Changes Coming To The US Bank Altitude Reserve?

US Bank’s Altitude Reserve is a very under the radar card in our hobby. Even though many people have it and like it a lot it doesn’t get a ton of coverage. That could be because it is from a smaller bank. Or it could be that it is somewhat difficult to get, needing another account with US Bank to be considered. Whatever the reason is it is something that many people value but it appears there could be changes coming to the US Bank Altitude Reserve. PDX Deals Guy shared a recent survey with me that was sent to him about potential card changes.

There are also some new lower end options coming down the pipeline as well, joining the Altitude family of cards.

US Bank Altitude Reserve Questionnaire

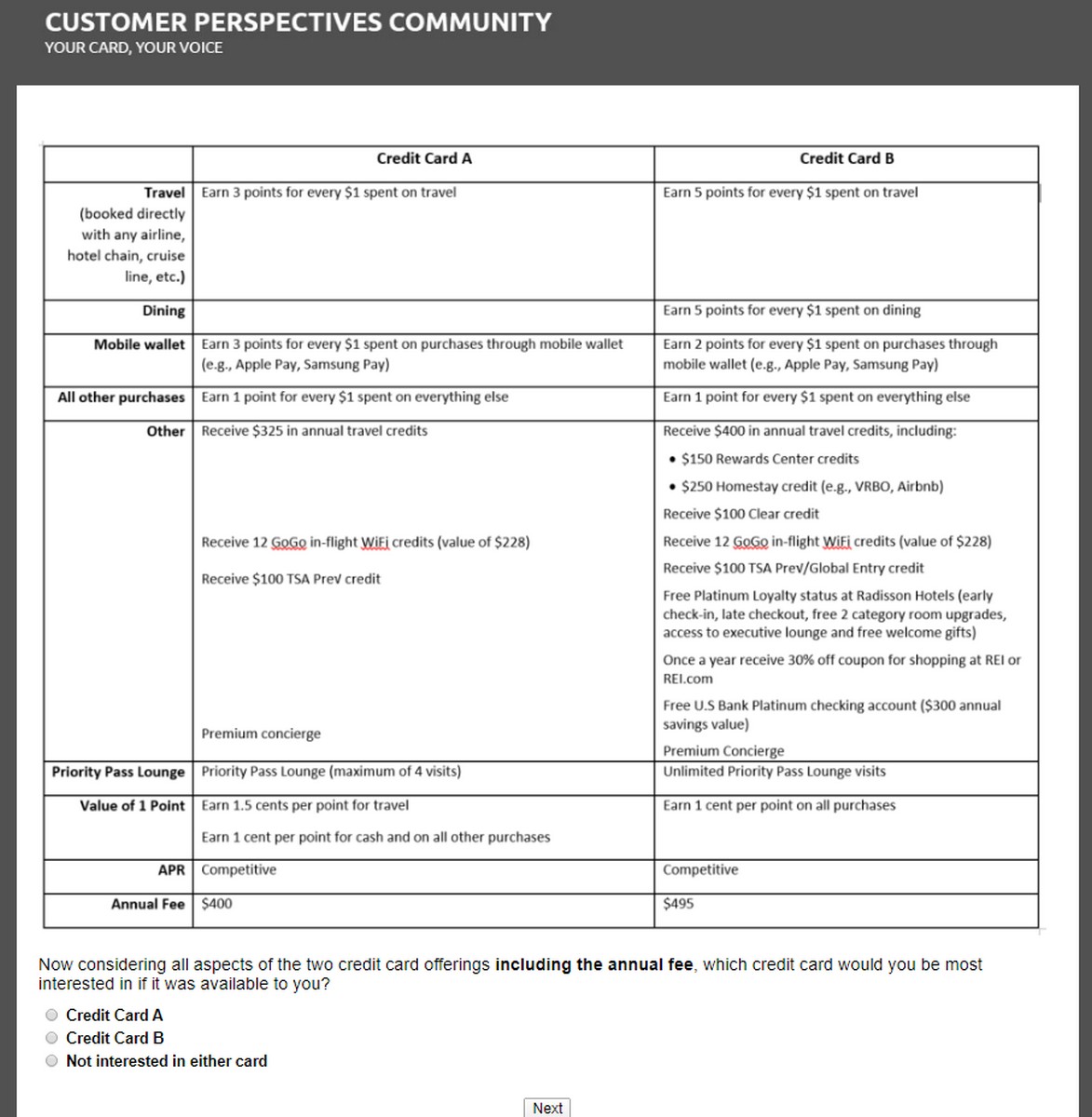

The main portion of the questionnaire was a picture of two card options side by side. PDX Deals Guy was asked to review it and then asked questions about it.

Some of the follow up questions were as follows:

Some of the follow up questions were as follows:

-

Before showing/discussing the annual fee, which card do you prefer.

-

What should the annual fee be for each card (just a box that let you put in any amount).

-

It then gave you a “digital” yellow highlighter and asked me to mark what I liked.

-

Then they asked what did you like about those things in an essay box.

-

He was then asked to use a yellow highlighter to mark what he didn’t like.

-

Then they asked what did you not like about those things in an essay box

- Lastly, there were multiple choice questions about whether you think the card is interesting, unique, etc. but the main point of the survey clearly seemed to be “do you like the Altitude Reserve (without ever naming it) as it is right now? or would you want to pay more for this extra stuff?”

PDX Deals Guy’s Take On The Proposed Changes

I prefer it as-is (or course would prefer better and/or cheaper), as opposed to the more expensive proposed changes. In fact, before they showed me the proposed AF, I guessed the AF on the new/different card should be lower (mostly to make the point that I thought the changes were bad).

Final Thoughts

I am sure US Bank sees competitors American Express, Citi and now Chase raising the price on their premium cards and they want to get in on the game. It also appears they are thinking about getting into the split up credit game probably to increase breakage. Reducing the redemptions to 1 cent each would also be a very poor move which they have already done on their Flexperks cards.

Overall these proposed changes would be a net negative if they do decide to install them.

Some of the follow up questions were as follows:

Some of the follow up questions were as follows:

[…] has sent out a survey regarding possible changes to the U.S. Bank Altitude Reserve. According to MtM it looks like there were two main […]

If they make those changes I’ll dump it as fast as possible. Option 2 is a complete POS card.

Please God no changes…. This card is my daily driver outside of Chase category spend for the reasons of 3x mobile wallet + 1.5x redemptions in their portal. Card version 2 is an absolute loser.

I think a lot of people would close the account if they went with these changes.

Another one bites the dust.

I received the same survey and had the same reaction. I’m not even sure what kind of person would be the perfect fit for a card like that.

Sometimes I wonder who banks consult with when coming up with these credit card perk options haha

I agree these changes would be very negative—especially the travel credit and reducing the value of the points to 1 cent. I’d be none to happy about reducing the earning on mobile payments. I have absolutely no interest in Homestay credit. I’ve had this card since it was introduced and tampering with travel credits and point value would kill it for me not to mention the higher annual fee. If they make changes like this, I’d likely dump it.

Tom, I couldn’t have said it better myself.

Let’s hope that is what people told them that received the survey. I wouldn’t be surprised to see them increase the AF at some point but most of these changes would lead to a lot of unhappy cardholders.

Holy smokes; please tell me they are not this stupid……I literally never use it again and probably cancel it.