How To Know If You’re Eligible For A Marriott Credit Card Welcome Offer

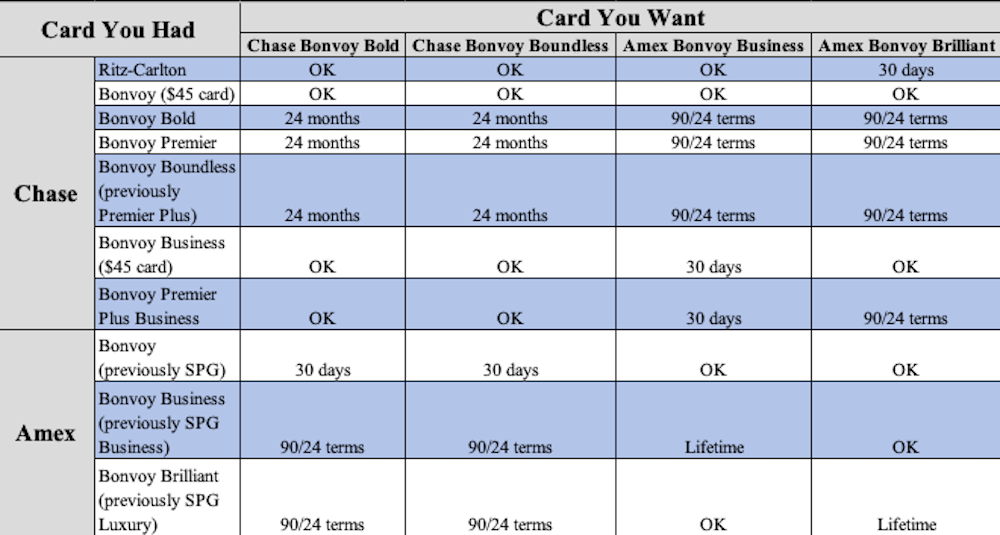

Wondering if you’re eligible for a Marriott credit card, now that they’ve pumped up the welcome offers? The terms can be a bit confusing. There are multiple cards currently, they involve 2 banks, and the terms reference cards that no longer exist. It’s a bit daunting. Now, we’ve made it easy with this chart.

Who’s Eligible For A Marriott Credit Card?

Check this chart to see if your’e eligible for the welcome offer on a Marriott credit card from Chase or American Express.

On the left, you’ll see cards you’ve had in the past. Move to the right to check eligibility for the card you want to get now.

What it means:

- OK – you are eligible

- 30 days – you must wait 30 days since you product changed or closed the card

- 24 months – you need to wait 24 months since you last received a bonus PLUS you cannot currently have the card

- 90/24 terms – you must wait at least 90 days after acquiring the card PLUS 24 months since you received a new card or upgrade bonus

- Lifetime – you are not eligible because of American Express “once in a lifetime” rules

Also, remember that you need to meet the general application rules for each bank. Those supersede anything in our chart.

Final Thoughts

We expect there will be a lot of questions about who is eligible for these cards, now that they have increased offers. The terms can be a bit daunting. Feel free to comment here or ask in our Facebook group. We’ll try our best to help you determine whether or not you should be eligible for these new offers on the Marriott credit cards.

24 months has a caveat that you can’t currently have the card but 90/24 terms doesn’t have that caveat. Just wanted to confirm that’s correct?

Yes because the 24 months is the same issuer (Chase) when 90/24 is talking about Amex and Chase. It is correct.

The Bonvoy Brilliant has no lifetime language?

Huh? In our chart it says “lifetime” when you match up Bonvoy Brilliant + Bonvoy Brilliant.

Oops. Sorry. Lined up wrong column.