Question Of The Week: Chase Sapphire Reserve Authorized User Benefits

This week’s question is about the Chase Sapphire Reserve authorized user benefits. What are they? Does your authorized user (AU) have all of the benefits, or just some? Here’s a look at what benefits your authorized user can enjoy from the Chase Sapphire Reserve.

The Question

This week’s question comes from Denise:

What are the current benefits offered to a Chase Reserve AU?

Great question. Not every bank and not every card extends authorized user benefits in the same way. Let’s check out the AU benefits on the Sapphire Reserve.

Chase Sapphire Reserve Authorized User Benefits

Adding an authorized user to the Chase Sapphire Reserve costs $75 per year (per each user). Obviously, if you’re paying for something, you want it to be worth it.

Here are the individual benefits the authorized user can enjoy:

- Priority Pass membership: yes, the authorized user can sign up for Priority Pass and get a membership.

- Travel / Insurance coverage: yes, the same coverage applies to your authorized user.

- Lyft Pink membership: yes, the authorized user can enroll for an individual account.

Additionally, you can share the following with your authorized user:

- $300 annual travel credit: your AU doesn’t get a separate credit, but qualifying charges on the AU card will count toward your credit.

- Global Entry / TSA Pre-Check: if you haven’t used this already yourself, then your authorized user can take advantage of it. Essentially, there’s 1 credit, and anyone can use it (you can even use it to pay for a friend who isn’t your AU).

- Door Dash credits: qualifying charges by the AU can count towards these, but there’s no separate/additional credit for the authorized user.

What about points?

The authorized user is not eligible to earn a welcome bonus / new cardmember welcome offer. Also, the authorized user will earn points that go into your account as the primary card member. The AU won’t earn points into a separate account that they can redeem.

For a full list of the benefits on the Chase Sapphire Reserve, you can read our analysis here.

Chase Sapphire Reserve Authorized User – How To Add One

Want to add an authorized user to your Chase Sapphire Reserve account. Here’s how:

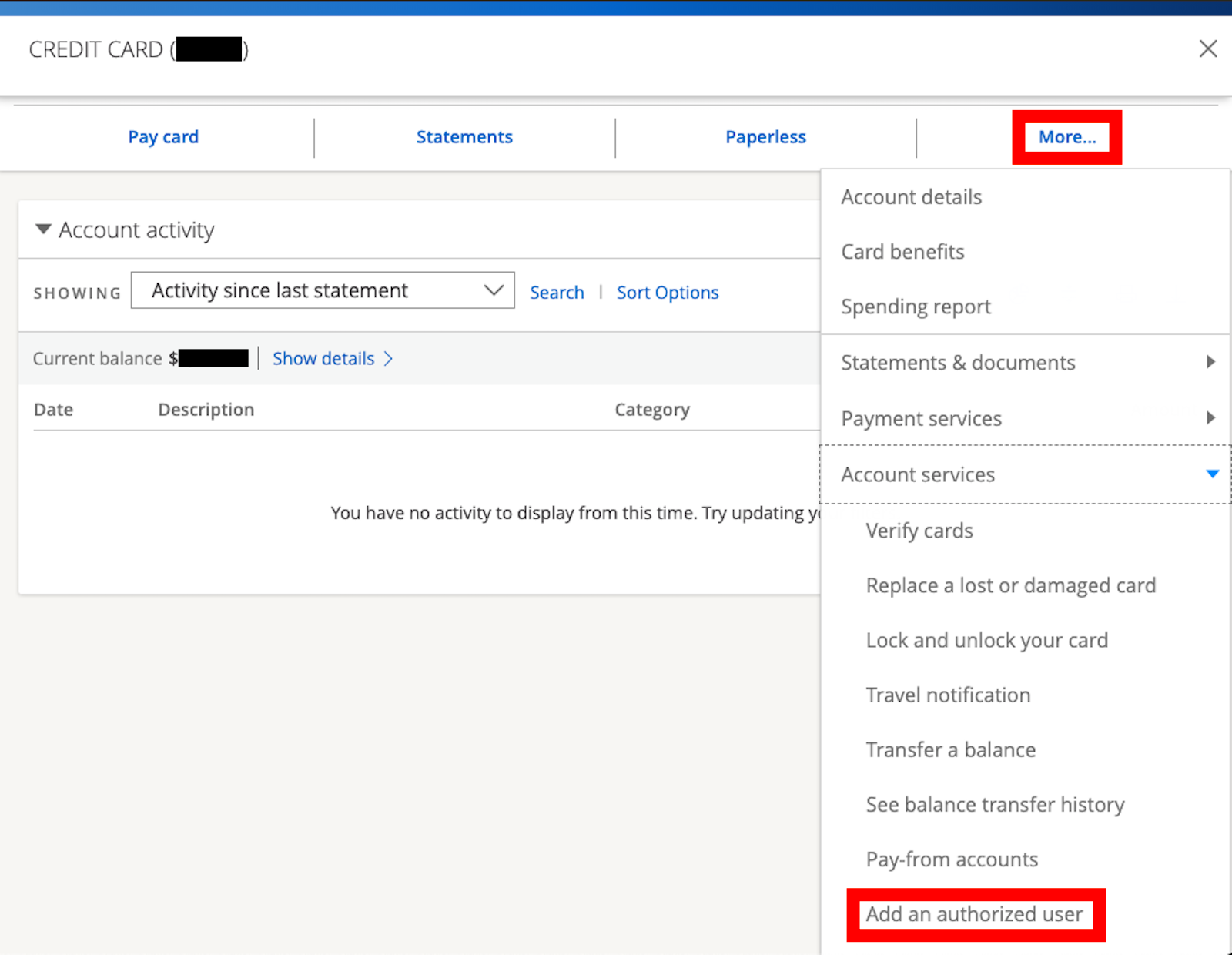

- Log into your account at Chase.com

- Go to your Chase Sapphire Reserve card

- On the right side, click on “More”

- From the drop-down menu, choose “Add an authorized user”

- Fill out the form and required information

- The card will come to you in the mail

- Activate the card

It’s worth noting that Chase is quite sensitive about authorized users. If you add people who don’t live with you and/or Chase thinks they don’t have a legitimate relationship with you, this can lead to a Chase account shutdown. It’s quite a headache to deal with (trust me). Be certain this person has a real relationship with you (family, business partner, babysitter, etc.) and be able to prove it if they ask.

Final Thoughts

If you’re thinking about adding an authorized user to your Chase Sapphire Reserve, this should help you judge whether it’s a good fit and whether it’s worth it. We know what benefits are shared, which are individual, and which don’t apply. We also talked about how to add the AU and what Chase accepts as a bonafide authorized user. I hope you found this helpful!

Is this the best available card for Priority Pass for 2 people? I feel like I heard the Ritz card was better, but since that isn’t available to new sign ups, I’m wondering which PP benefit from the different issuers is best. Currently I access PP through Citi Prestige, but I want to add a second membership for a reasonable cost.

Jason – there’s a breakdown of Priority Pass memberships here for comparison https://milestomemories.com/which-credit-cards-offer-priority-pass/