Best Amex Credit Cards, What Is The Perfect 4 Card Wallet?

American Express recently reduced the limit allowed on credit cards from 5 to 4 per person. This is only for credit cards, since the cards without a preset limit have their own 10 card limit. The move was not all that surprising with the economy being in the dumps right now and it is really more of a return to the old. American Express used to have a 4 card limit but it creeped up to 5, or sometimes 6, after Amex took over Citi’s side of the Hilton portfolio too. That left me wondering, with the new lower limits what are the best Amex credit cards? What is the ideal 4 card Amex wallet? A lot will depend on your personal situation but I will give you some of my thoughts on that question.

The Perfect Amex Wallet

We are going to ignore cards without preset spending limits, like the Amex Gold and Platinum, since they have their own 10 card limit and are not included in the 4 card credit card limit. Your decision may vary greatly depending on your goals. If you are a Delta enthusiast and try to spend your way to status then you may simply carry the 4 Delta cards to rack up MQMs. If you love Hilton then you may lean towards those cards, and carry 3 of them, for the perks and free night certs. I am going to try to focus on a more general picture. I will also assume you can get both business and personal cards.

The Everyday Champion

The one Amex card that everyone with a business should get is the Blue Business Plus. You earn 2 Membership Rewards on all purchases, up to $50,000 in spend each year. The best part is they are fully transferable points. There is no need for an annual fee card like Chase and Citi to have access to transfer partners. This is one of the best cards on the market and in the top 2 or 3 for no fee cards as well. It is the one Amex card that everyone should get and it deserves a top spot in the 4 card wallet.

The Bonus Point Earner

Now that we have the everyday card out of the way we should focus on the best credit card for bonus spend. My pick would be the Amex Everyday Preferred. After making 30 transactions per statement period you can earn 4.5X Membership Rewards on grocery (up to $6000 per year), 3X on gas and 1.5X on everything else. It is a great backup card for everyday spend if you are a big spender and max out the $50K limit with the Blue Business+ card. I think the Everyday Preferred is kind of underrated in this space because of the lower grocery limits. I still think it is a great all around card and one of the best one card wallet options out there for most people.

Another option would be the Blue Cash Preferred if you prefer cashback. You earn 6% back on grocery spend, up to $6,000 per year, and 6% on streaming services. You also earn 3% back on gas, transit including taxis/rideshare, parking, tolls, trains and buses.

The Co-Brand Option

We now have everyday spend and a lot of bonus areas covered let’s focus on getting some co-branded action in the mix. I wanted to focus on something that has a good earning structure plus the opportunity to earn some extra goodies. I think the Hilton Surpass fits that bill perfectly. You can earn 6X on gas, grocery and restaurant purchases. You can also earn a free night certificate after spending $15,000 on the card in a calendar year. That adds another $250-$300 in value on top of the points you earn. This also gives us a great option for restaurant spend, an area we haven’t touched on yet. The card also comes with pretty valuable Hilton gold status, probably the best mid-tier hotel status out there.

The Perks Card Option

Okay, so we have all angles of spending pretty much covered with our first 3 cards but what about some perks? We still haven’t touched on lounge access, resort credits or top tier status. There are a couple of options for you. My first choice would be the Hilton Aspire card since the card essentially pays you to take it. Others may prefer the Bonvoy Brilliant card.

Dividing your loyalty between two brands can make some sense, since you would already have a Hilton card that comes with decent status. But the Brilliant card doesn’t have great spending categories AND its perks are not as valuable as the Aspire card’s perks. I will say, some people struggle to use the American Express airline incidental credit and Aspire resort credit and prefer the simplicity of the Brilliant’s credit.

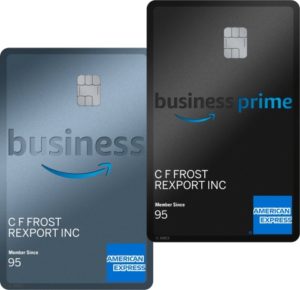

Bonus Option, The Card Often Overlooked

One option I wanted to bring up that kind of goes under the radar a bit is the Amex Amazon business card. The card allows you to earn 5% back on Amazon and Whole Foods purchases. I have this card in my current 5 card set up. Granted, I can usually do better than 5% by buying discounted Amazon gift cards but sometimes you just run out. Some people may prefer the simplicity of not chasing down every deal as well. However you want to slice it, this is a card that could slide into one of your 4 card slots for sure.

Best Amex Credit Cards – Final Thoughts

Hopefully I have given you something to chew on in regards to what the best Amex credit cards are. That is my ideal 4 credit card lineup with Amex. Remember that this does not include cards without a preset limit and it is not taking welcome offers into account. This is simply focusing on what the best long term strategy would be.

Please share your favorite 4 card lineup in the comments section below. I look forward to seeing what other people come up with.

As always, thank you Mark! (BTW, really enjoy the podcasts!)

I am on the opposite end… I actually have 5 AMEX credit cards, and they are mostly the high end ones, so, I am agonizing over cancelling my Delta Platinum Business, Hilton Aspire, Marriott Bonvoy Business, and, therefore, losing that extra slot. The others are the Business Plus and Everyday Preferred.

Would love to hear your thoughts on that one… (I know the world’s tiniest violin is screeching in my ear. 🙂 )

I am also at 5 right now too. Having to close 2 cards to open 1 new one is a tough pill to swallow for sure. If you are not chasing Marriott status and don’t need the 15 nights from the business card, since it now stacks with the 15 nights from a personal card, that should be an easy one to close. Same with Delta, unless you are spending for MQMs I don’t think the companion pass is going to be as valuable with prices being lower these days. That would free up a spot. I personally downgraded my Aspire in the hopes of getting an upgrade offer. If I don’t get one I will upgrade it back to the Aspire once travel is normal again. But I have already carried all of the personal Hilton cards so I wasn’t risking any welcome offers.

Hopefully that helps some and thanks for listening to the podcast doc! It is a labor of love for sure 🙂

Thank you, Mark!

My pleasure doc – always happy to see your name pop up in the comments 🙂

Right now I have the Amazon, HH Aspire, Bonvoy and Delta Gold. My wife has the HH Surpass Blue Bis Plus Bonvoy Brilliant and Delta Gold. We use the Gold Rewards for restaurant and grocery. Got rid of the BCP

That is a pretty solid lineup there. Got most things covered 🙂

There’s also the upgrade offers approach, so having cards in various groupings allows for this. You might not crush the bonus earning, but you’d have options for upgrading Delta Blue to Gold/Platinum, Surpass up to Aspire, Gold up to Platinum, etc. That’s another way to approach the concept of ‘what cards to hang onto’ for future prospects on upgrades.

Great point Ryan

Avios, Virgin and Flying Blue always have 40% transfer bonuses every year from MR so I figure my accrual at just under 3 miles per dollar spent on the Everyday Plus. And the $50K/year limit is about right for me.

BB+ is a great card for sure, especially when paired with transfer bonuses