Why You Should Give Your Travel Eraser Accounts Another Look

I wanted to do a quick PSA type of post about your travel eraser accounts. These are cards like the Venture card from Capital One, BoA Travel Rewards or Barclay Arrival+. These cards are what we call travel eraser cards because the points are worth 1 cent each when used on a travel charge. Essentially you charge travel (airfare, hotel, car rental, Uber, Disney tickets etc.) and then you use your points to wipe off the charge. There are two reasons I want you to give your travel eraser accounts another look, if you have a points balance sitting there that is.

Holding Onto These Points Costs You Value

The first point I want to bring up is an aha moment I recently had. If you are like me then you kind of store these points up for a specific redemption. I often use mine on a hotel in northern Michigan that is not a points hotel. Others will use them for taxes and fees on an upcoming international award flight etc. Saving them for an awesome experience was the norm for me. I would skip over lower end redemptions or small opportunities here and there and try to use the credit all at once. My thinking was it will feel more rewarding to use the points all at once and to “stay free”.

I have since realized that this approach is all wrong. By doing it this way I was giving the bank an interest free loan on my “money”. Those points are not gaining value by sitting in my account. But, if I cashed them in I would be able to use the money I saved somewhere else and could put it to work for me. I could then use the cash I saved to book that same trip at a later date. By doing this I would still get the travel I wanted but the points would also be liquid in case I needed them for something else not travel related.

You Can Not Predict The Future

Remember that points have no real value until you actually redeem them. Who knows when the next pandemic type of event hits and you can not travel for the foreseeable future. Life changes at a fast pace and plans change rapidly during normal times too. I am sure some of us would prefer that $500 in cash right now versus $500 in points towards future travel. It may have some thinking, if I had just cashed these in on my Uber rides or those room charges I had on my last hotel stay then I would have that money in my bank account now, where I actually need it. If things have become really dire you may have needed to cash them out for gift cards at a less than 1 cent rate. And by delaying your redemptions you have now cost yourself value.

This is all assuming that you have the will power to set aside the money for that redemption you were looking at in the future anyway. But if you can why not put that money to work for you in the mean time. Or at least have it on the sidelines if you need it for emergencies before then.

Check Your Accounts For Unexpected Charges

In the past I have talked about unlocking trapped rewards. These are balances that fall just below the redemption fray etc. And I may put a few hundred dollars of spend on a below average card in order to unlock the $20 of points trapped in the account. That is what I was doing when I checked out my wife’s BOA Travel Rewards card.

I knew she had a balance on her card and that it happened to be over the $25 min redemption amount. I also “knew” that we had not booked any travel with the card recently. The plan was to book some sort of travel with it and use her remaining $39 worth of points in the account. Well, that has been the plan for a while now and I just never get around to it.

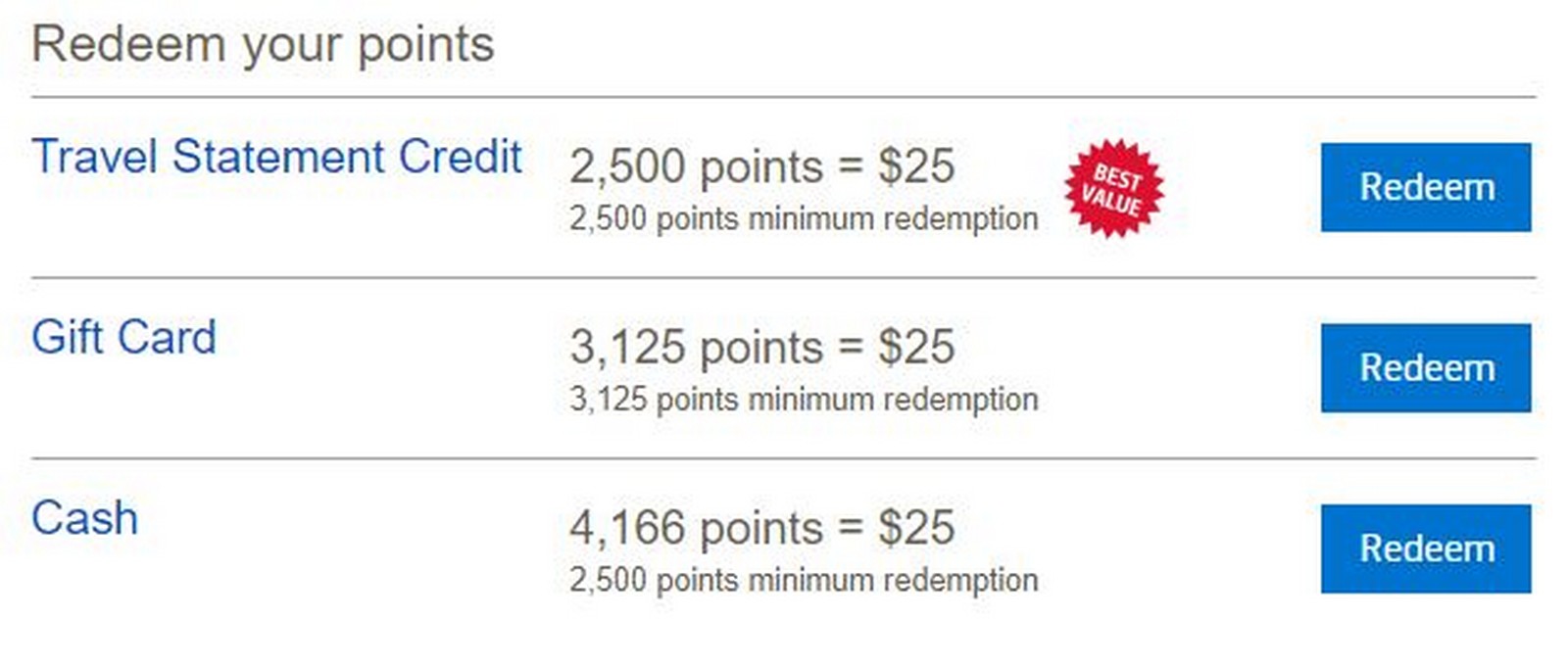

So I decided to see if what our other options were just to move on from this. The gift card option was not the best (3125 points for $25). Redeeming her points for one would leave some points orphaned points in the account on top of a less than 1 cent redemption rate. When accounting for the abandoned points it was like redeeming $39 worth of points for a $25 gift card. That was a tough pill to swallow but the cash out option was even worse. I almost went ahead with it simply to move on from this card. Then I would never have to look at it again, until BOA eventually closes it that is.

You Just Never Know

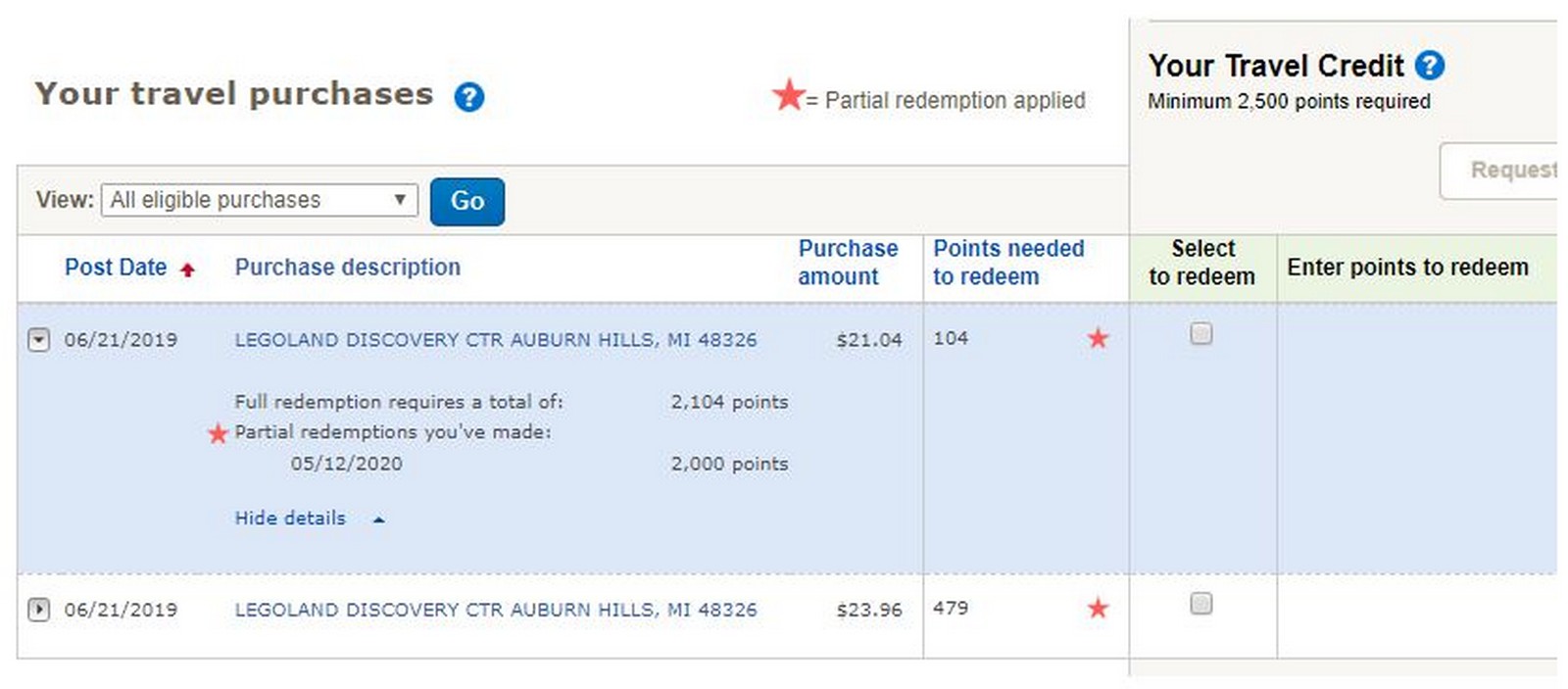

That is when I decided to see if there were any random charges I could redeem the points for. The few seconds of time was worth the long shot. When I hit the redeem option I was surprised with what I saw for two reasons. First, some charges from our Legoland Discover Center that were for food etc. were available for redemption (I reviewed Legoland here). I could maybe see tickets etc. coding as travel but regular restaurant and store purchases were surprising. I was also surprised how far Bank of America was willing to go back, almost a full year from when the charge occurred.

Luckily the charge exceeded my $39 balance of points and I hit redeem. That gave us a negative balance on the account which I can spend down by loading Amazon or ask for a check to be cut.

Final Thoughts

If you are sitting on a stack of points I encourage you to give your travel eraser accounts another look. The points are not gaining any value sitting in your account so you might as well cash them out as soon as you can. Especially if you were saving them up for a trip this year that may not happen now. You may be surprised by what is available for redemption and how far the card issuer will let you go back to redeem too. It is your money, so take what is yours! Remember, points collecting dust are not worth anything 😉.

[…] travel lockdown is causing many people to reconsider their credit card rewards strategy. Should you rethink how to use the points that can erase travel charges? I’m glad I burned through most of the points from my Barclays Arrival+ card, even if they […]

Not to mention you can transfer points from one card to another. I’ve moved points from my travel BOA card to premium rewards card and i was able to redeem those points for cash at 1:1 ratio instead of having to book some sort of travel.

Good tip Pablo – thanks!

@Mark,

Your point is well understood and is good advice. However, in your particular example with Bank of America, this is precisely why I prefer the Premium Rewards to the Travel Rewards card. Yes it does have an annual fee, but it’s easily offset by the airline credit. To readers who may not be aware, the Travel Rewards gives a preferential rate on travel expenses, whereas the Premium Rewards gives the 1:1 ratio on cash back too.

If you are going to chase BOA rewards then I agree the Premium Rewards card is better for most people.