All information about the American Express Schwab Platinum, Morgan Stanley Platinum, and Business Platinum cards has been collected independently by Miles to Memories.

Membership Rewards Cashout

It’s about that time. Back in the summer, American Express announced changes to the Schwab Platinum’s Invest with Rewards benefit. Amex is phasing in a new cap for Membership Rewards cashout via the benefit’s superior 1.1 cents per point rate. Anything cashed out prior to 1 October wasn’t subject to the new one million Membership Rewards ceiling. From that point until year’s end, each Schwab Platinum primary cardholder can cash out up to one million MR’s at that same rate. Subsequently, cardholders only receive 0.8 cents per point via Invest with Rewards. Starting in 2025, a primary cardholder can cash out a maximum of one million Membership Rewards at the 1.1 cpp rate for the entire calendar year; anything over that would be at the 0.8 cpp rate. But what does this devaluation actually look like now? How is Amex enforcing it? Dear reader, I’m here for you.

Our Situation

My wife and I have each held Amex Schwab Platinum cards for years and plan to do so indefinitely. We’ve enjoyed cashing out all of our Membership Rewards points throughout, and we don’t expect that to change in any major way (if at all). We each cashed out everything just prior to 1 Oct to have an empty tank to fill for the remaining three months of 2024. I felt fairly optimistic I’d reach another million of earning and burning for the remainder of the year, with my wife maybe a bit behind. Long story short, things worked out the way we expected. I hit the one million MR redemption mark for the quarter yesterday, and the wife did so today. But how did we know?

Hitting the Cap for Superior Membership Rewards Cashout

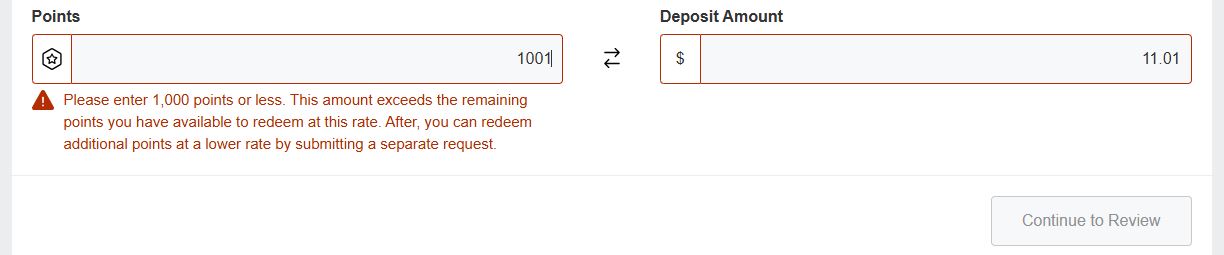

The short, boring answer is recordkeeping. We each keep a good tally of how many MR’s we routinely cash out. We each prefer our own reliable info in addition to whatever else Amex provides. But the good news for all of us in this situation – bean counters and anyone less detail-oriented – is that Amex offers a clear mechanism for knowing when you reach the one million MR cashout threshold in any given year (or this one-time three month period we’re in now). Here’s how it looks.

First…

My first notification on the Amex website was a day or so ago when I attempted to cash out my MR balance via the normal Invest with Rewards process. I received the above message from the site when I entered 1,001 points to redeem. But I only had 1k left to redeem at 1.1 cpp via Invest with Rewards. The site wouldn’t let me proceed – see the greyed-out “Continue to Review” button.

Next…

I shaved one MR off to exactly 1k. The redemption window looked like what we’ve all been recently used to. I clicked Continue to Review, and the transaction completed as usual.

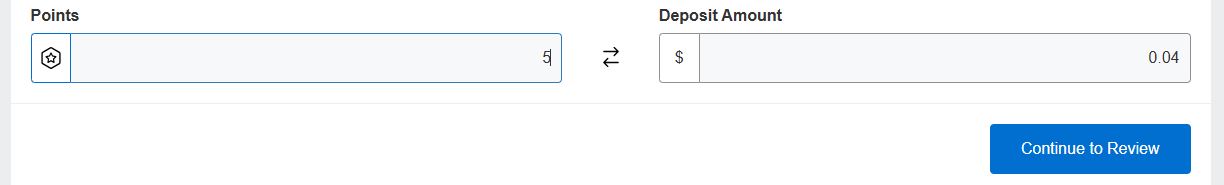

And Then…

As the site states, redeeming at the lower 0.8 cpp rate requires submitting a separate request. Curious, I cashed out a few more to see what it would be like to do so at that rate. I opted for a clean, exact amount of 5 Membership Rewards points, which meant a whole 4 cents after taking into account the lower rate. For those who are even more interested in splitting hairs, redeeming anywhere from 1 to 4 points rounds to the nearest cent.

Now…

The wife and I are now sitting on higher Membership Rewards balances than we’d ever cared to for a longer period than we’re naturally used to. But hey, this period will only last a few days (as of this writing). We’ll promptly start cashing out again at the superior 1.1 cpp rate on 1 Jan 2025.

Conclusion

So we now know what maxing out the superior Membership Rewards cashout rate looks like. I’m fairly confident that my wife and I will be hitting the ceiling next year, just like many of you. Beyond that threshold, I’m intrigued to determine what will be our preferred Amex redemption paths will be. Other reasonable options exist, including 1 cpp cashout via the Business Platinum’s Redeem for Deposits benefit. There’s also the Morgan Stanley Platinum’s version of the Invest with Rewards benefit. Beyond those limits, I’m fairly confident that many, maybe even my wife and I may – gasp – cash out at 0.8 cpp with Invest with Rewards. Given that no other redemptions provide my wife and I superior value and the tremendous ease of earning MR’s, I won’t be surprised if that happens.

Are you hitting the one million MR threshold with cashout via Invest with Rewards? What are your redemption plans beyond that level?

Are you earning MR through SUBs and referrals primarily or is there some MS or even business spending as well?

Will,

I earn MR through a variety of cards, new and old.

Maybe I’ve missed this, but exactly how does one “cash out” MR? I’m sitting on millions and should probably kick myself for not having opened the Schwab Plat earlier. Is the cash out deposited to one’s Schwab checking account and then used like a normal checking?

Abby,

Check out the link in the “First…” section above. Also, you can learn more about it over on Amex’s site.