Is The American Express Business Gold Glitch Fixed?

I covered the issues with Amex’s Business Gold card not properly coding the 4x earnings a little over a month ago. People have been having to call in to get their points manually adjusted because of the error. This had been going on for months but it appears to finally have been fixed.

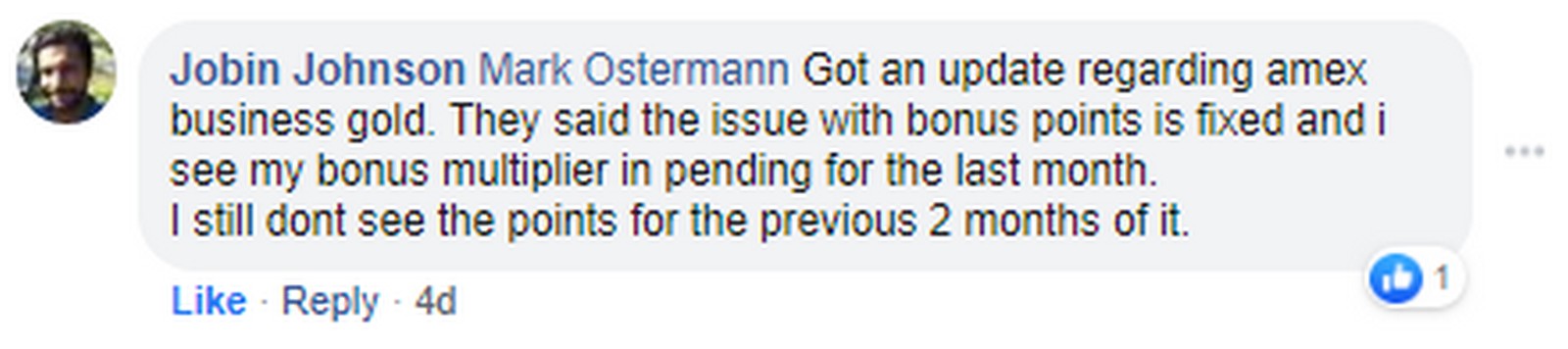

A member in our Facebook Group updated me with Amex’s recent response when he called in:

So it appears they have fixed the issue for purchases going forward but you will probably need to stay on top of them for previous charges. Hopefully the owed points are paid quickly and this isn’t a case going forward. It is already hard enough to decipher Amex’s point payouts with delayed crediting etc. I love Chase’s portal that shows you what every charge earns for their Ultimate Rewards cards. It is so easy to track!

Let us know if your account seems to be crediting properly now in the comments section.

My buddy got his fixed after 4 statements. Checked mine and nothing. I pushed all spend back to CIP – love watching it calculate s the days go by! Amex, get with the damn program! And the new statement that just came out, has all sorts of new terms and conditions that take place after 9/1/19 – didn’t fully understand it all but doesn’t seem great!

[…] 6/18/19: According to reports on Milestomemories and r/churning, this issue has been fixed. Credit for missing months has NOT yet been resolved, but […]

So far my restaurants and grocery stores have been coding correctly as 4X points. It takes them a few days, but they do code correctly. It’s almost as if someone is going in and doing this manually. Amex is a strange bird…the whole waiting a statement cycle for points to credit is odd to me too. Chase (although they need to catch up to Amex in terms of earning potential) is far superior in terms of crediting points quickly and properly coding; they even show you an estimate of how many points you will get in the future once you’re current statement closes!

Within the past 1-2 months I’ve moved all my spending from Chase to Amex…oddly enough someone from my local Chase branch called just today to see if I “needed anything.” Strange….perhaps they notice the enormous drop in spending activity and wonder what the deal is? Makes me wonder if they must figure the spending has gone somewhere…perhaps they offer bonuses to get it back?

Chase needs to add grocery and gas to their personal cards in a bad way. You would think they would give bonuses on those on the CSP and travel for the CSR and then have people carry both. But I guess they don’t like money haha

I applied for a business gold card from Amex a few years ago, upgrading it to the business card a couple of years back. I still hold the card. Any idea how it works with sign up bonuses? I think I could get some value from the gold card, but without a sign up bonus it becomes much less interesting.

Unless you are targeted for the card with a no lifetime offer you would be disqualified since you have already held (currently hold) the Gold card. Even if it is from a product change. Unless I am reading your question wrong…which I could be 🙂

No, you got the question exactly right, which is more than I can say about my description. Honestly, I’d completely forgotten about no lifetime offers. Thanks!

my gold biz only earn 3x /2x…, anyway to update it to the newest bonus structure?

You could call and see if they will product change you

Not fixed as of right now (June 18), my bonus multiplier is NOT correct. I am on the phone to ask for a manual adjustment, rep says cannot do it. Remediation timeframe for balance corrections, unknown. This just keeps dragging on on and on.

“Jobin Johnson” information is NOT correct.

Seriously? Dang – maybe they are rolling it out to a certain number of accounts at a time or something. It is crazy that it is taking them this long to fix something that is never a problem with any other lender.