More Gift Card Resale Follies

Over the past few months as I have really stepped up my gift card churning activities, I have run into a number of issues. Some of them were too small to mention and others were annoying enough that I thought it was worth sharing with others.

For example last week I shared how Gift Card Zen left me in limbo for a couple of days before cancelling a sale because they had already bought too much of a certain type of card. I’ve also shared about receiving bad gift cards and why it generally is not smart to buy from one exchange in order to sell to another.

The Blank Gift Card

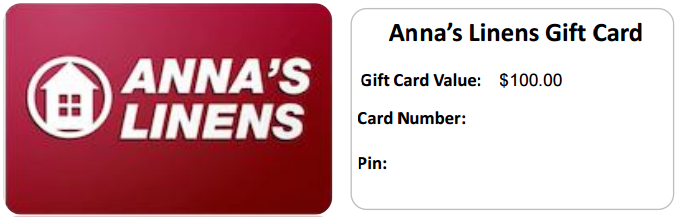

Today though something happened that sort of left me speechless. I noticed that a gift card exchange was selling a single $100 Anna’s Linen’s gift card for $50. Anna’s Linens is in bankruptcy in case you didn’t know, hence the very low value. Anyway, I decided to buy it, because another exchange would purchase it at a higher rate.

Yes, this goes against my own advice and I normally don’t do this type of arbitrage, but this was only one card and I thought it couldn’t hurt. So I bought the $100 card, received a receipt and about an hour later the eGift card came in my email. When I opened the PDF this is what I saw:

No you aren’t blind and the gift card number and pin aren’t in a white typeface. They sent me a PDF with an empty gift card. No number. No pin. Just empty.

So I emailed this gift card exchange with the subject: URGENT and they responded within an hour. Their response was that it was a mistake and it would take 3-5 business days to refund my credit card. Now I really don’t care in the grand scheme of things, but 3-5 days? WOW!

Conclusion

This is just another reason why it really is stupid to buy gift cards from one exchange to sell to another. So much can go wrong, even if it is something stupid like this. While I have experienced fraud and received gift cards with $0 balances, this is honestly the first time I can say they simply sent me a blank. Good job alphabet exchange!

Here is what I always wondered. How much value does one get for each MS dollar generated? Ignoring time, but factoring in all fees, is it more than let’s say 2.2%?

I’m aware that some international first class flights might yield 5% or 10% per point compared to the retail price, BUT unless one is willing to actually pay that price cash, this is not the value one is receiving. For example, a flight might cost $10k or 100k points (10%/point), but if you’d only be willing to pay $2k cash for that same flight, the real value drops to 2%/point.

Is it the chase to get something seemingly for “free” (obviously ignoring the opportunity cost of time, and complicating ones live)? Or just a hobby that generates money as opposed to costing money? I’m not referring to MS for hitting the sign up bonus, but folks who go to great length to rack up reward points.

What is a realistic hourly net earnings rate (including research, execution, customer service calls, etc) in relation to the actual price one would be willing to pay for those rewards?

I’m asking this in a genuine way, because I feel like I’m missing something.

This can get complicated and varies depending on how people MS and their goals, etc. Since anyone can earn 2% from a credit card, generally the goal is to get more than that back in value. My personal goal is around $100 worth of value out of every hour and I normally exceed that. I have personal values I set to the points, etc and that is how I value my time.

I think the best thing to do is to evaluate your goals and look at the time you are spending versus what you are receiving. This is definitely a hobby and there is a lot of time spent learning which is accounted for, but there is also a profit that can be made. MSing is not for everyone, but given the hassles involved, etc I like the $100/hr rule and it has worked well for me. Hopefully others will chime in.

Wow. I’ve seen it all now!!!

Yeah, I’ve learned the hard way recently that it’s not wise to buy used (from resale sites) gift cards with the intention to resell. I lost a few hundred dollars and I’m just going to chalk it up as a lesson learned. Let’s just say that you need to check the maximum value per gift card the resale site will accept from you is, otherwise you’ll be screwed and have to sell elsewhere, most likely at worse rates!

There’s a great write up from Chasing The Points made early this morning that is a must read if you haven’t already. Then again anything I read from CTP regarding gift card arbitrage is valuable. His experience in this market is immense.