Which Credit Agency Does Each Bank Use?

If you are into the credit card churning game, then you must at some point have run into an issue getting approved for a card. Many times the banks will cite “too many new accounts”, but other times they will cite the number of recent inquiries.

Thankfully there are three credit reporting agencies (Equifax, Experian & Transunion) and most banks normally only pull your report from one for credit card applications. (Capital One generally pulls all three.) This allows you to spread out your inquiries to make your credit profile look better to the bank.

A Fantastic Tool

While you can always check each of your credit reports to see which bank used which agency in the past, that isn’t necessarily the most efficient way to do it. CreditBoards maintains a “Credit Pulls Database“. This database contains information submitted from members of their site. Not only is the information generally accurate, but it is up to date as well.

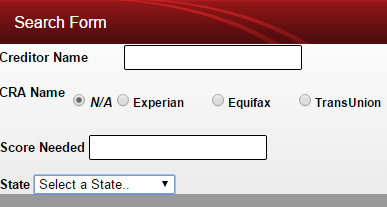

The Credit Pulls Database is a very simple tool. It allows you to search by creditor, credit agency, state and score required. In the creditor field you can either generically type in the name of a bank such as “Chase” or you can specifically type in the name of a product like “Chase Freedom”. (Some banks use different agencies for different products.)

After performing your search, you will find the results ordered from newest to oldest. If provided, you will see whether the person was approved or not, their score, the date and any other relevant data.

Conclusion

The Credit Pulls Database is a simple and easy tool to use to determine which agency a specific bank will use to pull your credit. When formulating a strategy for a round of applications, it is really important to diversify credit pulls as much as possible.

Did you know about this tool? Do you use it or another tool? Let me know in the comments.

Have lots of hard pulls transunion and Equifax only one on experian. If I freeze transunion and Equifax will they pull experian? Thanks

It really depends on the bank. Most will pull the unfrozen bureau but some will simply tell you to unfreeze.

Thanks for llnking to the creditpulls database. Just FYI, t is maintained by someone who works in the credit industry, so that no fake entries can get by. People who want to enter their information must be members because there are people who would like to corrupt the information. They usually won’t go to the trouble of registering and posting. We don’t do anything with your information, if you would like to register and contribute your information.

There was an initial database on yahoo, and it has been posted several times. It was originally posted on CB by psychdoc, who als posted it publicly. He didn’t maintain it, but we kept it going on our site and you’re welcome to search freely. We’d love it if you’d contribute.

We’ll be giving you a link back from CB.

Thanks for the information Linda! It is a great resource.

Thanks, will bookmark this database for future reference/ application strategy.

Was funny, the next CC I’ll be applying for got 4 hits. All are in the same state as me (CA) and two are Experian, one Equifax and one TransUnion. Can you say eeny meeny miny mo? lol.

Thanks, Shawn!

That’s quite an incredible tool – I couldn’t believe the detailed information that was provided. I find it fascinating reading to compare scores and credit limits of the various applicants; I would have thought this would remain the banks’ proprietary information. This is definitely a source I’ll use while planning my next credit card applications.

as a follow-up to my previous comment:

Now I understand why this is not proprietary information – the database comes from members of the Credit Board’s site. It is still interesting, nonetheless….

This would be great if every good credit issuer in my area didn’t pull from Experian.

Sad day.