Kabbage Debit Card Fraud

I know many of us, myself included, took advantage of the $300 Kabbage checking account bonus late last year. It was a nice bonus that netted me $600 towards my $25,000 earnings goal this year (did it for myself and my wife). The account also offers a decent 1.1% APR for anything sitting in the account so it was a useful option outside of the bonus. Because of that some people may have parked money there after earning the $300. If you did then you may want to lock up your debit card because of some Kabbage debit card fraud that has making its rounds.

What Happened?

A week or two ago my buddy Ivan alerted the MtM Diamond group to some fraud on his account. He got a text alert that someone had tried to use his debit card to make a purchase. He denied the charge and then went into his account and locked his debit card. At that point he wisely suggested we all do the same. I, unwisely, did not listen. I was traveling at the time and kind of forgot about it.

Last night my wife received a Kabbage debit card fraud alert that someone tried to make a $150 charge on her card. Luckily we only have under $2 in the account so there wasn’t much of a risk to begin with. She responded that the charge wasn’t her and I went in and locked her debit card. I then went into my account and did the same thing.

We only used the cards to make some loads on Amazon to fulfill the bonus requirements. I am not sure if that is how these people are getting the card info or if Kabbage (a subsidiary of American Express) itself was compromised. What I can say for sure is it didn’t come from a swipe anywhere. Because of that I would highly recommend you locking your card if you have any money in your account. You can then unlock before you need to use it, if you even need to. Then lock it back up after etc.

How To Lock Your Kabbage Debit Card

Here are the steps to lock your Kabbage debit card on a computer. It takes less than a minute so take the time right now. It takes longer to log into Kabbage’s site than anything.

Step 1

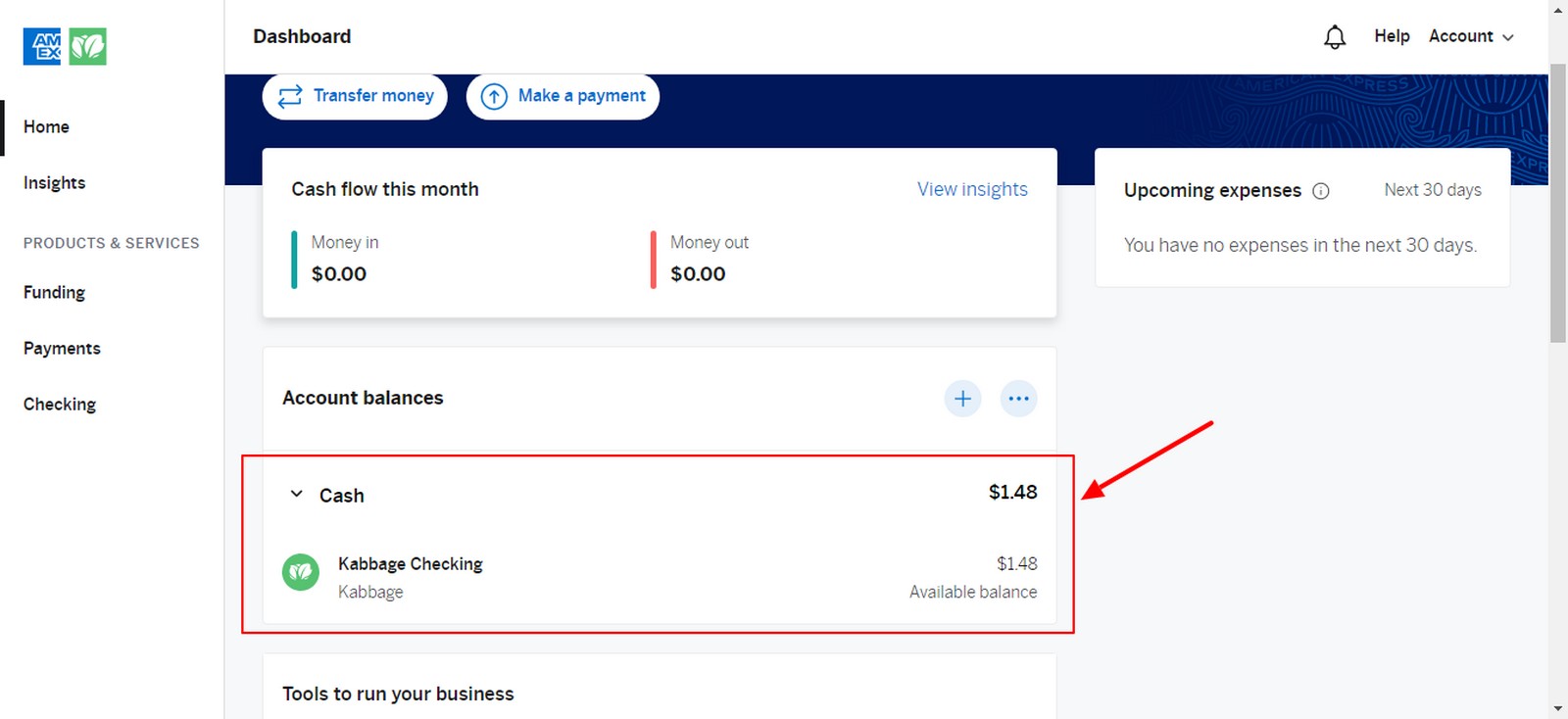

Click on your checking account to open up the details. I tried going through the account drop down in the upper right corner but it doesn’t pull up your debit card info.

Step 2

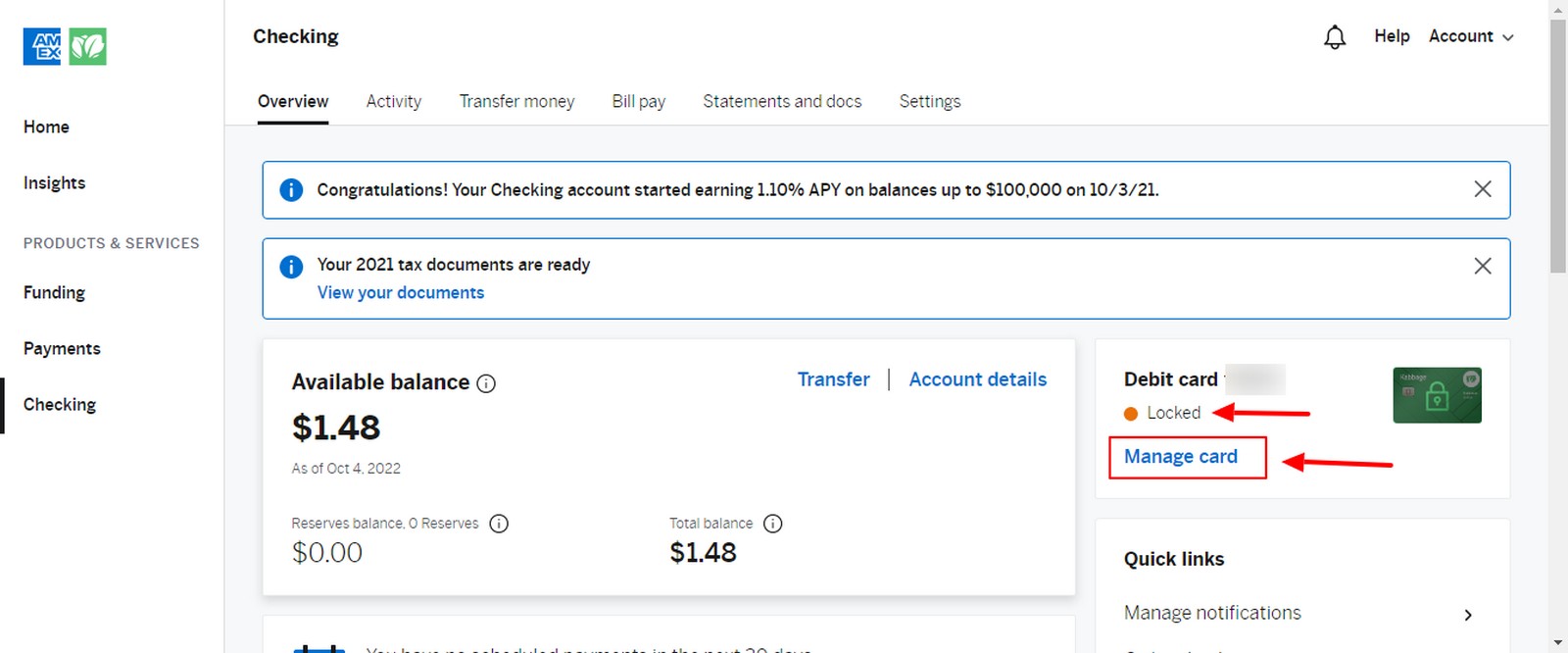

Once in the account click Manage Card. You can also take a look on this page if your card is currently locked or not. As you can see ours still is.

Step 3

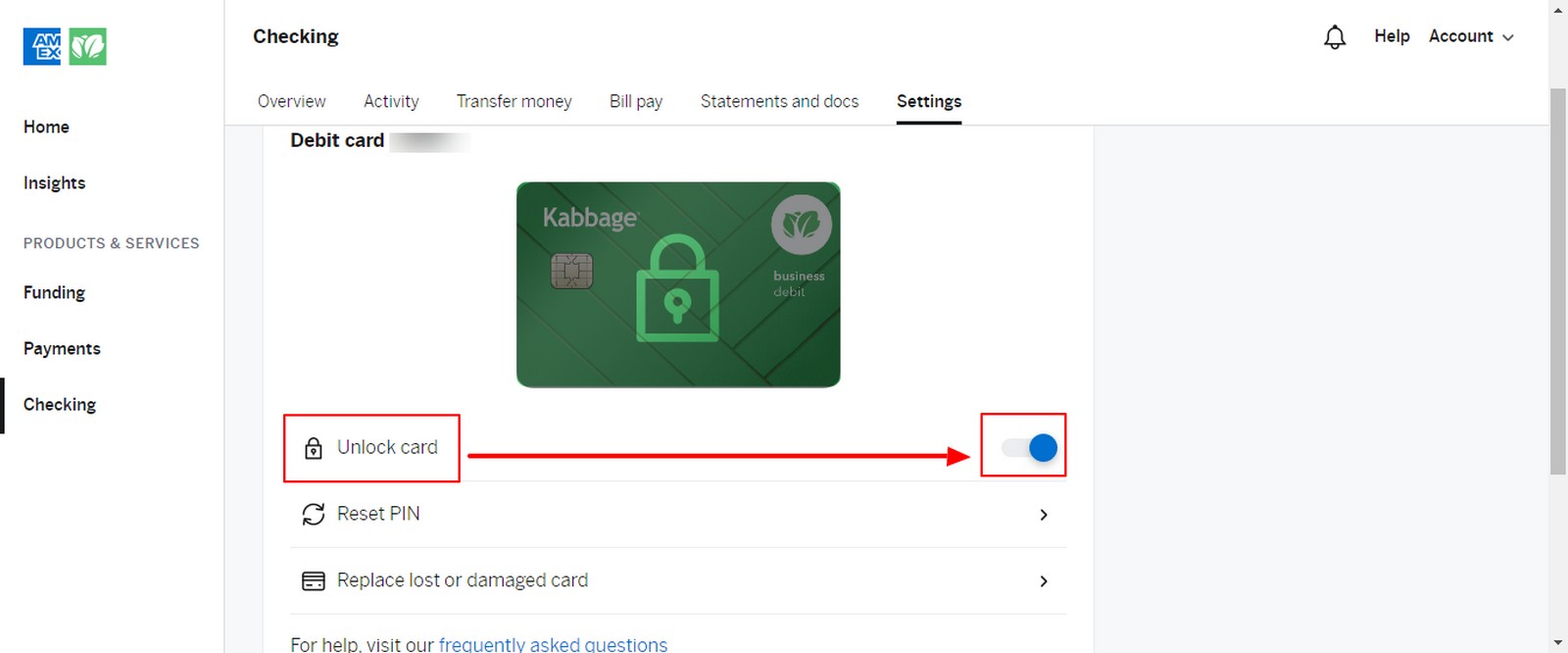

Once you click Manage Card you will be taken to this screen. All you need to do is hit the toggle to lock the card (or unlock it). That is it, you should be set now!

Kabbage Debit Card Fraud: Final Thoughts

That is all she wrote. Pretty simple process and it should secure you from anyone putting fraudulent charges on your Kabbage account. Even though I think their fraud alert system has proven to be pretty good I wouldn’t take the risk with a debit card. Since it is your money that gets locked up, versus the bank’s with a credit card, I wouldn’t mess around with it if you have any money in there.

Let me know in the comments if your account was compromised too.

My card was charged about 20 times and whenever I received a message from AMEX that there was a possible fraudulent transaction, I called them and asked them to block the card. They told me that they could not. I even sent certified letters (with return receipt) to Green Dot Bank and American Express several months ago. They just ignored them, I never got a response. I was not able to log into my account anymore because I had changed my phone number and they refused to update it, so every time when I tried to log in, I got a message saying “We have sent a code to XXXXX (my old number)” I even tried to report the fraud on Green Dot’s website and when I entered the card info, it said “invalid information” I complained several times to the FDIC and their response was “No consumer laws have been violated, since it is a business account, we can’t help you. I used the card only a few times in December 2021 at Walmart, Home Depot and Fry’s in order to get the $ 300 bonus. After that I put the card into my locked desk drawer. All the fraudulent transactions were in October 2022, as far as I know because I have not received any statements after that. Both companies had something to do with nutritional supplements, “SP VITAMIN BOUNTY” and “SP Ultra NMN” I lost almost $ 2,000.- Both companies are unreacheable. SP Vitamin Bounty has a website where you can contact them but of course, they never answered. I filed a police report and reported it to IC-3 but never heard back from them. Pathetic, that you can’t trust banks in this country anymore. They steal your money and nothing happens.

11/9/22 I just received another text Fraud Alert from Kabbage. Possible fraud on the card THEY canceled on 10/11/22! They asked me to call them. When I did, they said, don’t worry. That card is canceled.

I just got hit with another fraud alert at about 12:30am. I’m speechless.

I just realized a bunch of my fraudulent charges were from Klova. I have never heard of Klova before! Same as the guy who reported a Kabbage problem on October 4th.

I took your advice, Mark, and reported Kabbage to the Consumer Financial Protection Bureau.

Thank you very much for following this. It’s nice to have company …. even for bad things!

I have been on the phone and on hold for many hours since Kabbage notified of possible fraudulent transaction on a card I have never used. They are most difficult to deal with the lowest skill level imaginable. Each time I have called, I have asked if there was a known Data Breach. Until just now they have insisted that there was not.

The last person 10/24/22 at about noon, PST said yes. They are aware of a problem and Kabbage is investigating it currently. First honest response, I believe.

It is crazy how many people have been attacked and that they haven’t gotten it under control yet.

My card was hit 11 times starting on October 10th.

Kabbage sent me a text about “possible fraudulent transactions.”

I called immediately and they canceled the card. Their customer service is the most abysmal I have EVER experienced. There is no Fraud Department that you can talk to. The staff is untrained and clueless. There are still two charges from 10/11 that i am out over $160.00 and they say “everything is taken care of.” They will not respond to anything in writing nor by email. I will report them to the California Department of Financial Protection right now.

That is terrible – sorry to hear it Thomas. I think a CFPB complaint would be good as well.

My card was deactivated today because someone attempted 5 fraudulent charges. Tonight I received a fraud alert..again. I guess the moral of the story is to remove your money from these rinky dink banks as soon as the deal is done!

This is owned by Amex so it isn’t rinky dink but I can’t believe they haven’t corrected these attacks yet.

So here’s what is weirder. I have always locked my debit card but I got a text alert from short code 68825 saying it was used at SP AMAZINGHEAD. It quoted the last 4 digits of my debit card. I also got a fraud alert robo call which correctly quoted my name and last 4 of my card number. However there was no phone number to call back and it said call back at “application error”. There was also no caller ID with the call.

I logged into my account and found no signs of use or an authorization attempt and my debit card remained locked.

My Kabbage debit card was used last night for ~ $136. I have never used my debit card in-store or online as I am using my Kabbage checking account as a savings account. My guess is that Kabbage/Amex has been hacked. It’s a system breach.

[…] Why You May Wanna Lock Your Kabbage Debit Card […]

It hasn’t hit the news yet, but I’m expecting a big story on debit card fraud soon (and nothing to do with those swipe stealer things on gas pumps). Mine with US Bank (I never use the debit card except at their ATM about once every few months), a friend’s with Wells Fargo, another friend who has whatever card Door Dash pays onto. Since I don’t use debit cards and I have 2, I’ve locked them both.

Mark, thanks for reminding me of the uselessness, and now the risk of this account. I’m closing it tomorrow.

I originally did not want a debit card, but they would not allow me to cancel it, but only “lock” it. Although a 1.1% interest rate may be good for some for a business checking account, or you will need financing in the future, I see no other use for this account.

Yes, I got hit for over $2K, 12 identical “charges” from Klova. Did not get any notices from Kabbage, just happened to check my account. I withdrew the remaining balance, filed a dispute which reversed the “charges” a few days later. I immediately withdrew those funds and waiting for the interest to post before withdrawing and closing the account.

Glad you were able to get the money back at least.

I just realized a bunch of my fraudulent charges were from Klova. I have never heard of Klova before!