Discover Credit Limit Recycling & Increases

We are nine days into December, which means we are only about 22 days away from the end of the Discover Apple Pay 10% back promotion. If you are like me and have been a bit lazy with it, then you no doubt have much of your $10,000 limit in tact to spend. Of course, your credit limit might not be that high, so what should you do?

Credit Limit Cycling

Many banks allow you to cycle your credit limit more than once in a month. For example, if you have a $2,000 credit limit, you often can charge $2,000 and pay it off mid-month. When doing this your limit will return and you can purchase another $2,000. This isn’t generally an ideal behavior, but is normal enough that I haven’t had issues doing it from time to time.

I’ll have to admit that I have never cycled my credit limit with Discover, but have a lot of purchases coming up and may have to. I was talking with PDX Deals Guy about it and he confirmed with Discover it can take up to 8 days for your credit limit to return after a payment clears. It may be possible to get this cleared sooner by calling their “security department”, but that isn’t ideal. I would start forming a strategy now if you plan to cycle more than your limit before the end of the promotion.

Discover Credit Line Increase Request

If you have a low credit line on your Discover card, you may also want to request an increase. Thankfully Discover makes it very easy to do this and does not require a hard pull most of the time. Let me walk through the process and then we’ll revisit the hard pull issue a little later.

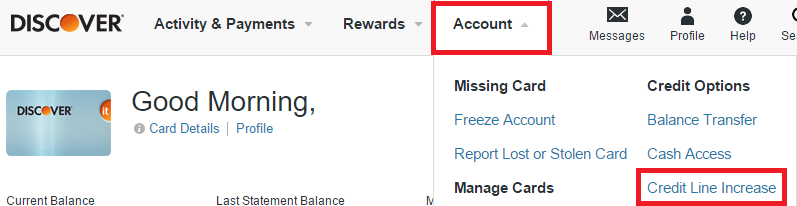

- To request a credit line increase, login to your Discover account and go to the “Account” drop down. Click “Credit Line Increase”.

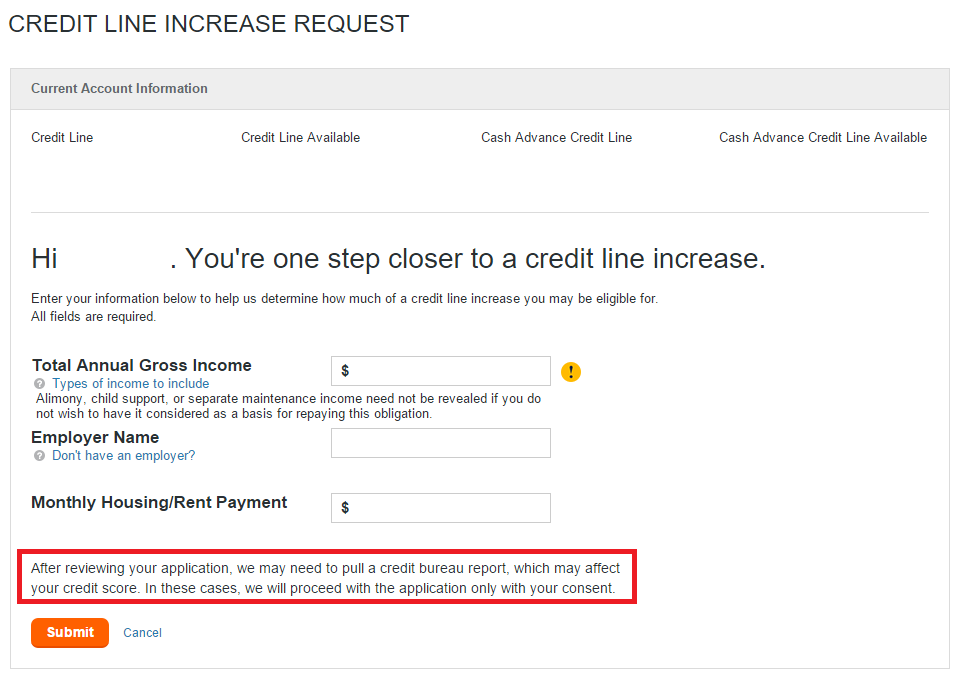

- You are now on the credit line increase screen. On this page you will be asked to input your gross annual income, employer’s name and monthly housing payment. Notice the language on the bottom. Submitting this request will not cause a hard pull. If Discover feels they need more information, then they will prompt you before making the pull. When all of the information is complete, hit “Submit”.

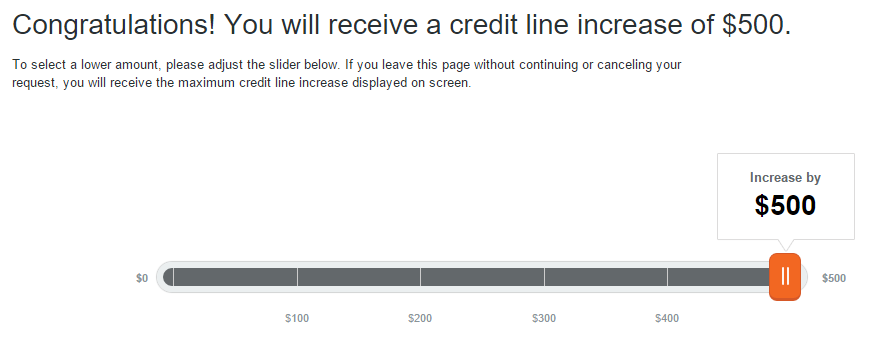

- On the next screen you will see the amount of an increase that is being offered. If they need more information this is where they would ask for your consent to do a hard pull. In my case, a modest increase was offered. You can adjust the slider if you want less than the offered increase.

Conclusion

Coming up with a Discover Apple Pay strategy for the next few busy holiday weeks will probably be a good idea. Keep in mind that it takes some time for your credit limit to recycle, so don’t go into the last week thinking you will be able to spend 3X or 4X your limit. I am happy for my modest credit limit increase, even though it isn’t much. Since there wasn’t a hard pull I felt it was worth asking for. With a hard pull I wouldn’t have done it. Happy Apple Paying!

Thanks for all the ideas and experiences. Samsung Pay works almost everywhere (MST technology, no merchant software needed). I went from $500 to 1500 to $1800 with Discover Card.

I have Discover and am considering doing this.I don’t want the hard inquiry but if they give the heads up beforehand and you can back out if you want,its a win win situation.Thanks for posting!

I have a Discover account that was opened around 24-Nov-2015 with an initial credit limit of $2,000. I thought that was pretty great considering my score (at the time) was 631. I have used the card a lot, though, and it always gets paid off (I’ve yet to carry a balance on it).

The Discover web page says my score was 646 as of 29-Feb-2016 and, after reading that it would just be a soft pull (with the chance to “cancel” the request if a hard pull was required), I figured I’d go for it.

In a few seconds, I was offered an increase of $1,000. I accepted, of course.

Nice. That may help your score improve a bit more since your utilization ratio will decrease with a higher limit.

[…] Discover Credit Limit Recycling & How to Request an Increase to Maximize the Apple Pay Promo wit… […]

[…] being lazy, so this past couple of weeks I have forged a plan to maximize. A couple of days ago I upped my credit limit and now I have been hitting the stores to buy […]

I have two Discover cards and using this method they went from:

3000 -> 4500

5000 -> 10000

Thanks a lot for this tip.

YOU DA MAN BRO! Good post. Dont forget to try and do something similar with your other CC too if potentially only a soft pull is possible (like AMEX).

You have something against hard pulls? Soft pulls are great but sometimes they don’t get the job done. It may leave a mark but it may be for the best in some circumstances.

I tried this method for 3 Discover cards, 2 of which were my wife’s. Soft pull on all three. Mine went up $500 but my wife’s two cards went up dramatically. In one case from $4500 to $15,000. Definitely worth doing if for nothing else to help your utilization ratio.

Here in Washington State, we don’t have many options for Apple Pay. (There are no grocery stores here that take Apple Pay and other merchants are somewhat limited). I did try to use Apple Pay at Macy’s and it didn’t work. Kept getting a message along the lines of “card read error” whenever the clerk tried to finalize the purchase. I do use Apple Pay successfully at McDonald’s from time to time, so I’m not sure what the issue with Macy’s is. But it’s annoying, because obviously my Macy’s purchases are larger than my McDonald’s purchases.

I’m in WA as well. So far I’ve been using Apple Pay at Albertsons and it works very well. It doesn’t work at Macy’s. I wanted to drive to Portland and buy liquor there (no sales tax no WA liquor tax), but haven’t found any liquor store with Apple Pay.

Oh- I didn’t realize that Albertsons is taking Apple Pay. Try are listed as “coming soon” on Apple’s site.

It has been listed as “coming soon” forever. But the truth is the local Albertsons introduced Apple Pay since May…I didn’t know until September. Even cashier had no idea and was amazed by “paying by phone”.

Otherwise I have no more creative idea on how to use Apple Pay on purchase.

I’ll have to pay closer attention at my local Albertson’s but I don’t think they have NFC terminals.

You might want to try again on the liquor store. All the liquor stores in my area (Southern Oregon) are listed as taking contactless pay on the master card site. I still haven’t made it in to test the waters myself, but would like to stock up on a few things before the end of the year. I wasn’t able to find any liquor stores just over the border in Cali, though…where it is cheaper still, even with taxes.

Surprise!:) An easy 4.5k increase. Time to shop.

I got a $500 increase as well. Not bad considering I opened the account in September.

I’m new to Discover and just hit the 3-month mark. They gave me a low CL ($3,500) and I asked for a CL today. Got another $1k!!! whoa. I like their interface. Light years above other banks (cough: Chase) with CLIs even if they are low.

If only other banks made the interface and process for a line increase that easy. Over the years we’ve had several emails with automatically increased credit limits too. They’re definitely more generous than other cc issuers when it comes to increases.

On a side note I know Discover is making a push with their banking and I think a year from now they’ll be a serious threat to the other no fee interest bearing options for everyday banking. Especially with the looming Ally Bank rate reductions that are likely to occur at some point.

My $300 checking bonus posted yesterday and I’ll keep that account open and on the back burner in case I want to use it in the future (plus I’m betting on some promos next year to increase their banking customer base).

Well, that was easy. $3k increase offer.