Citigold AAdvantage & ThankYou 50K Checking Offers

Update: I also posted a step by step guide to opening a Citigold account. I highly suggest reading the information in this post about the offers and then heading over there to learn about the application process.

Citi has been one of the more aggressive banks when it comes to giving out checking account bonuses. Back in yesteryear they used to consistently hand out 1099s, but it seems they have cooled down on that a bit. Over the past couple of days details have emerged about two pretty amazing new bonuses for opening a Citigold account. Let’s take a look.

The Offers

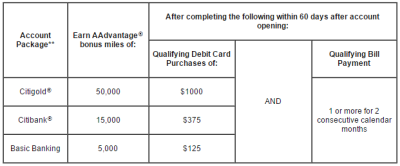

Earn 50K AAdvantage miles after opening a Citigold checking and making $1K in eligible debit card purchases in the first 60 days and 1 bill payment in 2 consecutive months. Full terms.

OR

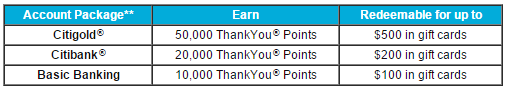

Earn 50K ThankYou points after opening a Citigold checking and making 1 bill payment in 2 consecutive months. Full Terms.

Who Is Eligible

- For the AAdvantage offer you must currently have a Citi AAdvantage Mastercard. An older cobranded Visa card may work as well.

- For the ThankYou offer you must currently have a ThankYou Preferred, ThankYou Premier or Citi Prestige card.

According to the terms of previous promotions, you can only get a bonus on a Citi checking account once every two years. Others have reported getting bonuses more often however.

How to Open

To open either account, simply visit the Citi website and enter one of the following codes:

- AAdvantage 50K – 42ERCWNQU6

- ThankYou 50K – 42ERCZ42PY

Citi only does a soft credit pull when opening a checking account.

Funding the Account

Citi checking accounts can be funded with a Visa or Mastercard up to $100,000. (If you have a credit limit that high!) There are numerous data points suggesting that Barclay’s, Bank of America and Citi cards all code as purchases. I highly suggest seeing this Doctor of Credit post for the latest data points.

When signing up for the account, there will be an option to fund with a credit card. You will be given a paper to fill out that you can either fax or mail in. Others have reported it normally takes a couple of days for the charge to go through.

Monthly Fee & Strategy

The monthly fee for a Citigold checking account is $30. This fee is waived the first two months. I found it took 3 months for my miles to post the last time I took advantage of this promotion. Once the miles/points have posted you can either downgrade to a Basic Banking account which only requires a direct deposit & bill pay to waive the $10 monthly fee or you can cancel the account.

Note: For the ThankYou offer, you must transfer out or redeem your points before closing or downgrading. For the AAdvantage offer, you can downgrade or close the account as soon as the miles post.

Citi Prestige Cardholders

If you have both a Citigold and a Citi Prestige card, the annual fee on the Prestige is reduced by $100 to $350. Even if you have already paid the annual fee, this amount should be adjusted for you. Note that some people have reported that downgrading their Citigold to a Basic Banking after the points have posted, has still allowed them to keep the reduced annual fee.

Possible 1099

As I mentioned before, Citi will send you a 1099 if you receive more than $600 worth of value from the points/miles. For the AAdvantage deal, it is hard to say how they will value the miles. The promotional page does not mention a 1099.

With the ThankYou points, it is very important to keep track and make sure you don’t redeem them for more than $600. For example, Citi Premier cardholders can book flights at 1.25 cents each. This would give you $750 worth of value. That would trigger a 1099. You can of course redeem ThankYou points for gift cards at $.01 each which would amount to $500 in value and should be safe.

My Thoughts

I was already going to open a Citigold checking account in the next week under the old 40,000 ThankYou point offer. Since I have a Citi Prestige card and a card currently giving me unlimited 3X points, I thought it was a great time to open an account and fund it with the 3X credit card. Now with these new offers, I am sort of torn.

Personally I value the 50,000 AAdvantage miles higher than the ThankYou points, but I am worried that they will trigger an automatic 1099. I have no basis for this other than a belief that Citi might value AAdvantage miles at 1.2 cents each or higher. At least with the ThankYou points offer I could ensure I don’t get hit with a 1099. To be fair, a 1099 isn’t the end of the world, however it does cut into the value of the bonus quite a bit.

Conclusion

Both of these offers are fantastic and both are available now. With the ability to earn 50K points plus the option to fund with a credit card, opening a Citigold account might make sense for a lot of people. I know I will be opening one very soon. Combined with the sign-up bonus, credit card rewards and the Prestige annual fee savings, I will personally get almost $1,000 in value from one checking account!

HT: Frequent Miler via Takeoff with Miles

You mentioned that for the AAdvantage offer, you can downgrade or close the account as soon as the miles post. They will automatically be connected to my AAdvantage card as long as I’ve entered my account information? Or do I need to transfer them somehow? If so, am I also limited by having to use them within 90 days?

Also – I am a little confused by funding with a credit card. It sounds great, but don’t my purchases need to be made via debit card? What you’re saying is I can actually fund the debit card with another credit card?

Lastly – has anyone who entered the code but not been targeted actually received the AA points after doing this?

Citi automatically gets your AAdvantage account number from your card account. Once the miles post to your AAdvantage account they won’t be clawed back.

You can fund the account with a credit card and earn rewards on that card as long as your bank codes it as a purchase.

Yes in the past many/most people earned the miles even if they weren’t targeted, but I definitely recommend checking with Citi to see if you are eligible just in case.

[…] my wife and I opened up Citigold accounts during the last round of promotions towards the end of 2015. We both met the requirements quickly and are waiting on our bonuses to […]

Fantastic post . I Appreciate the specifics – Does anyone know where my business could possibly find a sample IRS 1099-PATR copy to fill in ?

How long does it take to get the AAdvantage miles in your account after you completed all the required transactions?

They say 90 days after the statement closes in which you met the requirements.

I got targeted with a mailed offer and I applied in late october but the account was denied. I got a letter saying it had to do with the information on my Equifax but I have excellent credit and no issues so I have no idea what it could have been. I’m wondering whether to try reapplying- or if I would just get auto denied? Anyone have any luck with that? Or know reconsideration phone numbers?

Hi Shawn!

I tried applying for the AAdvantage one last night and just now and I keep getting this error:

Feature temporarily unavailable.

We’re sorry, but this feature is temporarily unavailable. Please try again later. If you continue to see this message, please call 1-800-374-9700 (TTY:800-788-0002) for further assistance.

We apologize for any inconvenience and thank you for your patience.

It happens right after I enter the amount I want to put in from a credit card.

Any idea? I’m going to call in to new accounts on Monday, but would like to know why this is happening.

Thanks,

Jackson

@ Jackson – the same thing happened to my husband on a Sunday evening. He tried again on Monday morning and everything was fine.

I see thanks!

I’ll try again.

It worked just now! Thanks!

Though I called and it says I got auto denied.

I called again later and they said I have to be targeted for the offer. If you aren’t targeted you wont get it even if you sign it with the offer.

Any one actually get the bonus without being targeted?

Some people have, but it seems they have tightened on their restrictions.

When you say tighten, what do you exactly mean? People now are not getting it? We have to argue with the rep more?

seems most people already had the AA credit card. Some were targeted & some weren’t..although most seemed to have received bonus pts.

If I sign up for the AA Platinum Select now, then apply for the citigold..would it still work, or is it too late?

Has anyone recently signed up for the credit card, then applied for citigold?

Or I guess I can sign up for Citi AA Platinum & call before opening CitiGold to see if I am eligible for offer…if not, hopefully they’ll have another promotion within the coming year before annual fee becomes due on the Citi AA Platinum ?

Reply

I applied for the AA Platinum card on 11/10/2015.

I am applying for the checking accounts now.

Though I keep getting errors online. I’m going to call in Monday.

Can I use my Citibank Thank you Premier credit card to fund the account?

And if so, does anyone know if Citibank would categorize the transfer as a cash advance?

Citi cards are coding as purchases. I funded my account with a Citi credit card.

If I sign up for the AA Platinum Select now, then apply for the citigold..would it still work, or is it took late?

Does anyone know if an auto insurance payment counts as part of the minimum spending? I pay for my whole family so it’d be nice if I can charge my debit to count towards the spending requirements.

Any debit spend should work as far as I know.

Shawn – if I have a Citi Prestige card which also earns TYPs, will I still lose these 50k TYPs if I close the checking account? Or is there a way to merge the TYP accounts and keep them?

Thanks!

You can transfer them to your Prestige account, but they would have to be redeemed within 90 days.

Shawn, were you able to get confirmation of the bonus from Citi?

Hi Kate. I was and posted an update about it. They confirmed it but warned that I may not get the bonus if I wasn’t targeted.

Just want to make sure I do this correctly.

I Have a citi AA Platinum. I didnt want to deal with credit card funding, so I am planning on just doing 1500 in cash deposit.

180×2 months for one of my car leases as bill pay.

Fund a Bluebird Gift Card for 1000 dollars using the debit card.

Question is I should be good to get the bonus correct?

Based on the data points of others Bluebird loads should work for the spending requirement. I have done this personally and will confirm the bonus with Citi as soon as my 2nd bill pay is completed on the first of the month. So yes I believe it will work, but I can confirm more in a week or so.

Is funding BB/Serve really falls under “eligible” expenses? How is this transaction would be billed?

Hi I currently have a citibank basic checking account, would i be able to create a 2nd account (the citigold) and get this offer for 50k TY points/50k Aadvantage points?

Thanks,

Jay

I don’t believe so. If you have a checking I don’t believe you are eligible, although you can certainly call Citi to verify.

Anyone having trouble logging in to citibank or citicards? I activated my new citi gold debit card on Tuesday, and today I can’t log on. I had both my checking and credit linked. I was able to log in on Tuesday, and even set up bill pay etc.

Here’s the error I got (BTW, called Citi, they had no clue and were no help):

===

At least one of your entries does not match our records.

Update your Citibank online account with your new ATM/Debit Card or Credit Card

You may have recently received a Citibank ATM/Debit Card or Citi Credit Card with a new number. You may have also changed your PIN by phone or at a branch or ATM. Be sure you are entering your current numbers. For further assistance, Banking customers can call Customer Service at 1-800-374-9700 with error code DA021. Text Telephone(TTY) call 1-800-788-0002. Credit Card customers can call 1-800-347-4934.

I had that happen, but the screen was prompting me to enter the new debit number, security code and checking account #. I didn’t know the checking # so I called Citi and they gave it to me.

Yeah. i got that too but luckily I had noted down the checking # initially, so I just entered the debit card number and the checking acct # and everything was normal again.

Thanks Shawn! It didn’t work for me the first time on Chrome (regular and incognito). After your reply I tried again using Firefox, entered those exact three items, and it worked.

A small scare. All good now!

[…] know a lot of you jumped on the recent Citigold AAdvantage and ThankYou bank bonuses. There is no doubt that the value of those bonuses justifies the effort you have to put into […]

Does someone know how long it takes after the phone call for deposit request? I requested on Oct 9(friday) and still do not see the account being funded with my Prestige.

It took about 3 days for me. They generally process it in the middle of the night. You can call to confirm over the phone. Your card may have had a fraud alert or something else that prevented it from going through.

What card is your go to for bank funding? Do you usually deposit the max allowed?

the docofcredit link suggests that Bank of American will not treat funding the Citi checking account as a Cash advance. However, I spoke with BOA and they said it will be considered as a Direct Deposit which will be a 3% fee instead of a 5% Cash advance fee. Furthermore, you do not get any air miles from the BOA CC when making this Direct Deposit. None of the posts I’ve read actually disputes this fact, only that it confirms that it is not considered as a cash advance. So really, I don’t see any benefit with using a CC to do the initial funding. Anyone here have success with using a BOA CC? Sounds like only Barclay CC is the one people should be using to do the funding.

Banks will often tell you one thing, but it codes differently. I do believe the people on the DoC post have said BofA codes as a normal purchase. Hopefully someone else who has used a BofA card can answer you with their experience though. I don’t blame you for being diligent!

I am really curious what a good approach would be for funding with a credit card. I read everything about setting the CA fees to 0. What I’m having a hard time deciding is how much should I fund? My credit line is around 5k on a few cards. Is there a way I can fund my account with a few cards? Is there a good card to apply for that is notorious for giving you higher credit limits so that I can fund as much as possible with a credit card?

Thanks for your help

It is tough on lower credit limit cards. I believe they will only allow you to fund with 1 card unfortunately. As for getting a high limit, that will really depend on the bank and your personal situation. There isn’t a “golden bank” who will give you a big limit every time.

Thanks for the reply Shawn. What card is your go to for bank funding? Do you usually deposit the max allowed?

Any idea how long these offers will be good for?

They are set to expire on December 31, 2015, however in the past they have ended early so no real way to tell.

Shawn, as my wife is not a primary holder of a citi cc that earns TY pts but only an authorized user of my citi premier card, will she earn the 50k pts bonus if open a citigold acct in her name? TIA

I believe you have to be a primary account holder to be eligible, but you would have to confirm with Citi. The ThankYou account for your credit card is in your name and not hers which could be the problem.

Hey Shawn. I currently have the Citi AA credit card. However, the annual fee is due next month, and I planned on cancelling it before it hit. If I get this checking account bonus with the offer, will it post if I cancel my credit card in between getting the account and getting the bonus? Should I just eat the $95 annual fee to be safe? Or maybe go for the typ offer instead? Would love to hear your thoughts on this.

I believe if you sign-up and confirm the deal with Citi, that they will give you the miles. I haven’t heard of anyone being denied because they closed the card between opening the account and receiving the bonus.

Hi Shawn,

Thanks for the great article.

Can I add a family member to my citicard and then open a citigold account in their name? I already opened one in my name. If that’s possible, will the 50,000 bonus miles go also to my aadvantage account, which is the one registered to the credit card?

I believe only the primary cardholder is eligible.

Hi Shawn,

I have both the Citi AA Advantage MasterCard as well as the Citi Thank You Premiere card. What would be more valuable to acquire, the AA miles or Thank You points in your opinion?

Thanks!!

Al

That one is tough. I went for AA miles since I have a need for them, however I was torn. If you don’t have a specific need for the miles, then I would probably go for the ThankYou points, but there really isn’t a wrong answer. I think my wife is going to do it as well and she will go for the ThankYou points.

Wouldn’t you agree that one shouldn’t choose TY Points if he doesn’t plan to use the points within 90 days after cancellation/downgrade?

Ah, so close but no cigar. Signed up for this promotion when it was for 40k TYP in June and still haven’t received my points. Figured I’d ask to be matched even if it was a long shot. Online chat CSR said they would make an exception since I hadn’t yet received the points, but I’d have to call. Phone CSR spoke to agents in various departments before letting me know they won’t/can’t match because I already fulfilled the terms of the promotion. What a bummer!

Oh man. Perhaps try again?

Shawn,

Great job! Looks like you just opened a new CitiGold again. When did you receive the sign up bonus last time (not open date but bonus received date)? Do you feel confident about getting the bonus again? I received my bonus in 12/2013 and closed the account in 3/2014. I am hoping to re-dip but am afraid it might not be successful. Should I go for it now or wait until Dec (so it would be 2 years)? Thanks for your help!

Hey Shawn – Just wanted to get your attention again. 🙂 Were you able to confirm your sign up bonus? What do you think about the WARNING comment in your CitiGold step-by-step post? I am hesitant to open the account again if the bonus is uncertain. Your advice is much appreciated as I need to take action before leaving the country in mid October. Thanks!!!

Hi,

you mention that you must have you must currently have a ThankYou Preferred, ThankYou Premier or Citi Prestige card for the thank you points options. I have a forward card that earns thank you points. Does it say anywhere this would not qualify? In the terms I was able to find that thank you points credit card is required. Thanks.

It most likely would work, but you would need to contact Citi to make sure. My language in the post is cautious, because people have had difficulty with past deals if they don’t have the card for which the deal was targeted. Yes, based on the terms it seems like your Forward card should work, but I couldn’t guarantee it will or won’t either way.

Thanks for sharing this, Shawn! I have a similar situation as I have an AT&T card and personally I prefer the 50k TY points offer. Not sure if I am qualified either. And the fact that AT&T card is a co-branded card makes me even more worried. Any thoughts? Thanks.

Great article. When funding with a credit card, how long do I have to keep that originally funding in? Can I fund it then take the whole amount out right away after it posts, to pay off the credit card?

As far as I know you can.

I dont currently have a Prestige card, but this offer is making me think about getting one because of the reduced annual fee. A couple of questions:

1. If I apply and receive the Prestige card, when does the annual fee hit?

2. If I appy for the Citigold Checking for the TY points option, when will the $100 credit be generated for my Prestige annual fee?

1. Your first statement.

2. If you already have the Citigold checking account when you apply, I believe it is already adjusted automatically.

Thanks for the responses. In regards to my second question, what if you have the Prestige card and then apply for the Citigold checking? Will Citi know to credit your annual fee $100?

I want to be certain to get the credit or otherwise I might apply for the Premier instead.

I have the Prestige and opened a CitiGold acct a couple of months ago. First they credited my account a prorated amount of my $450 fee. Something like $418. The day before my Prestige statement closed, they charged the $350 fee. I’ve had my Prestige since late 2014. So, not a full $100 reimbursement in my case.

Thanks Dee. I have had my Prestige for 6 months, so I am expecting something similar.

For those who are interested, I put up a step by step walkthrough to opening a Citigold account. You can find it here: https://milestomemories.boardingarea.com/citigold-bonus-application-process/

Sorry if this is an uninformed question….could you fund this with the Citi Prestige or the Discover card? Do they register as a cash advance..

There is a link in the body of the post with recent data points. I suggest reading through those to see which banks and cards will work. I don’t want to say anything specific here, since that is kept up to date.

I didn’t see anything in the T&C that says the $30 monthly fee is waived for the first 2 months. Where can I find that? Thx.

It is on the main Citigold page. https://online.citi.com/US/JRS/pands/detail.do?ID=Citigold

“There’s no monthly service fee for the first two statement periods. “

How do I do the initial funding?

You can find detailed instructions here: https://milestomemories.boardingarea.com/citigold-bonus-application-process/

At no point during the sign-up process did it ask if I have an AAdvantage card or account. Did anyone else have that problem? It allowed me to open it based on my current login information for my Citi AAdvantage card, though. So is that maybe how it knows?

Since it is open only to AAdvantage cardholders, my understanding is they use the information they have on file from your credit card.

So if you didn’t have an Citi AAdvantage card, would the application get automatically rejected?

I’m not sure, but I think you just wouldn’t get the bonus.

Two qs:

1-can you continue to fund via cc after initial funding?

2.-is there no automatic charge for checks for this acct., as you normally get with a new checking account?

1. No you can only fund with a credit card initially.

2. No. Checks come free with this account. https://online.citi.com/US/JRS/pands/detail.do?ID=Packages&JFP_TOKEN=RBJ4QW68

Thanks!

How much must be in the account to count as a citigold?

There is no minimum balance required.

Do I have to fund at the time of opening the account?

If you want to do it with a credit card you must input that information at opening. Details here: https://milestomemories.boardingarea.com/citigold-bonus-application-process/

[…] Open a Citigold Checking & Get 50K ThankYou Points or 50K AAdvantage Miles & Fund with a Cre… – Everything you need to know about getting these two very lucrative Citi checking account bonuses. […]

[…] Citigold checking account for 50k offer is pretty good, you can read the details on this post by Miles to Memories. I first saw it at reddit if you want to get […]

Why is everyone suggesting to use the Barclays card? I don’t have it so I’m wondering what the perks are to using it to fund the account. And secondly, for those of you that fund the account with some huge amount of money from a credit card are you just turning around and using it to pay the credit card back off? Does Citi have an issue with this?

Barclay pays 2 “miles” per $1 spent while most other cards pay 1 point or 1 mile. Barclay miles can be redeemed for any airline, hotels, or other travel at 2c a mile while other cards are typically restricted to that brand, like say AA or cash back at 1c per point. If you do have another card with a decent credit limit and you want those miles or hotel points, just make sure you won’t run into cash advance problems. See the Dr. of Credit link at the beginning of this write up.

One correction, you do earn 2 miles per dollar spent with Arrival Plus, but each mile is only worth $.01. I’m sure that is what you meant, but just wanted to clarify so others aren’t confused.

Because Barclay’s charges have reliably gone through as a purchase and not a cash advance.

Yes, you can max out as much of your credit limit as you feel comfortable to fund the account and use the Citi acct to pay the bill. It is a great way to double dip on the offer – credit card rewards + sign-up bonus.

Hi Shawn,

So If I cancel the checking account(to avoid monthly fees) after receiving the bonus I will need to use the TY points within 90 days or lose them? Is that correct?

Thanks

By the way these are targeted offers. On the Dr. of Credit site, it’s mentioned that similar offers may not be honored to non-targeted folks. Some people who were not targeted called to confirm the offer after applying the code. Some were told that all accounts are being flagged for review and if you are not on the targeted list, you will not receive the offer. I wouldn’t call to confirm. Not smart. Who knows if they will honor but don’t apply for the points alone, apply for the rewards from your credit card. Arrival is best. Already did two CitiGolds for my wife and I last week. I first requested a credit line increase. That’s a hard pull so be aware. It jumped our CL to 22,000 a piece (and I moved CL around from other Barclay cards). Also had the Cash Advance limit reduced to $1 on both cards just as a precaution. Can’t go to $0. Citibank stated to me they code it as a purchase and Barclay is known to do the same. Funding went through on both accounts which generated 44,000 Arrival miles per card or $880 in travel redemption value. Well worth it. Now going to do the same with Savings accounts. Will I care if I don’t receive the TYPs which I was not targeted for? You can probably already figure it out, I’ll be so devastated while spending the $880+.

Couldn’t you technically keep on doing that every few months? I’m guessing eventually Citi would catch on to this “abuse” and shut you down. Before that you would have a ton of points.

Very smart the abuse should stop

I applied for the 30K AA miles targeted offer in July. I found out about it online. I was not targeted for the offer. Had to apply over the phone because I could not apply online. I received a detailed packet in the mail with the offer terms confirming all.

Since we were meeting spending on another card, my husband waited to apply until mid-September (offer due to expire 9/30). He was able to apply online. A couple of days later I found the posts on Dr. of Credit about people being denied. He secure messaged Citi. They wrote back that the offers were targeted but they looked into it and since he had an AAvantage MC, they were going to honor it for him. So we were lucky in the sense that they honored it but unlucky in that we are missing out on this higher offer. Also, in a phone call followup to CITI, we were told that if you apply online, all documentation is online. You will see the links to all the disclosures and documents during the application process. My advice is to look at them, esp. the link to the Promotional Disclosure to make sure it is the offer you want, and then print that out or screen copy (I printed it and the printout was dated – useful)

Did you have to call Barclays and let them know that you an upcoming large “purchase”? I image a $22,000 charge would raise some fraud flags on their end?

I called Barclay and the funding went through without a problem.

Hi Shawn, I signed up for citi gold under the 30,000 points a few months ago. Do you know of citi will match the offer for 50,000?

What is the form required to fund with a credit card

You will be able to download it when you open the account. https://milestomemories.boardingarea.com/citigold-bonus-application-process/

[…] Open a Citigold Checking & Get 50K ThankYou Points or 50K AAdvantage Miles & Fund with a C… […]

how much are you required to fund the account with, and what is the minimum balance you must maintain?

$0 for Gold Checking, but I just did $20

How come you didn’t fund with your credit card? I wish I had known about credit card funding last year when I opened this account.

According to their website there is no minimum, but obviously you must put something in. The only balance to maintain is $50,000 if you want the $30 monthly fee waived starting in month 3.

Shawn,

I posted a while ago but my post is not posted , not sure why….anyways, here I reposted my question:

I saw that you mentioned in order to be eligible for this offer, you have to have Citi AAdvantage Platinum Mastercard. Does it have to be personal version? I have a business version of the card. does the business version also eligible?

Hey Jay. Sorry for the delay. Your previous comments got held for moderation. I believe a business card would make you eligible, however I would confirm with Citi.

Shawn, Did this work for you? I also have business AAdvantage only. I called to confirm if I was eligible and the rep just said there are no promotions listed for me.

Yes it has worked for me. I haven’t received the bonus yet of course, but I was able to confirm it was on the account via secure message after I opened it.

Jay, Were you able to get the AA bonus with a AAdvantage business card only?

Applied for the Gold Checking via Firefox private window (Incognito). took couple of times. Chrome gave me an error (Offered not valid in your state) and failed the 1st time on Firefox (offered can’t be found). Application has been approved and agent will be in touch via phone.

Encountered the same so many attempts.

Tried IE and went through apps.

@Jake — I got two bonuses — one in 2013, another in 2015 (but two years apart– which were the terms back then, there was a specific clause in the terms and conditions). Closed the account in July.

Like you, I am wondering whether I can do this again, since the 24-month language is gone… or whether this is a “once-per-lifetime” bonus.

I would hold off on applying until you find out the answer to this. This offer is valid until the end of December 2015!

If anybody knows the answer or has any datapoints, that would be appreciated!

I am wondering the same thing as I closed my Citigold account only a couple of months ago and wouldn’t mind getting it on this new offer.

*in

Would you be safe from the 90 day to use up the points rule if you combined your credit card and checking ThankYou accounts together, then downgraded/cancelled Citigold, rather than transferring the points from checking to credit card account. I believe Citi allows you to combine your TY accounts and value the points based on your highest level credit card (e.g. Prestige @ 1.6 cents)

Even when combined points are tied to the account they are generated. If you cancel the Citigold account you will lose them or will have to transfer them to another account where you will have 90 days to use them as far as I understand.

Why the worry about a 1099? If you get $800 in value from 50K TYP at the rate of 1.6 cents/mile and receive a 1099 you will pay tax on that $800. For those in the 15% bracket (less than $37.5K for individual or 75K for couple) you will still get $680 in value after taxes–I’d prefer that to $500 in gift cards. Or if you’re in the 25% bracket (under 90K for individual or $151K for couple) you’d still be better off with $600 in after tax value than $500 in gift cards.

Has anyone received more than 1 Citi checking bonus? I would love to do this, but already had a gold account a year ago that I closed right after miles posted to avoid monthly fee… Any help is appreciated!

I’ll definitely be doing this once my wife’s new Arrival+ arrives. I was going to do the 40k TYP before 9/30, but didn’t want to deal with the expiring issue.

Based on nothing at all, I’d expect AA miles to be valued at 1¢ a piece.

I tried the AA code and received this message: “We’re sorry, but we’re unable to open this account for you online. But you may open this account by calling 1-800-374-9700”

What balance do you have to have to get the 50K AA miles?

Others have had the same issue and report success when using private browsing mode and trying again. I would try that.

Hi, I tried it today from MA from 3 different browsers, but after selecting MA as the state, I received the same error message: “We’re sorry, but we’re unable to open this account for you online. But you may open this account by calling 1-800-374-9700.”

Will try tomorrow from another PC.

I have a basic Citi banking account now, will the bonus still credit or is it to new Citi customers only. I recall some of the previous offers being only for customers without any current Citi checking relationships…

In the terms it says the offer is for new consumer checking customers only.

shawn,

Not sure why my post hasn’t posted yet, so I am reposting:

I saw that you mentioned in order to be eligible for this offer, you have to have Citi AAdvantage Platinum Mastercard. Does it have to be personal version? I have a business version of the card. does the business version also eligible?

Once you fulfill the requirements, you have to wait at least 90 days before the points will hit your account. Factor that into any plans for using them.

Definitely! It does take about 90 days, although for some it has been as long as 4 months or so.

HECK YES. Thanks for this, Shawn. I just opened one for my wife, and we’ll definitely make good use of those AA miles.

What do you think about this offer for people who have previously had an account, but then closed it? I closed mine with Citi about a year ago. Terms say explicitly “This offer is available to Citi® / AAdvantage® credit cardmembers who receive this communication. Offers for new consumer checking customers only, 18 years or older.” But, no mention of “not available if you have previously had an account” or something like that.

Thoughts? Thanks!!

It is tough to say. I believe you need to be a current AAdvantage cardholder based on what I have read.

@Shawn. Well I’m still an AA cardholder. I’m just wondering if I can get the checking bonus more than once.

Im in same boat as Jake. also wondering about this. got offer and closed accts for wife and I bout 15 months ago.

Just opened this account couple days ago. Is citi good at matching bonus for bank accounts? I opted for 40k ty points from previous offer.

I am not sure when it comes to checking offers. I would send them a secure message and ask that they match.

This may sound rudimentary, but i was curious to see if using the citi debit card to load Bluebird could count towards the $1,000 spending requirement?

yes (at least in the past couple months it has)

yes (at least in the past couple months it has)

Are these codes

AAdvantage 50K – 42ERCWNQU6

ThankYou 50K – 42ERCZ42PY

used to track your commission?

Haha. I assure you I receive no commission. These codes came from the post that is linked to at the bottom.

What credit card did you use to fund the account?

Barclays Arrival Plus x2 points (counted as purchase)

I’m still waiting for my 40k TYP from opening an account a couple months ago and met the bill pay requirements, etc. I would be interested in having my sister open this account but can I fund her individual account with my credit card? Or should I just add/issue her a credit card and have her fund it?

I think the credit card has to be in the name of the account holder. I plan to add Hubby to my Aviator account so he can open an account.

What is minimum balance requirement to open these accounts?

Can you please elaborate on the ~$1,000 in value? I got $100 from the AF Citi Prestige savings and ~$800 for 50k valuation of TY pts at 1.06c. Where is the $100 coming from

I was talking about credit card rewards earned on the funding of the account. It will vary depending on the credit card you use.

I called Barclays (Arrival+) and Chase (UR). Both said it will trigger Cash Advance.

I opened a Cit Gold a couple of months ago with a Barclay Aviator. It went through as a purchase. I called Barclay ahead of time and asked them to lower my cash advance limit to $0, which they did.

A month after I opened the checking account, I opened a savings account tied to the checking account and funded that with the Aviator card, too.

The checking acct funded with a form that I faxed it. The savings was all done over the phone.

It will not with the Arrival. CSR’s are making an answer up when they don’t know the correct answer. Like children. Hate that.

Used the Thank You Promotion code, entered “California” as the state and got this:

We’re sorry, but we’re unable to open this account for you online. But you may open this account by calling 1-800-374-9700.

Slight bummer, since the Prestige card is in my wife’s name, and she hates speaking to reps on the phone.

Why not call Citi as “high-pitched voice Robert”?

That would sound more phony than, say … well honestly I can’t think of anything sounding more phony than me trying to imitate a woman’s voice.

LOL

@Robert. Same situation, down to the T. But then, I clicked through again (from this webpage) and it didn’t ask me for a state. Went ahead and got applied for my wife, and it was approved!

I live in VA, but used to live in CA. I tried both, but then it worked after I just retried… Hope this helps!

Same for me, tried VA and got the message to call. Refreshed the page, and got the normal application. Did not yet apply, so can’t say if it actually goes through or not, but at least was able to get the form to show.

Just re-tried it, after getting the “call to open” message, and this time, the account went thru.

So RETRY if you get the “call to open” message.

I have heard trying again sometimes works and also making sure you are logged out and using an incognito browser can work.

I have a citigold account for the last 10 years… can I open another one with this promo>?

I believe you can if you haven’t received a bonus in the past 24 months, however you might want to confirm that with Citi.

Correction: The terms say it is for new consumer checking customers only.

New customers only, but where are you getting the “if you haven’t received the bonus in past 24 months”? My wife and I both got the bonus last June (bout 15 months ago). -Would like to apply, but am within the 24 month window you mention?

Shawn, could you elaborate on needing to redeem or transfer out TYPs before downgrading the account? Is that a clause in the terms I didn’t see?

I was indeed wondering that too. If you close the account, but still have any of the Citi ThankYou credit cards, will you be able to hold the points in your account, or will you still need to transfer them out first before closing or downgrading?

I was wondering about the same note. If you still have any of the ThankYou credit cards in possession, would you then be able to close the account before redeeming or transferring the points?

You can transfer them to your credit card ThankYou account, however you will need to redeem them within 90 days.

Do they pull credit when you open one of these accounts?

soft pull only