Bank of America Card Shutdown With No Notice

Last week I talked about my recent application for the BofA Travel Rewards card. The main reason I decided to apply for that card is because I will soon become a Platinum Honors customer of Bank of America. Platinum Honors members get a 75% bonus on cashback earned on certain cards including the Travel Rewards cards. Basically that card goes from earning 1.5% back everywhere to 2.625%!

Another great card to have if you are Platinum Honors is their Cash Rewards card. That is because it earns 2% at grocery stores and wholesale clubs and 3% on gas. (Those categories have a combined cap of $2,500 per quarter.) Thankfully I didn’t need to apply for this card, because I have had one for awhile. Or, I did have one, but it disappeared.

Solving the Mystery

To find out what happened to my Cash Rewards card, I hopped on chat with Bank of America. I’ll skip through the pleasantries and get to the meat of the discussion. Here is why the agent said they closed my account.

Agent: Yes, I’m showing that account is closed

Me: When was it closed and why?

Agent: Checking the notes on the account now

Me: Thanks.

Agent: It was closed on 6/1/16 due to inactivity. If there is no activity on the account, the account can be closed.

Hmmmm. 6/1/16 you say? Strange that June 1 is the same day I applied for the Travel Rewards card. Also strange that the Cash Rewards card disappeared from my profile shortly after the approval. Still, she is right that I hadn’t used the card in awhile. To clarify, I did ask her how long an account needs to be inactive in order to be shutdown.

Me: How long does a card need to not have activity before you close it?

Agent: Usually, it is 6 moths to a year without any activity.

So that is their official policy, although in practice I have seen BofA cards left open with years of inactivity.

The Good News, Sort Of……

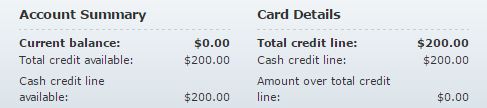

So the good news is that my wife also has a Cash Rewards card and she too will be Platinum Honors so that should work. Unfortunately, there is a bit of bad news as well. Last year in an effort to beef up her Alaska Airlines credit line for bank account funding, she reduced the line on the Cash Rewards card to just $200. Wah wah waaaaaaah. I guess we need to think about shifting credit back.

Conclusion

I am not quite sure what happened to my account. Perhaps when the new account was opened, the system automatically closed the inactive account. I refuse to believe it is a coincidence that the account was closed the same day as I opened a new card. Hopefully the account won’t show “Closed by Credit Grantor” on my credit report, but it probably will. A good reminder I suppose that it is never a bad idea to keep cards active by putting a small purchase on them every once in awhile. Lesson learned.

Same thing just happened to me closed without notice, due to inactvity. Nothing I can do. Not going to use BOA anymore to many problems. Customer service is a joke, very rude. They will mess up your credit.

New at this..Please delete my last name from Susan previous post don’t need anymore upsets..

I deleted the whole post – that is the only way to do it. So you will need to resubmit it – thanks!

Seems to me it would be pretty easy to put an monthly charge like a gym fee or something similar on a card like that set up with an automatic payment to prevent this from happening.

Hi Shawn. Nearly identical thing happened to me last November…. I had held the BA cash back card for over a decade, only using it rarely…. Then, I followed Drew @ TIF to hop on board the new BA Amtrak card (the choice transfer strategy) …. (they wouldn’t let me upgrade the one card to the other — originally, one rep had said yes in Sept., even approved it — but then later they reversed, something about you can’t upgrade from a no-fee to a fee card….. got a stateside senior supervisor involved too — who was apologetic, yet encouraged me to apply for the new Amtrak card as a separate application — which I did and was approved) Almost comically, soon after getting the new card, I logged on to my account (same credentials for both cards) — and within about 30 days, the original long held card had been cancelled….

I was dumbfounded…. Checked with various BA reps and they all said it was simple lack of use…. I’d received no such warning….. nor did it matter that I’d just opened up another account with them.

Only curious legacy is that my new card appears to show a very long credit history with BA — never mind that it’s only been open 7 months.

Does the 75% bonus apply to the 2% and 3% bonus categories as well? Meaning does 2% become 3.5% or 2.75% and 3% become 3.75% or 5.25%?

Yes – the percentage increases apply to the bonus amount as well.

Yes it would also apply.

Maybe they have different inactivity/approval rules when there’s a new application? From the bank’s point of view they may look at it as you still want one of their credit cards but you don’t use one they already have so they’ll close any accounts beyond xx days of inactivity to help make room for new accounts.

I’m just guessing here, but either way they handled this pretty poorly and if it was due to increasing your approval chances you should’ve definitely been given that option prior. The very least they could’ve done is notified you prior to account closure. I think the fact that they deviated from their standard snail-mail letter (as someone here noted) only proves that this was related to the new account.

Had the same experience a few years ago. BoA closed a dormant account without my knowledge. Most frustrating was the decent credit line I had on the account. Poof, no way to get it back, redistribute credit, nothing.

I would be checking your credit report because the same thing happened to me last year when fifth third bank closed a credit card and it dropped by 40 points. I had to call several different departments and follow up to make sure the credit score got corrected. It was a disaster and took 3 months to clear it up along with having to wait before applying for other cards. If the bank closes your account it is not good for your credit score no matter what they tell you. I also had an issue with BOA after cancelling the card due to annual fee. They never cancelled the card and i get a late payment notice. My score dropped another 40 points and when i called they told me it was their fault. Now i have to wait and check my score next month to see if it was corrected. What a joke!

is there any negative hit on your credit report because the bank closed it versus the impact if you had closed it yourself?

It’s a fine line. I sometimes leave cards inactive on purpose in hopes of attracting targeted bonus offers. Like the Barclay AA bonuses. I guess you need to be careful though.

My wife recently got notice that an old Home Depot card she has which we haven’t used in years is going to take her credit line down to like $1,000 due to inactivity. Not a great move either because it has a negative FICO effect I would think.

My wife has Cash Rewards card too and in the past we have received notice from BofA that there is no activity on your account for 24 months and if we wish to continue with the account we need to have an activity in next 30 days (I may be speculating but probably they send letters to platinum honors clients before closing their account for inactivity).

They didn’t send me a letter, but more importantly the account seemed to automatically close when the other one was opened.