Discover Apple Pay Lockup & Best Practices

As many of you know, I think that Discover’s Apple Pay 10% cashback promotion (possibly doubled to 20%) is one of the better deals we have seen in a long time. Of course I would have loved to purchase gift cards and move on, but that isn’t allowed. I spent much of October & November being lazy, so this past couple of weeks I have forged a plan to maximize. A couple of days ago I upped my credit limit and now I have been hitting the stores to buy “stuff”.

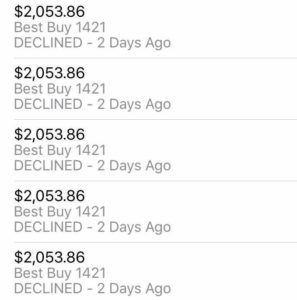

Best Buy Fail

The other day my wife and I set out to use Apple Pay at Best Buy. We were purchasing a few consumer electronic devices and the total for our purchase came out to $2053.86. After a ridiculously long wait to get our items (Best Buy is a time suck) and after turning down the warranty sales pitch, it was finally time to pay. We popped out our handy dandy iPhone and tapped it on the payment screen. The sales associate then got a message to call Discover.

After receiving the message, he called the number for Discover and talked to a person who asked for the physical card number, expiration and security code none of which we had since I was using Apple Pay and didn’t have the physical card. At the same time I got a fraud alert and cleared the charge with Discover’s automated system. Since everything was cleared and since the phone agent wasn’t helping him without the physical card, we decided to run the transaction again. Another denial.

At this point I got on the phone with Discover’s security department and they attempted to clear the transaction several times. Denial. Denial. Denial. The only way to get this thing to go through was to call for that voice authorization with the full card number, expiration date and security code. The agent even said, “In the future you should always carry your physical card on you in case of a situation like this.” Wow!

In the end, I realized my wife had her physical Discover card (a different account) and just enough of a limit left to make the purchase. So we tapped the phone with her card and another denial. This time the sales agent called the system and obtained the authorization code with the information gained from her physical card.

Will This Code as Apple Pay?

The one thing I was worried about was whether or not this would code as Apple Pay after the sales agent had to gain an authorization code via the telephone. I believed it would since the transaction was still initiated via Apple Pay and the card was never swiped anywhere. Still, crazier things have happened so I waited.

Fortunately this morning that charge posted on the account (see above) and I can confirm that it coded as Apple Pay. This is good to know and frees me from worrying about other similar transactions we had to do after that. For example, after running home to get my card, we visited another Best Buy later in the day and had the same issue. Of course, with the physical card it was easily cleared and we moved on.

What Should You Do?

I always thought the whole reason for Apple Pay was so you didn’t have to carry the physical card around, but apparently that isn’t the case according to Discover. If you are heading out with your iPhone and looking to make large purchases with Discover and Apple Pay, it is probably a good idea to have the physical card with you so that you can avoid issues like I ran into the other day. Based on my experience, even if they need to call for an authorization, it should still code as Apple Pay as long as the transaction is initiated via the app.

Conclusion

The first Best Buy experience took almost an hour and was incredibly frustrating given that I had cleared the fraud warnings on the card. Discover blamed it on Best Buy and Best Buy on Discover, but I don’t care. From now on I’ll just carry my card with me, because frustration sucks and 20% cashback is too good to miss out on while it is here.

So, if you I use one of my cards in a way the issuer doesn’t like, then I am not using is “as intended” and get my card terminated(see OBC). So if I use my card (discover) as intended I can’t use it because of possible fraud.

Banks are scum.

I have a purchase from a month ago at OM that is over$2K and I had no problems. I went to BB today and the purchase was just over $2K and declined. Luckily I had my card but the after the purchase was made the agent said the transaction didn’t post as Apple Pay. Time will tell when it posts to a purchase.

I feel Discover has realized how much money they are going to have to pay and would rather not pay out on the bonus.

Same here 10% manually added (supposedly) after 1 hour one the phone trying to make it work at best buy. Manager said based on code he is getting he can’t push it through. Basically Best Buy is blocked for apple pay.So is bloomingdales and others.

It’s time to submit complaints for bait and switch. This is a joke… Discover is trying to discourage people from taking advantage of promotion. And apple pay is talking more than 2 statements because haven’t seen a penny for 3 statements now.

[…] PSA on using Discover Apple Pay on Best Buy! I did not have a good experience with Discover Bank and I am back at Capital One 360 which still remains flawless and it’s just fine it pays a little less interest. I don’t like Discover’s recent crap about the gift cards either. Maybe it is time to eliminate yet another institution. I am in the process of simplifying my life, getting rid of many boxes to Salvation Army and killing institutions (bye bye Discover Bank and Bankdirect) and out to kill some more. I guess no more SPG and Fairmont Presidents Club soon too and I am so sad about them too! […]

Same thing happened to me today at Apple Store, except that after close to an hour on the phone with Discover they still could not (or would not) get the transaction to go through. The supervisor I was talking to by that time confirmed that the fraud alert was cleared but the problem was “with the transaction.” When I asked exactly what was wrong with this particular transaction he simply did not answer me. I asked, “Is there a daily limit on the amount I can spend on the card?” and again got NO ANSWER. Instead he tried to change the subject, babbling about how much Discover cares about keeping my card safe from fraud. I said I didn’t understand, because the fraud alert had been cleared, but again he could not explain why my transaction was denied.

He kept telling me to swipe my card instead, and I explained (truthfully) that I did not have my card with me because the point of Apple Pay is that you don’t need to carry the card. He finally told me to use a different payment method and swore that he was manually crediting my account with the 10% back. But when I asked him to send me an email or message confirming this, he refused. I finally paid with another card, and I have no idea if I will actually get the 10%.

I find it interesting that the agent could not give any reason for the charge being declined and refused to answer when I asked if there was a daily limit. The first CSR I talked to said outright that there is no such limit and that I was nowhere near my credit limit. But the supervisors know more, and perhaps don’t want to be caught on a recorded call denying there is a limit when they know that there is.

In any case, I am thoroughly disgusted with Discover at this point, and would never recommend their cards to anyone. This fiasco involved 3 Apple Store personnel, one of whom had to stand around waiting for nearly an hour to finish one sale. I doubt any of them will be rushing out to get a Discover card any time soon. Neither will the friend I was shopping with. Not the results you want from a big promo, Discover.

On my December 5 statement, I was credited with $80+ for Apple Pay purchases. This included only some of them so I called Discover and they told me that I will be getting the rest in the next 1 to 2 months. At least they are starting to credit the bonus.

Not surprised to hear you’ve also had crappy luck.

Although Target doesn’t accept Apple Pay, I tried to buy two Xbox One’s on Thanksgiving day. Charge declined (which was a swipe). Called Discover, answered the same questions you did, got transferred to security, hold lifted. Hung up. Tried again – declined. Called – answered same questions, transferred to security again. I asked her to remain on the line while we tried a 3rd time. Again – declined. Rep said there was nothing she could do to clear it – that their algorithm flagged it as possible fraud. This, after buying items at a Staples in another state with no fraud alert issued.

So incredibly frustrating! I’ll be gone, come January 1.

To my knowledge, I haven’t received any of the 10% cash back and I’ve been using Apple Pay since October. is the 10% supposed to show as a separate line item on my statement? I only have 1 line for the 5% cash back and 1 line for “everywhere else”. The problem is the amount for “everywhere else” doesn’t appear large enough to include any 10% Apple pay purchases.

Same here. They said to keep checking and that it sometimes takes 1-2 billing cycles before it shows up.

Yeah right now it seems like 2 billing cycles is the norm for the 10% bonus.

It will show as a separate item. Right now it is taking two statement cycles for most people to get their 10%.

No issues for me at Best Buy…then again, I haven’t bought any huge priced items either. Kohl’s still asks for the security code when paying via ApplePay. I’ve memorized it.

I had this same exact experience this morning at Best Buy. I told the Discover rep, that needing to have the physical card defeats the entire point of Apple Pay… Also agree that Best Buy is a total time suck, but, the discounts they have at the moment, make that time suck a little less painful.

Agreed.

Just to update from Today – I had 2 transactions at BBY and one at Staples, no issues. Not sure if that means Discover has fixed things, or if I was flying below the radar… the BBY transactions were 1 of $1.1k, 1 of $2.1k, Staples as unfortunately, insignificant.

Thanks for the post. This never happened to me, but I always carry by Discover just in case anyway. Good to know this issue actually happens.

Would it be better if you call Discover ahead of time and tell them about an upcoming large purchase for approximately so and so amount? I sometime do with other cards.

I’m not sure because it seemed to be an issue with their system. The fraud rep did all she could to get the charge to go through but it wouldn’t without the phone authorization which required the full card number, expiration and security code.

Same thing happened to me on Black Friday. Fortunately I showed the cashier my name in the discover app and he was fine with it. I also got the fraud alert email, so I called immediately. The automated system had the longest verification steps and asked me at least six questions (DOB, zip code, last four digits of card, exp, CVV, last four of social, etc), and I finally spoke to a human, but then she just told me verification was done and feel free to shop…

With Best Buy for some reason it freezes the transaction until they type in a verification code they get through the phone system. I had the best rep, but there wasn’t anything he could do without that code. I also agree their automated fraud system is clunky and slow. It is easier just to talk to someone.

I really like Chase and some of the other banks that send you a text message. It is great. Simply reply with a Y if the transaction is good and everything is unlocked. Discover has a lot to learn.

Actually what happened to you happened to me in exactly same way today.

I tried to buy a new iPhone 6s in Apple Store in DT Portland and the transaction couldn’t go thru. Always declined. I called the customer service and spoke to an account manager. He was able to lift the hold for this transaction, but when I tried to buy a second phone it got declined again. The same acct manager even told me he could not do anything, but the system flagged me. Very pissed off. I also could not access acct info thru mobile app, so I called the fraud department and went thru again the automated verification. It was long but all basic, same questions, and I remember all card info. Finally after the six questions I was routed to a act manager and she lifted the hold on my acct again but wanted me to wait at least 24h to use Apple Pay for large purchase again.

The acct manager did tell me Discover has a text msg system for fraud alert and confirmation, but I didn’t know and didn’t sign up

Two weeks ago in Bestbuy the transaction actually all went thru before I received the fraud alert email. The email was just like a reminder.

The same thing happened to me with Discover using ApplePay at T-Mobile. After dealing with all the fraud prevention stuff (T-Mobile had to call and run my card number that way), I called Discover a couple days after the transaction went through and Discover support said they didn’t think the transaction had gone through as ApplePay. However, after the transaction posted on my Discover account, it showed up as an ApplePay transaction. It’s been one billing cycle and I still haven’t seen the cash back post to my account. I called Discover again and they said I should get in touch with them if it doesn’t post by January or Feb. Exciting to have this cash back potential, but lots of frustrating calls to Discover! I will fight for the cash back though :).

“I always thought the whole reason for Apple Pay was so you didn’t have to carry the physical card around, but apparently that isn’t the case according to Discover. ”

I agree. What a load of crap from Discover.

I don’t believe Apple themselves ever said to not carry a credit card around anymore.

Besides paying by phone is still in its infancy, merchants are skittish, unaware, etc.

Not Discovers fault here.

So what then is the point of Apple Pay? Why should customers use it?

You shouldnt. Thats the point. Do it only because Discover is giving away money.

It was mostly a rhetorical question. If there is no compelling reason for a customer to use it, then they won’t. Which means Apple won’t make money from Apple Pay.