Barclays AAdvantage Aviator Silver

American Airlines gets a lot of flak, much of it justified. But in my view, they’ve hit a grand slam – for their own interests and consumers – with the Loyalty Points initiative. Thanks to the program and some fortuitous opportunities, I picked up Executive Platinum status in 2022. I have no plans to do so this year, but I may try again in 2024 – stay tuned. American offers myriad opportunities for individuals to pick up Loyalty Points, which brings a substantial part of the fun. Bonus Loyalty Points from certain credit cards is one such method. The Barclays AAdvantage Aviator Silver card is in that group, but it’s not easy to obtain. But I recently discovered a potential method to pick up this card. I’ll get into that below, but first, let’s cover why you should care.

Barclays AAdvantage Aviator Silver Benefits

I’ve talked at length about the Silver elsewhere, but I’d like to again highlight a few of the primary benefits. In return for the $199 annual fee, the biggest perk is perhaps earning up to 15k bonus Loyalty Points. Cardholders earn 5k Loyalty Points after spending $20k, an additional 5k with $20k more, and a final 5k with $50k total spending in the AA elite status qualification year.

The Silver also comes with one of the wackier credit card benefits out there. Individuals are entitled to $25 back daily in statement credits on inflight food and beverage purchases when using the card on American Airlines operated flights.

Cardholders also get $50 back annually for wi-fi purchases on American flights. The card offers a few other benefits similar to other products: $100 Global Entry fee credit, baggage allowances, preferred boarding, etc.

The Catch

This card sounds great to some of you AA fans, right? Unfortunately, the Barclays AAdvantage Aviator Silver isn’t available for new applications. It’s only available via product change from another personal Aviator card. And even if an individual holds one of those, they aren’t necessarily eligible for an upgrade. So how can individuals convince Barclays to target them for an upgrade to the Silver?

How To Get Targeted, Maybe

Earlier this month, I shifted a substantial amount of credit limit to my Barclays AAdvantage Aviator Blue as an initial preparation for potentially going after Loyalty Points later in 2024. Indeed, I’ve been able to easily move credit across Barclays cards in the past, and it was just as simple this time.

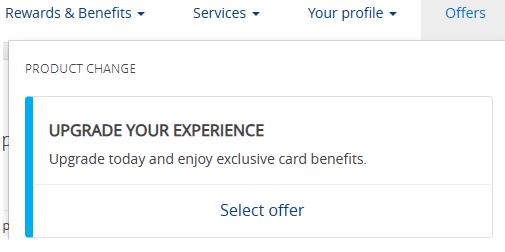

Soon after doing so, I started checking my Barclays online account to see if I was targeted for the Silver. Sure enough, about a week after moving credit to my Aviator Blue, I received what I expected. Within my Aviator Blue account in the top right corner under the Offers tab, I found the upgrade link (see above). I also found an upgrade link on the right panel of my Aviator Blue home screen (see below).

Is this simply a coincidence that the upgrade immediately followed my credit line shift? Perhaps, but I think probably not. Last year when I had a high credit limit on the Blue, Barclays targeted me for a Silver upgrade. After I shifted most of this credit back to my beloved Banana Republic card, the upgrade offer disappeared. These two data points indicate that carrying a higher credit limit on an Aviator card can potentially lead to a Silver upgrade offer.

Conclusion

I’m not ready to jump on the Silver upgrade yet, as again, I’m not chasing status this year. But maybe I will later in 2024. Perhaps I run the risk of the upgrade offer disappearing. Long story short, don’t be surprised if you see a future article from me on my preemptive upgrade to the Silver earlier than that.

It’s also worth noting that Barclays targeted my Aviator Blue card for a Red card upgrade in addition to the Silver. Some may find the Red better fits their needs than the Silver. Bigger picture, if you need more Loyalty Points and would like the Silver, consider shifting credit to your existing personal Aviator card to see what happens.

How are you earning bonus Loyalty Points, with credit cards or otherwise?

Benjy I stumbled on your recent article after the same experience. I transferred credit limit from an old largely unused Barclays View card (used to be the awesome Uber card!) to my Aviator Red this week and I had the offer to upgrade to the Aviator Silver this weekend. I’ve not had the offer before and have been watching for it since I’m interested in the 2 companion passes alongside the 5K loyalty point bump for $20K spend. I accepted the offer and should get the new card in a month.

Well done, Andrew!

The best perk by far is the 2 companion passes. I used to love the $25 in flight credit but they are making it harder and harder to use as only longer flights have snacks available for purchase. I believe over 1,250 miles?