Citi ThankYou Expedia Partnership

What is old always seems to become new again. Does anyone else remember all the way back to 2010 when you could earn and redeem ThankYou points at Expedia? Well that partnership ended on December 1, 2010, but it appears it will partially be returning. Today Citi announced that holders of select ThankYou earning cards will be able to redeem points at Expedia. But is it a good value? Let’s take a look.

How to Redeem Points

Redeeming ThankYou points on Expedia is quite easy. All you need to do create an Expedia+ account or login to your existing account and link your card from this page. I was able to link a card in under 30 seconds and see my points balance.

Eligible Cards

Quite a few cards are eligible. According to the Expedia FAQ on the partnership, the following cards are eligible:

Citi Prestige Card, all Citi ThankYou Cards, Citi Chairman American Express Card, Citi Forward Card, CitiBusiness ThankYou Card, Citi PremierPass/Expedia Card, AT&T Cards and Sunoco cardmembers with available ThankYou points.

Is It A Good Deal? A Detailed Comparison

To see if this was a good deal, I searched for a random hotel for a night in June. None of the materials I had seen stated what value you would receive for ThankYou points, but my guess was that it wouldn’t be good. It turns out I was right.

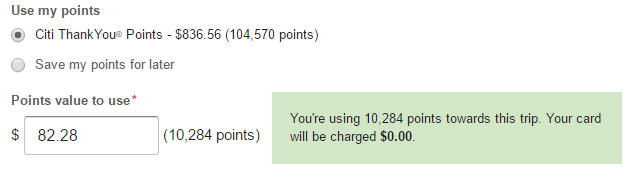

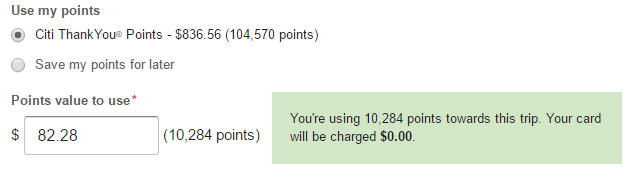

For the night of June 14th, the TI in Las Vegas came in at a rather cheap $82 including taxes. On the checkout screen this is what I was presented with:

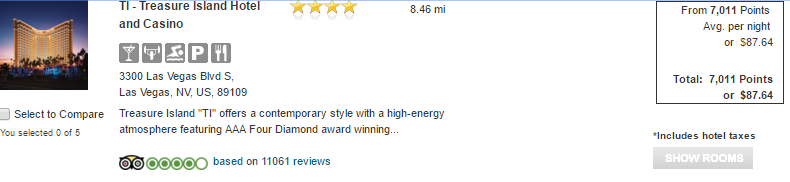

Yikes! I can redeem 10,284 points for $82.28. That is a value of .8 cents per point. Not a good deal at all! But of course sometimes Expedia has deals that other OTAs don’t have. Just to be thorough, I searched for the same hotel through the ThankYou travel booking engine where I can redeem my points at 1.25 cents each as a Premier cardholder.

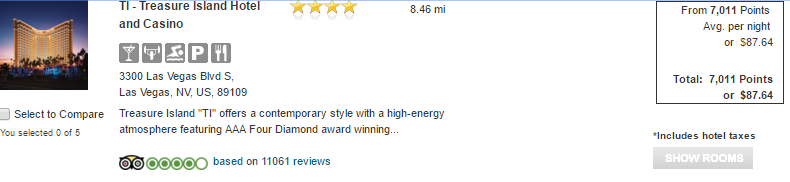

While Expedia did indeed have a lower cash rate, look at the difference in the number of points required:

So I can book through Expedia (where I would earn a few of their loyalty points) and pay 10,284 points or I could book directly through ThankYou and spend only 7,011 points. The truth is that Expedia would have to be signifcantly lower than ThankYou to make this work. I can’t see very many scenarios where that will happen.

Conclusion

It is nice that Citi is trying to find new ways to allow us to redeem ThankYou points, but at .8 cents per point they aren’t doing us any favors. For those with a Premier or Prestige card, the ability to book hotels at 1.25 cents directly will almost always be the better move. Now, maybe they’ll start letting you earn ThankYou points on Expedia bookings again? Probably not, but it would be nice.

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Back in the day, I loved TYPs and Expedia. When our 5 kids were in college, it was perfect for cheap hotels to visit them. We didn’t care about luxury. We were paying a LOT of tuition.

When Citi changed travel agents it wasn’t nearly as good a deal. It is part of what led me to Flyertalk and learning more about P&Ms.

A lot of regular folk will end up doing this and feel good about their “free” travel

Interesting, as Expedia is also partnering with Plenti.