My Credit Card Application Was Rejected By Synchrony & It’s Laughable

My credit card application was rejected by Synchrony, and the process has been comedic. A rejected application isn’t exactly newsworthy, but the fact they didn’t even process my application is getting there. The reasoning from their employees is just laughable. Here’s why my credit card application was rejected.

The Application

I applied for the Cathay Pacific credit card from Synchrony Bank. As you see in the welcome offer above, you can earn 40,000 Asia Miles after spending $2,000 in the first 90 days. I figured it was worth an application and filled out the info online here.

I Knew Something Was Fishy

The fact I didn’t get any “someone checked your credit” alerts set off a red flag. I gave it a few days and then decided to call. After getting bounced around a bit, I got the phone number for this specific card:

Cathay Pacific Credit Card information / reconsideration 866-273-9026

Write that down if you need it. Every Synchrony credit card has a different reconsideration/information number. That’s the number just for this card.

I told them I’d applied, no one checked my credit, etc. The man on the phone confirmed they’d received my application & that it was rejected. He was “not at liberty” to discuss anything about my application and told me to check my email. I promised him I’d received nothing (yes, even in my junk mail, I swear!!). He told me to wait for a letter in the mail.

The Letter Comes, And It’s Mysterious

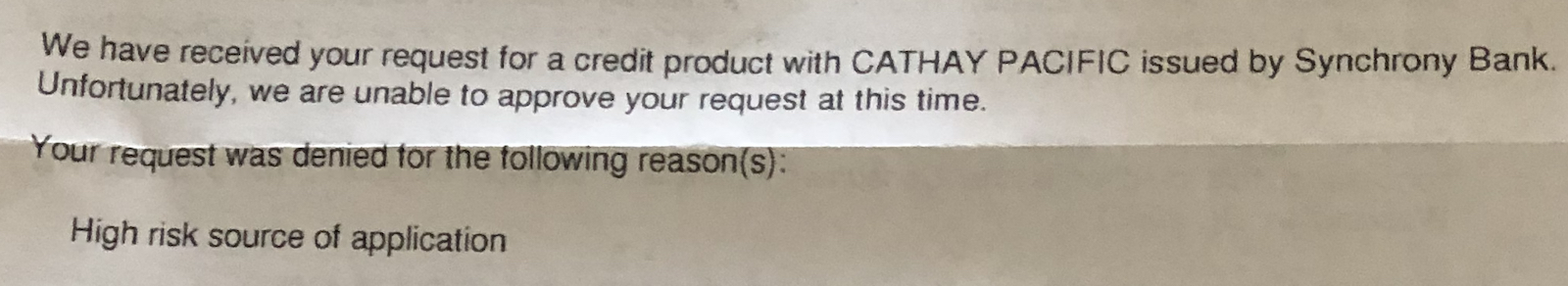

My letter came in the mail, and it’s odd.

“Your request was denied for the following reason(s):

High risk source of application”

Um, what does that mean? I was rejected for this singular, strange reason.

Phone Rep 1 Is A Space Cadet

I called to inquire what that meant. I knew they’d never pulled my credit, so this means something outside the norm. The first guy I talked to readily admitted that he doesn’t handle applications / reconsideration but also told me a few times he wouldn’t pass me to them. He seemed to “know it all” and wanted to tell me that a rejection is a rejection is a rejection.

“You didn’t check my credit. I don’t think that’s it.”

Then, he offered up this gem:

“Oh, that means we couldn’t find you. You must first sign up with the credit agencies, so they can have your information on file. Then, you can apply once you have a credit agency you work with. You can choose Experian if you want. That’s a good one.”

What in the…

How does this guy work at a bank?

I explained that I understand how credit works and that my application wasn’t processed. After much hemming & hawing, he agreed to transfer me to the reconsideration people.

*click*

Phone Rep 2 Is Helpful But Has Weird Advice

After being disconnected, I called back. Phone rep 2 gave me some information, but it was just plain weird.

- my application was never processed, which I knew

- this “high risk source of application” line means their IT system automatically rejected my application without sending it to a credit reviewer

- likely reasons for this are

- using public wifi, so your IP matches another application

- using a shared computer at the library or similar

I told her I’d applied while sitting at my family’s house in Florida last week. No one but me uses my computer, it’s not public wifi, etc. None of those reasons seem to match my situation. Her response is puzzling:

“We are aware that our IT system rejects applications without a good reason. Some people have told me they had to apply 3 or 4 times before the application ever went through. I have been told that applying via mobile device can increase your chances. Unfortunately, there is no way to apply by phone or mail.”

The fact this problem is prevalent enough that they know enough about it to develop a workaround is definitely an issue. The fact they recommend this workaround, instead of fixing it, is just plain nonsense. Is this Citi’s IT team??

Another Application, Same Result

Since phone rep 2 told me I’m free to apply again, I asked a friend to try on my behalf. He cleared his internet history and then filled out the info I gave him. Perhaps a different computer, different browser, and new IP wouldn’t wind up in the trash bin. The result?

No credit pull. No alerts. Nada.

We are heading into the same issue. I guess I’ll try a mobile device next time, but this is nonsense. It reminds me of Benjy’s attempt at applying for the Best Western Rewards Premium Mastercard from First Bank of Omaha. They had some laughable IT issues with his application also.

Credit Card Application Rejected By Synchrony – Final Thoughts

I like Asia Miles, though the program has some quirks. As long as this offer of 40,000 miles sticks around, I’m willing to give this application a few more tries. It really shouldn’t be this complex, though. The fact they have a “we know our IT sucks” response for customers is laughable. I’ll give it 30 days and then try again. I’m hoping the 3rd time is the charm.

Anyone else had odd experiences applying for the Cathay Pacific Visa from Synchrony? Got any tips for the application going through?

Synchrony Bank’s payment process is excruciatingly slow and aggravating. I’ve made multiple attempts to pay them through a credit union account and results have been days and days of ‘processing’ followed by ‘ payment rejection’ and accompanied by a late fee. I check my balance and it remains the same. I’ve contacted the credit union to verify the information is correct and it is. This morning no payment has been made and I’ve gotten a ‘ payment is overdue and any information given will be used to collect a debt. Great huh. When I fix this issue its time to cut ties with Synchrony Bank. Hasn’t been a good experience for me. Its been a difficult process just attempting to pay my due and it shouldn’t be especially when as a customer I have funds and means to pay and remain in good standings.

This exact same thing just happened to me when applying for a TireRack credit card. Letter says “high risk source of application” with no other information, and no credit bureau is listed. I applied from my home ip address and my credit is very good. My credit was frozen, but I unfroze it before I applied – which apparently didn’t matter because they didn’t even pull my credit. So ridiculous. I bought my tires elsewhere, and will certainly never apply for credit from Synchrony again.

No Synchrony Bank affects me like kryptonite effects Superman when he comes in close contact with it. the first experience was opening a bank account and not being able to because Synchrony pulled an old phone number from my credit report and wouldn’t allow me to change it (on the app). Then, any other type of credit products for example a Harbor Freights purchase for $199.00. Declined before the pre approval. So basically, they asked for my last four digits and my cell phone number and didn’t bother to process the app. Here is why. If your info on the Application doesn’t match the info they’re pulling? That’s an auto denial and 9 times out of 10 it’s the phone number. You have to find out what phone number they are using to verify your identity then call them up and have them change the number to your current number and THEN apply. You will at least get past the auto denial. The best way to do this is to apply for an pnline checking account and at the end they will ask to send a confirmation to the number they are choosing. You then write that number down as a reference when you call.

WOW – I guess I am not alone with these idiots at Synchrony. I sent a complaint letter to their corporate office after being denied and got 2 canned responses. I called the individual at 800-419-5010 ext. 4167226 and asked her how could you NOT find someone with 45+ years of credit history. I told her that I have 2 closed accounts with you and that didn’t even phase her. It was like talking to a robot. I plan to file a complaint on the federal level next just to piss them off further.

I have a credit score of 780, wife = 820 and a 45 year build up of credit.

No balances no debt no nothing.

Tried sighing up for a Walgreen’s card. Some of the perks looked nice.

Got rejected: High risk source of application

Oh well their loss.

Wow this makes a lot of sense now, all my years of applying for different credit I have NEVER received “high risk source of application”. After googling what this meant I found this. Only thing different for me is I actually applied on my mobile phone?? So I don’t think this is the case. Maybe if I try my laptop I will have different results. After reading this I tried again on my boyfriend’s phone but received the same bulls**t letter. The fact that Synchrony is the source for so many credit options more than you think this is ridiculous. how can they even let this issue continue knowingly??

Yep. Synchrony does it again. I found this article after I searched for why I was denied today trying to finance a Google phone. I have a good credit score and a great debt utilization ratio (3 of which are other synchrony cards with no balance). After I read this post, I tried a second time with the same result. Then we tried in my wife’s name. She was immediately approved. Her score is not much higher than mine and she has a worse debt utilization ratio than I do. The only thing I can think is different are my student loans are much higher than hers. It’s ridiculous though.

Troy – glad to hear you were able to find a solution.

Thank you for writing this piece it was good to know there is a problem other than myself.

Well, I’m glad I’m not the only one w/a “high risk of application”. My credit too was NEVER checked. I applied 15 times. Yup, 15 freaking times. 15 letters saying the same. All for a Lowe’s Credit card. Even went to the store and applied and was also denied. I have a damn good credit score so I know it wasn’t my credit. IT was useless & lacking intelligence. They probably think the Earth is flat too.

I’ve also experienced being turned down getting zero percent interest for 18 mos through Synchrony and the reason was high risk source of application. Has anyone been approved for financing by Synchrony and if so, what was your method of applying?

Synchrony bank turned me down as a high-risk! We have very little outstanding debt I’d say under 10,000 probably more like under 5000. No mortgage. When I asked 2 different reps. what that means; they cannot supply me a really good answer other than saying you need to go to copy of your credit report. This was a card that is being issued by Verizon through synchrony. I am honestly thinking About just canceling my Verizon.

That’s definitely strange. Did they actually pull your credit and process the application? I got mine to go through voa mobile. Now waiting for their decision.

Still not as bad as Popular Bank who issues the Avianca cards, they approved me, I received the card and even activated it but it was declined. They told me to send in a copy of my ID and a utility bill, which I did. They closed my account and would not tell me why. Sometimes my middle initial is on some documents and the city name is different on certain things, such as Atlanta or the town in Atlanta, but same zip code.

I’ve also had some weird moment with Popular. I got auto-approved for the first card but since then they keep telling me my personal info & my wife’s personal info don’t match what’s on our credit reports. Which is ironic, since they told me which report they wanted to pull (I forget which) and I logged into that agency’s site and literally copy/pasted the info into my Popular application so the spelling, abbreviations, etc. would be exact. They still told me it didn’t match…?

Never apply for a credit card or a checking account using an IP address for a location that doesn’t match your address on the application and/or the address on your credit file associated with your SSN. I have learned this the hard way numerous times. Many banks automatically reject or don’t process applications in this situation due to higher cases of fraud. Just because you disagree with Bob’s explanation above doesn’t make it wrong. To the contrary it’s very common in the industry. It’s certainly extremely aggravating and consumer-unfriendly, but they have the data on fraud, not yourself. I also suspect that Synchrony deals with higher levels of fraud because of so many subpar/secured line/store credit cards. It’s too bad that such a prestigious international airline works with such a crappy bank in the United States.

As stated in the article, everything matches.

Also, I’ve applied for a lot of cards with VPN turned on, so I have a ton of evidence that this theory of yours isn’t backed by data.

Try to apply mobile but make sure location is turned on.

Denial reason based on IP address many of credit boards say that.

Update us soon

If it’s based on IP, they’d have to be saying “this IP you used is high risk”. Considering Synchrony has never seen my IP before, and no other bank has flagged my IP, I’m not sure I’m buying anything but ‘crappy IT department’ on this. Is there anything more to this?

Ryan,

Thank you for the detailed sharing of your experience. I had a similar craziness a while back when Synchrony had the Virgin America card. I have avoided them since. Not sure I want to have any financial link with such an incompetently run entity. This is supposed to be a bank?

Interesting story, i’ve never heard of anything like this before. Please keep us posted (i.e. if you end up applying via a mobile device)

Also, how does this 40K offer compare to historical offers for this card? I.E. Lower than normal, higher than normal, average, etc.?

40 is elevated, the normal offer is 30k most times.

When I got my Rakuten card, I followed the procedure Frequent Miler gave and it worked without issue. Maybe reading that article and following those instructions might help.

Good Luck

Are you talking about their recommendation for freezing the 2 smaller bureaus? I have that, and it also doesn’t apply here, since they didn’t even check my credit.

Do you have any other cards with them? I have the Rakuten card and had no problems at any stage.

I don’t

Were you using a VPN, TOR or similar while you are at home? Some organizations in other contexts consider those high risk IPs.

No.

Synchrony’s response may be annoying, but I am not totally convinced that it’s unreasonable. I would imagine that identity theft, or otherwise applying for a card without a person’s permission, is a huge problem, and so it seems Synchrony has chosen to look for various things that could be associated with this problem. Now, obviously, their methods are overinclusive, but that’s the line they’ve chosen to draw. I always try to apply for cards from my home computer, while I am physically at home, because I never want to trip up any fraud detection. I currently have three Synchrony cards, and all have been through auto approvals.

Bob – I disagree. While I’m all for internet security, this is absurd. I think it’s unreasonable that the solution you recommend (apply from home, while at home, etc.) is exactly what I did, which is the same computer used for other applications, and Synchrony itself admits they have cast too wide of a web. I think it’s unreasonable that they have a problem they know is a problem and aren’t fixing it, such that they tell you how to try to get around it.

OMG I just had this exact thing happen and I was furious. I switched to Verizon a few months ago and kept getting preapproved card letters and emails. After researching and realizing the points are good and I can apply them to my cell phone bill, I thought why not. I got an email saying I was declined for the exact same reason and I was furious because it is my computer that I applied on. I have very little debt to income and my credit score is 840. I called and they were absolutely no help. They said there is no overturning a denial, but it was probably the VPN or a firewall issue and to apply again at the store. I went to verizon and I applied again at the request of the employee and it was denied because the app was too soon after the other. This time I asked for a manager who has never even heard of this reason. She could not help at all either. I was so frustrated. I have decided never to bank with synchrony.

Amanda – it turns out waiting 30 days and then applying using your phone (not computer) is the solutions. Weird, but it works.

Synchrony is the worst, in my experience.

I applied for this same card a couple years back. I was approved, they sent the card, but I could not activate it. Numerous calls to reps could only turn up that my ‘mobile phone’ number (needed to activate the card) was ‘suspect’ (I don’t have a land-line). This was the same mobile number I’ve used for all my other cards for the big banks with no problem, with many signups predating this one by years. By the end, their only resolution was to ask me to try and snail-mail in some credentials to prove my identity before they would activate the card. BUT, they did sent me a statement with the bill for the (Non-waived) annual fee, that I needed to pay….for a card I couldn’t use, with the welcome-offer window growing smaller by the say.

I felt this was truly ridiculous, and finally called to close the card (that had never been activated), and was promptly informed that I’d never be able to earn another welcome bonus (for the Cathay Card) again if I did so (not that I’d earned any bonus this time). By this point, I realized that Synchrony was not a company I wanted to deal with…ever. I see from this article, things have not improved.

Paul – that’s just…wow.

Same thing happened to me but with Capital One when I applied and was approved for the Venture card. Cancelled the card and will never do business with Capital One again. Based on your experience wand Ryan S’ post, I will also avoid Synchrony.

Wow, never heard that about Cap One before. That surprised me.

anytime I saw any offer from Synchrony I’ll pass