Barclaycard Stolen Card Double Charged

My wife has had her Barclaycard Arrival Plus for awhile and likes it for the 2% cashback, but admittedly them waiving the annual fee this year helped our decision to keep it. While it doesn’t give us the absolute best return, it’s still pretty good and thus we have some recurring charges on it. Unfortunately, a few weeks ago it became compromised.

In early August someone attempted to make a fraudulent charge on the card in the middle of the night. Luckily Barclaycard’s fraud algorithm caught it and they flagged the transaction and called my wife the next day. After confirming it wasn’t her charge, they quickly sent out a new card and life went on. Bravo Barclays.

Double Charged By Barclays

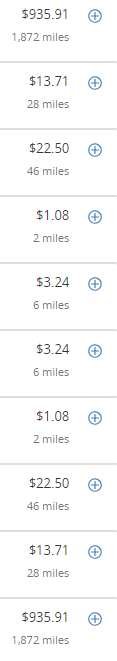

But the story doesn’t end there. I checked my wife’s Arrival Plus account the other day and noticed the balance was higher than it should be. I then went into the account and found that she had been double charged for several items. Take a look.

Keep in mind all of the above charges had posted to my wife’s account around August 1. They were charged and not pending and thus showed up on her balance as due. To save you the time matching them up, those are 5 charges that were each billed twice. So why did this happen?

Pending Charges Double

My wife quickly called up Barclaycard and discussed the situation with them. The agent investigated for awhile and determined that each of the above charges was pending when her new card was sent out. Apparently when they split the account from old number to new number, all pending charges got billed on each card. Yikes!

Barclaycard was quick to correct the error and make sure we were only charged once, but this is still a bit concerning. This is a good reminder of why you should ALWAYS double check your statements every month to look out for mysterious charges or in this case double charges.

Conclusion

The scenario of having a card number stolen and being issued a new card with pending charges is not unique. In today’s world of fraud it happens often and I hope Barclaycard can figure out a way to fix this glitch. In the mean time, I’ll remind myself of this moment every month when I am bored going over each charge on all of our accounts. This could have been an expensive oversight.

Has something similar every happened to you? Let us know in the comments.

I think serious account maintenance is part & parcel of managing points & loyalty programs. In the process I, too, have found fraudulent activity. As you say, it pays to stay on top of all accounts (even ones infrequently used) & monitor them regularly before errors/oversights/theft can get out of hand. Even if a bank makes you whole, better to deal with one to several items as you did rather than an overload.