bonus eligibility.

Conclusion

To many of you, I’m splitting hairs here. Guilty as charged. But I enjoy identifying how hard I can push on some of these promos. I bet I’m not alone here. And I could have gone even further with other offers and coupons, as the Target FAQ suggests. I probably will in the future, as long as it’s for items we already consume. The last thing I want to do is allow these Target promos to create unnecessary spending. How do you maximize the Target Circle Bonus angle with other offers?