A Few Random Items Of Interest

While today was a slow news day for the most part, I have a few things for you including positive changes to a popular credit card, a new Amex offer and an update on a recent Chime card offer.

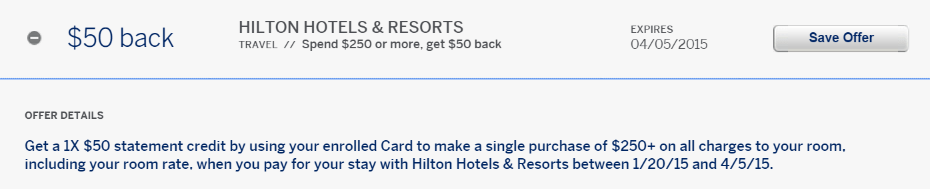

$50 off $250 Hilton Amex Offer

I use Wandering Aramean’s Sync Assist program to automatically load Amex Offers to my Serve cards. This morning I awoke to an email confirming my enrollment in a new Hilton Amex Offer. Naturally I was intrigued and found the offer was available on the American Express website as well.

The offer gives $50 back on payment of $250+ at Hilton Hotels & Resorts. According to the terms, this offer covers all room charges including the nightly rate.

I wonder if this will work like other recent hotel Amex Offers where you can purchase a gift card to trigger the credit. Since I don’t have use for a gift card, I won’t be experimenting, but if you do let me know. You can find the full terms here.

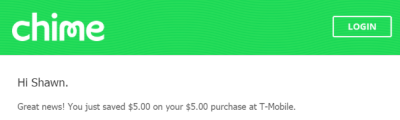

Chime T-Mobile

The other day I wrote about a new Chime offer for $5 off at most major cell phone providers. I am a T-Mobile customer and thankfully their system is pretty easy for making a small payment so I used my Chime card to pay $5 towards my monthly bill.

Within a minute of making the payment I received a message from Chime indicating I would receive a $5 credit. While I doubt they will be able to keep this up, I keep enjoying more and more free money from Chime.

If you are new to Chime, you can sign up and receive $10 free. (Personal referral link.) Have questions? You can find all of my posts relating to Chime here and feel free to ask away in the comments.

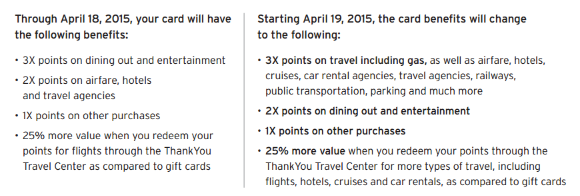

Citi Premier Card Changes

The other day I wrote about my recent credit card churn. As part of that churn I picked up the Citi ThankYou Premier card in order to delve a little deeper into the ThankYou rewards program.

As a new cardholder I am excited to hear about some of the changes that Citi will be reportedly making to the card. Starting on April 19, 2015, the card will undergo some (mostly positive) changes.

As you can see above, the bonus categories are switching around a bit. Also, the travel category has been expanded to include gas. Finally, the annual fee is reportedly going down from $125 to $95. Sounds good to me!

Since dining is dropping from 3x to 2x, I could see this being a negative for some people, but overall I think this is an improvement. Either way, the card is still pretty attractive, especially considering ThankYou points can now be transferred to travel partners.

You can see a full list of the changes here.

HT: Doctor of Credit

[…] Citi ThankYou Premier has recently undergone some changes to its bonus categories and annual fee. It seems along with those changes the bank has improved the bonus for the card as well. Previously […]

[…] can save $5 off on your cable or satellite bills by paying with Chime. This is similar to the cell phone deal I mentioned awhile back, but it requires a $25 payment. You can find more on Chime […]

[…] week I reported that the Citi ThankYou Premier card is having its travel category expanded to include gasoline and a number of other things. Doctor of Credit is reporting that Citi […]

[…] Personally I would go for the ThankYou offer if you have a card that allows for transfers like the Premier or Prestige. ThankYou points are worth a lot more than they used to be now that they have transfer […]

Thanks for the tip on the Chime Tmo offer. I tried to make a 2nd payment with my wife’s account and it looks like they didn’t process it immediately. Hopefully the offer is still there once it processes in 24 hours.

That happened to me as well. My guess is they limit the number of payments in a given amount of time to 1. They never processed it, so today (after 2 days of waiting) I just did it again and got the credit on my wife’s card.

Hi Shawn – just a quick observation on the Amex Offer(s) for Hilton. I think that most of my cards already have a $40 off $175 for Doubletree Hilton. A little bit more specific, but definitely a bit better percentage deal for potentially buying Hilton gift cards. I recently did that with the Hyatt Place Amex Offer – bought generic Hyatt gift cards that I used at Andaz (gotta like 33% off all dining and parking while we were there).

I don’t have that Citi Premier card (yet), but seems like a bad trade-off to me. At 3x Dining and Entertainment, I think it might have been in my everyday spend rotation. But I guess 3x for travel could be pretty good too. Just would love to see another redemption partner (per FM’s prediction) beyond Virgin.

It really depends on your spending patterns and what other cards you have. Remember that currently the travel category doesn’t have gas, so gas is going from 1x to 3x as well. At worst I think this is an even trade off, but you are right that it will be bad for some.