Updated: 8/11/2015

U.S. Bank Club Carlson Credit Card Review

| Miles to Memories does not have a direct relationship with the card issuing bank and this review does not include any affiliate links. If you wish to support the site, you can apply for cards by clicking through from this page. Before applying I highly suggest reading the following post about taking it slow. You can find all of our credit card reviews here. |

|---|

Overview

U.S. Bank and Club Carlson made waves in late 2012 with the launch of a group of co-branded credit cards. Currently there are three different Club Carlson credit cards which are issued by U.S. Bank.

- Club Carlson Premier Rewards Visa Signature

- Club Carlson Rewards Visa Signature

- Club Carlson Business Rewards Visa

While the requirements for each Club Carlson credit card differ slightly, the Business Rewards & Premier Rewards cards generally require excellent credit while the regular Rewards card requires at least good credit.

U.S. Bank is very sensitive to churners or people who apply for a lot of credit cards. There are many reports of people with very high credit scores being denied because of having too many recent applications. Later on in this review I will talk about how to increase your chances for an approval.

Product Features

Since there are three distinct Club Carlson credit card products, I will talk briefly about each one of them separately.

Club Carlson Premier Rewards Visa Signature

This is the top tier Club Carlson credit card product. Here are the product features:

- 10 points per $1 spent in eligible net purchases at participating Carlson Rezidor hotels worldwide.

- 5 points per $1 spent in eligible net purchases everywhere else.

- Club Carlson Gold Status.

- Visa Signature benefits.

- $75 Annual Fee

- 40,000 bonus points each year on account renewal.

- One free night after $10K in spend annually.

Club Carlson Business Rewards Visa

This card has many of the same benefits of the Premier Rewards Visa Signature. It does have fewer travel benefits and is not a Visa Signature card.

- 10 points per $1 spent in eligible net purchases at participating Carlson Rezidor hotels worldwide.

- 5 points per $1 spent in eligible net purchases everywhere else.

- Club Carlson Gold Status.

- $60 Annual Fee

- 40,000 bonus points each year on account renewal.

- One free night after $10K in spend annually.

Club Carlson Rewards Visa Signature

This is the lowest tiered Club Carlson credit card. It earns less, has a smaller bonus and comes with lower status.

- 6 points per $1 spent in eligible net purchases at participating Carlson Rezidor hotels worldwide.

- 3 points per $1 spent in eligible net purchases everywhere else.

- Club Carlson Silver Status.

- Visa Signature benefits.

- $50 Annual Fee

- 25,000 bonus points each year on account renewal.

- One free night after $10K in spend annually.

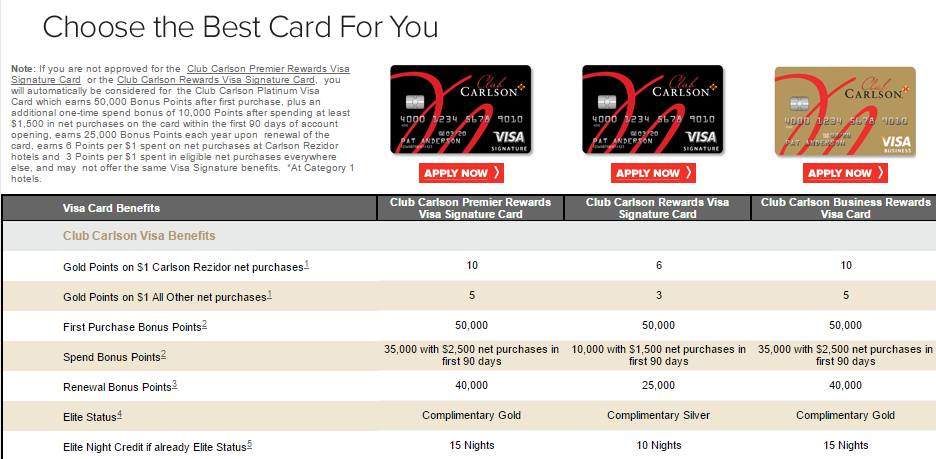

Comparison

As you can see, the regular Rewards Visa Signature is a lesser card in every way. It is mostly for those people who don’t have good enough credit to be accepted for the Premier card.

The Premier Rewards and Business cards are probably the most attractive to apply for. The main differences between the two cards are Visa Signature benefits and the annual fee. Since the business card doesn’t have Visa Signature & other travel benefits, it carries a $60 annual fee compared to the $75 fee of the Premier Rewards card.

Here is a chart comparing all three of the cards in detail.

Best Offers

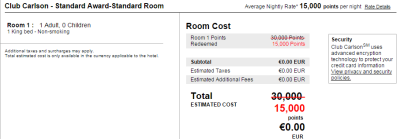

Premier Rewards/Business Rewards Cards

- 85,000 Bonus Gold Points to start – Receive 50,000 Gold Points after your first purchase. Plus 35,000 points once you spend $2,500 on your card within the first 90 days.

- Annual Fee not waived the first year.

Regular Rewards Card

- 60,000 Bonus Gold Points to start – Receive 50,000 Gold Points after your first purchase. Plus 10,000 points once you spend $1,500 on your card within the first 90 days.

- Annual fee not waived the first year.

Bonus Award Night Eliminated

The bonus award night feature of Club Carlson credit cards used to be one of the best benefits in the credit card space. This benefit would give you the last night free on award stays of 2 or more nights. If you stayed in increments of 2 nights, then it became a buy 1 get one free situation. Unfortunately the Bonus Award Night was discontinued in the Summer of 2015 and replaced with 1 free night annually after you spend $10K on the card.

Tips For Getting Approved

In addition to checking your normal credit report, U.S. Bank also uses alternative reports from two companies. Advanced Resolution Services & ID Analytics (ARS & IDA for short) provide U.S. Bank with alternative reports with a list of all of your recent credit applications.

If you apply for a bunch of cards in one day, the latest inquiries may not show on your credit reports, however ARS & IDA reports will show them. A lot of recent applications will usually cause U.S. Bank to decline your application.

Many people have had success with freezing these reports. The process of freezing them is relatively simple. If you freeze the reports then U.S. Bank will not be able to use them to determine whether or not to approve your application.

I highly suggest you check out this Flyertalk thread to read about the latest experiences others have had applying and more details on how to freeze your ARS & IDA reports.

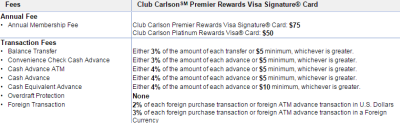

Various Fees

All three of these cards have an annual fee. The Premier Rewards fee is $75, the Business card is $60 and the normal Rewards card is $50. These annual fees are not waived the first year.

In addition to the annual fee, all three cards have a 2% foreign transaction fee when the transaction is done in U.S. dollars or 3% when done in a foreign currency. This is not a good card for international travel.

There are also a number of other fees for balance transfers, late payments and cash advances. You find the full list of each card’s fees on the application.

Annual Bonus

The nice thing about these cards is that they all have an annual account bonus. The Premier Rewards and Business cards give 40,000 bonus points each year and the normal Rewards card gives 25,000 points. I believe the value of the annual account bonus can offset the annual fee, especially if you redeem at lower-tier properties.

Our Club Carlson Credit Card Review

My wife and I both had the Premier Rewards version of the Club Carlson credit card. We each had our cards for several years, however with the elimination of the Bonus Award Night, have decided to cancel one of them. For now, the 40K annual bonus will be enough for us to keep one card around in order to keep the Gold status and a few points in our accounts.

The 5x points per dollar on all transactions is a very good earning rate as well. Even with the elimination of the Bonus Award Night, you can generate points relatively quickly, especially for lower tier properties. While this card isn’t as good as it used to be for generating free nights, there is still some value on low-end redemptions, although higher-tier properties are not as good a value.

It is true that Carlson Rezidor doesn’t have the greatest selection of properties here in the U.S., but their selection in Europe and other places is pretty good. Here in the U.S. we have stayed at some decent Radissons and their Country Inn & Suites brand is pretty good as well for a basic no frills family stay.

Club Carlson Credit Card Review – Conclusion

Many people decide to apply for the business version of the Club Carlson credit card simply because it has a lower annual fee. I believe either the Premier Rewards or the Business cards are definitely the way to go. There is just no reason to go for the regular Rewards card with its lower bonus, inferior earning and silver status.

If you are someone who hasn’t applied for a lot of cards lately, then you may consider getting the U.S. Bank Club Carlson credit card sooner rather than later. If you have already been active in applying for cards, then I suggest that you consider freezing ARS & IDA. Either way, this is a rewards credit card with a decent sign-up bonus and a somewhat limited appeal. I won’t lie, the elimination of the Bonus Award Night stings, however there are much worse hotel credit cards out there.

[…] Bank Club Carlson (My review) – 5 points per […]

Have you ever had any problems with the alternating of 2-night reservations between you and your wife? Is there anything you’ve seen (in any fine print) that suggests that would not be allowed? Do you usually check in & out ever 2 days, or explicitly talk to the front desk about your plans when you check-in the first time? I have the card, but my spouse doesn’t yet – so just curious. Thanks.

[…] sending out new targeted spending bonuses to holders of their co-branded Club Carlson credit card. (My review of the card.) They have done this in the past, although this round doesn’t seem as generous. (At least […]

[…] holders of the Club Carlson credit card (my review) this gets even better. With the credit card you get gold status and a 35% bonus on earned points […]

Very good review. I got the Premier personal card and love the last free night bonus. It’s awesome. I got 2 nights in London and 4 in Paris coming up in a month. Free bonus nights at 3 properties.