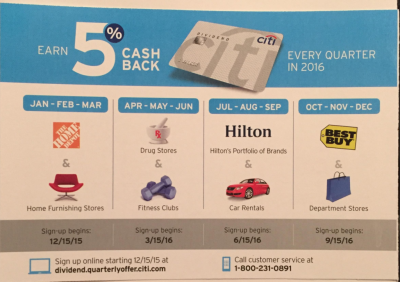

Citi Dividend Rotating Categories 2016

Citi’s Dividend card is no longer available to the public, but there are many people who have one. That is because Citi has been allowing people to product change to it (right now product changes seem to be on hold) and since it carries no annual fee, the Dividend is a good option for keeping your account history alive. I personally have two Dividend cards, having converted old AAdvantage Executive cards over.

Rotating 5% Categories, But Different

Like the Discover It and Chase Freedom cards, Citi’s Dividend has rotating 5% categories. Unlike those other cards, you can earn a maximum of $300 cash back for an entire year. The kicker though is that all of that cashback can be earned during one quarter. For example, if you find a category where it is easy to manufacture spend, then you can max the card out and move on.

Details of the 2016 Citi Dividend categories have leaked and there is some good news. Let’s take a look:

Home Depot and Best Buy have some potential since they sell Visa gift cards, but the real winner here is Quarter 2. Many drug stores sell variable load Visa gift cards in denominations up to $500 for a $4.95 fee. By purchasing those, it should be fairly easy to max out the $300 cashback for the entire year relatively quickly and cheaply.

Cashback Rollover

Keep in mind the $300 cashback earned includes cashback for purchases made at the end of 2015 for which the statement closes in 2016. That means you want to make any 2015 purchases before your December statement hits in order to preserve your $300 cashback for 2016.

Conclusion

This year’s Citi Dividend rotating categories were terrible, so it is good to see that drug stores have been added back. I really like the fact that you can earn all of the cashback in a short period of time and then just throw the card in the sock drawer until next year. If you are interested in getting a Dividend, hopefully Citi will begin allowing product conversions again. Until then, see you in the 2nd quarter with my Dividend in hand!

HT: Doctor of Credit (Photo from Reddit)

Thanks for the post man. Had a quick question.

For the longest time, I never understood the fuss of GC via drug stores because ALL my local Rite Aid is CASH ONLY and CVS asks for all this info including Drivers License/Address with limit of 1 GC/Day and Walgreens is YMMV for me (sometimes CC or CASH only or sometimes 1 GC/Day etc).

So what have you seen? Are people really able to get crapload GC from drug stores via CC?

I must live in a crappy place for MS.

You can, but liquidating is a pain because you can only do one a day at family dollar. Walmart won’t take them.

And Old Blue Cash already gets 5% at CVS anyway.

In some areas Rite Aid is fairly MS friendly as is CVS. CVS limits you to $2,000 per day, but this promo would only require $6,000 in spend, so it is doable. For me in Vegas all Walgreens are cash only and only one CVS that I know of is credit card friendly. I think the situation is much better other places.

Thanks for the response man. Yea, I have been jealous for a long time of MS friendly drug stores and gas stations.

Can you elaborate on the Cashback Rollover….does this mean if I don’t spend enough to achieve the $300 by Dec, I won’t get the full $300 potential the following year?

No, but if you spend in December and it posts to your account in January, then it will count against your $300 limit in 2016. You only get $300 per year, so it is best to make sure the cashback earned in 2015 posts in 2015, so you have your full $300 to earn in 2016.

Hey Shawn. So my statements close on the 1st of each month. Meaning, DEC 2015 transactions will all close by JAN 1st 2016. Does that mean ALL my DEC purchases will count towards my 2016 limit because my DEC statement closed in 2016 and the corresponding CB will post in 2016?? Holy crap.

Yes. According to everything I have read, the cashback earned counts in the year when it posts. If you purchase in December, but it posts to your account on January 1, then it should count towards your 2016 $300 limit.

Holy Crap. Appreciate the response brotha. Will have to strategize carefully now!

As always, THANK YOU VERY MUCH!

lol leaked? I got the mailer yesterday

I didn’t realize the mailers had been sent out to everyone. I have fixed the title to say “Released”.