Opening a Citigold Account with a Promotional Bonus

Citibank is often very generous with bonuses for setting up a Citigold checking account. In the past we have seen bonuses of 50K AAdvantage miles and 50K ThankYou points for opening an account. Here are the currently available promotions as of January, 2016.

Today I’ll walk you through every step of opening a Citigold account with a bonus code.

The Account Opening Process

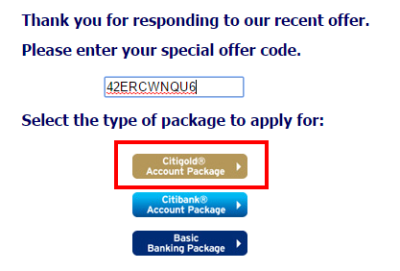

Click through to Citi’s website and input your offer code. Once you input the code, click “Citigold Account Package” as shown.

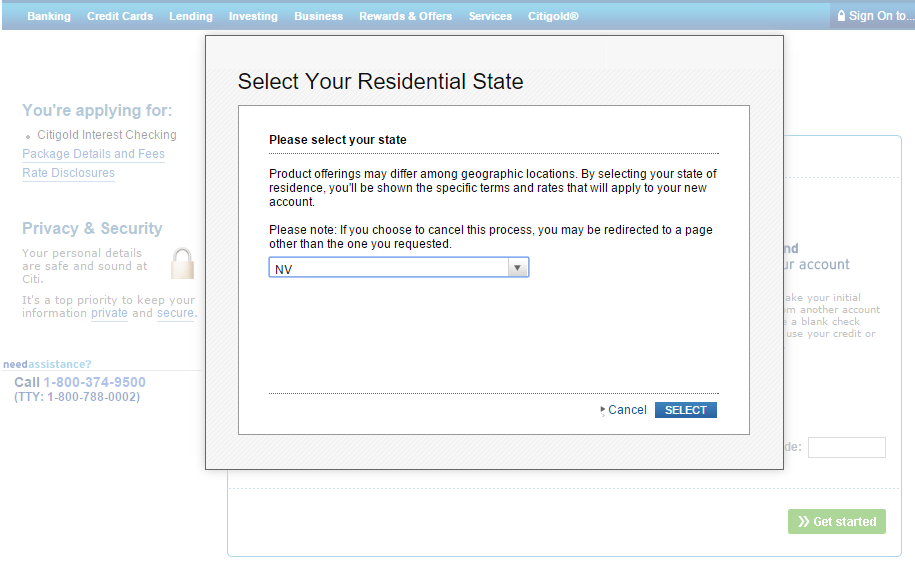

Depending on a few factors, the next screen will vary. If the website knows your location and determines you can apply online, it will go through to the application. If it doesn’t know where you are, you may receive the following screen:

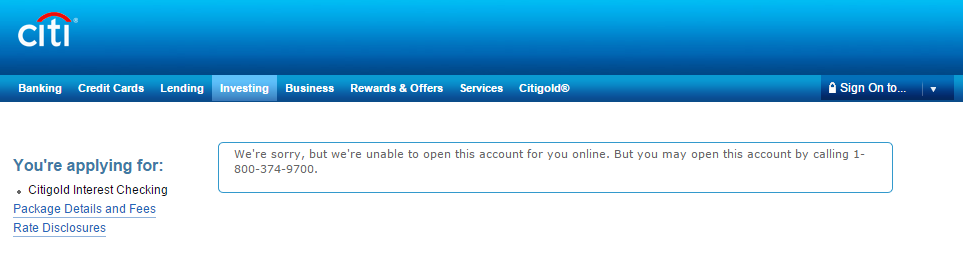

Most people should be able to select their state and then begin the application. Some people have reported receiving the following error message after selecting their state:

If you receive this message then don’t worry. This an error and you should be able to get past it. Many people have had success simply trying again. If you were logged in when you tried, then logout. Try a different browser or private/incognito mode. Everyone I have spoken to has been able to eventually apply online.

Application Beginning

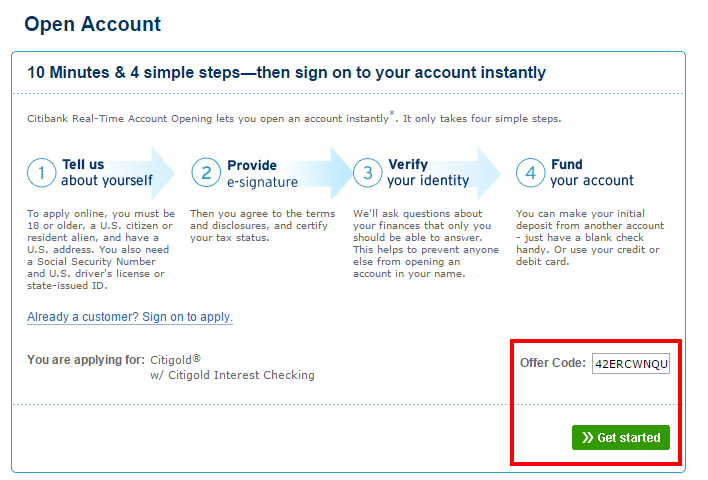

You will reach the following screen either after clicking “Citigold Account Package” on the first screen or after completing the location information. Simply verify the offer code is correctly in the box on the bottom right and then click “Get Started”.

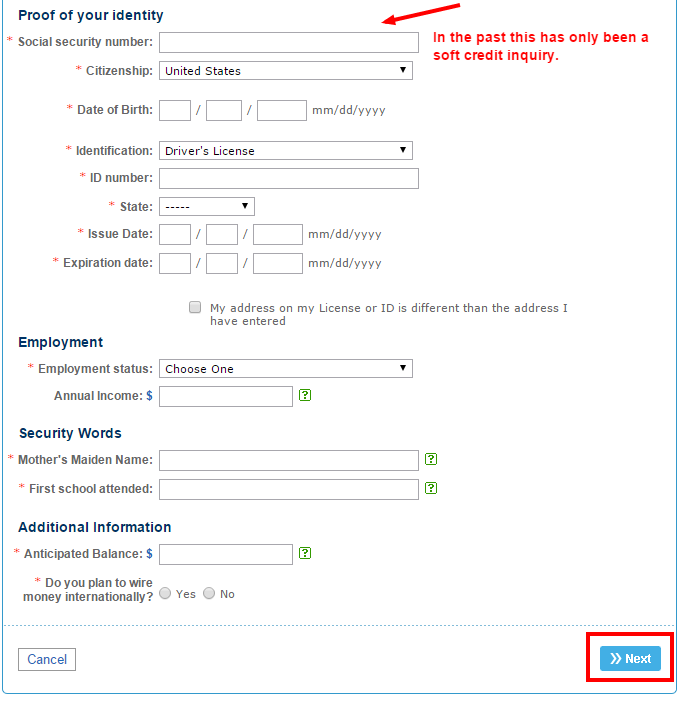

You will now be asked for personal information. In addition to your name and address, you must provide your social security number, employment and income information. In my own experience and the experience of others, Citi only does a soft credit inquiry.

When all of the information is filled out completely in this section click “Next”.

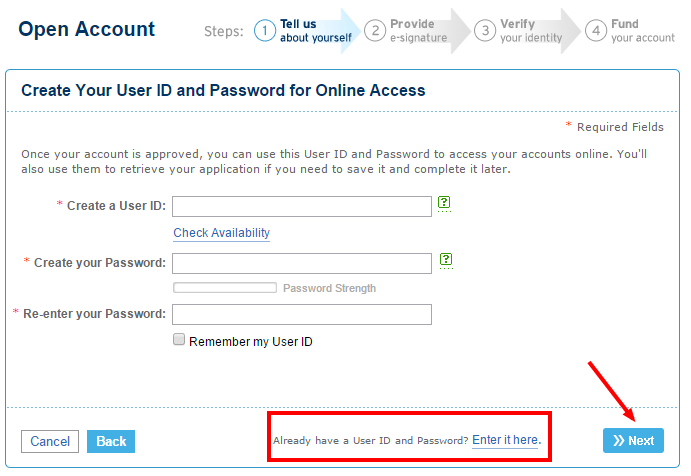

The next screen will ask you to create a user id. If you already have an account you can click “Already have a User ID” towards the bottom. If you are logged in before you start the application then you may not see this screen at all.

Note: The first time I went through, when I tried to login to my id and I got an error and had to start the application over. I recommend trying to login first before starting the application unless you get the location error as described at the beginning.

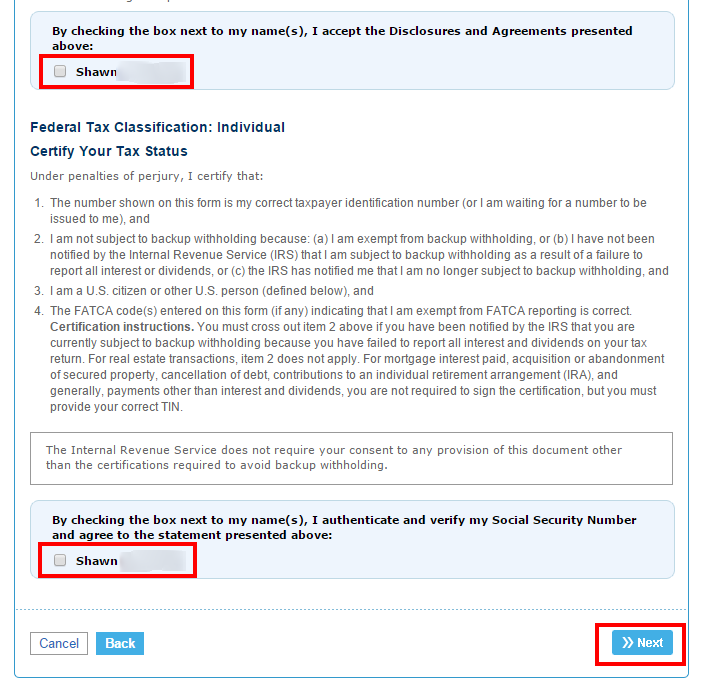

You will now be asked to provide your e-signature. On this page you can read all of the account disclosures. Also verify your name and social security number. You are required to check two boxes before clicking “Next” to continue on.

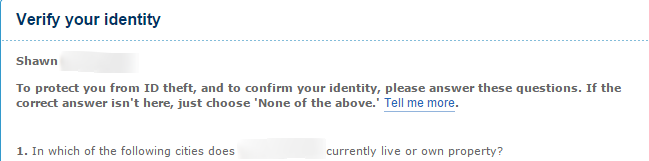

At this point Citi will try to verify your identity with cool questions like, “Where does this family member live?” or “What county is this address in?” Hopefully you know the answers to prove you are you!

Funding the Account

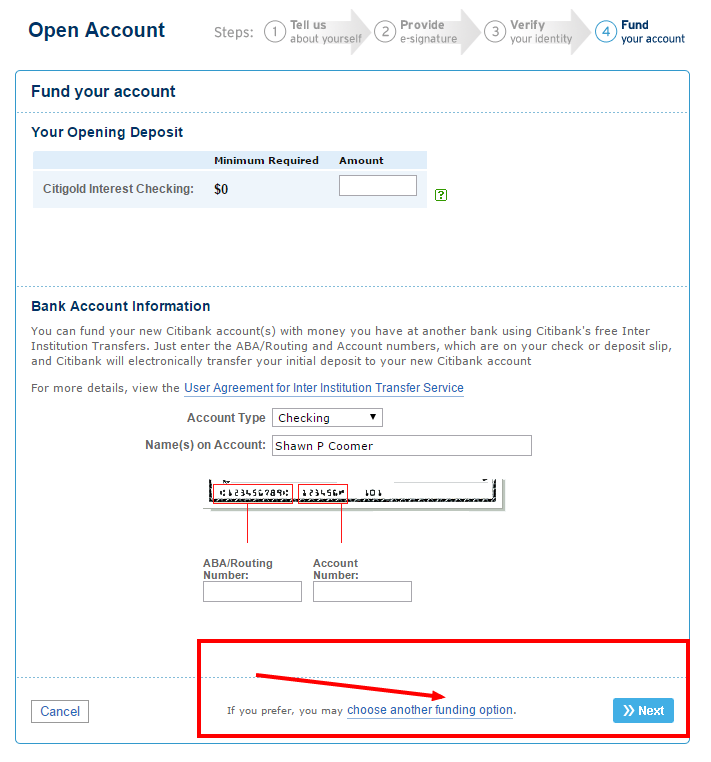

For most of you, funding will be a BIG DEAL! This is because Citi allows you to fund a checking account from a credit card up to $100K. Keep in mind that some banks do charge cash advance fees, so it is probably a good idea to lower your cash advance limit to $0 before attempting this.

You can only fund with a credit card when setting up the account. If you want to fund with a credit card make sure you DO NOT put in checking information. Instead click “choose another funding option” on the bottom.

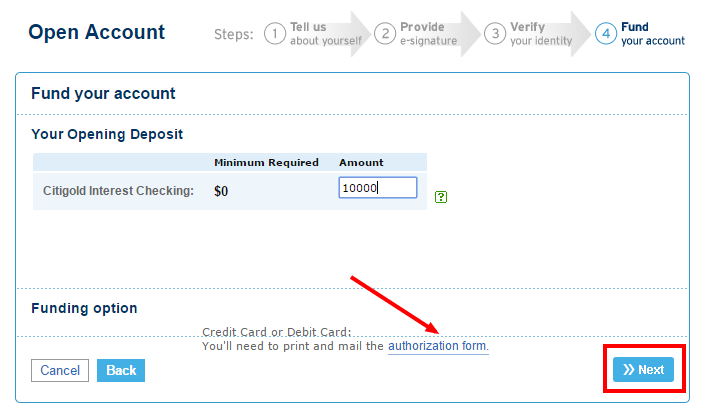

You can now choose how much to fund your account with. Make sure to click and download the authorization form. If you forget to do it in this step, you will have one more chance to do so at the end of the process. Once you have input the initial funding amount, click “Next”.

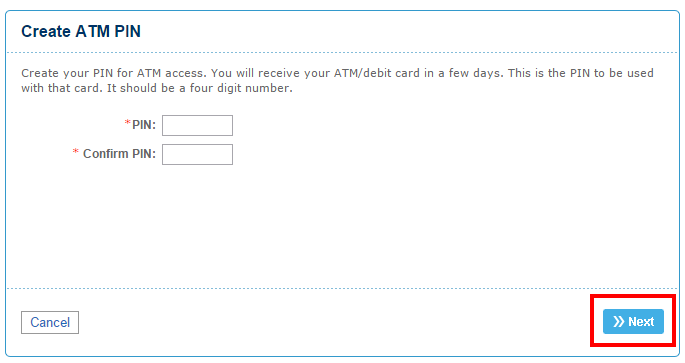

On this next screen you will select your four digit account PIN. Click “Next” when you are done.

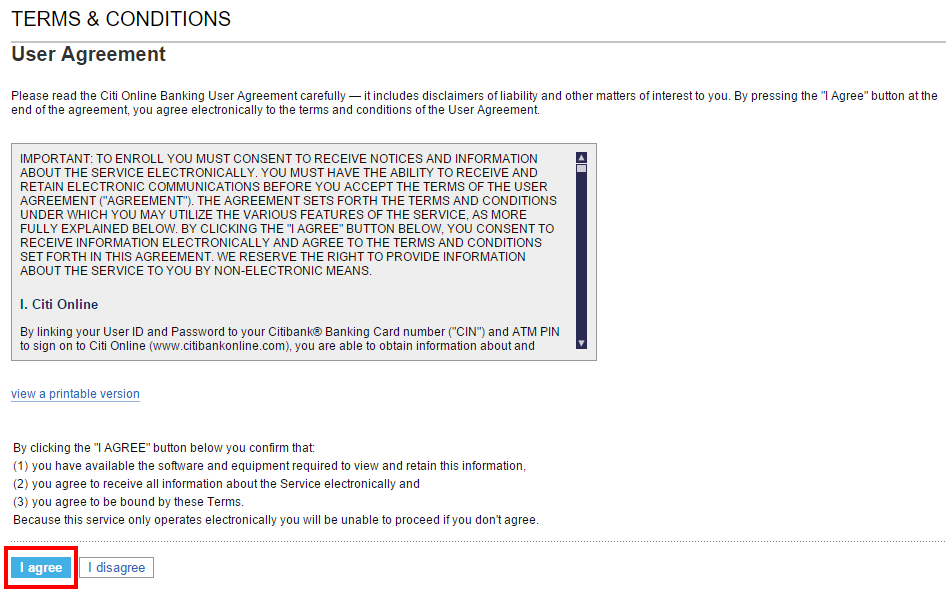

Now you must agree to the User Agreement. Once you have read through everything click “I Agree”.

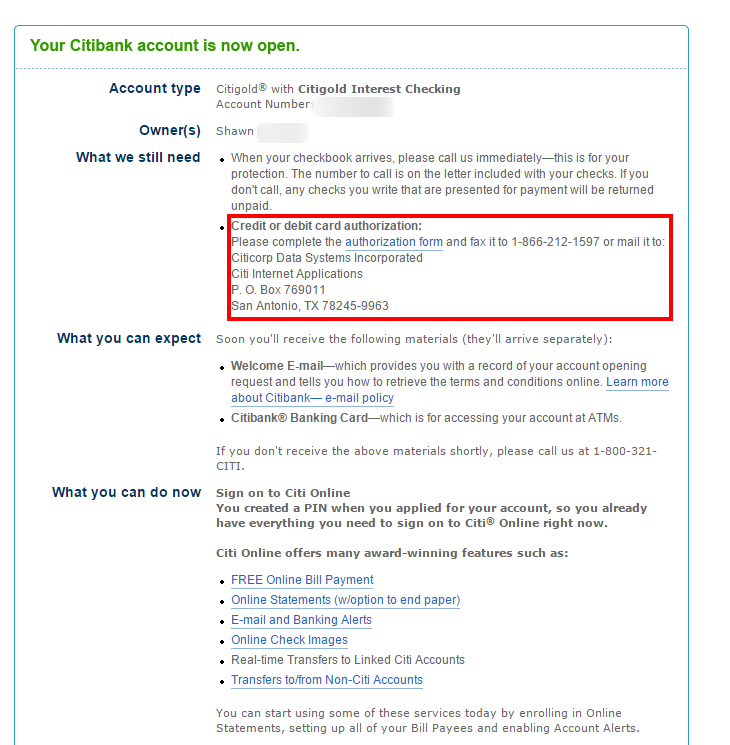

Congratulations your account is now open! You should now be at the following confirmation screen. If you forgot to download the credit card authorization form, you can do it now.

Confirming the Bonus

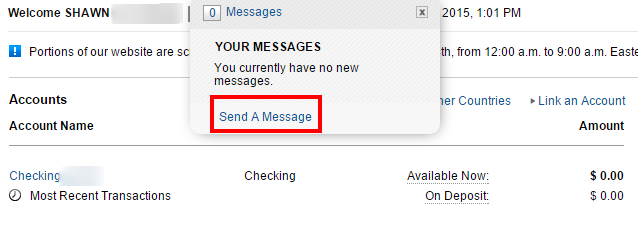

After your account is setup you should see it when logged in. You definitely don’t need to do this, but I like to confirm the amount and terms of the bonus via Secure Message. To do that, simply select “Message” on the top and then “Send a Message”.

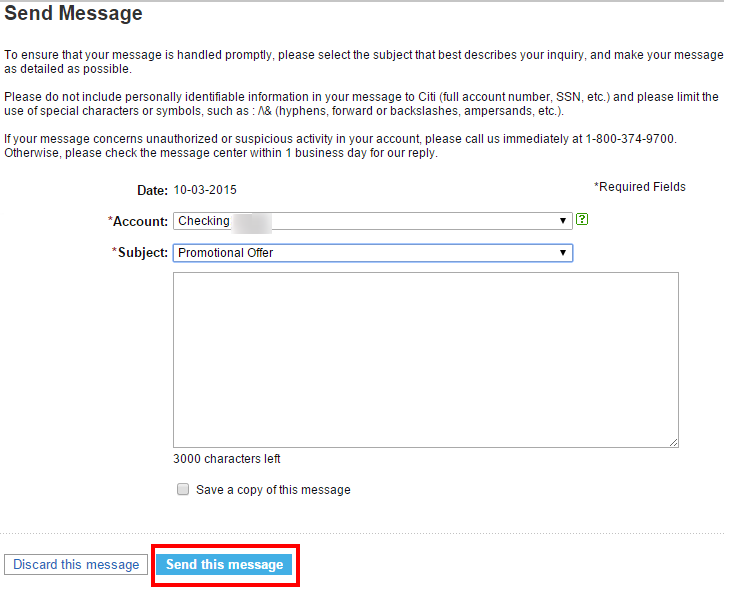

Once in the message center simply select the new Citigold checking account and the subject “Promotional Offer”. I generally just state the terms and bonus as I understand them and ask that they confirm them for me.

Conclusion

While it can seem complicated to see the process broken down like this, it takes less than 10 minutes from beginning to end to open a Citigold checking account. If you have questions about the recent offers or about specifics to the bonuses and accounts, you will most likely find the answer in the body or comments of this post.

Haven’t attempted the call yet, but the website, both within account and incognito both say the TY code is invalid. Wondering if I missed the window?

[…] Opening a Citigold account isn’t always straightforward. For more information on opening an account online, see: Citigold Checking Application Process – Step By Step Walkthrough […]

Shawn, thanks for the post. Will it show as a purchase if I fund the account using my AA Platinum Select Citi Credit Card or as a cash advance? Thanks in advance.

As far as I know all Citi cards show as purchases, but of course I can’t guarantee anything. I have personally used a ThankYou Preferred and it counted as a purchase.

[…] Note: Before opening online, I highly suggest reading: Citigold Checking Application Process – Step By Step Walkthrough […]

[…] Citigold Checking Application Process – Step By Step Walkthrough […]

If you fund with a citigold American Airlines card will this show up as a cash advance or a purchase? What kind of fees might I expect if it shows up as a cash advance?

Also, the terms say you need to do a couple months of bill payment–any tips on the best way to do this?

Thanks so much for the primer. I got stuck several times in the process of opening the account and would have given up if not for knowing how to get around the problems (error after choosing state and also after signing in mid-way through). I plan to call in tomorrow to fund.

I’m glad it helped!

hi I currently have a citibank basic checking account, would I still be able to open a 2nd account (the citigold) and get the recent bonus of 50k Aadvantage miles?

I did the different funding option, printed out the Deposit form, and clicked Next, but the next screen was not as pictured above it went to a screen that said “Your Citibank application is being processed”. I wasn’t able to create a PIN.

The rest of the page says:

What we still need

– When your checkbook arrives, please call us immediately—this is for your protection. The number to call is on the letter included with your checks. If you don’t call, any checks you write that are presented for payment will be returned unpaid.

– Credit or debit card authorization:

Please complete the authorization form and fax it to 1-866-212-1597 or mail it to:

Citicorp Data Systems Incorporated

Citi Internet Applications

P. O. Box 769011

San Antonio, TX 78245-9963

What you can expect

– Welcome E-mail—which provides you with a record of your account opening request and tells you how to retrieve the terms and conditions online. Learn more about Citibank’s e-mail policy

– A call from Citibank to confirm your application.

– After your account is approved, you’ll receive the materials you need to access your account at Citi Online and at ATMs. They include your:

1. Welcome Kit—which contains your new account number.

2. Citibank® Banking Card—which is for accessing your account at ATMs.

3. Personal Identification Number (PIN)—which is the code you enter at ATMs. You’ll also need it to set up access to Citi Online.

I wonder if everything is ok? Since I’m funding with a credit card, maybe that’s why it’s “in process”?

I had just been thinking about getting around to doing this, and the targeted offer for the 50K AA miles showed up in the mail today. woo hoo!

I paid my AA card with a different bank account. The fund went into Citigold is still there. However, I have read people used the fund to pay their AA card so you could if you prefer to go that route. Personally, I don’t like to “rub the bank” that much so I plan to park the money there for 6+ months before closing the account.

Thanks JW. I just got approved for the Citi gold account today. Was thinking of funding with my Barclay’s Aviator instead of a Citi card for this reason. Another option may be to ACH into another checking account and pay off the card balance that way. Thanks for your insights.

Just wanted to share my experience. I opened a new account online on 11/7. Waited until 10/9 to let it establish the account. Called to give funding instruction and used Citi AA Plat MasterCard to fund the new account on 10/9. I also used the opportunity to confirm the promotion. BTW, this is my second time opening a Citigold. Last time was in 8/2013 and received the bonus in 12/2013. Hopefully the bonus will be posted successfully this round. Going back to the funding, Citi said they process all the funding orders once a day after midnight. The transaction showed up on 10/10 and remained pending until 10/12. Around 10/13 2AM, it posted and it was treated as Purchases. Around 10/13 12PM, the funding became available on the Citigold checking side. I quickly paid off Citi AA card since I maxed out my credit line and I don’t want to have a huge utilization ratio at the next statement close time, which could bring down my credit score. I also added a payee and scheduled a payment for 10/15. Hopefully the debit card will arrive soon!

Did you use the funds transfered from your AA card to pay off the AA card balance? Or did you ACH into another checking account first?

Just noticed I had a typo. The opening date was 10/7 instead of 11/7.

The debit card arrived on 10/13 (i.e. 10/7 + 3 business days).

Hi Shawn.

I want to found my account with Chase United (since I have the most credit w/them). I tried to set my cash advance to zero, but the min. amount they allow is $20. I am assuming that if I place a large transaction it will get declined right away if it goes through as cash advance… Am I correct to think so? Or is there any chance that I will get slammed by fees?

RE: Thank You Points

I’m confused by different versions of Thank You Points. If I open this account, could I transfer all my points to my Citi Prestige Thank You Point account and then subsequently transfer them into miles via a partner (i.e. Krisflyer).

You can transfer all points to a Prestige and then to a transfer partner, except for points acquired from a checking account.

I didn’t realize the CC funding option until after I supplied my bank info to load account.

However, I did see they will do two test deposits and then they’ll be follow-up steps for me to load. With that said, can I call up and get the bank load cancelled and do it with a CC or is my only shot for this funding method in the application process?

Thanks!

If the account isn’t funded I would call Citibank and see if there is any way to fund with a credit card. Just tell them that you gave the wrong information. Hopefully it works!

After several days of trying online to open a Citigold account using the open browsing, private browsing, a different browser, etc., I have pretty much given up on trying to open an account online, despite Shawn’s helpful and detailed instructions. I never have been able to get past the Create Your User ID and Password screen, always getting some (and varying) kind of error message. Maybe it’s because I apparently had a Citigold account some years in the past. But calling 800 745-1534, option 1 then 2, I was able to connect with an agent who said she could take the application over the phone, warning me that it might take a couple of weeks to complete. She readily accepted the promo code Shawn has posted, but when I asked her about the account fees, she said the $30 was waived for the first month only, not two months, to allow for the opening and funding process to complete.

Has anyone else had this experience of only a first month fee waiver (for balances below $50K)? I may have missed it, but in trying to interpret and digest the terms and conditions, I saw no reference to any fee waiver, whether for one or two months, but it makes sense to have the first month’s waived to allow for account opening completion.

Regardless, paying $60 for two months’ worth of fees before the 50K AA points post isn’t too much to pay, considering that the great 100K point AA World Elite MC offer of early last year netted a fee of $250.

It says right on the main Citigold page that the fee is waived the first two statement periods. My guess is the agent just misunderstood the policy. https://online.citi.com/US/JRS/pands/detail.do?ID=Citigold

“There’s no monthly service fee for the first two statement periods. After that, we’ll continue to waive the monthly service fee if the combined average monthly balance of your eligible linked accounts for the prior calendar month is:

$50,000 or more in eligible linked deposit and retirement balances”

Thanks for passing on that fee reference — it looks the agent did misquote. And BTW, I didn’t take the agent up on opening an account through her, which she said could take weeks longer to process. This evening I was finally able to use the Citigold website to open an account, getting my confirmation e-mail. with no glitches or delays or error messages along the way. Now I’m just waiting for the response to my Citibank online message about the potential 50K AA miles bonus.

I was finally able to get thru the apps: “Your application is being processed”

Do I call to fund now or wait unitl I have confirmation that my account is open?

thanks,

Jocelyn

Citibank’s initial response to my secure message asking for confirmation of the potential of 50K AA miles bonus was that I would be getting 50K Citibank ThankYou points! And this was despite my having entered the AA miles promo code. However, I responded that ThankYou points were not part of the potential bonus, as my request had been for AA miles confirmation in my initial message. The next message from them did correct that and confirm that my potential bonus is 50K AA miles. I’m glad I did the bonus confirmation messaging, and I’m glad you included that step in your posting.

I wonder if they are just responding to so many secure messages that they got it mixed up. I’m glad you were able to get confirmation!

Is there a list of “safe” credit cards that works to fund the account without being treated as CA?

I have Amex platinum with no limit.. Wondering if i can use that…

Doctor of Credit maintains a page with a list of data points. http://www.doctorofcredit.com/does-funding-a-bank-account-with-a-credit-card-count-as-a-purchase-or-cash-advance/#Citibank

Not sure but I followed the steps but now it is not allowing me to proceed after the question on funding the account.

I have no checking acct. with Citi..

[…] Citigold Checking Application Process – Step By Step Walkthrough […]

If I’m an authorized user of citi premier, anyone knows that I will get the bonus for doing the citigold 50k TY promotion? TIA

Read some of the comments above: If you ask Citi, they will tell you that you must be targeted.

Good luck if you try anyway. (I am trying and I’ll report back. At this point, though, I can’t see why anyone would recommend to others to go for it.)

I can confirm that a SECURE MESSAGE after opening the account DID get me the promotion attached to my account.

It was a leap of faith to open the account first (i had not yet funded it) and especially after the runaround I got with the various phone numbers that I tried …. BUT…. it seems all is well now.

I just faxed in the credit card deposit form. I just realized that it doesn’t leave a place on the form for my new citi checking acct number or anything so I wonder if they will be able to match it up with my checking acct. should I fax another credit card deposit form and write in my citi checking acct number somewhere on it?

Any idea if existing citi checking customers (I have one of their basic fee-free accounts) would be eligible?

It says that it’s for new customers only. What I am wondering is if existing customers are eligible. Does anyone have any definitive answers on this?

WARNING! I HAVE CALLED 6 DIFFERENT NUMBERS AT CITI AND NONE OF THEM ARE CONFIRMING THAT I WILL GET THE OFFER UNLESS I AM TARGETED.

And, what’s worse, they cannot say if I am targeted or not.

[…] Miles To Memories leads you through it, screenshot by screenshot, on how to go for that 50k Citigold checking account promo. […]

I think I read that application for this account results in a “soft pull”. I’m not sure what that is. Could that effect my being approved for a credit card issued by another bank (Chase)?

A soft pull is where they basically confirm your identity and information. This doesn’t show up as an application for new credit when other lenders look at your credit report.

https://www.creditkarma.com/article/hard_inquiries_and_soft_inquiries

Has anyone tried funding with a Cities credit card? We’re there any issues?

HI Shawn,

Thank you for this post.

What is the minimum deposit required to avail of the bonus?

Any deposit works. There is no minimum balance either.

Shawn, after being approved, it’s asking for my ATM/Debit Card Number to set up the online access. Seems like I have to wait for that to arrive in the mail, unlike that screenshot that says you can log on with the PIN. Thoughts?

I was able to link it to my existing login, which is perhaps why it worked. Did you not setup a login on that screen where it asked for a username?

Could one combine this offer with Citi Business Checkint Acct (15k deposit and no fees) to keep tbeir Gold checking account and avoid fees?

Thanks

Excellent post! Thank you!!

Circles and arrows lol. Nice work Shawn!

Just a word of caution. There is a similar offer discussed extensively on DoC and nobody has actually received the TY points yet after 3 months. Apparently the TY Points are issued by a different business unit within Citi and even if you have the promo code in your application, they might not issue the points if you were not specifically targeted. The DoC offer was from Citi Small Business and the one discussed here apparently is from the Premier / Prestige credit cards, so YMMV.

But there’s not much to lose by opening the Citigold checking and then a savings account and funding with a credit card. I’m getting about $1,000 cash back on my BofA Travel Rewards card. TY points will be gravy, but I’m not counting on it.

Hello Shawn, could you do some follow up posts on how you spend the $1000 with your debit card and how you pay your credit card (the one used to fund your checking account)?

You can just use bill pay to pay your credit card. As for the $1,000, I believe loading Bluebird, Serve or REDbird online should work based on data points I have read.

Shawn, could you add the phone number to fund the account to your instructions? It might be helpful for some (read: me!). Thanks!

It isn’t officially listed on the form, but I believe you call the main Citigold number at 1-888-248-4728. They should be able to pull up the application and fund over the phone.

I called the New Account Department at 1-800-745-1534, M-F hours. They knew exactly what I needed to do, was off the phone in less than 5 minutes.

can we fund with multiple credit cards?

Not as far as I know.

I did the 40k point offer about two weeks ago so I missed out on 10k. Bummer. There’s a few things I’ll add in case it helps anyone:

– Wait 24 hours (1 business day) to deposit. It’ll help prevent issues if the account hasn’t been fully processed yet.

– Call to fund instead of fax. Before calling in, ask your credit card provider to put a note on your account that you’ll be making a purchase close to your credit limit. I called in 1 business day after account creation and the Citi rep easily processed my request over the phone. I used my entire credit limit and had no issues with Barclay’s either. No CA fee either on the arrival+, although that shouldn’t be news as there’s many data points on this. The funds were available within a day or two and I was able to bill pay my Barclay card. All in all, it was pretty quick and took about a week from account opening until my cc was paid off, give or take a day or two.

– Log into your bank account and make sure you enroll in the TYP that comes with your banking. It’s small potatoes, but I’ll take a free potato any day if it requires no work other than clicking a button once!

– I’ve read reports that it’s taking AT LEAST 90 days, i.e. 3 full billing cycles. A few reported they weren’t charged for the first 3 months but were at month 4. I’m sure it depends on timing and if Citi’s diligence in issuing credit cards expeditiously is any indicator, we’ll have to be patient on this one and just know that even if we eat a few $30 monthly fees we’re still making out like a fat kid in a cake shop.

– Open a savings account. I haven’t done this yet so I’m not 100% on the details, but it’s supposedly an easy thing to do and you’ll get to double-dip with your credit card again. That’s the one and only reason for opening it. AFAIK there’s no other fees, limits or minimum balances to worry about.

On that note, have you (Shawn) or anyone else done the savings account route? I found a few data points on DoC regarding it and it doesn’t seem like there’s much to it.

+1 Repped. Thumbs Up. Liked. Pinned. Shared. Tweet. ReTweet.

Thanks for the additional info. Very helpful.

Not yet, but I plan to. Thanks for the useful information.

Thanks for all the circle and arrows bro! I hope this deal doesnt die quickly! haha.

You should publish a book. MS Strategy Guide similar for games. I guess it would be outdated too quickly though.

I have two AS Visa cards I want to use to fund my checking account. Does anyone know if it is possible to fund the account with two credit cards?

Oops, just saw Shawn’s reply below. My bad.

You can call to do the funding via the telephone and ask though.

Hi still wondering if you think having Citi Amex AA Select will let you have 50k AA offer if setting up CitiGold account. Thanks.

I believe it should work, but to be 100% sure you would have to confirm with Citi. I still have an Amex, but I also have a Visa so it would be impossible to tell in my case which made me eligible.

I tried 3 browsers (Chrome, FF, and IE) and incognito. Never got past the error.

Spoke with a rep. Citi has a broken link issue so she said to reapply and when you get to the funding screen leave the field blank and click next. I did that and I successfully opened the account.

How long did it take for your account to be set up?

I spoke with an agent and they said it could take a couple days, but that you have 30 days to fund the account with a credit card.

[…] Citigold Checking Application Process – Step By Step Walkthrough […]