Bank Of America Business Checking Fees Rules Have Changed

For those with Bank of America business checking accounts, their rules on account fees just changed. This is regarding how to get the monthly account fees waived. For our hobby, they made an important change in what counts (or what no longer counts) as qualifying activity. Here’s what you need to know.

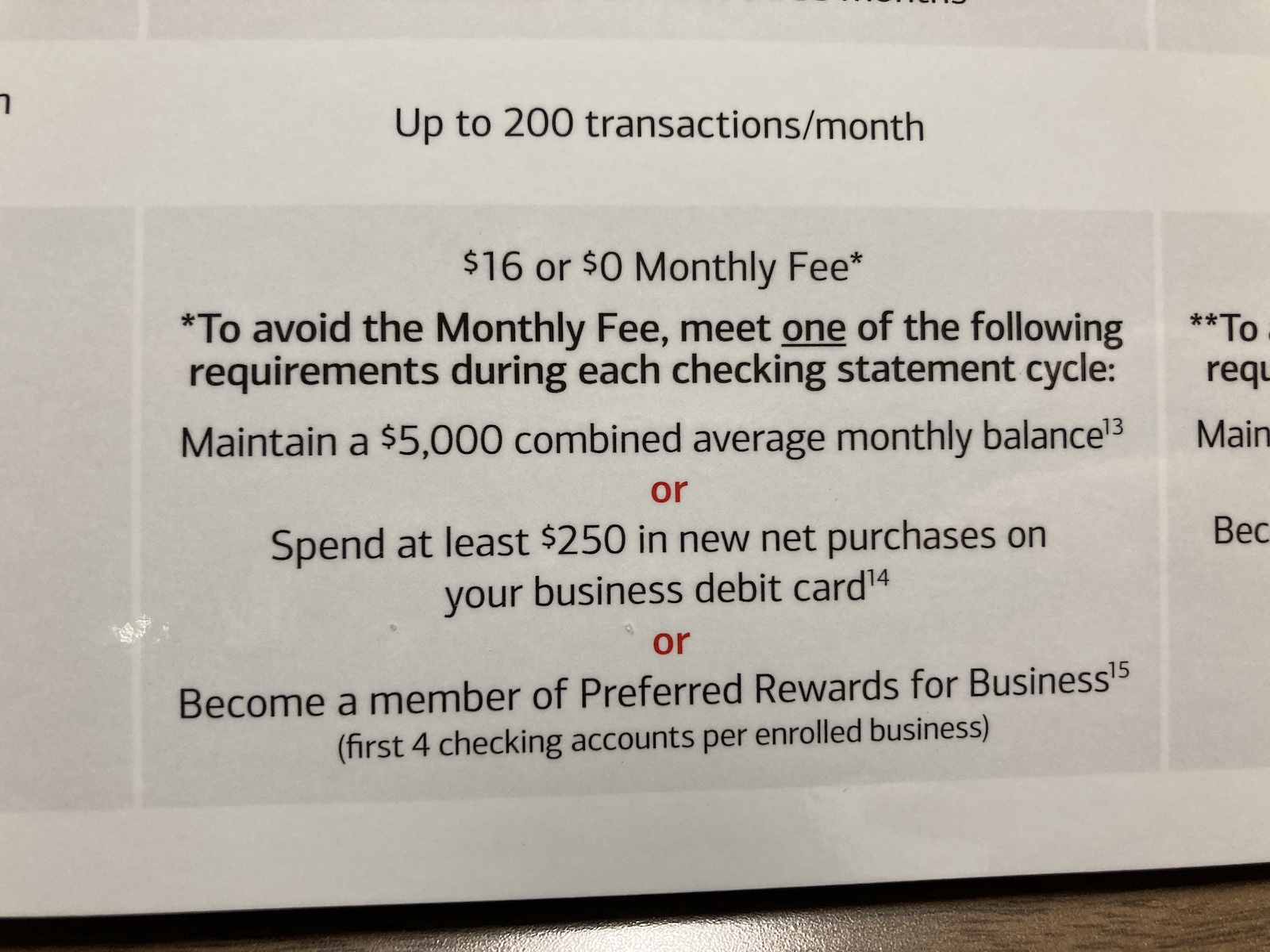

Bank Of America Business Checking Qualifying Activities

Until recently, “spend $250 or more per statement on a linked Bank of America business credit card” was on this list. Neither the phone rep nor the business banking specialist could tell me when this change went into effect. However, this is the new information all reps have on hand (if they pay attention to it). I took this picture in a business banking specialist’s office this week.

I first noticed this when my account showed a $17 monthly fee last month. I called Bank of America and asked about it. They informed me how I could avoid the fee, citing the information in the picture. I asked if credit card spend counted as a qualifying activity, and the phone rep said no. I said this previously was qualifying activity and that I didn’t like the change. The phone rep waived the fee as a one-time courtesy and I almost forgot about it.

The fee showed up again this week, so I went to a physical branch to close the account. The business banking specialist in the branch didn’t even know about this change and had to confirm it with someone. The info clearly didn’t get to her before I showed up. We confirmed it, and I closed the account to avoid the fee. I don’t use the account enough to meet the requirements. I have no plan to use the debit card to get the fees waived.

Final Thoughts

I opened this account just to help me get the Alaska Airlines Visa Business Credit Card, and I don’t really need it any longer. It’s always disappointing when there are less paths to getting fees waived. If you have a Bank of America business checking account, watch out for new fees on these accounts. In fact, while writing this article, I logged into my online account to see if the closed account still showed up or not, and I got this pop-up message about updated information. Better late than never.

This may be state specific. On my Business Fundamentals account (address is in MA), it lists business credit card spend as still a criteria to waive the monthly fee. It also lists this same information when browsing their site for checking fee waivers.

Brandon – definitely state specific. My account address is in FL, but the bank I went to in person was in NY. Looks like MA is doing you favors!

Not good news but good to know nonetheless.

Say Ryan, you’re the best person I know that writes about award sweet spots. I didn’t know how often you’re hunting for new ideas but it occurred to me that I hadn’t read anything in some years about mileage upgrade sweet spots, assuming they still even exist. I’ve generally used miles to fly long haul but sometimes there are really nice economy sales to Europe where a mileage upgrade might be worthwhile. I think that would be interesting and informative to readers.

Christian – I can look into this. I’ll need to read up on it to get smart about upgrades and when to make best use of them. Expect something next week.