CNB Crystal Visa Infinite Authorized Users Will Cost $95 Each

We wrote recently about the CNB Crystal Visa Infinite Card losing a long list of perks next year. You can read more about that here. And if that is not bad enough news, now we also have confirmation that authorized user cards will cost you soon.

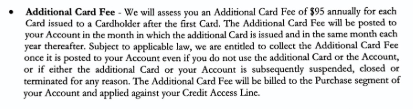

Starting next year, you will be charged $95 for every additional card. Here’s the relevant part of the notice that was sent out to cardholders as posted on reddit:

The fee, or fees will be charged on the anniversary date. Unlike other banks though, CNB does not refund annual fees once they post to your account. So if you have your primary card, or additional cards open by your anniversary date, you will be charged a non-refundable fee. That’s $400 for the primary card and $95 for each additional card.

CNB Crystal Visa Infinite authorized user cards don’t really have many perks as of next year, so it doesn’t make sense to keep them open. Try to maximize everything before the year is up, and if you plan to keep the card, make sure you cancel additional cards at least.

Conclusion

Lots of bad news for this card and a big blow to those who have it. Goes from probably the best value out there, to barely worth applying for. Only a huge signup bonus will probably make you go through the application process with CNB.

I’m reading it a little differently. The additional card fee will hit NOT on the primary card anniversary date but the anniversary date of when the additional cards were opened, if they are different. I imagine there are people who added AU after having the account opened for a little while. My primary card anniversary date is 11/30 but i’m not sure when i had the AU’s set up. The bank is so odd to deal with. It may have taken until January to have them set up. In which case if additional cards were issued in January, I would be hit with the additional card fee in 1/2020 not 11/2020.

So the card is basically useless now. I am glad I never wasted the time and hard pull to apply. With all these recent devaluations and fee increases in the premium card market I appreciate my Sapphire Reserve more and more.

?? It was easily worth the hard pull. $1000 airline credits, unlimited Priority Pass guests, 3x gas/groceries, large (100K-50K) signup bonuses and points worth 1.3c on travel. And if you spent >$50K they’d reimburse up to $500 for lounge subscriptions. It was the biggest no-brainer of any card available. Of course, it was too good to last.