How to Check Stimulus Payment Website

This is the week that many people have been waiting for! The U.S. federal government is sending out economic stimulus payments to eligible Americans. For many the money has already been deposited in the bank, but others are still waiting. Here is how you can check the status of your U.S. Stimulus payment.

Are You Eligible for a U.S. Stimulus Payment?

U.S. government stimulus funds are now being deposited into bank accounts with paper checks coming in the next few weeks. Eligible Americans will receive stimulus in the amount of $1,200+ depending on qualifying factors. Here is how it works.

- Single people earning $75K or less will receive $1,200

- Heads of household who make $112,500 or less will receive $1,200

- Married couples earning $150K or less will receive $2,400

- Additional payments of $500 per child 16 or under will be given

Those with higher incomes than shown may be eligible for reduced payments depending on overall income. Check out this Stimulus FAQ for more info on who qualifies for the U.S. federal stimulus.

How to Check the Status of Your Stimulus Payment

If you are eligible for a U.S. stimulus payment, have filed taxes in 2018 OR 2019 and the IRS has your direct deposit info, then you should receive your money this week. If you did not file or the IRS does not have your info, then you can check the status of your stimulus payment on the IRS website.

U.S. Stimulus Website for Non-Filers

If you aren’t required to file taxes or otherwise didn’t file in 2018 or 2019, you can register for the stimulus on the IRS website. You’ll want to select “Non-Filers: Enter Your Payment Info Here” and follow the prompts to provide the IRS with your information. It doesn’t take long and it should ensure you properly receive payment within the next few weeks.

Check Your U.S. Stimulus Status for Tax Filers

If you are a tax filer, than the IRS has finally opened their U.S. stimulus website for you. The IRS Stimulus website for tax filers allows you to check the following:

- Check your payment status

- Confirm your payment type: direct deposit or check

- Enter your bank account information for direct deposit if we don’t have your direct deposit information and we haven’t sent your payment yet

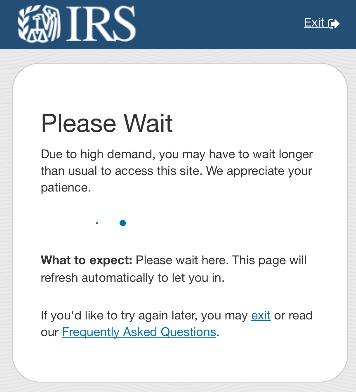

This system for checking the status of your stimulus is very new and very busy! It took me about 20 minutes to get in this morning since so many people are checking the status of their stimulus payments. Thankfully the website will place you in a holding area while you wait your turn to check your status.

What Info Do You Need?

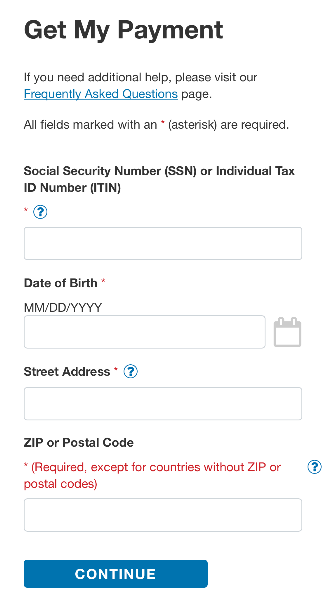

When you finally are allowed on to the IRS website to check the status of your U.S. stimulus payment, you will be required to provide some information so they can look you up. Thankfully the IRS only requires your SSN or ITIN, date of birth and street address including zip code.

If your information matches what the IRS has on file then you should have access to check the status of your stimulus payment and to provide the IRS with direct deposit information if you wish to receive your money faster. I will say the new IRS stimulus website works fairly well based on my limited time with it.

How to Check Stimulus Payment- Bottom Line

If you are looking to check the status of your U.S. stimulus payment then you are in luck! First check your bank account to see if funds have been deposited and if not head over to the IRS to ensure they have your information. Whether you are a tax filer or someone who hasn’t filed the past two years, you should now be able to get in line and check the status of your stimulus payment!

Have you received your U.S. Stimulus payment? Have you used the new Stimulus website from the IRS? Share your experiences below!

I need my check the 1st one where is it how long I need some feedback please I’m desperate here

For those who filed amended taxes in 2018 and then just got around to filing for 2019, FYI, if you need to enter your account info and they ask for your AGI and refund amount, you need to use values from your original, unamended 2018 taxes. They’re ignoring amended returns.

Got mine as well, but it was 1000 less (compare to the calculation I got from TurboTax). Does the payment comes in installments?

Yep. I got the same “Payment Status Not Available” message like millions of others. I didn’t yet file my 2019 as it’s not due until July now but I did file a 2018 tax return. I didn’t have my direct deposit details but wanted to add it but can’t even do that as it won’t pull it up. How frustrating.

I checked for a bunch of family members including me and we all got the same message.

Payment Status Not Available

According to information that we have on file, we cannot determine your eligibility for a payment at this time.

I got a very comforting message:

Payment Status Not Available

According to information that we have on file, we cannot determine your eligibility for a payment at this time.

Already received mine.