Today’s post comes from PDX Deals Guy who has previously written about using the Amex Fine Hotels & Resorts program in Las Vegas and Ticket Reselling. You can follow him on Twitter and look for the latest deals on his website.

Best Everyday Card Debate

The battle rages on all over the miles and points blogosphere regarding the “best one card” to have, either in a non-enthusiast’s wallet or for everyday non-bonus-category spending. While some argue for the Chase Sapphire Preferred (and others call it far overrated or worse!), the nearly undisputed king over the past few years has been the Barclay’s Arrival Plus.

Given the recent bad news from Barclay’s, however, it seems like now is as good of a time as any to re-open the debate. Now the Arrival Plus is still a solid contender, with effectively a 2.11% award earning rate to cover travel expenses. The standard offer of $422 worth of points for signing up for the card is very generous as well. But with a high annual fee of $89 (that most have found difficult to get waived or otherwise compensated for) and the new minimum threshold of $100 for redeeming travel reward benefits, a bit of luster has fallen off this former star.

Other 2% Options

Three of the other strongest contenders in the 2% back-on-everything space, are the Capital One Venture, the Citi Double Cash and the Fidelity® Investment Rewards® American Express® cards.

Capital One Venture

I have a soft spot for the Capital One Venture Rewards card. (Find out the current bonus and compare offers here!) Besides being smitten with Jennifer Garner since her Alias days (!!!), this was also my first foray into the miles & points space, a few years before I got fully sucked in! Who could pass up on an over $1000 sign-up bonus?! The card pays 2% back on all purchases, in the form of erasing travel purchases, but carries a $59 annual fee after the first fee-free year (and comes with a $400 sign-up bonus).

I have found that Capital One will always waive the annual fee with a phone call request, but if they stop doing so in the future (as I use the card less), there’s always a downgrade option to the no-annual-fee VentureOne card.

Note: For those considering applying for this card, know that it is common for Capital One to pull credit from all three major credit bureaus.

Citi Double Cash & Fidelity® Investment Rewards® American Express® Card

Both the Citi Double Cash and the Fidelity® Investment Rewards® American Express® cards have NO annual fee and pay 2% back on all purchases. (Citi requires the balance be paid off on the Double Cash to get the 2nd 1%.) The one minor downside of these cards is a lack of a decent sign-up bonus. The Double Cash doesn’t have a bonus and the best you can do on the Fidelity card is $50. They are definitely still strong candidates as no-fee 2% cards, but you might be able to do better …

It is also timely and worth mentioning that the Discover it credit card is also effectively a no-fee 2% everyday spend for the first 12 months, if you sign up by September 30, 2015. This is because of Discover’s extremely generous ”Deal-Of-The-Year” Double Cashback promotion (also discussed on my humble little blog.) If you value the Discover Deals shopping portal (and you should!), then this is a really good deal you should strongly consider. You might also want to check out the full Miles to Memories review of the Discover It card.

Enter BofA

While there’s a few moving parts and hurdles to get there, how does 2.625% back on everyday non-category spend sound? Even better, no annual fee and a nice little sign-up bonus! That’s what I’ve found in the BankAmericard Travel Rewards® credit card. But, again, unfortunately this won’t be an option for everyone.

I must give credit where credit is due for first coming across this option in a Doctor of Credit post back in January of this year. In that post, the good Doctor walked through a number of BofA credit card options, but the clear winner that stood out to me was the Travel Rewards card.

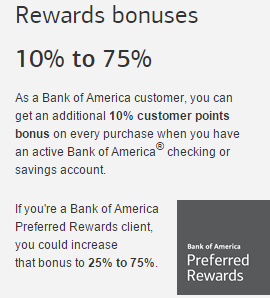

BofA Preferred Rewards Program

But to unlock the full value of the Travel Rewards card, one must first attain Platinum Honors status in the BofA Preferred Rewards program. While I encourage you to read more details about the program on BofA’s website, I’ll make two quick points:

1) To make the Travel Rewards card really worthwhile, you must qualify for the highest “Platinum Honors” level of status. To do that, the most likely route for most people will be to have $100,000 deposited in either a BofA bank account or Merrill Edge brokerage account. I would suggest for most people, the potentially easiest way to make this happen would be via an IRA (or rollover IRA from a 401k plan) account with Merrill Edge.

2) I agree with Doctor of Credit in his post that it is generally unwise to mix investment decisions and credit card decisions. That said, I find the Merrill Edge product offering to be compelling, especially when combined with the Platinum Honors status in the Preferred Rewards program. As the saying goes, consult your own investment advisor before making any decisions you’re not comfortable making on your own! The Platinum Honors status also brings with it some nice BofA checking account benefits, such as elimination of most standard fees (such as non-network ATM fees).

I also encourage you to check out Doctor of Credit’s website for the best available sign-up offers at any given point in time for opening new bank accounts with BofA and/or Merrill Edge.

All Hail the New King?

Okay, that might be going a bit far. But if you can qualify for the Platinum Honors status with BofA, it’s tough to beat the BankAmericard Travel Rewards card for non-category everyday spend. Why? Let us count the ways (benefits)!

- With the 75% earning bonus from the Platinum Honors status, the card earns 2.625% (1.5% x 1.75) on all purchases! And the amount of reward earnings is uncapped! (I’ll let you do your own math on what the extra 0.625% equates to over the 2% earned on the 2% cards previously mentioned.

- No annual fee. Ever. (Okay, ever is a long time. But at least for now.)

- A $200 sign-up bonus, after $1,000 in spending within the first 3 months of having the card open. Not huge, but many no-annual-fee cards do not have any sign-up bonus.

- No foreign transaction fees.

- Low $25 minimum threshold for applying reward earnings towards travel expenses (compared to the new $100 threshold on the Arrival Plus).

- No “hoops” to jump through, such as having to wait for half of the 2% upon payment of the card balance (Citi Double Cash) or waiting for a rebate (like the 5% rebate on the Arrival that takes its reward from 2% to 2.11%).

Other Considerations

Be aware of the fact that it takes at least 3 full months to get Platinum Honors status with BofA. There’s really no way to speed it up (I tried!). Thus, you may want to wait to apply for the Travel Rewards card until you achieve the status (and, per the SlickDeals thread linked above, waiting may be beneficial). That way, the $500 initial minimum spending towards the sign-up bonus will earn 2.625% instead of just 1.5%.

Also, given that this is a no-annual-fee card that will undoubtedly be useful at 2.625%, it can be a great way to expand your relationship with BofA. And BofA has other nice credit card offerings, such as the Alaska Airlines Visa, so having a strong relationship with the bank cannot hurt.

Conclusion

While the BofA Travel Rewards card might not work as an option for everyone, it’s tough to argue that 2.625% isn’t great for a “one card in the wallet” or non-category/everyday spending. It is surprising to me that this card gets so little attention. I have been very happy with the card and it sits in the top slot of my wallet for non-category spending.

Does anyone else have similar or different experiences with the BofA Travel Rewards card?

[…] I have written about before, I moved some money around in order to gain Platinum Honors status with Bank of America. I use that […]

With Fidelity moving their AMEX card to a Visa away from FIA, is there a solution to the issue of redeeming points earned for cash at the 2.625% rate? I’ve read suggestions on TFB and elsewhere that you can transfer the points to another Worldpoints card and then cash out, but I’ve yet to see a specific example laid out with a confirmation that it does work. Anyone figure this one out yet?

[…] written about using the Amex Fine Hotels & Resorts program in Las Vegas, Ticket Reselling and how to earn up to 2.625% with the Bank Americard Travel Visa. You can follow him on Twitter and look for the latest deals on […]

On the redemption side, i’m aware of the Fidelity cashback angle, and also the lesser-known Fidelity redemptions for flight awards, especially for the Fidelity Visa only. But what is the payment side angle for the BOFA Trav Rewards card mentioned above? Anyone? Other than standard Blue and Red birds, I don’t know about payment opportunities specific for this card?

I have had this card for about a year now and at the platinum level at BOA. The best benefit for me has been the current offer of 3 additional points or % in addition to the 2.625% when you book travel via the cards web travel service. That is a whopping 5.625% off travel related expenses on the statement. I have verified this on my monthly statement and by phone to BOA.

That’s great. Have you found the BofA travel service to be good to use? Most importantly, the prices as good as elsewhere?

Your calculation for 3 additional points via the cards web travel is incorrect. It is 1.5% for base point and 1.5% bonus point. Since you have got 2.625%( 1.5% base & 1.125% bonus preferred point), You will only gain another 1.5% point through their web travel service. I have confirmed this with from BoA customer support.

Their airline ticket price is somewhat competitive.

I just ended a chat with BoA. According to the agent I chatted with, retirement accounts (IRAs, 401k, etc.) do not count. Only Brokerage Accounts are eligible. The agents definition of a brokerage account, any non-retirement investment account. That definition is pretty consistent throughout the industry. Schwab has the same definition.

All I can say is: a) opening a $100k+ rollover IRA account (and waiting 3 months) worked for me, and b) I don’t see anything in the terms that would exclude an IRA account from qualifying. But I can’t blame you for being careful and checking. It is possible that the chat rep you were dealing with was mistaken. You might want to check with MerrillEdge directly. I can’t speak to Schwab, but I know that there are other brokerage firms that will pay sign-up bonuses on IRA accounts (and I think some that will not).

Totally agree with your assessment. I got a bonus from Schwab when I switched to them. This card has been sitting in my drawer since 2013 and with the demise (IMO) of the Arr+, this discussion caught my attention. Just part of the research.

I have had this card at the top level for over a year. I have over 100K in a ML account. All IRA only. Check with another agent.

Just like PDX said, you gotta keep trying and look for a different answer. No matter what institution, you always have the stupid people bell curve. Keep digging.

My ML account is a Roth IRA account and my checking account is barely $400. I still qualify for 2.625% since last September.

[…] Up to 2.625% Back with the BankAmericard Travel Rewards Visa – Is It the King of the 2%+ Cards? by Miles to Memories. You need to have a spare $100,000 laying around to get this rate and the Discover it Miles card is 3% for the first year so probably a better option if you’re doing significant volume. […]

This is a good write up.

My only note is that for those who want to be Ninja and take their game to the next level without going too crazy, one should really learn to implement “5X Everywhere” strategy via 5X GC load to any useful daily driver reloadable debit and do all spend using that card with 5X point dollars loaded.

That should trump most point based discussions, but there are many fringe benefits to discuss too like purchase protection and cash vs points preference etc.

Also, I want to note one more KEY thing: REDEMPTION

This article is good, but it should be clearly outlined because that is what makes/breaks you.

This cards redemption is pretty limited IMO.

Again, YMMV for “one card in the wallet” or non-category/everyday spending just as you had mentioned, but people really should read a shit load before doing $50k spend on this card when there are plenty others better for all that spend.

NinjaX – I appreciate your comments. And while I’m not certain that I follow your strategy completely, I think I get most of what you’re saying and agree to a large extent.

This post was really written to point out that there is a better option for SOME people than the Arrival Plus and Double Cash, since they seem to be favorites for the “one card in the wallet” or non-category-spend options. For non-hobbyists, I do think this could be a great card to just use and not think about it. (Of course, if they were my friends, I would recommend a few other strong “category” cards, as well.)

As for redemption, I agree that’s key. But it can be very simple with this card ($0.01 per point towards offsetting travel expenses, in the form of statement credits – exactly like the Arrival Plus, but with a lower minimum threshold). As I’m gathering from some of the comments left here, I think there might be other potentially more interesting redemption options as well. But at the simplest level, the travel redemptions (at $0.01/pt) make this card a nice 2.625% option with PH status.

Very true. Many people do prefer limited hassel and strategy thinking via “one card in the wallet”.

You are correct to point out some people will love this card and some non-hardcore hobbyist will enjoy the straightforwardness of this card. A very simple $0.01 per point towards offsetting travel expenses, in the form of statement credits that can be executed via super easy BofA interface is exactly like the Arrival Plus and is exactly what people like.

Also, I do want to point out for everyone that this card will earn 3 points per dollar (consisting of 1.5 bonus points and 1.5 base points) for the first $6,000 in airline purchases (up to 9,000 bonus points) made at the Bank of America Travel Center each calendar year. All other purchases made at the Travel Center, excluding insurance purchases, will receive 3 points per dollar with no limit on bonus points as well.

However, I have to say that the BofA Travel Center website is so ghetto that I really didnt think the website belonged to BofA. It probably doesnt and is run by another 3rd party with a license.

I would love a bank to introduce a true “one card in the wallet”. Someone should consult a bank to develop this and put in good limiters to prevent over gaming of the system so it remains profitable, but still being an industry disrupter.

I think a large bank would hugely benefit if every single gamer would obtain and retain this single card even if its for MS, but they would also use it for normal spend.

Imagine Chase to come out with 5x all spend w/ no categories for the first $50k in spend and 1x after w/ $75 annual fee. Things would get pretty cray cray.

How does this work exactly?

Folks, do your research before getting this card. Higher IRA interest rates and lower fees than B of A are available at credit unions, online banks, and online brokers which, when combined with a Citi Double Cash card, will likely leave your with more money in your pocket.

Never going to disagree with doing your own research. I have nothing to gain from people getting this Travel Rewards card, but I’ve found it to be a nice everyday/non-category option (certainly better than the highly popular Arrival Plus – IF one can qualify for Platinum Honors). As I wrote in the post, you definitely don’t want to go for the status unless it makes sense overall in your banking/brokerage strategy. For me it was a no-brainer. I had $100k+ in rollover IRA assets that I could put at MerrillEdge that were (and will remain) fully-invested (not sitting in a money market account earning interest). In fact, I funded the ME account by transferring over assets (not cash). I also made a nice little sign-up bonus on the ME new account, and got 100 free trades per month (not that I intend to use anywhere close to that many!).

Discover it Miles is also a pretty good option for the first year for those without the 100k required.

Yes, the Miles card is a nice option. But if I had to choose one (and, as your website points out, I think you can only get one Discover card within a 12-month period), I’d go with the Discover it. It’s tough to beat the doubling of everything (most notably the shopping portal and 5% categories) in the first year for the Discover it.

Thanks for being the one to initially turn me on to the Travel Rewards card (and BofA checking bonus). Apparently from some of the insightful comments here, I have a bit more to learn …

The way to use the card for cash back is to also have one of the Fidelity credit cards, along with a Fidelity Brokerage account. Every month and since both cards are managed by BoA, once the BoA TR statement closes, log into your BoA travelrewards online account and transfer the points over to your Fidelity credit card. At the beginning of the month, as long as you have 5,000 BoA/Fidelity points, they will be converted and transferred as cash to your Fidelity brokerage cash management account.

Very interesting. Thanks for sharing.

The discovery IT miles gets 3% for the first year

I’ll have all of them at some point. The Amex GC payout on portals is only increased twice a month, and it takes almost two weeks for the charges to post, so I need as much raw spending power as I can get. Ideally 50-60k worth every two weeks.

The signon bonus $100 is not too good. But if you combine with checking account and Merrill Edge sign on bonus, It will be very lucrative. When I applied this card last August ( Platinum Honors was available since January, 2014 but only available to 5 States, I waited about 6 months to be available to apply) , I got $150 for a checking account, $100 for BoA Travel card, and $1200 sign on bonus for Merrill Edge. I believed the sign on bonus for Merrill Edge has been reduced now.

Great points, Jonathan. I did a bit better on the checking bonus, but a lot worse on ME. Congrats!

“No minimum threshold for applying reward earnings towards travel expenses (compared to the new $100 threshold on the Arrival Plus).”

That’s a bit misleading. You need to redeem at least $25 at a time, but you can put together a whole bunch of small charges to meet that $25 requirement.

To be precise, it’s no minimum threshold per transaction.

Yep, you’re correct, as I noted in my reply to SE (above). But the post will be updated soon. Thanks.

Lol, the reason this card is under the radar is no affiliate payouts for bloggers. Has it ever even been mentioned by the twerp who has never had a job but flies everywhere First Class affiliate payouts and referral bonuses?

If you have $100K, this card dominates everything else for everyday spend unless you are 100% focused on premium airline travel. The combination of (1) no annual fee, (2) 2.625% on all spend and (3) no FT fee is unmatched.

You can also get a BofA Cash Rewards card which, with the 75% Platinum bonus yields 5.25% on gas and 3.5% on grocery. So if you spend a lot on gas and grocery, your payout could be 3% or more. (Of course , keep Ink and Discover cards for their 5% categories)

If you have $100K. putting it in a Merrill Edge account is actually a good deal. You can get 100 free trades per month and just invest in ETFs like SPY if you want.

I can’t speak to affiliate links, but you might be on to something. I do agree (obviously) that it is a fantastic and underrated card. I also agree that the Cash Rewards card could be interesting for those categories. And the Ink and Discover (especially with the current promo) are great cards, but I wanted to focus this post on the Travel Reward’s 2.625% (potentially) versus other 2% non-category cards.

I also agree with you about Merrill Edge. I’m not an active trader, but free trades are better than non-free trades. 🙂

“twerp who has never had a job but flies everywhere First Class affiliate payouts and referral bonuses?”

… Jealous much? Seems you are living with the archaic mindset that a job must be 9-5. Furthermore, if someone is able to support themselves legally without public assistance (let’s just say through a trust for example), who are you to judge? Everyone’s path in life is different.

I think the reason for the relative anonymity of this card is that nobody knows how to use BOA points or if they are even valuable enough to accumulate to begin with …

I’m trying to think if there are other BofA cards with confusing-to-use points (like USBank Flex Perks that Shawn wrote about yesterday I think). But for this card, it is really simple. Maybe I should have made that more clear in the post. If one is familiar with the Barclays Arrival (or Capital One Venture) system for redeeming points (effectively cashback percentage) to get a statement credit to offset any travel expenses, it works almost exactly the same way for this card.

Your statement did prompt me to go to my BofA account and double-check this. And I did find one small error in my post that might need updating. This Travel Rewards card actually does have a $25 minimum redemption, but you can stack up a bunch of little charges (I did it with multiple sub-$25 Uber charges) to add up to $25 or more. I don’t know if that’s how the Barclays Arrival works now (with it’s new $100 threshold), and I can’t test it (because I don’t have the card any longer).

Great idea, Robert, if that works. Sounds like you have personal experience with it? Of course, $100k is a stretch for a lot of people (although not horrible for folks who have some IRA assets built up), so $300k is an even bigger stretch. But a nice idea for folks with $300k+ in IRA assets available, and they could move $200k of it back away (to another broker, to get another sign-up bonus) after the first month.

The Arrival Plus is still great for the sign-up bonus, but I think 2.625% (if one qualifies) is better than 2.11%. By approximately 0.5%, if my math is correct. 🙂 And no annual fee or minimum travel redemption threshold.

Yes, I’ve seen Platinum status conferrered in one month for multiple people, including me.

There are also some additional benefits to this card that are not well known that can boost the return even higher–both on the payment side and the redemption side. What I will say here is that confusing point programs benefit those who understand them, because this is really an arbitrage game that we play, and information asymmetry is key.

I can think of so many better sign-up bonuses other than Arrival, but I suppose if you’re in the churn game it is another bank and another bonus once other wells run dry. Still, Arrival is the most overrated card ever, especially to anyone who still holds its precursor, Barclays Travelocity Amex.

Yes, I have seen Platinum Honors status conferred in one month for several people, including me.

As mentioned by another commenter, points can be converted to cash, which is a big advantage over Arrival. Plus you can boost your 2.625% return even higher using the right payment method.

I can think of many other sign-up bonuses other than the overrated Arrival that are worth more and cost less. But if you are a churner, it’s another bank and another bonus. Holders of the Arrival’s predecessor card (Travelocity Amex) know just how overrated the Arrival is.

It doesn’t take 3 months to earn Platinum Honors status, but it does take at least one month where your trailing 3-month average balance is $100,000. So if you deposit $300,000 or so, it could take a month, assuming you deposit it at the beginning of the month.

I am surprised it’s taken this long for the card to get more attention, especially after the mysterious lovefest that bloggers have for Barclays Arrival.