The 2022 Points and Travel Changes on My Christmas Wish List

As we close in on the end of the year, it’s safe to say points and travel hobbyists have experienced another busy and lucrative one. I could’ve (and probably have) said something similar in previous years. I described the developments I was most grateful for around Thanksgiving time. I’m shamelessly going to the seasonal-themed well one more time today. I haven’t put much effort into making wish lists in years, so a points and travel-related one is a fun way to return to the process. These are the top points and travel changes I’d like to see in 2022.

Chase Pay Yourself Back Closure

As most are aware, Chase unveiled the Pay Yourself Back feature on their flagship cards in mid 2020. Since then, certain cardholders have received 25% or 50% extra value (over the usual 1 cent per point cashout rate) by redeeming points to cover charges from some merchant categories. You can read more here about the current categories.

Since its inception, Chase has periodically changed the Pay Yourself Back-eligible categories. Importantly, each change came with an expiration date for those categories. Sure, Chase has extended those dates here and there, but the program is still technically temporary. Chase has never officially announced Pay Yourself Back as a permanent feature.

Chase, give me some closure. Either announce that Pay Yourself Back is permanent, or tell me when it will ultimately end. Without that, I’m ultimately left a bit off balance by Chase. Perhaps this is exactly what Chase wants. If they keep it in flux, the wife and I will keep doing this and that.

Amex Makes Good on Long-Awaited Bonvoy Brilliant Changes

We’ve heard rumors about upcoming changes to the Marriott Bonvoy Brilliant Amex card for months. Most importantly, we’ve heard of an annual fee spike somewhere in the realm of ~$700 per year. Much has been flying around about the potential tweaks to the card to justify the annual fee. And maybe we could see a juicy welcome offer to lessen the blow of the new annual fee! Whatever the changes are, I hope they don’t disappoint. I’ve spent years out of the Marriott game, until I couldn’t help but return recently. My Amex credit card options are increasingly dwindling, since I’ve had most all of their products. The Brilliant is one I haven’t held, and I hope they make it worth the trouble at a sky-high annual fee.

Hotels Introduce More On-Property Redemption Options

As I’ve described plenty, I don’t bother much with elite status these days. I’d rather maximize my travel freedom without being unnecessarily swayed by elite status. Therefore, I don’t end up with the nice comps many of the elites obtain. Overall, I’m fine with that trade to keep my freedom. That said, I’d enjoy the option to redeem points on-property for certain perks. I’d like the option to use points to cover stuff like:

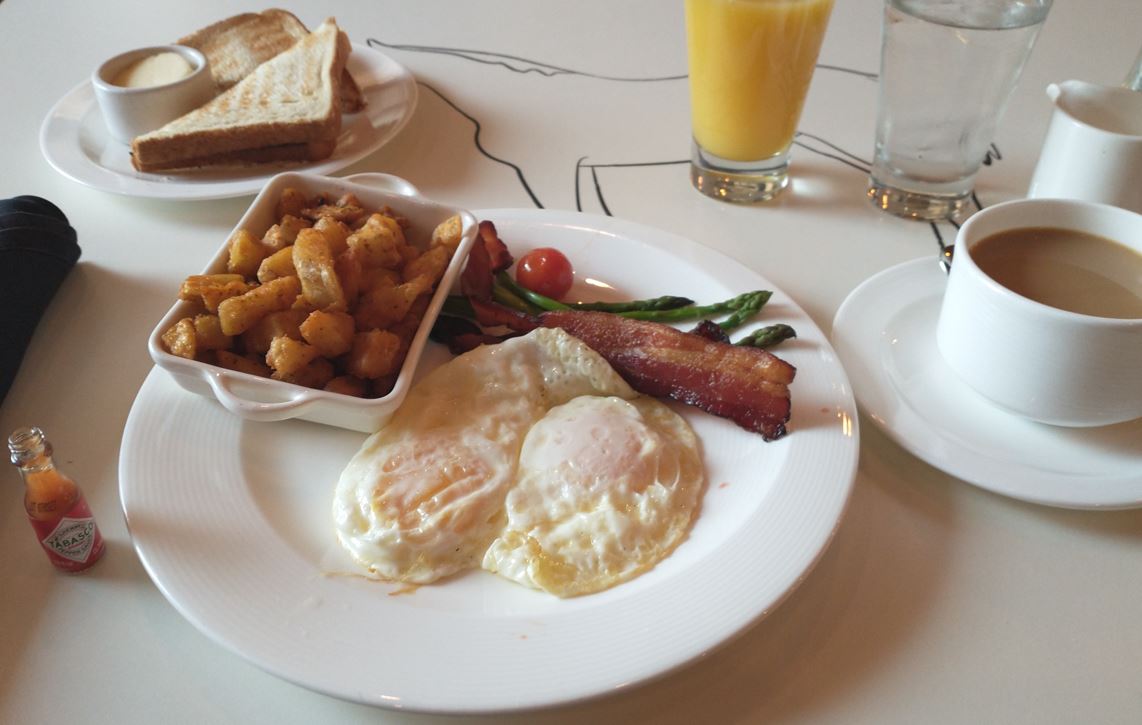

- Meals at hotel restaurants

- Parking

- More suite upgrade flexibility

- Confirmed early check-in/late checkout

Inevitably, I would imagine hotels providing a lame redemption value for such options. Regardless, I’d like to see more creativity from the chains here.

Hotel Chains Consolidate Brands

In recent years, hotel chains have been in an obvious arms race to acquire more properties and brands. I’ve given up on trying to delineate between many. Here are the brand totals as of this writing:

- Marriott: 30

- IHG: 16

- Hilton: 18

- Wyndham: 22

- Hyatt: 19

Of course, I know certain brands can’t be unnaturally placed together. But surely, chains could simplify a bit. Perhaps this would only come if or when they can realize a cost savings by doing so. I know many out there love all the variety. This one is probably the most selfish wish I have this year.

Amex Pushes the Envelope Even More

My favorite card issuer has been so giving for years. Amex has routinely energized how we’ve earned points, miles, and other benefits. Just a few examples: their industry-best referral program, Amex Offers, welcome offers’ flexible terms, pandemic era benefits, frequent bonus points earning plays, generous retention offers, and card refreshes. Sure, some tweaks come along with increased annual fees, eventually. Those Platinum fee hikes are certainly polarizing to many.

I wish for Amex to continue creatively engaging their customer base. From my perspective, even with the negatives, active hobbyists have come out way ahead with Amex. What will they do next? I’m excited to find out.

Conclusion

Ultimately, I’ll be pleasantly surprised if even one of my wished-for points and travel changes comes true. However, I’ll more likely get hit sideways by completely unrelated points and miles changes in 2022. But hey, that’s just another aspect of what makes our hobby so exciting. Many of us enjoy the unpredictable changes that come down and subsequently figuring out how to leverage the most out of them. We’ve had many successes in 2021, and I’m enthusiastic for what 2022 will bring. What points and miles changes do you wish for the coming year?

Reboot the Citi Prestige…with insurances.

That’s a good one for sure.

Crash_Log,

You nailed another one!

They might even be able to get away with their strange magnetic stripe placement these days too! I hated having cashiers and servers bring my card back and telling me it was either declined or not working haha

One thing I wish for is all the incremental credits to be combined in to one annual credit that one can chip away at rather than playing the monthly spend game.

My biggest wish is that Amex and Chase allow product changes as freely as Citi does. I would love to swap my Ritz card for Hyatt since I already have the CSR and Bonvoy Brilliant.

While im at it, I’d really like it if cards posted points in real-time like CapOne does. Amex already does this if one has a +4 referral bonus so why can’t they do this all the time for all transactions.

Wishful thinking I’m sure…

2808 Heavy,

I agree with that first wish. But if they made it that easy, they’d probably decrease the value along with it, as well. Maybe you’d be okay with that. I also agree on the PC’ing wish, but I’d rather Barclays be more flexible there. Thanks for reading!

This RC card is very valuable and of no comparison to any Hyatt card. Just apply for a Hyatt in addition and also an IHG

I’m LOL/24 and won’t be under anytime soon otherwise I would.

Nice list. Here is my wish list (in order of importance):

1. Boarding Area does away with the pop up video ads (yes they suck that much).

2. My AA Simplymiles from the recent promo post on January 2nd 2022 and trigger Concierge Key elite level 🙂

3. American Airlines doesn’t Devalue further in 2022.

4. Chase offers the $120 and $60 Peloton benefit on CSR/CSP again in 2022.

5. Amex personal platinum adds the Dell credit like they have on the business version.

DaninMCI,

Bravo on your wide-ranging list. For #1, you don’t have to worry about that with MtM. 😉 For #2 and #3, I’m not sure both of those can come true. For #4, I’m impressed you apparently have used this credit. And finally for #5, I guess you don’t have problems getting orders through with Dell (neither do I). I appreciate you chiming in!