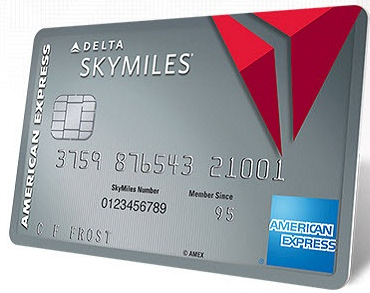

My Amex Platinum Delta Skymiles Retention Offer

I wanted to share my recent American Express Platinum Delta Skymiles Retention offer results from earlier this week. As you may remember, I am currently trying to purge myself of unused credit cards. There are two reasons for this:

- I am trying to simplify my life some, especially if something unfortunate should happen.

- I am trying to increase my chances for future approval.

The annual fee just posted on my American Express Platinum Delta Skymiles card and I have been wanting to free up an Amex card slot. I am currently holding their maximum of 5 cards (4 for some people) and unable to get any new cards from American Express.

Did I Keep or Cancel It?

I almost did the closure via chat since I didn’t expect much of an offer. My wife cancelled this card a few months back and did not get an offer of any kind. But then I remembered my horror story from last time I tried using chat to close a card. Plus I wanted to see if I could get anything good.

I also didn’t think they would offer a retention offer since the card comes with some nice perks, the ability to earn status through spend and a yearly companion certificate. Since I don’t care much about status and the companion certificate isn’t all it is cracked up to be this card isn’t a great long term fit for me. Outside of the initial bonus spend I only used this card for Amex Offers.

American Express offered me the following retention offer:

- A $75 credit after $2000 in spend.

That is a decent offer that offsets a nice chunk of the $195 annual fee but I passed on it anyway. The agent also offered to downgrade me to the Delta Blue Skymiles card but freeing up the Amex credit card slot was what I was really after.

If you plan on keeping this card long term it still may be worth calling to see if you can get the same offer. If it had been 7,500 Skymiles I may have been a little more tempted.

Conclusion

Even though I decided not to take American Express up on their retention offer it is good to see them giving out something on the Delta Skymiles Platinum card. I know a lot of people out there keep this card in their wallet for the additional MQM’s and MQD waiver. I would suggest calling in even if you have no intention of canceling just to see if you can get something similar.

Hey Mark q?, Why is 7.5k sky miles more valuable than $75 isn’t it the same thing?

Most people value airline miles at more than 1 cent a piece. I would value 7500 miles at $100 or more.

I’m calling back to take the 10k!

Nice!

I was offered either 10k miles or $75 credit with $2k spend.

10K in miles is a pretty solid offer…did you take it?

Possibly. I was somewhat bluffing only because I have 6 AU cards all loaded with the Lowes, Staples, & Exxon offers…. Can’t cancel yet!

Haha definitely not yet!

I’ve had the card 8 years and put about 50k+ spend on it per year. I was told to go pound sand.

It is so strange that they will offer something to people who rarely use it but nothing to people they are actually making money on. Maybe their algorithm thinks you’re bluffing or something.

Got 40k Skymiles. I was shocked, but I was pretty adamant that I was closing card.

Say what? I am very jealous right now.

That’s insane – more than covers the AF twice over – you sure it wasn’t the DL Reserve you’re talking about?

I’m 100% sure!

I was offered 10,000 SkyMiles after $2000 in spend – I took the offer lol!

I would have taken it too :). May have downgraded to a Gold or Blue card after a few months too to get a prorated refund….shhhhh did I say that out loud?

can you please explain what is a prorated refund? im actually planning to convert my platinum into delta blue card as my fee will post anytime now

You wouldn’t get one since you went the whole year with the Platinum card. But if you paid the annual fee and then three months later downgraded they would give you the difference in the annual fee between the two cards averaged out over the next 9 months (since 3 months were already used).