Big Banks Are Spending More to Attract New Customers

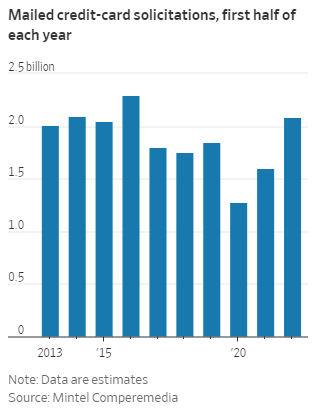

Big banks are spending more to add new customers and looking to increase credit card balances. Marketing expenses are up at major credit card issuers and new accounts are surging, even as the economy could be tilting toward a recession.

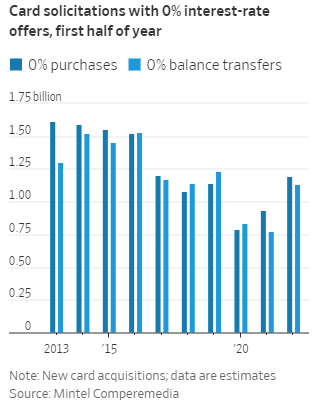

After a pause during the pandemic, we are now seeing once again promotions for zero-percent interest rates on purchases and balance transfers.

Big card issuers reported record levels of credit card spending for the second quarter. Chase saw a 1.09% increase for a total of $271.2 billion in purchases. That’s the highest amount dating back to at least 2004 and 33% above the fourth quarter of 2019, the last full pre-pandemic figure.

A slowing economy would normally prompt banks to pull back on lending. But, with low unemployment rates and credit-card delinquencies, banks are showing confidence in U.S. consumers.

The credit-card business has defied expectations since the pandemic began. Most card issuers expected that delinquencies would rise, but the opposite happened. Consumers actually paid down debt. Credit card debt fell to $748 billion in April 2021 from $913 billion in January 2020. Total debt has been rising recently, but remains below pre-pandemic norms.

Card issuers are pouring more money into marketing expenses, WSJ reports. Capital One, the second-largest U.S. issuer, is spending 62% more in marketing in the second quarter compared to a year prior. Discover’s marketing expenses increased by 45%. We have also seen many big bonuses especially form American Express, but also from other issuers.

All that, has resulted in new credit card accounts. Citi and Wells Fargo have reported 1.07 million and 524,000 new credit cards in the second quarter, up 18% and 62%, respectively, from a year earlier. Bank of America added 1.07 million, up 15%. Amex said that new U.S. consumer-card sign-ups for its premium Platinum card, Gold card and Delta Air Lines Inc. co-branded cards reached record highs in the second quarter.