Bank of America Application Process

I had several recent successes with Bank of America, including a small profit, a windfall of airline miles, and a retention offer. The purpose of this post is to share these with you to provide data points and also help you to see possibilities for your own situation. I originally shared the plan for some of these when I applied, provided some data points on what we thought was possible, and now can confirm that everything I hoped for became real. The Bank of America Application Process can be long but I will show you ways to improve your odds.

Bank of America Application Process Step 1 – Sign Up For A CD

I first shared a year ago that Bank of America wanted me to open a CD to get the Bank of America Alaska Airlines Visa Business Credit Card as a secured credit card (card details here). I opened the CD then sent in the required forms. They approved me for the card, and I got the miles from the welcome offer–all as expected.

I also shared that you could double dip this. We were able to use this same business CD for an application for my wife for the same card. Thus, we could use this one CD of $1,000 to secure two separate cards.

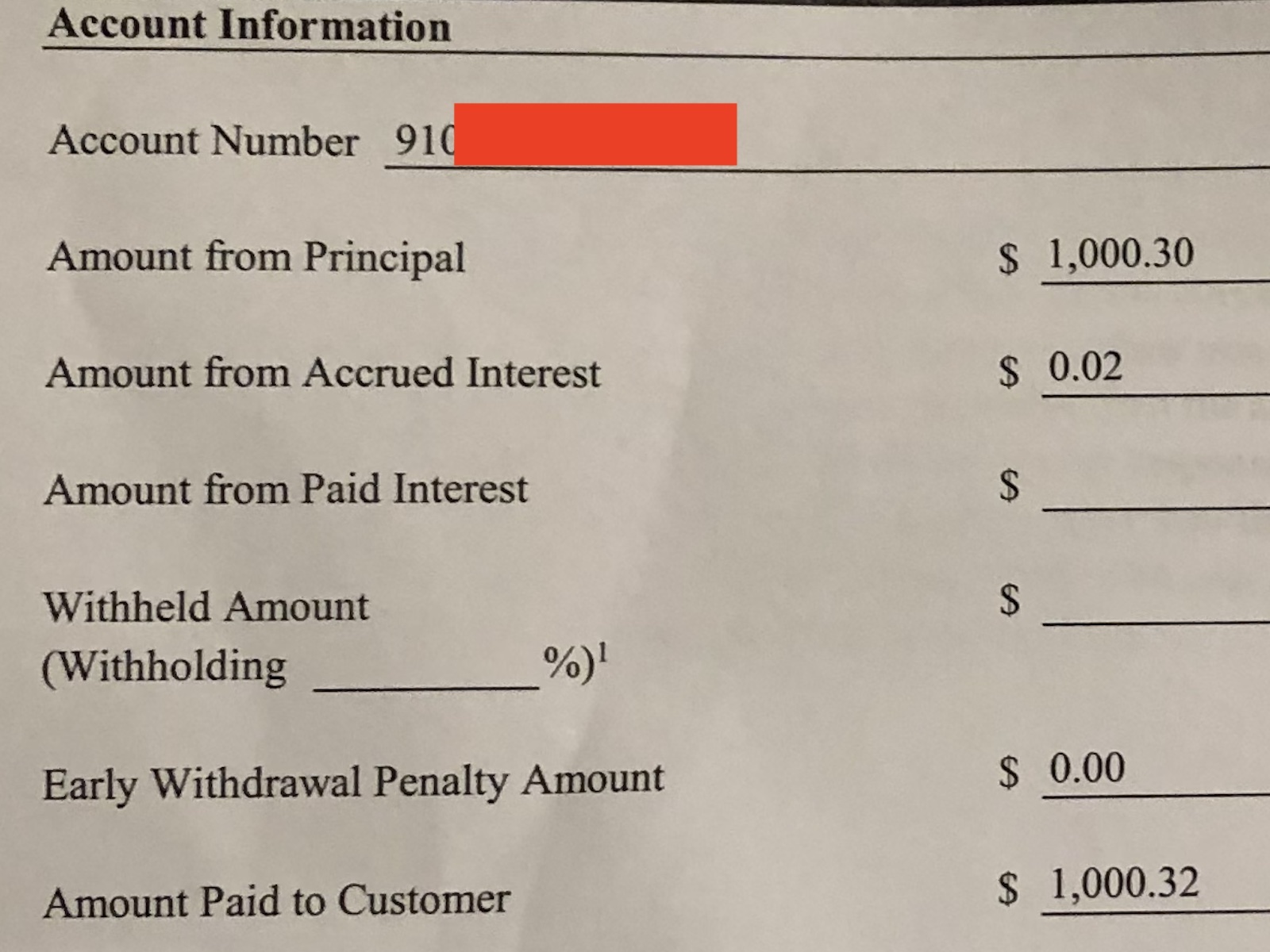

Now that the year has ended, what of the CD? The CD matured with a measly 32 cents of profit. No, there’s no digit missing. It’s a profit–a very small one. Since that wasn’t really the goal or primary concern, I’m fine with this. Yeah, I could’ve put that money somewhere else for a better return, but my goal was something else: the miles.

Also, Bank of America sent a letter in the mail to remind us about the CD maturity date. We had it marked on the calendar anyway, but it’s good to get a reminder. This way, we could close it without it rolling over automatically/fighting about fees/etc. later on.

Step 2 – Instant Approvals & Lots of Airline Miles

The real reason we opened the CD was to secure some credit card applications. The profit wasn’t the real priority–a good thing, since it was so small.

Since we used the CD to secure two separate applications, we were approved for two separate Bank of America Alaska Airlines Visa Business Credit Cards. Both of us received 40,000 Alaska Airlines miles, which our research shows to be worth around 2 cents per mile. That’s $1,600 in value for those miles between the two of us. We also got $200 in statement credits each, adding another $400 in value. These were part of the welcome offers on the cards during our applications.

Using the one CD to secure both of these applications was more than worth it for us. Just these two successes with Bank of America over the past 2 weeks already made us happy with the applications and outcomes.

Bonus Win – Retention Offer

This was a bit of an up-and-down element. When applying for the business card last year, I also applied for the personal version: the Bank of America Alaska Airlines Visa Credit Card. From the welcome offer, I received a total of 65,000 Alaska MileagePlan miles (valued at $1,300 or more).

Now that I’ve had the card for a year, I called for a retention offer (see our recent retention offer data points here).

At first, I was beyond elated. The phone rep told me the computer showed a retention offer of $100 statement credit PLUS waiving the $75 annual fee. Of course, I jumped at this. Then, when making notes in the computer, she informed me that I had to choose which one I wanted: the credit or waiving the annual fee. $100 > $75. That was simple.

Then, the let-down came: when reading me the terms, she discovered that I had to spend $1,500 on the card within the next 90 days, in order to get the $100 statement credit. I went from a free $175 to a free $100 and then ended with “spend $1,500 in 90 days to get a free $100”. That’s quite far down hill from where we started.

I still accepted the offer, but it felt like a real letdown after what I had thought I was getting. In the end, I still consider it a success, though not as great as the other Bank of America successes I described above.

Bank of America Application Process – Final Thoughts

Sometimes, just knowing what’s possible can help us. I wanted to see if the same CD could be used to secure more than one card, and I proved that it’s possible. My wife and I made a very small profit from it, but we achieved the real goal. We got a windfall of valuable airline miles by securing two cards with a small CD for a year. The number of phone calls involved was a bit circuitous. We had to get approval to change our cards to “unsecured” before they’d let us close the CD. However, we achieved all of our goals and now have data points to help others.

Ever done anything like this to achieve a windfall of miles? Got anything to share to help others? I’m all ears.

I was turned down for an AS card after being approved before, then I just opened a business savings account and have kept it just so I get easy BoA approvals, which has worked. The account has a $500 minumum and I keep it there except that before I apply for another AS business card I add $1000 to savings since they like people to have a $1500 CD. Has not failed me yet. The 500 just sits there with almost no interest but is worth all the approvals I have gotten.

My wife and I have had recent success after years of nothing. Each of us got the AK Air Sig Visa with 67k Mike’s after 8 k spend. Then I got the Virgin Atlantic MC with 60k Miles after 2 k spend. Plus 5k for adding my wife as AU.