Disclosure: I am not a lawyer and this post is in no way trying to provide legal advice. The goal of this post is to educate and help you find relevant information so you can decide for yourself what action to take.

Money Orders Manufactured Spend

In the past there have been a number of controversial posts about manufactured spending with money orders. In those posts (which have now been heavily edited) the authors described some best practices for buying money orders and liquidating them. Despite the authors not really knowing, some of what they wrote may have described a practice known as structuring. PF Digest also wrote a follow up with some of the information I am going to describe below.

Since I know a lot of people might be interested in buying and liquidating money orders, I thought I would help by laying out some resources everyone should probably read before they do this. I am not advocating that people buy money orders, nor am I saying not to.

Bank Secrecy Act

The Bank Secrecy Act of 1970 is the root of what we are talking about today. It established a wing of the treasury department called FinCEN which is mandated by Congress to track and carry out regulatory responsibilities established in the act. According to their website, here is their mandate:

- Maintaining a government-wide data access service with a range of financial transactions information

- Analysis and dissemination of information in support of law enforcement investigatory professionals at the Federal, State, Local, and International levels

- Determine emerging trends and methods in money laundering and other financial crimes

- Serve as the Financial Intelligence Unit of the United States

- Carry out other delegated regulatory responsibilities

So why does this act exist? I remember reading it had to do with money laundering and the drug trade, but that doesn’t matter. It exists to stop money laundering in any form. Part of the way it achieves this is by putting the burden of reporting and detecting suspicious activity on the banks. Again from the FinCEN website:

The Currency and Foreign Transactions Reporting Act of 1970 (which legislative framework is commonly referred to as the “Bank Secrecy Act” or “BSA”) requires U.S. financial institutions to assist U.S. government agencies to detect and prevent money laundering. Specifically, the act requires financial institutions to keep records of cash purchases of negotiable instruments, file reports of cash transactions exceeding $10,000 (daily aggregate amount), and to report suspicious activity that might signify money laundering, tax evasion, or other criminal activities.

Types of Reports

The law requires the banks to report information they find in a variety of ways. Here are the three main types of reports that are filed. (Taken from Wikipedia):

Currency Transaction Report (CTR)

The CTR must report cash transactions in excess of $10,000 during the same business day. The amount over $10,000 can be either in one transaction or a combination of cash transactions. It is filed electronically with the Financial Crimes Enforcement Network (“FinCEN”).

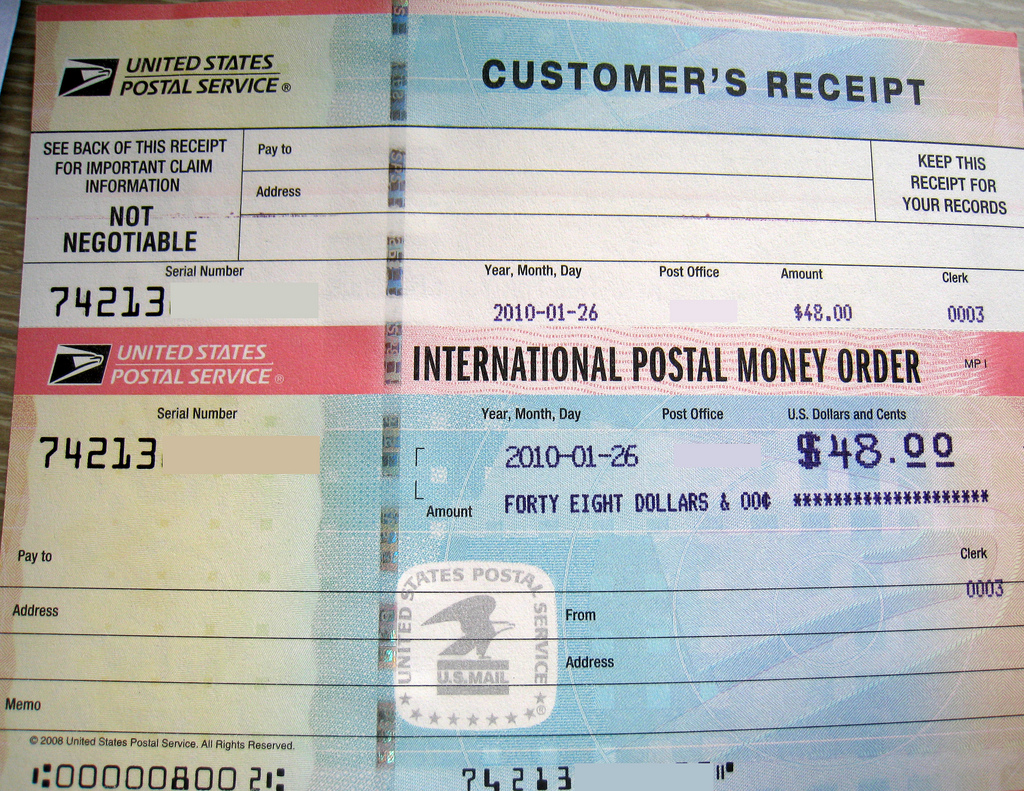

Monetary Instrument Log (MIL)

The MIL must indicate cash purchases of monetary instruments, such as money orders, cashier’s checks and traveler’s checks, in value totaling $3,000 to $10,000, inclusive. This form is required to be kept on record at the financial institution, and produced at the request of examiners or audit to verify compliance. A financial institution must maintain a Monetary Instrument Log for five years.

Suspicious Activity Report (SAR)

The SAR must report any cash transaction where the customer seems to be trying to avoid BSA reporting requirements by not filing CTR or MIL, for example. A SAR must also be filed if the customer’s actions suggest that he is laundering money or otherwise violating federal criminal laws and committing wire transfer fraud, check fraud or mysterious disappearances. The bank should not let the customer know that a SAR is being filed. These reports are filed with the Financial Crimes Enforcement Network (“FinCEN”). This requirement and its accompanying implied gag order was added by the Annunzio-Wylie Anti-Money Laundering Act § 1517(b) (part of the Housing and Community Development Act of 1992, Pub.L. 102–550, 106 Stat. 3762, 4060).

Banks can heavily be fined or even lose their charter if they fail to report suspicious activity. In other words, they will report anything that they are required to and they should.

How They Find Suspicious Activity

The banks use a variety of methods to detect suspicious activity and those who try to avoid reporting. One of the main methods used is Anti-money laundering software. This software analyzes transactions and customer history to give the bank an idea when something suspicious arises. Any sort of activity that differs from the norm should be caught. As technology progresses this type of software grows more advanced as well. In other words, it is hard to hide stuff without it being seen.

Structuring

Which brings me to structuring. The definition of structuring is simple in my mind. Structuring is defined as anything you do to avoid any sort of reporting requirement. Let me give you a more formal definition. This is from Wikipedia:

Structuring, also known as smurfing in banking industry jargon, is the practice of executing financial transactions (such as the making of bank deposits) in a specific pattern calculated to avoid the creation of certain records and reports required by law, such as the United States’ Bank Secrecy Act (BSA) and Internal Revenue Code section 6050I (relating to the requirement to file Form 8300).

This isn’t a minor thing either. Structuring in and of itself is a serious crime. Since it is so serious, here is a link to the actual U.S. code regarding structuring. I’ll highlight some things below, but I highly suggest giving it a read.

No person shall….

cause or attempt to cause a domestic financial institution to fail to file a report required under section 5313(a) or 5325…

cause or attempt to cause a domestic financial institution to file a report….that contains a material omission or misstatement of fact

structure or assist in structuring, or attempt to structure or assist in structuring, any transaction with one or more domestic financial institutions.

Fairly straightforward. Notice it makes no mention as to whether or not your activities were legal or not. You could be depositing money very legitimately, but if you simply structure in any way you have committed a crime.

Punishment

So what is the punishment for structuring?

Whoever violates this section shall be fined in accordance with title 18, United States Code, imprisoned for not more than 5 years, or both.

Whoever violates this section while violating another law of the United States or as part of a pattern of any illegal activity involving more than $100,000 in a 12-month period shall be fined twice the amount provided in subsection (b)(3) or (c)(3) (as the case may be) of section 3571 of title 18, United States Code, imprisoned for not more than 10 years, or both.

So huge fines if your are LUCKY and up to 5 years in prison. (Or Both!)

But It Gets Worse

So what can happen if the government suspects you are structuring? Well let’s look at the example of Lyndon McLellan. He is a convenient store owner who was suspected of structuring his deposits. He committed no other crime, but had his assets frozen by the IRS when they suspected him. Despite a supposed recent change in the rules, this seems to happen a lot.

I found this tidbit in the Fox News article linked to above interesting:

From 2005 to 2012, the IRS seized more than $242 million from alleged structuring violations in more than 2,500 cases, according to an Institute for Justice study. In more than 830 of those cases, no other criminal activity was alleged.

So basically 1 in 3 structuring cases involved no other criminal activity. That could be a store owner like Mclellan or a manufactured spender like you. Now there is some good news. In the past year or so both the IRS and DOJ have changed their policies to no longer go after structuring cases where no other criminal activity is alleged. Unfortunately those are the policies but the enforcement doesn’t seem to be so black and white. (In other words, I wouldn’t count on them not going after you.)

Money Orders Manufactured Spend – I Wouldn’t Evade Reporting

Which now brings me to the point of this article. If you are going to be purchasing money orders for manufacturing spend then you should be aware of this stuff. Be aware of what the banks are required to report and DO NOT IN ANY WAY try to evade reporting. I am not a lawyer, but here is what I wouldn’t do:

- Deposit over $10,000 in a short period of time in smaller amount or spread across different institutions.

- Purposely deposit less than $10,000 just to avoid the reporting requirements.

- Anything else that even remotely feels like I am avoiding the reporting requirements.

This article isn’t about teaching you how to avoid bank shutdowns or to get a bank to allow you to deposit a lot of money. The truth is that banks don’t like people who deposit a lot of money orders because they need to monitor and report you and it creates a hassle for them. They would just rather shut you down even if your activities are legal.

Because of shutdowns, some people would advocate using multiple accounts and depositing smaller amounts in them to avoid scrutiny of the bank. Just remember that previous sentence included the word “avoid” and thus is a dangerous practice in my personal opinion. Again, this is all my personal opinion and not legal advice.

Conclusion

I am very sorry to write such a lengthy post, but I thought a more thorough look at this subject was possibly needed before people decide to engage in the practice of purchasing money orders for manufacturing spend. If you decide to do it, be prepared for strange looks, scrutiny from the bank and even the possibility of being investigated. No matter what though, don’t structure. Or since this is just a personal opinion, I’ll say that I won’t be structuring.

[…] is true even if you’re not doing anything else illegal. You can read about how to avoid trouble here, but the basic rule is to never try to evade bank reporting […]

So don’t hide money the way the CIA and other entities do? Instead just become Amazon? Got it.

Thank you for the reminder/update. I’ll add a little more data from my perspective as one who handled my firm’s FINCEN compliance for 15 years.

For the record, any financial institution is required to file reports and answer requests from FINCEN. That’s AMEX, PayPal, E*Trade, Blackhawk as well as many others. Not just banks. I worked for a stock broker/dealer who was required to comply. As for what any given entity considers suspicious, it depends on their compliance department/officers. They may use software, random audits, human review or other methods to detect what they believe they need to report to stay out of trouble.

In addition, at least weekly those institutions receive an electronic list of individuals or entities that need to be reported on. Included on that list are known aliases, SSN and other demographic information. These requests originate from any Federal agency, be it the Forestry Service, Customs, Treasury, DEA, intelligence agencies or any other part of the Government. This means there are a number of ways that eyes can get put on your accounts.

MS with MO looks just like money laundering, regardless of the amounts. The risk is dependent on the fear of the institutions involved under-reporting and what FINCEN randomly does with the reporting.

[…] is true even if you’re not doing anything else illegal. You can read about how to avoid trouble here, but the basic rule is to never try to evade bank reporting […]

[…] MilestoMemories […]

Much to do about nothing. I deposit $100K per Month, totally legal, and if anyone questions me, I’ll Tell them where to stick it. My Money, my business. I dont even try to be coy about this. I MS openly and proudly.

Many people MS as much or more than you do and don’t have issues. This post is about structuring or making your deposits appear in a way that avoids reporting. Again, I am not an attorney, but there have definitely been prosecutions for structuring and I think it is a good subject to be aware of.

Boom! Teach me the way!

[…] MS techniques are perfectly legal, but the same techniques are often used by criminals to launder money or to convert stolen credit card numbers into cash. This leads many businesses to stop allowing those techniques to work. One way of looking at it is that criminals indirectly steal our points by killing easy MS options. Sidebar: While MS is legal, structuring is illegal. Read more here. […]

So this post talks al lot about MO’s and Structuring, and I noticed this piece of research while looking at Venmo as an option to unload some gift cards (you can attach VGCs as a payment option and then send money to anyone).

The limits of structuring seem to kick in around the 3K-10K range. If you are avoiding 10k, shoot and even 3k, you could be flagged for structuring essentially.

Venmo lets you send payments to people with a limit of $2999.99 per transaction and $2,999.99 a week. Just under the 3k limit. So essentially anyone who uses Venmo is considered to be structuring by the above definition of “avoiding” certain limits. I haven’t heard a lot of people using Venmo as an option yet to unload VGC’s, maybe because they are owned by paypal, and paypal is complete flesh eating assholes, but that’s another story.

[…] MS techniques are perfectly legal, but the same techniques are often used by criminals to launder money or to convert stolen credit card numbers into cash. This leads many businesses to stop allowing those techniques to work. One way of looking at it is that criminals indirectly steal our points by killing easy MS options. Sidebar: Structuring is illegal. Read more here. […]

Stealing your points? This is hilarious. How entitled are you? MSer’s don’t deserve the points in the first place. The high end redemptions are meant to be given to those who actually spend the money. By your logic I can say that those of us who legitimately put consistently high organic spend are being robbed of award space and elite upgrades at hotels and punished by way of devaluations by you MSer’s. I hope these MSing techniques get eliminated so that I can easily book redemptions how I used to. Sign up bonuses are bs too.

I agree with you. I have 150K MQM with Delta and purposely got Amex cards to enable this to happen, in addition to the MQM that I earned by flying. Delta encouraged me to do this but then they put in this ridiculous MQD waiver amount of 250Kt. To make matters worse, MQD doesn’t apply to anyone with a non US address. Supposedly this was because Diamonds were complaining about lack of benefits. Well there’s entitlement for you. In the several years that I was Diamond, and at one stage flying every week, I never had reason to complain about my upgrades or benefits. But thanks to these complainers I now could be Platinum next year and thanks to MS, the status quo is less likely to change.

What happens after you get an SAR? Does anyone know?

Much to do about nothing. I deposit $100K per Month, totally legal, and if anyone questions me, I’ll Tell them where to stuck it. My Money, my business.

Dude, you’re awesome. I want to be like you.

Bulls and bears get slaughtered just as much as pigs, let’s not forget the lessons learned from redbird/bluebird/serve. What works for u now will not always work and may not work for others.

Good post Shawn. Will definitely cut back on my MO deposits after finishing off this last minimum spend. Guess its for the best, I’m growing weary of this game as it gets harder and harder to win. Feels like I’m constantly playing chess against a computer that learns from its mistakes. I’ll likely still get a few CC a year especially if a good sign up comes around but no more app on rammas for me.

Exactly. Thats why Shawn is reselling now. Its LEGIT spend. No MS.

“Bulls make money, bears make money, but pigs get slaughtered.”

I work for a major California bank (that narrows it down to two) and I can tell you that no one cares if you deposit less than $10,000 in money orders in a 7-day rolling period.

Remember that money laundering rules are meant to curb drug dealers, terrorists and tax avoidance. The FBI is a little busy with computer crimes and bank robbers (those actually using a gun) to show up at Joe and Jane Podunk’s door to inquire about $25,000 in credit card spend at a Simon Mall and $25,000 in VIP Serve and money order deposits into three different bank accounts over 30 days.

I’ve heard the stories of some MS pigs doing $25,000 per day, seven days a week, in VCG – MO – ATM deposits. This will alert the bank’s computers (sooner or later) and get your account flagged for shut down, especially when depositing more than $10,000 at a time in sequential money orders.

Be smart.

Limit your MO deposits to under $10,000 in a 7-day rolling period.

Use numerous different banks to deposit your MOs and pay back your credit card using phone payments over different days. Remember “Bank A” has no idea what you deposited into “Bank B” and “Bank C”.

If anyone saw the movie “Sicario” paying back your CC directly at the bank is not a cash deposit, it is a repayment of a loan. Huge difference to banking regulators. That being said, I’d keep it under $10,00o in a 7-day rolling period for MO payments to CC.

Many of us still VCG – VIP Serve – CC $5,000 per month ($10,000 per couple/month). Then use three different bank accounts and VCG – MO – Bank – CC another $20,000 per month. That’s $30,000 per month in MS flying under the radar.

You want to avoid the bank’s computers picking up “unusual patterns over $10,000 in a 7-day rolling period”. Spread it out. Keep it simple. Don’t give the bank a reason for the dreaded “Your credit card / bank account has been shut down” email.

“Limit your MO deposits to under $10,000 in a 7-day rolling period.

Use numerous different banks to deposit your MOs and pay back your credit card using phone payments over different days. Remember “Bank A” has no idea what you deposited into “Bank B” and “Bank C”.”

This seems like very bad advice to me, because it feels a lot like structuring. I don’t censor comments here and certainly value your opinion.

Meanwhile, I think it’s likely not all the federal rules that apply to banks also applied to Bluebird/Serve, which I’m positive American Express didn’t run illegally and which didn’t run the way it did by accident. But which turned out to apparently make American Express money, but not enough money. And AmEx is acting a lot like its eye is on a whole new thing. I also think it’s likely the shadowy regulatory area where manufactured spenders like to operate is permitted to exist at all only because it coincidentally somewhat meets the needs of millions of poor people, the so-called “under-banked”. Some new method will come along that will pass muster with both the accountants and the lawyers at the banks. They’re the ones that count. One way or another, after all, the customers for the product are by definition desperate and many will take whatever they can get, and some will like it.

Has ANYONE on this blog actually GONE the Money Order route?

I’ve still got active Serve/BB accounts, so I am going to start “slow” with MO’s, at my Primary Bank…..

[…] Manufactured Spend & Money Orders: What You Need to Know to Stay Out of Legal Trouble […]

Why even bother with money orders when the risks of bank account shutdown, federal agents showing up at your door, and asset forfeiture are even remotely possible? All so you can get some “free” travel benefits or feel important with a shiny elite card.

No not for free travel benefits, for free travel to amazing destinations. Let’s not kid ourselves in thinking that this isnt risky but let’s not also minimize the payoff as “some” free travel “benefits”. I think most of us could give two sh!tsa about “shiny”elite cards.

I know the people here are not legal experts but just wanted to know from you guys if you have any knowledge whether ACH transfers can create any issues? I am asking as for some bank bonuses we have to do lot of ACH for e.g. some bank ask $10,000 for one month. Doing those ACH can lead to SAR?

I am not quite a “lawyer”, but have some knowledge of this.

The basic answer is NO, since ACH transfers (within the US) are entirely traceable and documented, so they would not have the same issue as “cash” deposits/withdrawals….

Yes. However money is moved, it is counted. 10k… even 8k is a lot for the average person to be moving everymonth. .. especially in a non business account situation. You get noticed.

I’m an insider to those laws. I know…. don’t be stupid… with any large sums that are not coming from your payroll…. you are being watched. The fed has a strong control on bank reporting & banks can be shut down…. and frequently are for misreporting. The fed has the right to tell a good-standing banks to take over a poorly reporting one… don’t mess with them. This is a way for the fed to stop tax evasion, too…. so don’t mess with them & their money.

Any financial institutions have a bsa dep. Credit cards, casinos, banks, currency exchanges, etc.

Don’t piss them off & stay off their radar.

Anon,

I am not sure that I understand your point correctly. I bought few CDs from local bank or Ally with no penalty for early withdraw or “breakable CD”. Once a while I cashed in these CDs for many reasons and did ACH. Do you mean it is illegal?

Forgot to subscribe.

Shawn,

Are you going to make a post of how you recommend people liquidate their Visa/MC gc (besides normal spend)? Lately I have seen you and several other bloggers mention how dangerous dealing with MO are but the only one I have seen give any alternative is FM (prepaid cards with a fee). That isn’t sustainable though as he implied that it’s against the TOS.

I don’t have a ton to add to what FM has said. There are some other ways, but none that are going to be painless.

The part I find strangely excluded is extending the concept of structuring to BlueBird/Serve/Redcard. Amex clearly isn’t reporting those running monthly limit scraping cash deposits (liquidated gift cards) through them, but it doesn’t mean it’s not structuring.

Look at it this way……..if the cap on what you’re running through isn’t that substantial, and it’s not a piston driven machine of structuring beauty, they aren’t going to come after you. They have limited resources and focus on the cases of consequence.

It just so happens that I am a criminal defense lawyer, although at the state level and not federal. I also do a small bit of manufactured spending.

Here is my two cents on this for what it is worth.

The federal statute regarding structuring and bank reporting is fairly straightforward. However, its application can obviously be very broad. That’s why there is no clear cut answer to the questions of “how much is too much?” and “how many times a month can I deposit with ______ banks and not get caught?”

Back up for a minute and let’s look at the big picture. You are buying cash equivalents (gift cards) with a credit card, transferring that to a money order, depositing that money order into a bank, and then using the bank money to pay back the credit card company. You’re doing all of this so you can get “free” or at least discounted travel.

You can argue with me all you want, but let me assure you the vast majority of people think you’re scamming the system with this behavior. And when I say “vast majority of people”, I mean the people who are going to be sitting in a jury box in some Federal District Court hearing your case on structuring… meaning… you won’t get any sympathy from them when you say “everything I did was legal” and “I used separate banks so that the banks wouldn’t shut me down, not to avoid reporting requirements.”

If you decide you want to keep doing this, my suggestion is simply buy your gift cards, then the money orders, then take them to the same bank you always use. Keep receipts of EVERYTHING. If they decide they want to call you in and talk to you, tell them everything up front what you are doing, send them copies of any receipts, if they ask, and hope they don’t shut you down. If they tell you to stop doing it, then you need to make a decision whether to keep using them as a bank. I wouldn’t use several different banks to do this activity.

Either way, once you start depositing thousands of dollars in money orders in a bank, and then almost immediately paying it back out to a credit card company, you are going to get noticed.

To me, this just isn’t worth the hassle.

Nice input David. Thanks a lot. Great to see attorneys part of this community.

Everything you said is on point, but I would “black out” the last paragraph with your actual recommendation and stay away from “How to MO” advice. Stupid people are also reading this blog and I cant imagine how they will take your “innocent” input. Not to mention banks shoot and ask questions later so they probably wont bother calling you in anyways. They will call FinCEN, FBI, and IRS first.

For someone calling themselves a ninja u sure act like a big o puss. People r gonna do what people r gonna do stop worrying so much about those chumps and live ur life. The advice is out there as well as the info so stop harping on it and making it ur personal crusade.

very interesting and sobering discussion here. Thanks Shawn, David, et. al.

Pardon if you’ve addressed this somewhere else, but how about the approach to using money orders directly for “real” spending, as suggested via mms/Dariaus, et. al, that is, to use money orders to pay conventional bills, like mortgages. (rather than depositing mo’s to a bank account — and then pay the cc that bought the gift/debit card, etc.) That is, you purchase the money order, then write out the precise name of the payee directly on the mo, as you would in preparing a check. (then mail or deliver to the recipient)

Would this too be deemed tantamount to “suspicious” activity? Or “old as the hills” — from back before the days of computers even? Thanks for any perspective.

what you describe is not manufactured spending nor is it even structuring of deposits. youre just doing what RB/BB/Serve used to do, but now forced to use MO instead of electronic bill pay which is an entirely different problem.

This way sounds good to me. I only want to pay my bills and get reward points while doing it.

You’re a lawyer and you advise people to comply and turn over everything???

Ridiculous, the smart/right thing to do is “lawyer up.” You can’t handle alone. I’ve never heard of a lawyer telling people to comply without counsel. Most attorneys advise NEVER even if INNOCENT do you speak to anyone who can influence legal proceedings versus a person.

Horrible advice

for newbies who read FT and see all discussions there with posts of up to $60K MOs deposited to just one CU(IIRC that’s in WI), I see why many get encouraged to try their luck by opening several CU accounts and start depositing MOs there. these poster(s) aren’t bloggers and they can say they owe no one an explanation to what they do and what works for them but in the grand scheme of things, such posts ought to have warnings *caveat emptor*.

with the death of Serve/BB, I’m expecting many to switch to MO deposits whether or not they are aware of structuring and other rules. there are those determined to get their piece of the pie and thereby disregard what others say. everything’s working fine until one day, their MS world crumbles with a knock on their door.

NinjaX’s post has too many caps but for most people his point is right. I’m as far from a bank lawyer as you can get while still being a lawyer but have did this type of thing a bit in law school. First, You are really unlikely to get caught doing this. Think of how many people do this and how few get in trouble. The flipside is, if they catch you the Feds can bend you over a barrel. As Shawn wrote, you don’t have to be doing anything illegal. Just separating deposits to get under 10K or making it look like you did so is enough. Just hiring lawyers probably ends up costing 20K minimum and you are unlikely to win as the Feds have a very low bar in order to prove structuring. I’ve seen plenty of people who could prove they weren’t doing anything illegal but the feds still stuck it to them. That is the big thing. Innocence is likely not going to be a successful defense. Personally, my life is far too comfortable to risk messing it up on a federal structuring charge.

ATTN Citizens of This Blog:

While I respect everyone concerns and questions on this blog, the basic advice I want to mention is “STOP DOING THAT CRAP & STOP ASKING QUESTIONS ON HOW TO DO THAT CRAP UNDETECTED”.

For example: “Is doing X and doing Y structuring? What if I did Z? How about if I just did W?”

Not attacking anyone specific, but Shawn was very kind to write up an ULTRA risky and controversial area for the benefit of his readers. As he said, he is not an attorney and dont expect him to help you like an attorney. Do your own follow-up research, but STAY AWAY from remotely doing this crap (or do it at your own risk).

Everyone on FT is doing it so you may think its safe, but now with BB/Serve gone, guess whos gonna be doing it too? AKA THOUSANDS of low hanging fruit eaters.

Let me tell you how serious this is. The Bank Secrecy Act together with FinCEN has powers that YOU CANT EVEN UNDERSTAND. It goes beyond normal understanding of “due process” and “innocent until proven guilty”.

Look up “Civil Asset Forfeiture Abuse” Youre welcome. This single piece of UNTOUCHABLE legal process allows anyone to simply take your assets without formal charges. Thats what happened to the convenience store guy in the post.

So many people outside of this blog are SO DAMN ignorant. Always crying “But But I didnt do ANYTHING ILLEGAL..”

FinCEN can care two shits if you didnt do anything illegal. They will tell you to suck it.

Very little is being done to correct this and some on FT already got first hand experience of this.

I assume many fans on this blog have families and kids with assets like a house. FinCEN will TAKE THAT CRAP AWAY from you EASILY. Hope the MO and points were worth it. At least you can stay in a nice hotel and fly first class while the government is seizing your shit. That must feel nice right? You have been warned.

Take care.

Wow what crawled up ur butt? I like how u insinuate that the government will take ur home and hell even ur family and kids. Lol I know that’s not what u meant but that’s how it reads.

I guess you didn’t read the latest developments? Check this out on how real civil forfeiture is and how it is now affecting those who MS.

http://www.tulsaworld.com/news/state/new-front-in-civil-forfeiture-authorities-get-devices-to-seize/article_4a16da04-374b-51fe-aeab-2ad804b6b83a.html

I’ve been to Tulsa and there’s plenty of opportunities for MS activities there but after reading the article, I’m going to think twice before buying some VGCs when we’re there.

Guess I’ll take it easy to start with and try to keep it below $1,000 a month to start with.

Thanks for the info!

Very Informative post. so is there any amount considered fine? Eg:- Less than $4000 a month or that too looks suspicious ?

There are no hard and fast rules about what’s “safe” and there’s a degree of randomness in who gets flagged. Legally speaking, I would think you could deposit $9,900 every day just so long as there was a good explanation for why you’re depositing that particular amount and you’re not doing it to evade bank reporting. Of course, you’re still more likely to get noticed doing that.

Hypothetically speaking, $9.9k every day would raise a red flag at most everyone banking institution I could think of. The 10k limit is nothing to sneeze at.

Adding more details . Did more research online, and there are posts about folks getting burned with $1000 in MO value deposited weekly for months. I believe $4000 monthly is also risky. Thanks for posting this Shawn.

Can you give a little more detail of what you mean by burned, since that seems to nowhere near approach the definition of structuring? And thanks for the well laid out article, Shawn.

a reader has mentioned in another blog about using 2 banks(A big NO and definitely structuring) to deposit $1000 in MO’s weekly for months. 1 bank closed account and another reported to IRS for audit.

Thanks. Don’t like the sound of that one!

So I wonder if depositing 1 $500 money a month in a bank would raise red flags? This is what aggravates the hell out of me. Nobody knows what triggers alarms and what to do to avoid it. But I guess that’s the point so criminals won’t know how to get caught…Wish they’d spend this kind of time and energy into other problems as well.

All of the information that you provided is related to cash transactions. Have you seen anything from any reliable sources that would suggest that the same reporting occurs or needs to occur for non-cash transactions (money orders, checks, debit, credit)?

It is a different story if you are purchasing thousands of dollars worth of money orders using cash, but then the burden of reporting should be on institution selling you the money orders and not the bank accepting the money order, unless they are giving you cash in return.

Money orders are specifically mentioned in the regulations. Here it is taken directly from the IRS website: https://www.irs.gov/irm/part4/irm_04-026-013.html

4.26.13.3.1 (01-07-2016)

Identification of Potentially Structured Transactions in a Title 26 Form 8300 Examination

The preplan for a Title 26 Form 8300 examination must include steps to identify transactions which may have been structured to avoid the reporting requirements of 26 USC 6050I.

Whether a transaction is structured is determined by the definition of “cash” received. The regulations (see 26 CFR 1.6050I-1(c)) define cash to include monetary instruments (such as cashier’s checks, bank drafts, traveler’s checks, or money orders) having a face value of not more than $10,000 when received in a designated reporting transaction (see IRM 4.26.10 and section 1.6050I-1(c)(1)(B)(1)), or when received in any transaction in which the recipient knows the instrument is being used to avoid reporting of the transaction under section 6050I (section 1.6050I-1(c)(1)(B)(2)).

Financial Institutions consider MOs as cash. Anyone not 100% sure of what they are doing should avoid this part of the process. Its deep water

Relax. I deposit $100 K of MO’s Monthly. Totally legal

Thank you for writing this and getting the word out! I was shocked yesterday to find out how many people (much less bloggers) are unfamiliar with structuring.

Very insightful…. Wanted to know your thoughts on the difference between MO deposits and Bill pay with MO at a branch…

I still think it is probably subject to the same requirements, but I am not a lawyer. If I had any doubt then I would do everything I can not to structure.

Agree. But if you are doing Bill pay and if the CC balance is $5500 and other CC for $3000 and if both of the CCs are paid on different dates or the same date. I get the msg that this could get us in serious trouble and we need to find another safer way to MS.

^^^ this…. what if we used MO to pay credit cards at the branch?

Ask your attorney?!?

This looks unusual/suspicious IMO. Most people with Credit Cards pay their bills from a checking account.