Chase Ink Plus Application Experience

My wife and I have a long history with the Chase Ink line of credit cards. Way back in time when there used to be both the Ink Plus & Bold, my wife and I both opened up those cards for our separate businesses. Over the years we have cancelled some, downgraded one and even signed up again during the switch from Mastercard to Visa.

Those Were the Days

As most of you know by now Chase isn’t being so generous with credit card approvals anymore. Last year they instituted the so called “5/24 rule” which limits approvals on their Freedom, Slate & Sapphire Preferred cards for people who have opened five or new credit card accounts across all banks within the past 24 months.

Doctor of Credit recently reported that the Chase Ink cards will be subject to this same rule sometime in March and we will eventually see it extended to their co-branded credit cards in April as well. This means that a lot of people are scrambling to get their “final” Chase applications in.

Why I Applied For the Chase Ink

Up until now my Chase Ink cards have been applied for with my social security number. My business recently incorporated and thus I now have a new name and EIN that I can use to apply. I really do need a credit card in the name of my new business, so I thought why not take a shot at my favorite overall business card, especially since it has a 60K offer right now.

There are numerous data points saying that it is best to let your application process naturally instead of calling into the reconsideration line. Since it often takes 2-3 weeks for this processing to happen, I figured it would be good to apply before the end of February. My speculative belief is that I need my application processed before their new rules go into effect sometime in March. Of course I have no proof of this and it is just a theory, but I gave it a shot.

My Application Experience

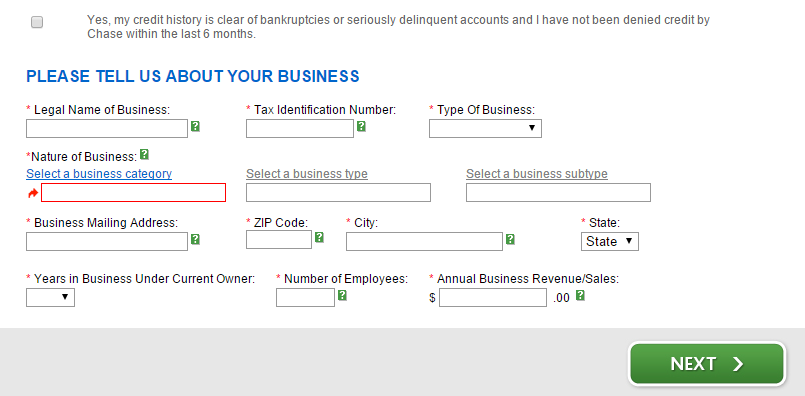

Chase’s Ink application is among the most complicated since you need to dig down through their categories to find your business type and subtype. After doing that and inputting all of the relevant information, I hit submit and the page refreshed for over a minute while it processed my app. Once it was done I got the dreaded “need more time to process” message.

What to Do Now

Now all I can do is wait for my application to be processed. I have a stellar history with the bank, a 780+ FICO score and I spend a lot of money with their products, but that might not be enough to overcome my recent applications. Even though the 5/24 rule isn’t officially in place yet, Chase has still been denying quite a few people for “too many applications” or “too many new accounts”. I probably give myself a 30% chance of approval, but I thought it was worth applying given the 60,000 point bonus and my actual need for a business card.

Conclusion

I know a lot of you have decisions to make as to which Chase card/cards you want (if you want any) to apply for before these changes happen. (Frequent Miler has a great post to help with that.) For me, getting an Ink card is the best move since I have all of the co-branded cards I want and this card fills a need I have, has awesome bonus categories and an amazing sign-up bonus. I’ll follow up in a couple of weeks when my application is processed, but for now I’m keeping my fingers crossed.

I know this thread is a bit old, but I just opened a biz checking account in-branch and at the end the banker said i was pre-approved for Chase Ink Plus. So, I said ok, and applied.

I am wondering if it is possible to be declined after they say you are pre-approved. The reason I ask is, I did my app-o-rama 17 days ago. I got Alaska Air, Chase Sapphire Preferred, and AMEX Hilton Honors. I had also applied for Southwest card from Chase which was declined because of the pending CSP app. So, last week I applied for Southwest and got pending, so I called immediately and it was approved.

Now, two days later, I applied for Ink Plus… I don’t even see the southwest account yet online. I am wondering, has anyone been declined for Ink Plus after being preapproved in branch?

Hi Shawn, any word on your app?

It is still processing. They sent me a letter asking me to send in my business information (proof of LLC and EIN) and I faxed it in about a week ago. I called and they said it would take up to two weeks to process.

Just applied for an Ink card and was not instantly approved – got a message that they would like to talk to me. They even asked me to call Chase asap. In the meantime, I got an email saying that they would let me know within 30 days whether I was approved or not – you know, the usual stuff.

I was initially going to wait to for the mail to arrive, but just couldn’t help. Called Chase and they just wanted to verify few personal details. I was approved in like 5 mins.

Great! The message to call is not normal so I’m glad you called in and were approved.

I have been denied twice in the past four the ink card. But i thought it doesn’t hurt to try again as part of my app-o-rama. Surprisingly i was approved instantly even though i have 9 experian hard pulls in the last year. My second app for United card went pending even though i was targeted for it.

In total applied for 9 cards,7 approved instantly and one pending and one denied. Surprisingly citi denied me even though i only have one card with them. I applied for AA business card.

When you say “stellar history with the bank” you are speaking of the total number of points you have racked up with their cards? 😉

Is the Ink card worth it if one is not going to MS at office supply stores. I have CSP and Freedom. The way I see it, 60K UR points for $5K spend. I have better gas card with Citi Premier (3X). I don’t spend a lot at office supplies so I would basically just be getting this for sign up bonus.

I wonder if most people wouldn’t be better off splitting the 5K spend between two cards, say SPG and fill in the bank? I love my CSP and Freedom, but not sure how this fits.

I received a targeted mail offer. I already had 3 Ink cards for 2 businesses but decided to try again. It took about 2 weeks, but got approval yesterday. Hang in there!

Can you share your experience about how to start a business for MS purpose?

John. I find your publicly open question very interesting. Hope you get a response.

I can refer someone for Chase Ink Plus for 60k bonus points. If you want, you could send me an email with your name and email address. You should receive the referral within 7 days:

wonderfulname123@hotmail.com

I just got approved for INK. I applied the same day as the Hyatt card about 2 weeks ago. I called Hyatt 1 day after the app and had to move some credit around before getting approved. I called INK the next day and they asked some questions on the app and told me that it will go up for Sr review. Didn’t hear back for a week so I called again. The rep asked me similar questions and said it was weird that some information was missing. After being in a lengthy call with lots of holding, I got approved. I started my CC apps last year starting with CSP, then SPG Amex (Per, Bus), Freedom (Auth user), SW (Pers, bus), AA Citi and now Hyatt and INK. I might be pushing my luck going for Marriott and/or United now?

Shawn do you know if there’s a way to get the 10k Chase INK referral link? I have the INK, albeit for less than a month, but I’m not able to pull up any referral links. I was going to apply for one in my wife’s name. If I can’t get a link and you have one I’m happy to use it.

If you cant get your own, here is Shawns backdoor super secret only VIP link.

https://milestomemories.boardingarea.com/credit-card-referral-links/

Its up to date.

It takes awhile for the links to get up and running. On my new card the last time it took months.

I applied for UA business card. No immediate decision and went pending. Called the next day. Couple of questions about my business. I had nothing much to add as I sell a few stuff at ebay and amazon without any significant revenue. The rep said my application will be further reviewed and I will be informed of the decision by a letter. I took that as a polite NO. Just out of curiosity, I called the automated number today and heard the sweet music “YOUR APPLICATION HAS BEEN APPROVED WITH A CREDIT LIMIT OF 5K”

Excellent!

Just got approved for my Ink Plus, on the first day of this month, after applying at a branch. I’d been pre-approved, but the rep couldn’t tell me if the approval went through. A day or so later, the new card appeared on my Chase app, and I received it about a week after that. This was my fifth credit card in the past 24 months. Glad to get it! Since I now have the Freedom, the SP, and the Ink Plus, I’ve no need to apply again with Chase anytime soon. I still MIGHT try for their Southwest card late this year.

Please update us with your results!

How did you get pre-approved on INK plus? Do you have Chase biz checking/saving accounts? Or just personal accts? TIA. I am only pre-approved for CSP and United Club.

I opened personal savings and checking accounts, last year, to “court” Chase, hoping I’d eventually be considered for the Sapphire Preferred. Sure enough, just a few months later, the branch rep told me I was pre-approved for the that card. So I applied there and was immediately approved. Then just this month, I went in and opened a business checking account. While I was there, the rep told me, “You’re pre-approved for the Ink Plus.” So I pulled the trigger, then received it a week or so later. I think the fact that I maintained a positive relationship with them helped. Also, I believe that going into a branch to apply worked in my favor.

That sounds right! Thank you! That’s the answer I am looking for. I think Chase pre-approved me with offer on CSP and UA Club card because of my relationship on checking and saving accts, and high balance of deposit.

When you opened the biz checkingacct, did you have a legit biz with EIN or just your personal name with your SSN? Did you keep high balance in your biz checking acct? That’s my plan to sign up a biz checking account, deposit some money into it and wait to be pre-approved to get thru the 5/24 barrier. Thanks again.

Kris, to be honest, I’m not sure if my opening a business checking account actually helped me (didn’t hurt, either), because within minutes after setting up the account, they told me I was pre-approved for the Ink. But still, I firmly believe that being a good, responsible Chase customer, while maintaining high balances for several months, will definitely work in your favor. I already had checking and savings accounts with $5K and $15K average balances, respectively.

To open business checking, I transferred $5K from my personal checking. They didn’t mention anything about checking account signup bonuses. But since I’m self-employed, I’m not sure if I’m able do any direct deposits anyway.

I opened the biz checking account as a sole proprietor, using my SS#. A few weeks before opening that account, they told me I’d at least need to register a DBA with the county, then have it notarized. In all, the cost to do that was about $75. Worth it in my book. And the funny thing is, the Chase rep asked me about my employment income. When I gave her a figure, she kind of encouraged me to quote a higher figure, then told me it would help me get a higher credit limit. I think we upped that figure to about $68K, so I was eventually approved with a $13,500 credit limit. A lot more than I expected lol.

A follow-up question. Any idea on the signup offer on biz checking acct? I did some research online and it looks like there used to be a $100 bonus offer a few years ago but not anymore…

See my last reply. I covered it there. Let me know how it goes!

Thanks David! I am in the similar situation. I have both checking and savings accounts with $7K and $18K average balances, respectively. I have scheduled to open a biz checking but want to push back the app for INK plus to at least March, since I just signed up CSP on Feb 1st.

Good move. It’s hard enough to meet the minimum spend requirements on one card, without attempting to do it with two. And opening biz checking now sounds smart, because it’ll give you almost two months to put on a pretty face for the bank.

I kind of lucked out on the minimum spend for the Ink. I’ve been delegated the responsibility of collecting the money for my 40th high school reunion. The total cost will be about $4200, and all the old classmates are sending me money to pay for it. Once all the funds are collected, I’m going to use the Ink to pay for the reunion. That’ll instantly put me over the top. :-D.

@David R

I went to the local Chase branch and signed up a biz checking acct. Just like what you saw for the pre-approved offer, once I finished the app of biz checking acct, the banker showed me that I am pre-approved for INK plus or cash card, I think that was a right move! But since I just opened CSP on Feb 1st I want to wait for another few weeks to sign up the INK plus card. So I am still worried about the 5/24 rules, considering I have a recent new Chase credit card.

Shawn I only sell a few things on Ebay, is it worth it to apply for the Ink Plus using this as a business. Would they even consider it a business?

GL, Shawn. I still have Ink +… no biz EIN to apply for another 1. Applied for IHG & Explorer on the same day, 2/11, but today still says 2 wks. Will wait til next week & hope the get both approved

I wonder if you would have been more likely to get an instant approval if you used your SSN instead of the EIN? If the EIN does not have a credit history then it may not get approved. Or did you also use your SSN? Can you tell on your personal report if there is a hard pull from Chase based on this application?

Yes you also put your social security number on the application since you are guaranteeing the card and your personal report is run.

On the topic of business credit cards and credit reports… I read somewhere that Chase doesn’t report business credit card activity to your personal report. If that’s true, how do I obtain my business credit report? I got my Ink card with a DBA ( sole proprietor) and my SS#. Do I need to get a DUNS number, or what?

Northeast, I applied at a branch (and got approved) as a sole proprietor, using my SS#. They pulled Equifax and Experian from my personal reports. But it’s to my understanding that this account won’t show up on my personal reports. Which is kind of a good thing, because it won’t affect my average age of accounts.

Why are you not calling right away for reconsideration? I always have to do that will all Chase cards and after moving lines around or more info am always approved:

Chase Bank Reconsideration numbers

(800) 432-3117 – General Application Status Line, automated

(888) 245-0625 – Personal Reconsideration Line with a live rep

(888) 609-7805 – Alternative Personal Reconsideration line with live rep

(888) 871-4649 – Alternative Personal Reconsideration with live rep

(800) 453-9719 – Business Credit Card Reconsideration Line with live rep

(800) 432-3117 – General Card Services and Application Status, automated

(800) 955-9900 – General Card Services and Application status, automated

There are a ton of data points in the last couple of months that people with a lot of new accounts/inquiries are automatically denied when calling in, but have a much higher success rate by letting the process play out. I agree that it used to be beneficial to call, but specifically with this card it seems that it is better to wait.

Agree that waiting is best! I was approved 2 weeks ago after my application went pending.

I applied last month and it went into pending but eventually was approved. I did not call or SM Chase.

I called for a personal SW Plus application. At first they denied me. I asked them to swap out another co-branded card and they said yes.