Discover it Student First Credit Card

For someone who only recently turned 18 years old, my son has a fairly long & extensive credit history. He has been an authorized user on many of my cards going back years and that helps a lot. Of course the banks still know he doesn’t have any real credit history of his own which could potentially present a problem.

Update 3/15/22: The referral offer has been increased to $100 and the first year earnings are still doubled.

Finding the Perfect Card

My son graduated High School last year and went on to a local college like so many young students. Knowing he has been getting ready to apply for his first card, I have kept my ear to the ground about what has been happening in this sector. While this is anecdotal, I have heard several times that both Chase is being tough with Freedom applicants and that Discover it Student was much easier to get.

Why Discover it Student?

And Discover it Student is actually a really attractive card for students to get. Let’s take a look at why.

Here is why Discover it Student is a great first credit card:

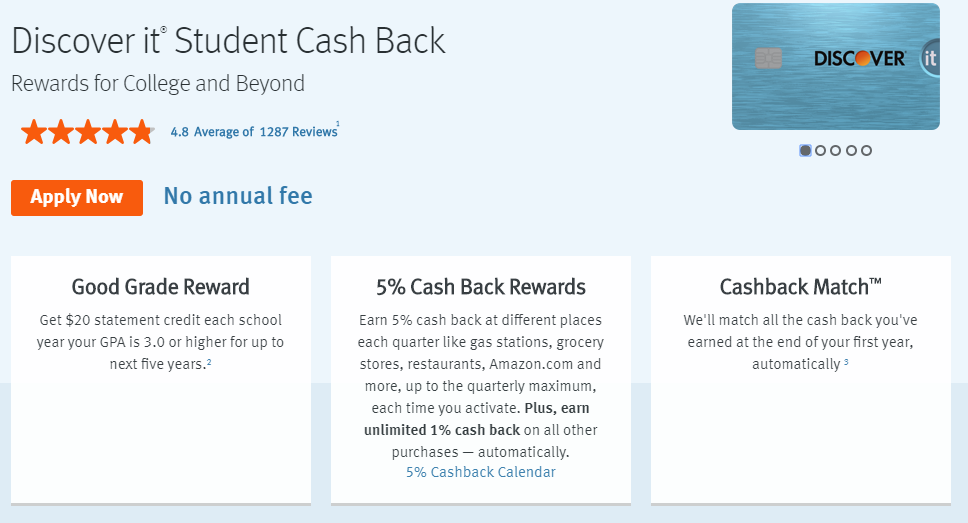

- It has no annual fee

- The card works just like the normal Discover it card with 5% rotating categories

- It earns 1% back on everyday purchases, but that is doubled the first year

Those three points are all different but each is critically important. Let me break down each one.

No annual fee – Building credit is important over the long term. Having no annual fee means this card is one to keep. Having long term accounts helps with your credit score.

Works like normal Discover it – My wife and I each have 2 Discover it cards of our own. We use these cards because of the quarterly categories and my son will have the opportunity to do the same. This card is not only good to keep long term for building credit, but it is quite rewarding too.

Double Cashback Match – While the Discover it Student card is not the best for everyday purchases giving 1% cash back, new applicants currently get all earnings in the first year doubled plus up to $20 per year for getting good grades. While the student builds their credit to get bigger and better cards, they are essentially earning 2% back on everyday purchases plus 10% back on quarterly categories the first year. When that first year is up they can expand to better everyday earning cards.

Discover it Student Application Process

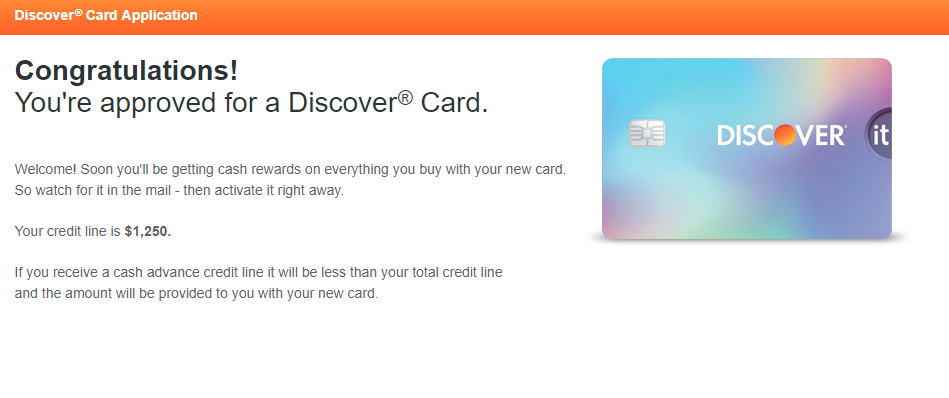

For many of the reasons above, my son and I decided the Discover it Student card was the right one for him. With my help he then applied on the Discover website and was sad to see he needed to wait. His application required additional processing. Boo. 🙁

A bit later we received a notice that Discover needed to verify my son’s status as a student. A friend’s daughter recently applied for the card and wasn’t required to provide this, so I assume it varies based on what they see on your credit report. Anyway, it took a few days for my son to get me what they wanted, but we finally were able to upload the proof and he was approved within a couple of hours.

Our Initial Plan to Build Credit

I think it is essential for young adults to learn how to manage their credit and money the right way. Since my son was given a relatively low $1,250 credit limit, it will be key for him not to use this card too much in order to keep his utilization low. I like that he is already learning the credit rules, since this knowledge which will serve him well in the future.

Our overall plan is to put a couple of his small recurring bills (Spotify, etc.) on the card each month and to setup Discover to Autopay the entire balance out of his bank account. For now he won’t be using this card for everyday spend, but this plan ensures he doesn’t accidentally tank his score by using up too much of his small limit. He will miss out on a few dollars in rewards for now, but will make it up later. I promise! 🙂

Not A Student? Get A $100 Bonus!

If you are not a student, you may still be able to start with the regular Discover it card which also just happens to have a $100 sign-up bonus for getting the card in addition to the 5% rotating bonus categories, no annual fee and double cashback the first year.

Conclusion

The Discover it Student card really seems to be the perfect first card for my son and I suspect it will be for many young adults in the same situation. My son turned 18 a few months back and my only regret is not applying for the card until now. Now that this first credit card is in the books, all of the fun stuff is about the begin!

It’s also worth noting that you can also get a $50 signup bonus on the discover it student card. It should be fairly easy enough to find a referral link by googling.

Interesting. My son’s referral goes to a regular it card. I’ll have to look again at it.

I applied for a freedom unlimited card for my son last year (shortly after he turned 18). He had a part time job and a 780 credit score (thanks to many years of AU). I figured that would be a prefect card that he would want to keep forever.

Denied.

I was kind of surprised that they would be so tight with this card. I didn’t try to get a CSR, haha. So I got him the Discover student card when he went off to college.

Same exact situation for my daughter and was also denied 2 months ago. 783 credit score thru AUs, on my accounts.