Maximizing the 3rd Quarter Bonus Categories on Discover, Dividend & Freedom

In this hobby a new month can be both a good and bad thing. Sometimes the end of a month means the end of a great deal. That was the case yesterday with the end of some great credit card offers like the Ameriprise Platinum 25K. Of course we also saw the end of our beloved Smart & Final offer as well.

The good news is that new months bring in the joy of new exciting deals. Since July 1 also happens to be the first day of the new quarter, I thought it would be a good time to look at how to possibly maximize the 5X bonus categories on the Discover It, Freedom and Dividend cards.

For most, the truth is that it is hard to meet the $1,500 spending threshold on these cards with regular spend. That is why it is good to know exactly how to juice it up a little to put you over the top. ABM. Always be maximizing!

Discover It

I’ll start with the Discover It since I am most excited about this card given its 5% now and 5% later structure for the next year. As you can see, the bonus categories for this quarter are: Home Improvement Stores, Department Stores, and Amazon.com.

Some people will be able to maximize the entire bonus at Amazon.com, but you can always earn 5X at Amazon.com by purchasing their gift cards at Staples with a Chase Ink or at a grocery story with the Old Amex Blue or another 5% card. So lets look at Home Improvement Stores & Department Stores.

According to the Discover website, there are many brands that fall into these categories. Among them are:

- Home Depot

- Lowe’s

- Sears

You can look at the full list if you want, but there really isn’t any need to go any further than these 3. All 3 stores sell a wide variety of gift cards including $200 Visa gift cards in some locations. At 10% back, the math on 7 x $200 Visa gift cards is:

- Cost: $48.65

- Cashback earned: $144.87

- Profit: $96.22

I think it is a good idea to keep the gift card option open in the back of your mind, but you may want to actually hold off, since you may incur unforeseen expenses in these categories. I would wait until September and then calculate how much spend you need before going to one of these stores to top up to $1,500.

Freedom

This is yet another easy set of categories to max out, although I’ll take home improvement stores any day. Some of you will be lucky enough to have gas stations that sell $500 cards for $5.95. Lucky you! If you are like me and aren’t so lucky, here are a couple of things you can do.

- Buy merchant gift cards at gas stations for use later.

- Buy gift cards at Kohl’s for use later. They sell a wide variety, although I do not believe they have Visa or MC.

- Buy merchandise for resale at Kohl’s during 30% off promotions. (Not generally recommended.)

This is another case where it DEFINITELY pays to wait until the end of the quarter to “top up”. Most people have enough gas expenses that they can get relatively close to maximizing the total. For me, I am still floating in gas cards I purchased at 50% off at Smart & Final. What to do. What to do.

Dividend

Note: As Free-quent Flyer pointed out on Twitter, the cashback on Dividend is maxed at $300 for the year ($6k in spending) , but there is no quarterly maximum.

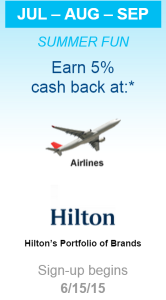

As you can see, I definitely saved the worst for last. Airlines and Hilton? Are you kidding me? For those who purchase airline tickets, then this should be easy, but for the rest of us it will be a struggle. You can of course buy gift cards for an airline or Hilton, but who wants to do that?

My wife and I recently downgraded Citi Executive cards to Dividend cards and they just arrived. Unfortunately it doesn’t look like I’ll be able to get much use out of them this quarter. I am floating in points since I have been home with the baby, thus there is no reason I need to pay for an airplane ticket. The good news is that the Dividend 4Q categories are Best Buy and Department Stores, so I should be able to do a little better there.

Why Talk About This Now

At this point you might be wondering why I would write about this now if my advice tends to be to wait until September. The main reason is it pays to always have this information in the top of your mind. First, you want to make sure you use the correct card for normal spending in these categories.

But then there are deals. Normally during the course of the 3 months a deal will pop up. You want to be ready so you can try to use the 5X as a jumping off point to something better. That may or may not happen, but it is always a good idea to familiarize yourself with the bonus categories at the beginning of a quarter or I guarantee you will forget what they are.

Conclusion

Hopefully this post was helpful in showing you how to begin to formulate a strategy. Sure 5% of $1,500 is only $75 per quarter, but if you have each of these cards and even potentially more than one of each, then that starts to add up to real money/rewards. Happy 3rd Quarter, 2015!

[…] New Month, New Quarter – New Deals to Maximize […]

[…] New Month, New Quarter. Miles to Memories has all the details on the 5% card categories, good reminder. […]

All 7-11s should code as gas station – so you have plenty of options there.

Be careful when you say all 7-11’s while it may be true for the Discover network (I don’t know) I know my local one does for Discover and Visa but not Amex (and obviously not for Visa/MC that is limited to pay at the pump transactions only).

Why would 7-11 code as a gas station?

Hi Shawn,

DO you know if visa gift card purchase at sears store earns reward points? I bought some last year, but I did not pay attention to that. Thanks

They should earn points on your card, but do not earn Shop Your Way Rewards points.

Thanks Shawn !