Citi Shop Your Way Mastercard Increased Bonus Offer

In case you didn’t know it, Shop Your Way is still going strong and Citi has a new offer for signing up for their co-branded credit card. Let’s take a look.

The Offer

Earn a $75 statement credit for every $500 spent, up to $225, on eligible purchases in the first 90 days. Valid for new accounts opened 5/8/2022 – 1/28/2023.

Card Benefits

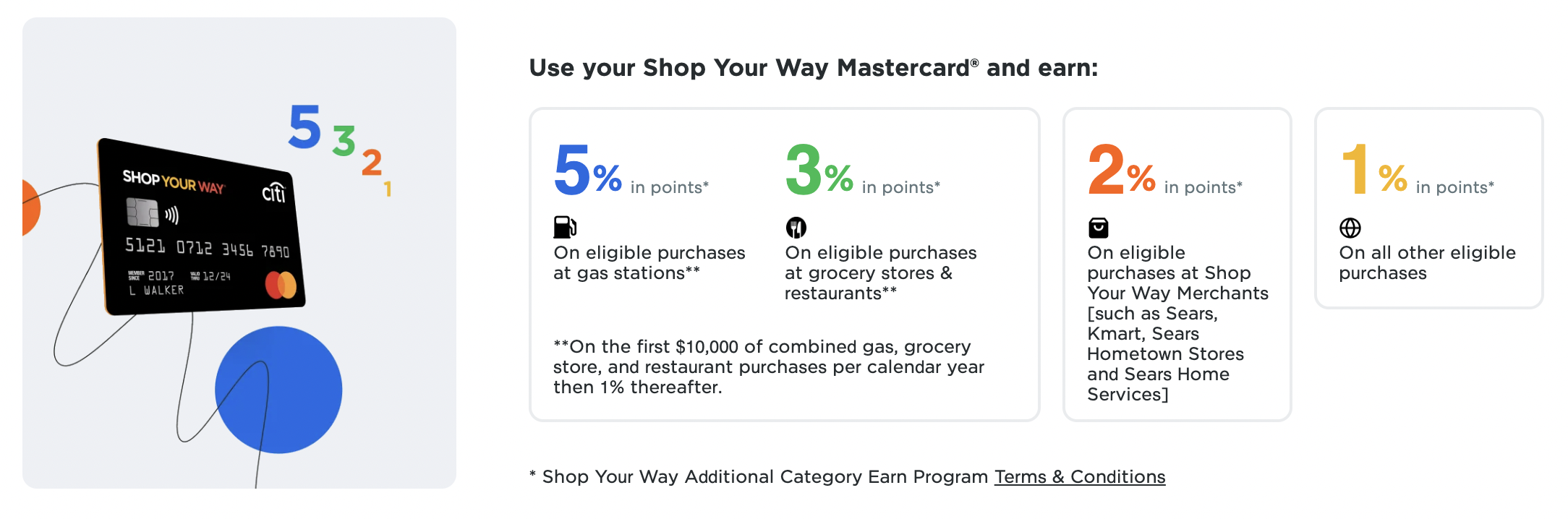

The Shop Your Way Mastercard earns at the following rates:

- 5% back on eligible gas purchases

- 3% back at grocery stores and restaurants (up to $10K per year)

- 2% back at Sears, Kmart, Sears Hometown & Sears Home Services

- 1% back on all other purchases

Need to Know

This seems to be about the best offer this card has had. Many people receive very lucrative targeted spending offers when holding this card, so it has become popular among some crowds. The offers don’t often come right away, but if you spend a little on the card it can pay back quite a lot. I have an older version of this card and often get 10X spending offers. Of course there isn’t much left of the Sears empire, so I wouldn’t get it to take advantage of 2% back at those stores!

Citi Shop Your Way Mastercard Increased Bonus Offer -Bottom Line

Perhaps the most exciting thing about Sears these days is the spending offers you can get on this card. The capped grocery and restaurant bonus categories aren’t terrible either, especially if you are someone who is always looking for more bonused grocery spend.

HT: DoC

The CITI offer expired over a year ago. You can take it down.

I love this card. There are always ongoing targeted offers for true Cash Back. And this is on top of the 5%, 3%, 1% you earn in points as you spend toward those targeted offers. A very lucrative card indeed!

One can trade the SYW points for Thank You points, if I recall correctly. What is the ratio? 10:1, right?

Not that I can tell. This used to be an option but no more. Other citi cards (Double Cash, Custom Cash, etc.) share and pool your TYPs but the SYW card has it’s own point system.