3x Everywhere – NO Cap!

Yesterday Frequent Miler wrote about retention offers being given by Citi on their ThankYou Preferred card. (Worth reading for his analysis.) Last year many people were able to sign up for the card when it was offering 5x points at gas, grocery & drug stores for the first 12 months.

Our Journey with the ThankYou Preferred

My wife actually signed up for the card in branch awhile back and was verbally told that she was getting the 5x offer. Unfortunately she didn’t read the disclosures which the teller buried under checking account paperwork.

When my wife got home I read the paperwork and found that she was given the normal public sign-up bonus. The teller immediately played dumb and after escalating the matter pretty high within Citi, they decided not to honor the 5x offer.

While my wife should have read the paperwork, we were obviously upset with Citi, but our only other recourse was getting the government involved. Not wanting to jeopardize our relationship with the bank, we decided to drop it, spent the minimum on the card to get the 20,000 ThankYou point bonus and put the card away.

The Card Just Got Valuable

Inspired by Frequent Miler’s post, my wife decided to call up Citi to see what they would offer her to keep the card. She hasn’t used it in over a year and wasn’t expecting much.

The retention agent was trying to scare her into believing that all of her points would be lost (they are in a joint account and could be transferred out), but finally after specifically asking if there was any offers, my wife was presented with two choices.

- Offer 1: 10,000 bonus ThankYou points after spending $3,000 in the next six months.

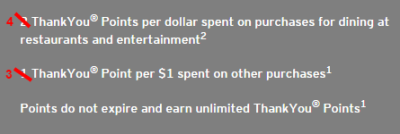

- Offer 2: 2 extra ThankYou points per dollar on all spend for the next six months with NO CAP! This equates to 3x on all spending and 4x on dining and entertainment.

She ultimately chose option #2. To avoid any repeat issues, we also sent a secure message to Citi following the phone call to confirm the terms in writing. The agent made everything clear on the phone, so if the terms don’t match what my wife was told, the recorded call can be listened to.

Other Offers

Frequent Miler also reported a couple of different offers:

- Offer 3: Same as offer 2, but with a cap of 35,000 extra points.

- Offer 4: 5x points per dollar at drugstores, grocery stores, gas stations, commuter transportation, and parking for 3 months with a limit of 35,000 extra points.

Conclusion

With unlimited 3x everywhere and 4x on dining and entertainment, I think my wife’s offer is the best out of the four. While the 5x offer looks good, its low cap is the killer.

In the end, this offer by Citi has had its intended effect. The card has already made its way back into my wife’s wallet!

[…] The Double Cash card is probably the best overall card out of these three since it earns 2% back on all purchases, however one of those cards is known to have amazing retention offers. […]

[…] 2 extra points per dollar on all spending for 6 months with no cap! (See the full details here & […]

[…] I had to convert an existing Citi card to the ThankYou Preferred in order to get one of the very lucrative retention offers that they have been handing out. This past weekend I answered a lot of questions about it at […]

[…] My Citi ThankYou Preferred Retention Offer – It’s Good (Really Good)! – 3x everywhere! Enough said. […]

[…] terrible, but not really amazing either. (Of course other factors can change this like the recent 3x everywhere retention bonus on the ThankYou […]

[…] have stack of ThankYou cards, maybe I should try to get a bunch of retention offers? (Miles to […]

Hey Shawn,

Nice post! I’ll try by myself later. A quick question: If I really go ahead and cancel this card, will I lose all the points associated with this card? I have another thank you credit card and have combined my thank you accounts. However, it seems to me each thank you account still stays independent when earning points, and we cannot really transfer points from one account to another. This seems a bit different from Chase and I’m getting a little confused. Can you clarify this? Thanks a lot!

You can combine accounts. As long as you have an active ThankYou point account, you should be able to close a different one and combine the points. See #5 at this link for the fine print on their site.

https://www.thankyou.com/tc.jspx

[…] bonuses). People have been receiving some very generous retention offers, Frequent Miler & Miles To Memories both wrote about the offers they received and their experiences. I’d recommend reading their […]

Called Citi to “cancel” AAdvantage card and was offered 3K miles or $95 fee waived after $1045 spent for 3 months. Went with the $95 fee.

Agent was going to cancel so I just asked him for any offers.

Shawn,

We got the same offer just 6 weeks out from our renewal ofour Citi AAdvantage Executive Card ($450 annually fee)

Might give some pause to reconsider cancellation of their cardholders after getting lucrative sign-up bonuses

What’s the proper play in order to receive the best retention offer, is a card holder straight up with the customer service rep and say “i’m looking for your best retention offer” or do you pretend to be calling to actually cancel?

I have the Citi Aadvantage card, and would likely keep it, but why not squeeze some extra benefits out of it.

Thanks for any insight.

-Mike

Generally ask to cancel your card so they will transfer you to a retention rep. Once on with retention, they usually will ask why you are cancelling. Sometimes they will sell you on the benefits and sometimes they will just come out with an offer.

After hearing their pitch, if they still haven’t offered anything, feel free to ask if they have any offers. I generally just use the terms “offers” and don’t use the word retention.

Usually they have multiple offers so don’t feel awkward pushing to get them to spill all of the options before choosing the best one.

I have had this card since 1995(!) and haven’t used it much since then. That was a long time ago and I have no idea what type of rewards program it was back then (I’m new to this so I don’t even know what partner airlines and hotels the points on this card can be used for). I called and got the same offer #1 and then asked if there were any others and got #2. Since I’ve been with them 20 years I asked if they could email me the offers so I didn’t have to make a snap decision – even the supervisor said it was verbal only. Feel like I’ll call back and take them up if for no other reason than I understand the length of time I’ve had it helps my score. Any advice?

Great deal for your wife, Shawn. Congrats to her. I don’t have a card with ThankYou points, so I don’t have to think too much about it. But there’s obviously a trade-off point in terms of expected amount of spending, in terms of choosing between 5x (capped) at Grocery versus 3x (unlimited) everywhere.

John’s experience getting a similar offer for the AA Exec is interesting. I’d have to run the numbers, but obviously the expected usage would have to be fairly high to justify paying the $450 AF (and AA miles a bit less desirable than TY points? maybe not).