fp

Why American Express Is Dead Wrong With Their Latest Clawbacks

It has been a week now since American Express started clawing back airline incidental credits for 2019. My first response to hearing the news was, well that was kind of expected. We did predict that this very thing would happen on a podcast episode earlier in the year. But we had the timing off and thought it would happen for the 2020 credits. We never fathomed that American Express would dip into 2019 credits though. The more I thought about it the more this whole thing nagged at me. I have now come to the conclusion that American Express is dead wrong with these latest clawbacks.

Hopefully by the end of this article I have made a quality case for why American Express is in the wrong even if they were within their rights.

Moral Question

This post isn’t going to be a morality debate. I know there are people out there that think that these people deserved it. They were gaming the system and Amex had the right to get theirs. While I don’t agree with that stance, we discussed why corporations don’t need our sympathy on last week’s podcast, I understand where they are coming from.

I will say that I have never used the airline credits in this way. I used to purchase gift cards for my credits until that got shutdown, which was also against the terms. This year I used all of my credits on low cost carriers Spirit and Frontier for seat assignments, one of the better remaining options in my opinion. So this isn’t me trying to justify my choices or anything like that, I wanted to make that known. I also think that many people that are saying they deserved it likely purchased gift cards in the past. So I ask you to look in the mirror and ask the question, was this really that different?

Regular People Caught Up In This

Moving on from the morality question I want to get into the meat and potatoes of this debate. I want to first start off by saying that not everyone who got hit with the clawbacks were trying to game the system. I imagine there were a lot of people that were simply collateral damage.

It is completely possible that someone selected Southwest Airlines as their airline. They were planning on using the credit for snacks, drinks and early bird check etc. It just so happens they booked a flight to Cancun or Nassau or whatever and paid the taxes and fees with the American Express Platinum to earn 5X Membership Rewards points. When the charges posted the taxes and fees triggered the credit. They thought that was strange but moved on with their life, with their credit now depleted.

Months later a family emergency came up and they had to cancel said flight. Southwest’s flexibility allows them to cancel the award ticket without penalty and refunds the taxes and fees to their card. This is why they fly Southwest so often and selected it as their airline of choice. They find the flexibility to be invaluable. They continue to fly Southwest throughout the year and use their card for early bird and drinks on the plane and the like but they don’t receive credit because their incidental tracker is already full. Then in 2020 they receive the clawback, is that fair to them? Is American Express in the right here?

American Express I.T. Issue

This issue really all comes down to bad I.T. on American Express’ part. If they would focus on setting up everything on their end so certain purchases don’t code for the credit there would be no issue. They finally got around to shutting down the gift card loophole so I have to imagine that they could do it if they wanted to or would put the effort into it. There are going to be people that randomly trigger these credits without intending to and that is American Express’ fault. Which brings me to my next point.

Can’t Select To Use Credit

It isn’t like American Express allows you to select when to use the credit. It is automatically applied on their end. If they would send a message saying would you like to use your airline incidental credit for this purchase (like companies do with travel eraser points) that would be one thing. But when you don’t have a say in the matter on when or how things are applied can you be held accountable for it?

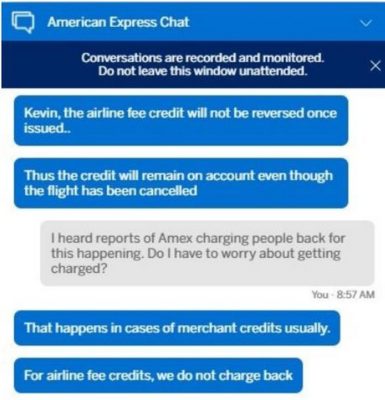

Here is a chat that a Miles to Memories Facebook group member had last week after the clawbacks were reported. He had a flight canceled by the airline and wanted to make sure his credits won’t be clawed back in 2020 when the airline issues his credit. It appears the chat agent had not heard the news yet…

American Express Won’t Reverse Credit

Even if you did catch that the credit was applied improperly it isn’t like you can have them easily remove the credit and update the tracker. Let’s say you are a Mosaic elite with JetBlue and booked a flight and paid for seats but had to cancel later down the road. That is one of the perks of your elite status, to be able to cancel award tickets and get refunded.

Should you not use this status because American Express may claw back your credit later? Or should you only use Amex on flights you know for sure you are going to fly? Isn’t that against what American Express wants? Don’t they want you to use your card for every purchase? With the way this is currently set up you have to actively manage when you use your Platinum card until the airline incidental credit is depleted. And then you have to hope that life doesn’t get in the way down the road causing a cancellation and refund.

The Timing Of The Decision

So American Express makes this credit hard to use, hoping for breakage, and then punishes you later when their I.T. is bad. But they don’t stop there, they wait to do the clawbacks until the calendar year is up. That was intentional because you have no recourse to go back to use the credit. The time has passed and Amex simply pockets your money.

This shouldn’t be too much of a surprise after the reports coming out that they have a predatory culture there since losing Costco as a customer. I wouldn’t be surprised to see them wait until 2021 to perform any clawbacks from this year too.

Will They Back Credit Accounts?

So let’s say you are the person above. You canceled a JetBlue flight that had paid seats on the booking and got the clawback. You would think American Express would go through your account and see if you paid for seats later on with JetBlue and use the credit there wouldn’t you? If you were being fair and valued customer service that would be expected but it doesn’t appear that was the case. That brings me to the next point…

Customer Service Is Dead

The customer used to always be right, but not anymore. Not in today’s economy it appears. Even when the customer was wrong back in the day the company would work with them or do what they could to make it right. That is because it is more expensive to get a new customer than it is to keep and old one. That is probably why American Express has 50K Membership Rewards retention offers these days without requiring any spend. They feel like offering that is cheaper than finding a new you.

Well it appears that the customer service department didn’t get the memo that they are hemorrhaging customers. Maybe the memo came from the accounting department saying we need to increase our profit and go find some easy money.

When a company’s own system is at fault, when it is their error, they should eat the cost and work on fixing the error. Not make the customers pay for their mistakes. Why do airlines allow mistake fares to be used most of the time? Because they know it was their fault, they want to honor their mistake. It usually leads to good publicity too.

Final Thoughts

Hopefully I was able to give you enough evidence on why American Express is dead wrong with their latest clawbacks. They should have focused their energy and effort on fixing the error in their system. That would eliminate the option to “game” the credit or to become unsuspecting victims too. Since American Express doesn’t let you pick and choose when to use the credit or let you reverse the credit when applied incorrectly they should have fallen on that sword. That is the way customer service used to be. Focus on your errors and improve the experience overall. Not wait until your customer has no recourse and take the credits back to pad your bottom line. I’ll say it again, American Express is in the wrong even if they are within their rights.

Does this change your mind at all? Do you agree with my take or think I am off my rocker? Share your thoughts politely below.

[…] airline credits for future travel. These are not charges that would be refunded since Amex loves to unfairly claw back refunded transactions. If you’re not traveling you should be able to get the following charges […]

[…] airline credits for future travel. These are not charges that would be refunded since Amex loves to unfairly claw back refunded transactions. If you’re not traveling you should be able to get the following charges […]

no clawbacks on my accounts either with SWA, keeping my fingers crossed.

In the “Will They Back Credit Accounts” section, it even goes beyond that. Some folks may have seen that their credit tracker said zero credit remaining for the year, so they may have put charges on another card, or elected to not upgrade a seat, since they (thought that they) had already expended the credit.

Yup – great point.

Abused the systems. And now whining about it. Wished other banks would do the same soon. If I was a biz owner I wouldn’t wanted those abusers. Well I personally closed more than a dozen abusers’s visa cc, ck, etc (financial/verbal…) at my local branch in Dallas.

Did you read the article at all? Many of these people didn’t abuse anything – American Express’ terrible system was the abuser.

You made a very good point here. Their IT is the worst of any company’s.

I have come to realize that there is something very wrong with IT at Amex. I still have a live Bluebird and in the course of their “upgrading “ or fixing their platform for billpay they created a glitch that makes it unusable and cannot seem to fix it. Plus they bounced a preapproved check for no reason (for this they did eventually apologize and reimburse costs). I e never had anything like this happen before. It’s the same IT as for the credit cards. How come no other financial institutions I use have such problems? Maybe it’s because they hire RATs instead of people who can actually create IT that functions.

Their I.T. isn’t as bad as Citi but they sure do struggle with stuff they shouldn’t.

My wife and I have 2028.00 dollars in a account and they have took our money for there on use..

I have never encountered this particular issue but declining customer service is one reason why I, after forty-nine years as a cardmember (Plat since the first year that became available) I switched from Amex to Chase Ultimate. Not only did Amex show absoltely no curiosity about my reasons for switching after so long, but the promotional emails I keep getting for Membership Rewards show that the company doesn’t seem to be even aware that I dropped.

It does seem like their customer service has completely deteriorated just as competition has increased greatly in the premium card market. It doesn’t make a lot of sense to me.

How do you know if you’ve had money clawed back?

They have sent out emails letting people know that they were being charged back.

Anyone impacted by this, it is completely FREE (except 1 postage stamp) and very easy to file an arbitration case against American Express via JAMS (the arbitrator). American Express pays all expenses per their terms and conditions, and the work/time taken to file isn’t much (except mailing one letter).

– Send a certified postal claim to Amex outlining your grievance (this is the only postal cost to you), saying that if matter isn’t resolved you will be filing for arbitration.

– After 30 days, file for JAMS mediation online with your claim. Everything from this point forward will be free for you and entirely 100% online via email. Amex will most likely settle before any mediation date because why would they spend their time on such a small claim.

Ben – thanks for the great info. I will have to look into this for sure and see if we can write up a post about it. Thanks again!

It’s the *retroactive* factor that gets me with their decisions/policies in-general. Instead, they should re-write the policy in question to be more clear…issue a polite warning to anyone who they feel may have violated it in the past…and then move forward. Anyone who breaks the rule from that point forward is fair game. But if the rule was unclear/murky in the past, then it’s unfair to punish people like 8mon AFTER the fact. If something isn’t flagged within 1mon, then it’s on THEM for having a piss-poor IT system. You are 100% correct that Amex’s “customer service” is pathetic — and trending downward. I run a small business. If I made a mistake, I would not chase down a customer 8mon after the fact for my own error/issue. That’s just BAD business.

Yup the delay is the thing that really got me. For some people this could be over a year ago that the charge happened. That is asinine.

I’m not talking travel specific here. Maybe the customer was once always right, but then something changed and more and more customers gamed the system. When LL Bean had to stop the lifetime guarantee it was a culture shock (for them and long-time customers. The same for REI. But they could only take so much of people buying boots at yards sale and then turning them in for a new pair under the guarantee. Or bringing in empty empty food wrappers saying they decided it wasn’t good (but wanting a replacement). Or items obviously intentionally damaged.

Their cultures were the customer was always right, until it was obvious it wasn’t true and such a policy could no longer be afforded.

Good point Carl. I would say that things should be adjusted to take stuff like that into account. With technology these days it should be easier than ever but it seems like it is going the opposite way. I believe there has to be middle ground somewhere. Amex simply making this a travel credit (even if for less money) would be an easy fix that would finally bring them in line with the competition. The fact that they are unwilling to concede that just proves (to me at least) that this is all about the bottom line. There can be a win-win scenario but they want an unlevel playing field imo.

So very true….while a majority of the people do the right thing…there are enough people with the mindset of taking advantage of everything to the nth degree and spoil it for everyone. And after doing it for so long….it is just part of who they are and how they think. They don’t care whether it is fair to the company or anyone as long as they take advantage of the situation.

I am sure that we all recognize people who do this. I know someone who loves Costco because of their return policies. He would buy the cheapest luggage and after it gets destroyed from a trip, return it for another. If all of Costco’s customers were like him then it would have filed for bankruptcy long ago. Fortunately he is in the minority.

Well, the fix would be is for Amex to issue credit for actual covered expenses so there’s no more of these issues or make it a travel credit for all eligible travel expenses or make it so it’s for any covered airline and not just of one airline of your choice that you can’t change until the next year. Wouldn’t one of these fixes be more customer-friendly, less hassle, and also less work for Amex.

I would love to see it go to a travel credit. With the CSR increasing their fee and people debating whether or not to keep it or go to Amex they had an opportunity to take some of that business. But they went the other route. A short sited decision to temporarily increase the bottom line that will probably end up costing them membership in the long run.

File a lawsuit. We need clarity on this.

We have needed it ever since amex clawed back staples a couple of years ago.

I don’t disagree with their clawback. I disagree that they don’t give the credit back. And a clawback can’t be done after day 2c months or whatever.

In any case amex used to be very lenient. They would let you keep credits even if undeserved as one time courtesy. People began to exploit it. Amazon was the same. People began to exploit it. REI used to have lifetime return policy no questions asked. People abused it

We need someone, an exceptionally egregious abuser, to be punished severely, so people come to their senses stop exploiting and we can go back to good old days of one time courtesy

is it possible to do a class -action or sue amex? or only an arbitration?

Mark,

You nailed it. BTW, i have not had any claw backs to my accounts thus far. Do we know if some of this is airline specific? (ie targeting SWA?)

I don’t think it is targeting specific airlines – at least I haven’t seen that. I do think JetBlue and Southwest is where a lot of it happened just because of how their programs are set up.