Chase 5/24 Rule Change, You Don’t Need To Wait Quite As Long

So much digital ink has been spill on the Chase 5/24 rule that I don’t want to go into a ton of detail here. If you are new to miles and points and are not aware of the rule we have a great explain all guide. One of the nuances of the rule has always been when the Chase 5/24 clock actually resets. Does the card drop off the day after it hits the 24 month mark? Or, does it take a few weeks to drop off etc.? It appears that there has been a slight Chase 5/24 rule change when it comes to answering this question.

When Does The Chase 5/24 Clock Reset?

It has always been believed that you needed to wait until the following month for your card to drop off Chase’s 5/24 radar. The first of the month to be exact.

Example:

- Applied for card on 11/14/18

- Should fall off on 12/1/20

That is the way it has always been explained. Most people followed the advice and moved on with life. It appears that is no longer necessary.

I had my wife apply for the IHG Premier card a day before the first of the month because I thought the offer was ending. I figured she could just recon a day or two later if she was denied because of it but I wanted to grab the increased 140K offer. In case you were wondering, the offer didn’t end so it was much ado about nothing. But, she was automatically approved. I didn’t think much of it because it was only a day early.

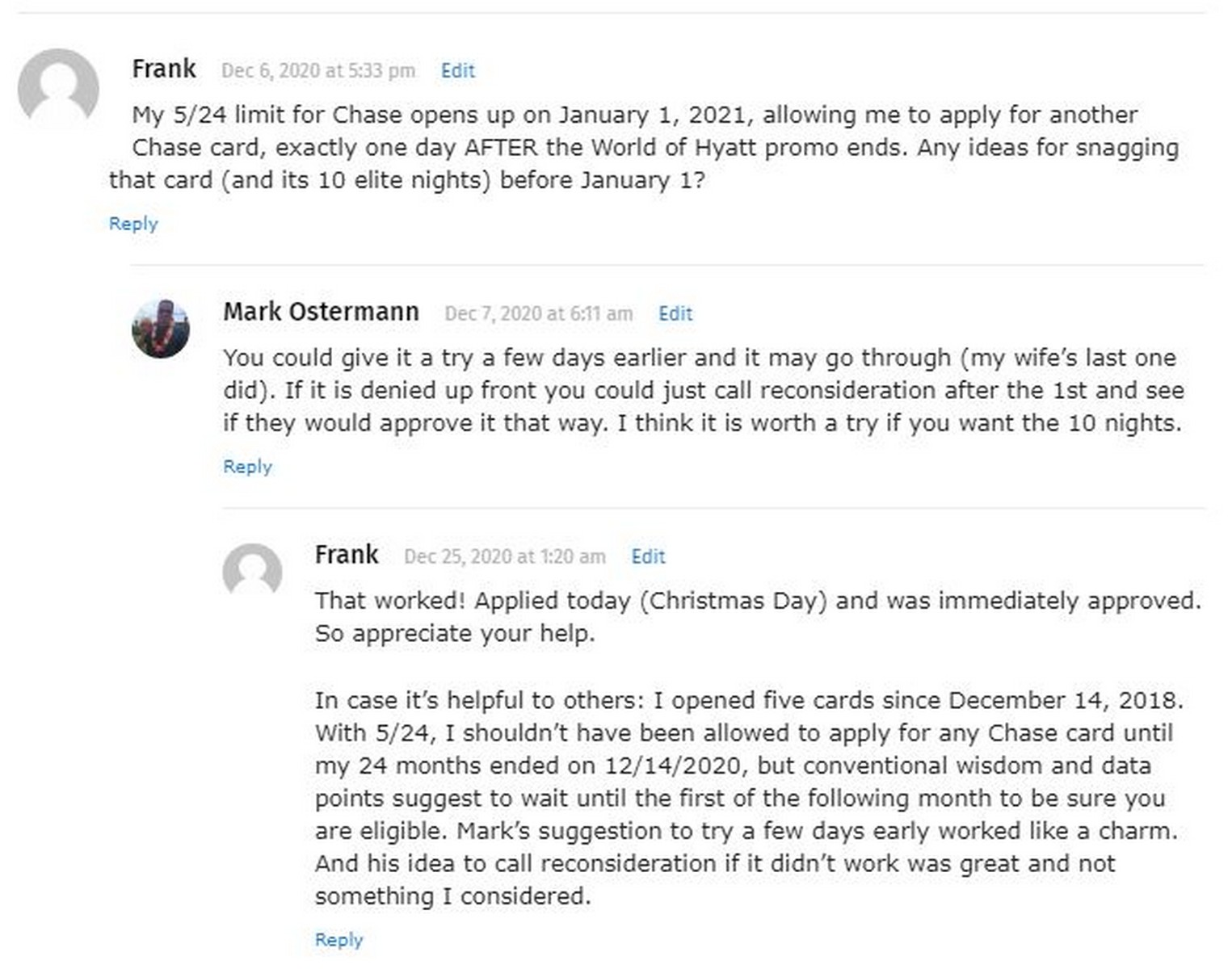

Then last week a reader was in a predicament and asked for some advice on my getting Hyatt Globalist on the cheap article. Here is how the conversation went:

So here is another data point that waiting until the first of the following month is not necessary. Frank’s was also 7 days before the first of the month instead of just one day. Does that mean we can apply the day after a card falls off? I wouldn’t risk it unless you had an offer ending that you wanted to grab. There is no rush after all, might as well be safe.

As fate should have it I am running into that very issue with the Chase Freedom Flex card. My wife’s 5/24 count will drop to back under on 1/7/21 and the increased offer on the Flex card ends 1/13/21. So I will need to have her pull the trigger early once again and it will be closer than ever to the true application date.

Chase 5/24 Rule Change – Final Thoughts

While this isn’t an earth shattering improvement it can come in handy at times. Knowing that you don’t have to wait until the first of the following month could save you from missing out on a limited time offer. It already has for Frank, and hopefully it will for my wife in the next few weeks. I can already taste the 80,000 Ultimate Rewards 😁.

“Nope – all Chase cards fall under 5/24.” Mark, I thought business cards did not count in the five. Can you verify please?

TY

They do not count towards 5/24 but you need to be under 5/24 to be approved for them. So all Chase cards, including business cards, fall under the 5/24 rule.

Perhaps it’s a change in how Experian reports account opened date.

It used to be Exp reported all CC accounts opened on the first of the month, (as opposed to TU and EQ which reported the actual day of the month).

I haven’t seen my actual credit report since 4Q 2016 when I was on the 5/24 bubble for the C$R on launch.

Or maybe Chase just wants to open more accounts before year-end?

My experience was towards the beginning of the year so I doubt that is it.

I thought that maybe Chase took away the 5/24 limit when considering an individual’s new Hyatt credit card applications but that otherwise the 5/24 limit was still applicable for most/all other Chase card applications from the individual.

Nope – all Chase cards fall under 5/24.

Or maybe 5/24 doesn’t exist anymore.

Give it a try and let us know Jeff 🙂

So now the 100k point question is how far can we push this? Maybe they just set it to 23 months to ‘fix’ the problem with any cards aging out in the last month?