Quick Take: SoFi is a great money management tool/account with decent interest rates and a very lucrative and simple $50 sign-up bonus offer. Bonus has been increased to $75 on 03-01-20.

SoFi Money Review, Overview & An Easy $50 Sign Up Bonus!

I wrote an article a few months ago that said the Charles Schwab Debit Card is the ONE card everyone should get. That was because the card refunds any and all ATM fees across the globe. But there is one big downside to the Charles Schwab card, it comes with a hard pull. Enter in SoFi Money, a card that refunds all ATM fees worldwide but without a hard pull. Not only that but it gives you an pretty great interest rate on your money for a checking account. In my SoFi Money review I will take a look at the program, the bonus and compare it to the Charles Schwab card.

SoFi Has reduced their APR interest rate to 1.1% after the Fed dropped the rate by .5% on 3/3/20.

SoFi Money Program Overview

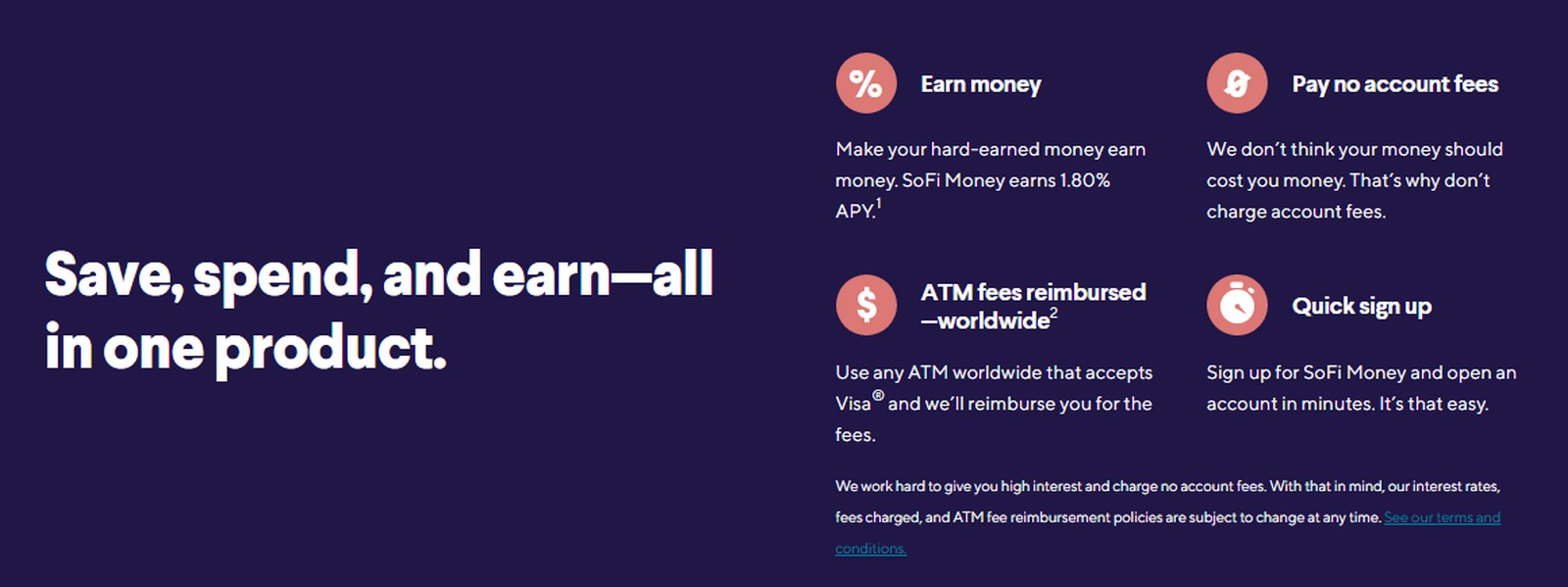

Your SoFi Money is a completely fee free set up. There are no account minimums, no monthly deposit requirements and no fees to take your money out! Here is a breakdown of the program’s perks:

- Earn 1.1% APY (updated 3/3/20) on your account balance. This rate moves as interest rates move. It was up to 2.25% a month or so ago.

- No minimum balance required to unlock the interest rate.

- No account fees.

- ATM fees reimbursed worldwide. As long as there is the ATM is displaying the Visa®, Plus®, or NYCE® logo.

- No foreign transaction fees. There is a 1% foreign exchange fee though (there are a few comments on Facebook and on the article that lead me to believe that Schwab has this fee as well since it is from Visa).

- The cash balance in SoFi Money accounts is swept to one or more program banks where it earns a variable rate of interest and is eligible for FDIC insurance. FDIC Insurance does not immediately apply. Coverage begins when funds arrive at a partner bank. There are currently six banks available to accept these deposits, making customers eligible for up to $1,500,000 of FDIC insurance (six banks, $250,000 per bank).

- There is a ATM withdraw limit of $615 per day but there is no ACH money transfer limit that I know of.

Sofi $50 ($75) Bonus Offer – Sign Up

SoFi Money Bonus

This is probably the easiest bonus I have ever done and it pays out quicker than pretty much any other bonus. The current offer is available via referral only and it is as follows:

- Get

$50($75) bonus after signing up and making 2 direct deposits of $500 of more. - The

$50($75) bonus is awarded the day after you make the deposit. Yes it is that quick! - Link to Offer

$50($75) Bonus Offer

Signing up for the account took me under 2 minutes. I was able to log into my bank account so they could pull my account info and make the first deposit. My bonus was waiting in my account the next day. The whole thing is pretty slick and the mobile app is pretty easy to use.

SoFi Money vs Charles Schwab Debit Card

Let’s take a look at the two heavy hitters! I think SoFi has a few things going for it versus the Charles Schwab debit card. First and foremost it earns a very respectable interest rate that beats many online savings accounts these days. It also doesn’t require a hard pull like the Charles Schwab card does. The ATM fees are refunded within a few days versus the end of the month like with the Charles Schwab card. This is the perfect option if you are trying to keep your hard inquiries down.

The Charles Schwab card wins in a few different categories too. First of all it opens the door to the Charles Schwab Amex Platinum card and that 60,000 point offer. It has a higher bonus at $100 but it is more difficult to earn versus SoFi (but not very difficult). Lastly, the Charles Schwab doesn’t charge the 1% foreign exchange fee. It appears they may have this same Visa fee.

I plan on carrying both cards. The SoFi account will be my go to everyday checking account that I keep the bulk of my money in. The Charles Schwab will be used strictly as my international travel ATM card to avoid the 1% fee. But if I was looking to avoid the hard pull (or didn’t already have the Schwab card) I wouldn’t have a problem using the SoFi Money card everywhere. Since I have both I will use them where they both make the most sense.

Sofi $75 Bonus Offer – Sign Up

Final Thoughts

I hope my SoFi Money review showed you all of the great perks of having one of their accounts. It is a pretty great set up and the fact that there is no hard pull makes it a viable alternative to the Charles Schwab card. Not to mention the quick and easy bonus plus the amazing 1.6% APY earning rate. All of that for no minimums, account fees or ATM fees…that is hard to beat!

Clicking the offer results in a page saying the invite link has expired. Are they still having an introductory deal?

We updated the link. The offer is only $25 now and has been for a little while.

Newbie question here. What does the bank consider as a “direct deposit”? I always thought of it as my employer putting my pay directly into my account. As a new retiree I don’t have that option but I do have several banks that I could pull money from. Would that be considered a “transfer” instead?

Sometimes doing a push from another bank does trigger it. Since it is such a new account we don’t have a lot of data points on if that works or not.

Hi Mark, have you ever compared the Fidelity cash management debit card with Charles Schwab’s? They sound very similar, except I know for certain fidelity refunds the ATM fee immediately.

I have not – I will have to check out Fidelity. Thanks for the tip Marcus

I signed up for the Sofi checking offer on Nov 18th and was approved. I recently checked my credit reports through crediwise and credit karma and they both show a hard inquiry on that day from both equifax and transunion.

Institution Information:

Cic Credit

GOODLETTSVILLE, TN

37072

(615) 386-2282

None of the other soft pulls that have been done to my credit over the past 2 years shows up on these reports. Any idea why these are showing up as hard inquiries if Sofi supposedly only does a soft pull?

This is the first I have heard of anyone having a pull show up. CIC does Trimerge reports (merging the three bureaus together). These are normally done for mortgage loans, but can be used for other purposes. Are you sure there isn’t some other potential cause of it? If not, I don’t know. All of us have signed up and so have many many readers and no one else has reported a hard pull.

I looked into it further and it was for a payment processing app. It was just a coincidence that it was around the same time as the Sofi app. Sorry for the confusion.

Schwab does not have a 1% fee. I’ve used my Schwab cars multiple times in Japan and Canada with no fees.

Schwab’s foreign fees are 0%.

I can tell you that SoFi and Schwab have the same transaction amounts so I am not sure if they both eat the fee or if they both charge it but they are the same.

Hi Mark,

Thanks for the informative write ups. Used your link for the singing up. Then the referral said Mark now it says Kirsten. I did a screenshot in case I did not get the $50. Whole process took about 3 weeks because of a fraud alert I have with credit agencies.

I set this up as a foreign travel debit card. Talking to a SoFi rep he said even if you use the card at a Casino where you ma hu get hit with a $12 transaction fee, it gets refunded!

Thanks

Awesome and thank you for using our link! That has been my experience that pretty much any ATM fee has been refunded immediately so far. Pretty awesome!

Hopefully everything goes smoothly now but let me know if you have any issues with the bonus.

I signed up using your referral link!

Now when I look at my own referral, it says:

Invite friends to apply for a SoFi Personal Loan or Student Loan Refi with your personal referral link.

Does it mean I only get referral when people sign up with a loan using my referral link?

Thanks for using our link – much appreciated!

You need to go into the SoFi app on your phone to get the money and invest referrals. Let me know if you have any issues.

Mark,

are we certain that sofi didn’t do a hard pull? tried to sign up & got this error msg:

Sorry, we aren’t able to open your account at this time.

Unfortunately, we couldn’t open your account, because your credit file is frozen at Experian. Please unfreeze your credit file, wait one hour, and re-apply. We’ve sent you an email with more information.

shoot, the deadline for a sign up bonus was yesterday, right? missed out…

They do a soft pull credit check but no hard pull. The bonus on the Money account is still good and the investment bonus has actually been extended too (the one that was ending).

ok Mark, will try again using ya’ll link. thx

Appreciate it Dan – let me know if there are any more issues!

[…] from Miles to Memories wrote about Sofi Debit Card a few weeks ago and I let it slip through my reading because frankly I […]

Where are the complete directions for signing up for this? Including getting the app and all because I know you have to have that as well, right?

You don’t need to have the app to sign up but to produce referrals for others you need to download the app. I like the app so even if you aren’t referring people I think it is worth downloading.

Thanks!

You inspired my post today 😉

https://milestomemories.boardingarea.com/how-to-create-sofi-money-referrals/

Does anyone know how old one needs to be to open a SoFi account?

From what I have heard it is 18 or older

I signed up using your link. Thank you.

Awesome – thank you very much Alex! Now go get those referrals 🙂

How long do you have to keep this account open?

I haven’t seen anything in the terms that gives any type of time frame so I think you could close it right away if you wanted. I would keep it open even if you just pulled the money out. It could be useful in the future or on your next trip.

Sounds good. Thanks!

Any time!

Mark, I assume they still do a soft pull? Any idea which bureau? All 3 of mine are frozen. Thanks!

Soft pull – I would guess it is just a Chex pull but I am not sure on that.

[…] The SoFi Money account is a brokerage account. Neither SoFi nor its affiliates is a bank (note that according to Miles to Memories, your money is periodically deposited into FDIC-insured banks and may therefore be eligible for […]

Funded account on 10/3/19, signed up through your link, no bonus yet, contacted Sofi:

Congrats on your new SoFi Money account! We are happy to look into this bonus for you? Did you use a referral link to apply for the account? If so what is the name and email address for that person. I am sorry the bonus wasn’t added automatically. We will look into this for you once we get some more info. The bonus can take up to 7-10 business days to receive.

So I need your email address, you can send to me directly if you don’t want to post it here.

Sorry to hear that Roy. Should be from Shawn@milestomemories.com

What is the daily limit on atm withdrawal at Schwab? $615 doesn’t seem like much if you’re in a foreign country and a real bind.

The Schwab account was supposed to give me $100 after depositing $1,000 but I never deposited a cent and still got the $100.

Schwab is $1000 a day I believe

Mark, if I open up a Sofi checking account then can I deposit money orders in there via ATM? They don’t have any branches where I can go in and deposit MO.

They only have mobile deposit and no money orders. You would have to deposit them into a credit union acct etc. and then transfer the money over to SoFi if you wanted to use it to earn some interest before paying bills etc.

Schwab no hard pull if you opt out of margin trading on the application.

I think it still happens more often than not. I still got a HP on mine.

Here is a thread that says it still shows up a few days later.

https://www.reddit.com/r/churning/comments/6u98hd/comment/dlzbgnm

BElieve I signed up thru your link but, not sure. Haven’t verified transfer account as yet and just called them and they won’t know if I used the correct link until 10 days after my $100 deposit doesn’t cause the $50 credit. Said I had to phone them with Shawn’s email address so they can apply the credit Appreciate the email address of Shawn which is the name on the referral page so I can get the credit if it doesn’t appear. Really like this website.

Thanks,

I think you should be fine. It may already be showing in your account. Let me know if it isn’t showing tomorrow though. Thanks for reading David!

Another feature I like on SoFi is their beta “vault” feature which lets you create a lot of sub accounts to store money for different purposes (e.g., emergency fund, wedding savings, house savings, etc). They aren’t actual separate accounts with different account numbers, and you can’t access them via an ATM, but it provides a logical separation that can be really handy.

I’m keeping the Schwab account if for no other reason than that my employer users them for distributing stock, and it’s handy to have a paired checking account for that (and a backup fee-free int’l card with some emergency funds in case I lose my SoFi debit card when traveling). But, moving my day-to-day banking to SoFi seems like a no-brainer.

One thing I haven’t really figured out – when I do a bill-pay on SoFi (like for rent) it doesn’t seem that it shows me anywhere that the check has been cashed. The funds are debited when the check is mailed, but it’s helpful to know that it was actually processed. My landlord (or their mail carrier) is very unreliable and I’d rather know sooner than later that there’s an issue.

That is interesting that the debit it when the check is mailed versus when it is cashed. I am surprised they do it that way.

Used my schwab card to get Pesos in Mexico and the exchange rate was better than at any exchange kiosk. Schwab reverses ATM fee pretty quickly, within a couple of days, not once a month.

I have a Schwab card and my ATM fees are reimbursed at the end of the month every month.

Was deciding between Schwab and SoFi. I was going to go Sofi but it looks like there was a recent switch from Visa to MasterCard which just killed Sofi for me as my only other debit card is a MasterCard which I’ve found way more difficult to use in off the beaten countries (around Africa, Central Asia, the Caucasus region etc.) where VISA ATMs dominate. So if your travels take you away from places that are more traditional, that should be another consideration.

Great point Kory – something to consider for sure.

The 1% foreign exchange fee is a deal breaker for me. I will stay with the Schwab card.

Someone commented in our Facebook Group that they did a withdraw with SoFi, Fidelity and Schwab and they all came out to the same amount which I found interesting. I haven’t done any tests yet but will give it a try the next time I am out of the country and see what happens.

SoFi says the 1% is a Visa fee, not a SoFi fee. When I signed up for the account a few months back I bugged Schwab on Twitter to try and answer whether they are also subject to the same Visa fee and they wouldn’t answer and said to call, which I didn’t bother doing. I suspect Schwab (actually Visa) was charging it all along, but if someone wants to call and confirm we’d know for sure! 😉

That is interesting Ben – I had suspected something like that when the person commented they all charged the same on her test.