Chase Minimum Spend Extension

Things are tough right now as we all still contemplate what the fall out will be from all of this. One of the immediate issues though is our ability to go out into the world and spend money. There are a lot of people who signed up for credit cards before the worst of COVID-19 hit and now are unable to hit the spending requirement to get their welcome offer.

While Chase isn’t always perceived as being the most customer friendly bank, I have mostly had good experiences with them over the years. Now, it seems they are doing right by customers when it comes to meeting a minimum spend during COVID-19, however you have to ask for the help! Let me show you what to do and explain why you should ask for the extension even if you don’t think you need it now!

How to Get A Chase Minimum Spend Extension

Let’s look at how to possibly get a Chase minimum spend extension on a new credit card. Thanks to Derrick in the Travel on Point(s) Facebook group for the info.

Send Chase a Secure Message to Request Extension

If you need a Chase minimum spend extension then the easiest way to ask Chase is via secure message after logging into your account. I suspect you can call in, however wait times are long lately and you may still have to wait for an answer while it gets escalated. Writing a secure message saves you the hassle of waiting and allows them to get your request to the right person.

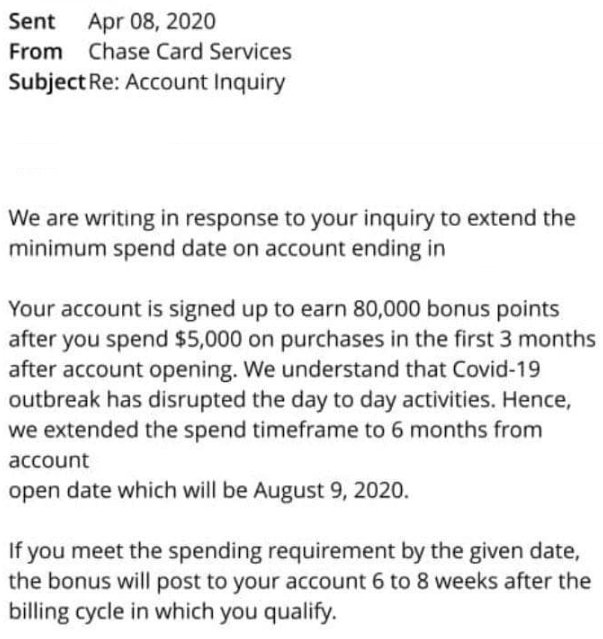

Several people including Derrick have had success asking Chase for an extension. He was able to get them to extend the minimum spend date to 6 months from opening instead of the usual 3. You can see the response from Chase below.

What You Need to Know

Here are a few things you should know about the Chase minimum spend extension process and what to expect.

- Chase won’t contact you – Chase won’t proactively reach out to you and extend your minimum spend date on your new Chase credit card. Instead, you will have to contact them in order to request a Chase minimum spend extension. The good news is that they seem to be granting these to everyone who asks, although that is just anecdotal.

- Be prepared to wait – If you do send Chase a secure message be prepared to wait. Just like the phones, secure messages are overloaded and it is taking about a week and sometimes more for Chase to respond, but they will respond!

- Better safe than sorry – Even if you think you are going to hit your spend threshold, I suggest sending Chase a message and getting the extension just in case. Things have been changing quickly and it’s better safe than sorry. It’s easy to forget about arbitrary dates when you have other pressing matters to attend to, so this allows you to place that spend on the back burner while you deal with the more important issues of the day.

Chase Minimum Spend Extension – Bottom Line

Chase is now extending minimum spend dates for many new cardholders, but for now only the ones who ask. Many holders of new Chase cards are being given 6 months to hit their spend thresholds which should make things quite a bit easier!

Has Chase given you a minimum spending extension on your new credit card? Share your experiences with this in the comments!

[…] Miles to Memory 的數據點,可以向Chase發 Secured Messages (SM) […]

[…] Having a hard time doing your minimum spending done to get your signup bonus now that you are stuck at home? How to Get a Chase Minimum Spend Extension & Why You Should Ask For One! […]

[…] 更新】据 Miles to Memory 的数据点,可以向Chase发 Secured Messages (SM) […]

Wonder if enough people ask will they just extending it automatically at least for certain cards

Have to apply and be approved for the card first then fingers crossed…

[…] minimum spend requirements for sign ups through December 1, 2019 through May 31, 2020. According to MtM Chase is offering an additional three months as well, but you need to request the extension. […]

[…] new cardholders with further time to finish the spending requirement of bank card welcome bonuses. Miles to Recollections studies a number of optimistic knowledge factors the place individuals have efficiently been in a […]