Chase Card Strategies

Update: In April, 2016 Chase is likely to institute a much stricter approval process for their co-branded cards. More info here.

Yesterday I wrote about recent shift in Chase’s policy towards getting credit card bonuses multiple times. Basically they went from a policy of allowing cardmembers to get a sign-up bonus only once per product to a policy where you can get the bonus every 24 months.

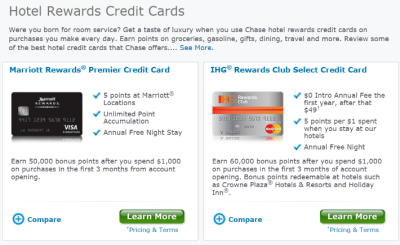

This new policy brings forth some interesting possibilities with their hotel credit cards, especially the IHG Rewards Club, Hyatt & Marriott co-branded cards.

Chase Hotel Card Strategy

Each of those cards not only has a sign-up bonus, but they also have annual bonuses for keeping the card. The IHG Rewards Club card gives 1 free night annually in any of their hotels, while the other two cards give a free night in lower category hotels.

The interesting thing about Chase is that they tend to deposit the annual bonus into your loyalty account on your card anniversary date. While the annual fee is technically charged at the same time, you have 60 days to cancel the card without paying it.

This leads to a situation where you can get the annual bonus and still cancel the card without paying an annual fee. Chase has not been known to ever claw back the annual bonus after you cancel the card, however I am not sure if that is possible or not if they choose to do it.

Maximizing Under the New Rules

Before analyzing scenarios, lets look at the new two part 24 month rule mentioned above. First, to be eligible for a new cardmember bonus, you must not have received a bonus for the same product within the past two years. You must also not be a current cardholder.

With that information in mind lets look at the best strategy to maximize the bonus on these hotel cards. I will use the IHG Rewards Club card as an example. Currently the best sign-up bonus is from a zombie link which is known to give 80k points after spending $1,000 in the first 3 months.

IHG Rewards Club Card Scenario:

- Month 1: 80k points new member bonus

- Month 13: 1 Free Night – Pay $49 Annual Fee

- Month 25: 1 Free Night – Cancel card after the annual free night posts

- Month 25 1/2: 80k points new member bonus

With this new policy you could theoretically get 2 free nights and 160,000 IHG Rewards Club points within two years for the cost of one $49 annual fee. To really maximize, you could also try to call retention to get Chase to give you another bonus or waive the annual fee in month 13.

Now lets look at the Hyatt card (my review) which has a sign up bonus of 2 free nights anywhere.

Hyatt Credit Card Scenario:

- Month 1: 2 free nights at any property new member bonus

- Month 13: 1 free night at a category 1-4 property – Pay $75 annual fee

- Month 25: 1 free night at a category 1-4 property – Cancel card after the annual free night posts.

- Month 25 1/2: 2 free nights at any property new member bonus

In this example you can get 4 free nights at any Hyatt and 2 free nights at a category 1-4 property for the cost of the one $75 annual fee (see retention possibility above).

While I have personal experience with both the IHG & Hyatt cards and their annual bonuses posting right on the anniversary date, I have never had the Marriott card. Based on my understanding, it should work the same way as the other two.

Keeping Card Benefits

In these scenarios since you will only be without the card for a short period in between cancelling and signing back up, you should keep most benefits of the card including status and perks.

The worst case scenario is that you will temporarily lose status and perks only for the small amount of time you will be without the card. In my experience though status tends to go in annual cycles and canceling a card won’t immediately mean a downgrade. Other benefits like the 10% rebate on the IHG card may go away temporarily.

Drawbacks & Warning

I want to make it clear that I am not advocating that people do this, but recognize that this information may be of value to some people. In my opinion Chase is a very valuable bank to have a relationship with and they may spot this type of behavior and view it negatively.

Despite having thought of this scenario, I have personally chosen to keep my IHG Rewards credit card open and pay the annual fee. I get great value out of the free night and it is one of my oldest Chase cards so it helps my average age of accounts.

Conclusion

It is possible to get two sign-up bonuses and two annual bonuses on select Chase hotel cards for the cost of one annual fee (or less possibly) based on Chase’s new policy. Whether you want to do this or not is a personal choice.

So what do you think? Is this something that you would try?

If you like this or any content on the site, consider supporting us by applying through our affiliate links. More info here.

[…] Of course miles & points hobbyists see those rules differently. We immediately pick apart the words and start to formulate a strategy. If I apply for a Sapphire Preferred now, I can then downgrade it to a Freedom in a year and then get another Sapphire in month 25. Rinse, repeat. I even wrote about the best strategy to do this with Chase hotel cards. […]

[…] wrote a few weeks ago about a possible Chase hotel card churning strategy. One of the cards mentioned in that post was the IHG Rewards Mastercard and its […]

[…] Also see this related follow up post: Hacking Chase Hotel Cards – Maximize Benefits & Bonuses […]

Hi, just wantedd to tell you, I enjoyd this article.

It was practical. Keep on posting!

Nicely done!

One question: Can this be done with the Business cards as well? Or do they follow different pattern?

This seems to apply to all of their cards now. The language appears on both the Ink Plus and Southwest business cards for example.

Thanks for the tip. This makes me re-evaluate keeping my Hyatt card into my 3rd year next year vs just cancelling and re-applying down the road. Definitely something to think about.

Excellent work dear Watson…. Like any of our techniques use it (thanks for the tip) just don’t abuse it….

Why pay the fee at all? Cancel the card after 12 months with the bonus 1 night stay. Then in month 25 reapply and cancel again after getting the nightly bonus.

I have had the IHG car at least 3 times, the marriot card at least 3 times and the united card at least 4 times. I have never paid an annual fee.

I guess it depends on your priorities. If you priority is not to spend any money then canceling after one year works. Looking at my scenario for the IHG card, if you pay that one annual fee of $49 you get an extra free night at any IHG property worldwide. I think it is worth that cost.

So there is no wrong way to do it, but your way nets 1 free night plus the points in the same time for $0 cost

My way as laid out nets 2 free nights plus the points for a $49 cost.

Either way it is a great deal. Doing it your way has potentially less risk since you won’t be closing and reopening the card in as short a time. Thanks David.

Ok, perhaps the language has changed since I last re-upped for a Chase issued card, and you may be able to double up on bonuses this way now, but I would be reluctant to engage in this pattern of behavior. As a previous poster said, Chase can shut you down and permanently blacklist you for any future credit cards. So play at your own risk with that in mind.

The language has been changed and added to pretty much every Chase card in the past couple of months. I am just pointing out what seems to be possible based on that language. Whether to do something like this or not is definitely a personal decision.

Problems with it:

Dishonest and not ethical.

Chase has specific language saying that if you get cards just to play bonuses that they can

Cancel all of your cards, with you forfeiting accumulated unrEdeemed points (think ultimate rewards).

So clever, so very clever. Not up to your usual standards.

Andrew do you work for Chase? Its called gaming the rules, that is what this hobby is about. …… Thanks Shawn, more good stuff as usual from the hardest working blogger in Vegas.

Thanks Ramsey!

Perhaps I am missing something here, I thought you could only reapply and get the sign-up bonus after NOT having the card for a period of 24 months. Why would they encourage people to close and reapply as you have described here?

As I wrote yesterday, the language is as follows, “This new cardmember bonus offer is not available to either (i) current cardmembers of this consumer credit card, or (ii) previous cardmembers of this consumer credit card who received a new cardmember bonus for this consumer credit card within the last 24 months.”

This means that it has to have been 24 months since you received the bonus and you must not currently have the card. There is no language stipulating that the card has to be closed for any length of time.

That’s really interesting, I wondered the same thing about the cards and assumed it was 24 months since last having the card.

I’ll be interested to hear if it plays out like this in practice – thanks for digging into all this!