This is a guest post from our friend, Derrick Dye, of Travel on Point(s). A while back I had shared the idea of using the sale of your house as a way to manufacture points. Well, Derrick ended up doing it in the real world instead of just thinking about it. And, with the help of PayPal Key, he was able to do better than I ever imagined. This is a good reminder to look for the cracks out there and think outside the box!

When Selling Your House Turns Into A Point Manufacturing Machine

As I shared last week, we recently used points and miles to offset the costs in preparing our home for sale. We cashed out 600,000 Amex Membership Rewards to my Charles Schwab account for $7,500. In part due to the upgrades we completed, our house went under contract in three weeks and we are scheduled to finalize the sale very soon. But for every opportunity to spend points, there’s an opportunity to earn points. After formulating a plan, I realized selling our home was a points manufacturing machine! How? PayPal Key and Plastiq.

What is PayPal Key?

PayPal Key (PPK) is a virtual Mastercard debit card that allows you to pay online or over the phone at any merchant that accepts Mastercard. On the PayPal side of things, you can link your PPK to any form of payment you desire. For all of us points and miles enthusiasts, this means we can use a credit card to pay anywhere Mastercard debit cards are accepted.

What is Plastiq?

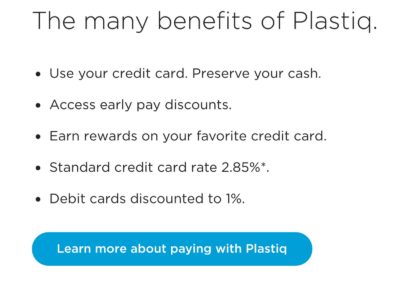

Plastiq is an online bill payment service. You can pay with a debit or credit card and Plastiq mails (or electronically transfers) a check to almost any business. Currently, Plastiq charges 2.85% to use a credit card for payment, but only 1% for a debit card. Plastiq accepts American Express (only select merchants), Discover, Mastercard (including mortgage companies), and Visa. If you have not signed up for Plastiq, you can use our referral code:607465. You will earn $1,000 fee-free dollars to pay your mortgage, car payment, student loans, another business, etc.

The Plan

Once our current home was under contract, we learned our expected closing date. In just 4 short weeks, our house would be sold. As part of the sale, our existing mortgage is paid off and we receive all remaining monies. I quickly decided to aggressively pay off our mortgage using PayPal Key on Plastiq. Since PPK is a debit card, it was only a 1% fee (see below for current status of PPK for Plastiq).

With only 4 weeks to prepare, I had to limited time to execute the plan. I figured payments must arrive at least 5 days in advance of closing (to avoid any delays or miscalculations during closing) and there was a 4 day lead time for the first payment to arrive. Essentially, I had 19 days to pay off as much as possible.

When PPK first arrived earlier this year, the daily limit was $10,000. Sometime in September, the daily limit was quietly scaled back to $3,000 or less, before changing again to approximately $5,000. Users began seeing different transaction limits and experiences. While I was able to make payments of $5,000, only 1 PPK transaction would process per day, regardless of the amount. Therefore, I decided I was paying $95,000 towards our mortgage in 19 days, by paying $5,000 per day.

While almost all credit cards are worthwhile for the 1% fee, I considered these cards to be the best returns (in no particular order):

- American Express Blue Business Plus: earn 2x Membership Rewards on all spend up to $50,000/year, for a cost of 0.5 cents per MR.

- Citi Double Cash: earn 2% cash back (or 2 Thank You Points if you hold a Premier or Prestige), for a 1% profit or 0.5 cents per TYP.

- Chase Freedom Unlimited: earn 1.5x Ultimate Rewards on all spend, for a cost of 0.667 cents per UR.

- Chase Freedom Flex: earn 5x Ultimate Rewards at PayPal, up to $1,500 per card in Q4.

- Capital One Venture: earn 2x miles on all spend, for a 1% profit when redeemed for travel or restaurants through 4/30/21.

- Chase Ink Unlimited: earn 1.5x Ultimate Rewards on all spend, for a cost of 0.667 cents per UR.

Additionally, cards that I don’t have, but others could have utilized in a similar way:

- Alliant Visa Signature: 2.5% cash back, for a 1.5% profit.

- Bank of America Premium Rewards: up to 2.85% cash back (with Platinum Honors status), for up to a 1.85% profit.

The Execution

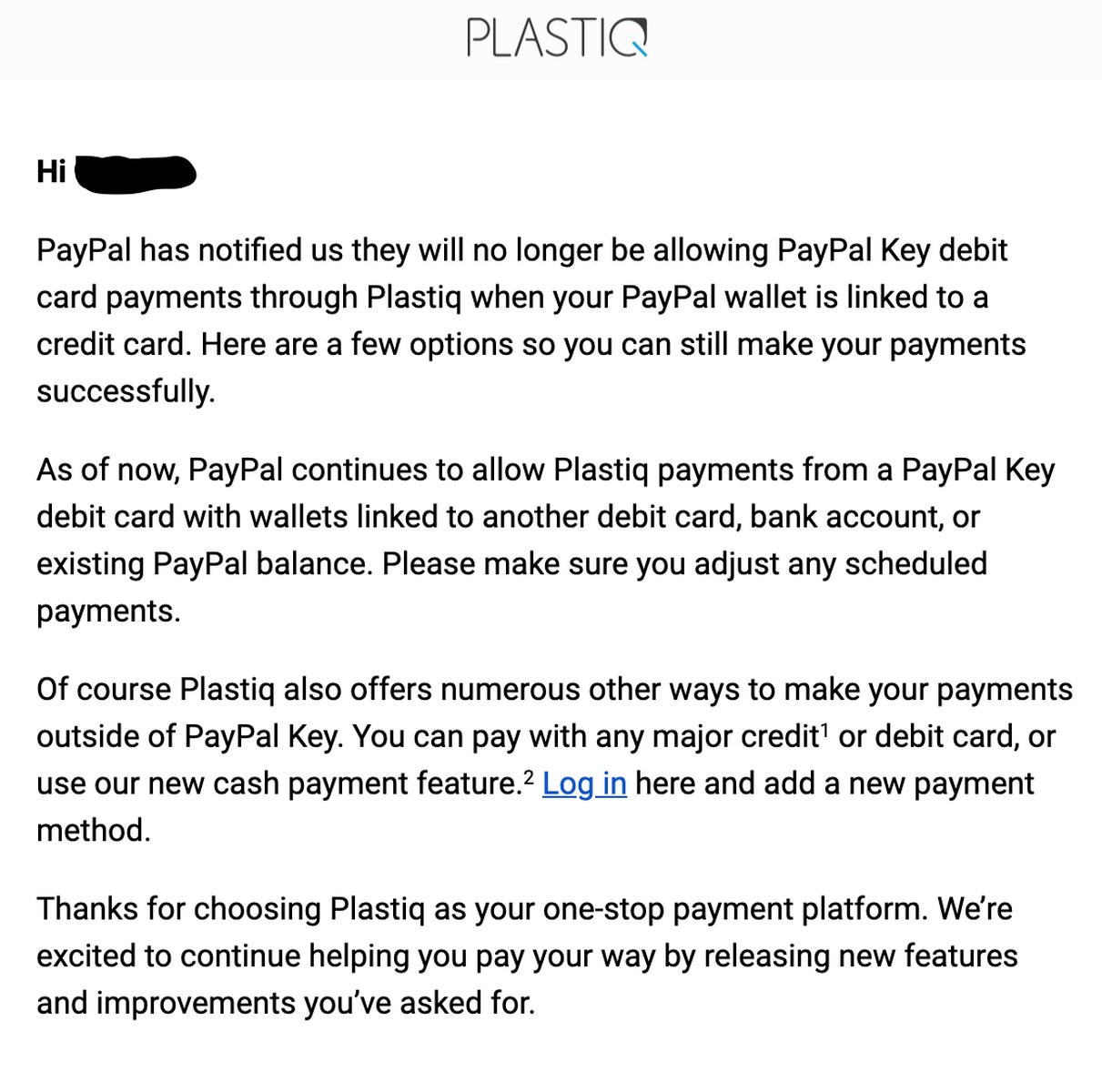

Day after day, I made mortgage payments hovering around $5,000 each. I maxed out a Double Cash, converted a Citi AAdvantage Platinum to a second Double Cash and maxed it out, finished maxing out the $50,000 annual spend cap on a Blue Business Plus, and then starting hitting my Venture card. Unfortunately, my plan was never finished. Less than two weeks in, PayPal Key suddenly stopped working for Plastiq. Whomp, whomp, whomp.

Final Calculations

Overall, employing this plan, I earned 44,000 Membership Rewards on a Blue Business Plus, 77,496 ThankYou Points on a Citi Double Cash (or $774.96), and 28,213 Capital One Venture miles.

While I wish I could have finished the plan, I am quite happy with these returns in less than 2 weeks. Assuming I cash out my Membership Rewards with a Platinum for Charles Schwab, cash out my Thankyou Points as cash, and redeem my Venture miles for restaurants or travel, I earned rewards worth $1,607.09, in just a few days.

Our home remains scheduled for closing very soon and I will not pay a single penny of interest on these charges.

Potential Risk

I should note there are potential risks with this play or other ideas like this. If my house doesn’t close on time or if the deal falls through etc. I would need to be able to cover the credit card bills. If you get involved with a plan like this be sure to only go as deep, or hard, as you can afford to. While I don’t plan on any issues arising I was ready and made my decisions based on the chance that there may be problems. As you should with everything that you do.

Conclusion

As always, there are lessons to learn after any loophole closes. Should I have paid off our mortgage while the home was on the market? Probably. This was a massive money-maker, so I should have realized the value and begun paying off the mortgage while our home was listed for sale. Oh well. More importantly, this is a reminder that when valuable play appears, do your research and analysis, but do not wait too long. Very few lucrative plays last long. If it works today, there’s a great chance it is gone tomorrow.

Did you utilize PayPal Key via Plastiq? Let us know in the comments below or come join our Facebook group to discuss.

Note From Mark

I just wanted to thank Derrick again for putting this together for us. Be sure to check out his website, Travel on Point(s), and his Facebook Group with over 4,000 members.

[…] I discussed in both Travel on Point(s) and at our friends at Miles to Memories, Sarah and I aggressively earned American Express Membership Rewards in 2020 and successfully sold […]

[…] and fall significantly boosted our earning capabilities. Then came PayPal Key, selling our house, paying off our mortgage, and the rest is history. 2020 was a gold mine for earning boat loads of points and miles! We may […]

I’m a little confused. Say I pay $50000 on one of these cards. So then, I pay a 1% fee? So if i pay $50000, it costs me $500…… but I get back more than that, depending on which card I use?

Yup – if you used a simple 2% cash back card like the DoubleCash you would get $1000 back on that spend. So a $500 profit. Could be more if it is a card with a welcome offer etc.

There was technically no need to send it to pay your mortgage. Plastiq has a few banks that you can pay a “loan” but the deposit actually goes to your checking or savings account with no loan being necessary

Ran about $400K through this between September and when it died.

Remember even if something is said to be “dead”, always be testing and confirming for yourself.

What if I told you it was still alive…? 😉

Is there any other way to use the Paypal key to generate points on a credit card?

Post-closing, think paying capital gains taxes. I earned 5k from the spread when I paid my taxes on my house sale.

Well done!

It seems like PayPal has shut down most (all?) of them at the same time. I will still use it for sites that don’t take Amex if Amex is the best option etc.

Hopefully you did not pay taxes on a primary home sale? Unless of course you made over $250k single or $500k joint. I assume your referring to paying taxes on the sale of a rental home. Thats what im in the process now trying to figure out taxes on my rental home to include all of the deprecation tax deduction taken over the years.

You understand that someone has to pay the credit card fees if you are paying with a credit card, right? If you aren’t paying them, someone else is. In this case it sounds like PayPal was eating the cost. This is not sustainable for them and it’s no wonder they shut this down.

I don’t think anyone expected it to last for a very long time.

I also just tried the same type of plan with BlueBird as I was using BB to make payments for year but my last payment was a mistake. I sent in $5k BB 2 days before closing as I was not aware they would wire money to my mortgage same day and also though big deal if they did my BB payment would arrive soon after give me a negative mortgage balance which I can have the bank cut me a check, nope! Its been 3 weeks and im still trying to track down the BB check. The $5k was removed from my BB account, when I called the mortgage they said as the account is closed they would not accept the check and would mail it to me. So far after 3 weeks still no check and my plan tomorrow was to call BB find out how to put a stop payment on the check to hopefully recover the $5k.

Im selling another home around Feb I think ill still try it again just have to be more careful with timing and when to cut it off.

Yeah my guess is the check would get sent back to Bluebird and then they will have to redeposit it into your account but just a guess on my part. Sucks for sure but it will work out at some point.

At least you know what not to do for the next sale in February :). Hope it sells quickly Mike.

US Bank informed today they will be mailing the BB check to me, which may still be a win if im able to cash it myself although my other bank may reject the check of its made out to US Bank. For the next home sale I will start the paying off process earlier before the mortgage account is actually paid & closed. Unlike CC they do not accept overpayment or a negative mortgage balance. Next time ill use the combo punch approach to hit it hard between BB, Paypal Key and Vanilla.

Have to think out of the box even more now for yearly spend since Walmart MOs are shut down.

Exactly, gotta keep innovating as things get axed.

I did something similar years ago. Bought a ‘ton’ of Vanilla Reload cards and prepaid into mortgage a few weeks before closing sale of my house. Ahhh, the good old days.

Vanilla reloads for the win!!! Nice work Mark 🙂