| Miles to Memories does not have a direct relationship with the card issuing bank(s) and this post does not include any affiliate links. If you wish to support the site by applying for credit cards or using other referral links, you can do so here. Before applying I highly suggest reading the following posts: Slow & Steady Doesn't Make You A Loser and A Mandatory Waiting Period to Apply for Credit Cards?. You can find all of our credit card reviews here. |

|---|

Chase Sapphire Preferred 55K Offer

The Chase Sapphire Preferred card is one that is on everyone’s minds. Some people think it is the best card in the world, while others don’t quite see it that way. No matter what your thoughts are on it, most everyone agrees that the bonus is generally worth getting. Thankfully Chase has just increased it by 10K points!

The Offer

Last week Frequent Miler wrote that the Sapphire Preferred would be increasing to 55K sometime soon. Then this morning he informed me it had happened and I was able to locate a direct link. Let’s look at the offer in more detail.

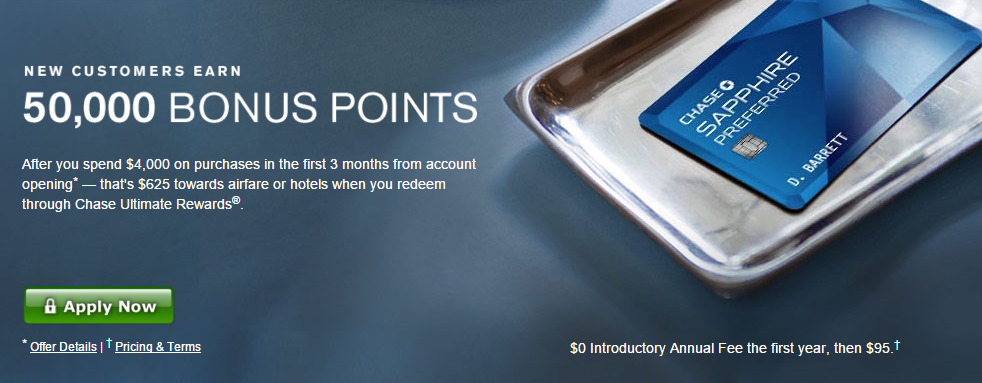

Earn 50,000 bonus points after you spend $4,000 on purchase in the first 3 months from account opening* – that’s $625 towards airfare or hotels when you redeem through Chase Ultimate Rewards®.

Earn 5,000 bonus points after you add the first authorized user and make a purchase in the first 3 months from account opening.*

Update: This is now also available via our referral links. I will still leave the direct link below. If you want to support the site by applying for cards, you can find more info here.

Useful Benefits

The Sapphire Preferred really is a useful card for many. Here are some of the key features in my mind:

- 2X on travel and dining.

- Unlocks the ability to transfer to travel partners.

- Primary rental car insurance.

Things to Think About

In my review of the card, I said it was a great card to get, but not necessarily a good card to keep. This still holds true in my mind. 55K Ultimate Rewards points are incredibly valuable, however after the first year I would probably (and have in the past) downgrade the card to a Freedom for the rotating 5X categories.

In my mind there are two main reasons you might want to keep it past the first year:

- If you don’t have a Chase Ink Plus which also allows transfer to travel partners.

- If you rent cars often and want to use the primary auto insurance.

Now that the ThankYou Premier offers 3X on travel, I find myself using that card more often and while the 2X on dining is nice, it can be had elsewhere. Like I said, this is a good card to get, but not necessarily one to keep after the first year since it can be downgraded to a no annual fee Freedom.

Churner Warning

There have been numerous reports over the past several months of Chase tightening their restrictions on credit card churners. Many people have been denied because they had opened more than 5 new cards across all banks during the previous 24 months. It isn’t evident if this is a hard rule and I do know of several recent examples of Ink card approvals for people who had more than 5 new cards. Either way, use caution when applying.

Conclusion

This is a great offer and 55,000 Ultimate Rewards points are incredibly valuable for travel. If you don’t have a lot of applications, then this may be an offer to consider since the normal bonus is only 45,000. With that said, don’t rush in and make sure it fits in with your overall plans. 10,000 extra points are nice, but they aren’t worth screwing up your entire strategy over.

Thanks Shawn….Do you know how long this offer will be available ?

I don’t see an expiration date on the page. Normally offers like this run a few weeks, but I can’t tell you for sure.

I’ve only had 3 inquiries under my own SS # in the past 2 years, however I just tried applying and got denied. The rep said I had 29 accounts open in the last 2 years. I’m an authorized user on my parents’ credit cards. So I’m guessing all those A.U.s count in Chase’s no-more-than-5-accounts-open-in-the-last-2-years rule…=\

Call them back and explain they are AU accounts and they should reconsider you.

I did do that, I told her they’re all AUs but she wouldn’t listen, she said something about how they look at the “debt to credit ratio” and even though they can’t see how much debt I have (which is none!) the 29 accounts is a high risk for them.

HUCA