Update: This offer has expired.

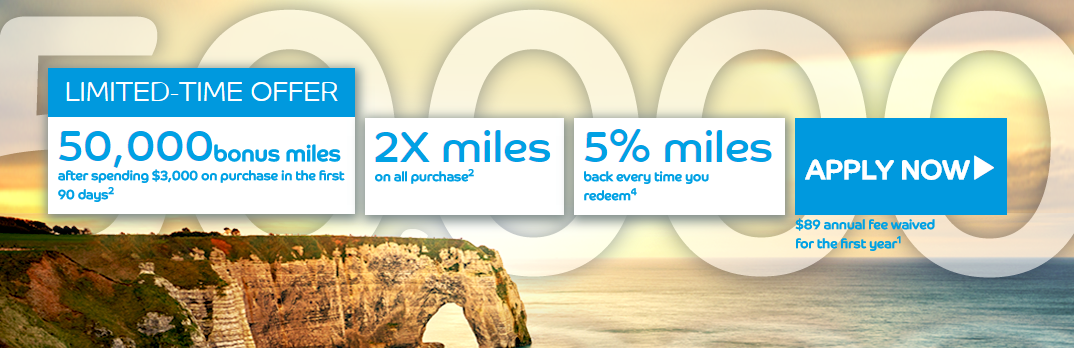

Barclaycard Arrival Plus 50K Bonus

Barclaycard is getting into the increased bonus game with a higher offer on their flagship travel rewards card, the Arrival Plus. Let’s take a look!

The Deal

- Earn 50,000 bonus miles (~$525) after spending $3,000 on purchases in the first 90 days. $89 annual fee is waived the first year.

Card Benefits

- 2X miles (2%) on every purchase.

- 5% rebate on travel redemptions.

- Chip and PIN.

- No foreign transaction fees.

- 5% rebate on travel redemptions.

Analysis

There are other 2% cashback cards out there without an annual fee, but you can’t argue with a $500+ bonus. Barclaycard doesn’t forbid you from getting the bonus again if you have had the card before, but they won’t approve you generally if you currently have the card. In my book this is a card to get, but not necessarily one to keep unless the chip & PIN along with the 5% rebate are enough the justify the $89 annual fee after the first year.

I have had three Arrival Plus cards in my life as has my wife. We actually do like them, but for our day to day spend have moved on to the BofA Travel Rewards card since we now earn 2.625% there. With that said, the Arrival Plus’s PIN feature is great, especially when traveling to Europe and using unmanned kiosks such as at train stations. Oh and that $500+ bonus is nice too.

Bonus Matches?

I have heard mixed reports over the years of Barclaycard matching bonuses, but haven’t seen any recent data points. If you have recently opened an Arrival Plus it is probably a good idea to ask for a match via secure message or phone call. It isn’t guaranteed, but it can’t hurt to ask. Feel free to share your experiences in the comments to help others.

Conclusion

The normal bonus on this card has been 40,000 miles FOREVER, so it is nice to see Barclaycard step up their game a bit. Given the tightening of the other banks lately, the overall value of this offer and the fact that Barclaycard pulls Transunion in most locales, this is a card to look at. Right now my wife and I both have an Arrival Plus so we won’t be applying, but if we didn’t have one, we would be all over this.

Have you had an Arrival Plus before? What are your opinions on the card? Let us know in the comments!

HT: Doctor of Credit

[…] about a year ago Barclaycard raised the bonus on their Arrival+ from 40K to 50K points. While I believe it was […]

[…] Barclaycard Arrival Plus 50K Bonus: Analysis, Matches & Why It Might Make Sense to Apply […]

Hi Jonathan, you must close your Arrival CC first before applying for the Arrival+. I would wait at least one month after closing your Arrival CC.

Why the 1 month? Where does it say that’s a hard rule? Asking since I closed my arrival yesterday and plan to apply for arrival plus in a few days. No data points anywhere that show how long you should wait b/w closing the no fee version and applying for the plus.

Not sure a month is necessary to wait. Don’t see any hard set rule on time to wait after closing regular arrival and applying for plus.

If I weren’t waiting for a bunch of credit cards to drop off from my credit report (in order to qualify for the CSR) I would apply for this. I’ve never had this card. Too bad it’s not a business card…

I’m in the same boat.

I downgraded my Arrival plus to Arrival after I got BofA Travel Rewards a few months ago. Can I apply now and get the sign on bonus?

Would the miles earned just remain in the new card if I have the no annual fee version or would they be combined? I downgraded the card like two years ago. Thanks.

I believe they are kept separate.