Does It Make Sense For Me To Spend Towards Delta Status?

I shared a week or so ago why the Delta Reserve has been creeping up on the Amex Platinum for me. If the rumored changes roll around for the Amex Platinum then I am ditching it and keeping the Delta Reserve instead, probably will either way honestly. One of the perks of the Delta Reserve, and Platinum, card(s) is that you can earn valuable Medallion Qualifying Miles (MQMs) by hitting big spending goals each year. But maybe even more important, for me at least, is the possibility to earn the Medallion Qualification Dollars (MQD) waiver. You earn the waiver when you surpass $25,000 in spending on the card in a calendar year. Having said that, I am going back and forth if I want to do it this year or not. So I figured we could dig into it together and you can share your thoughts below.

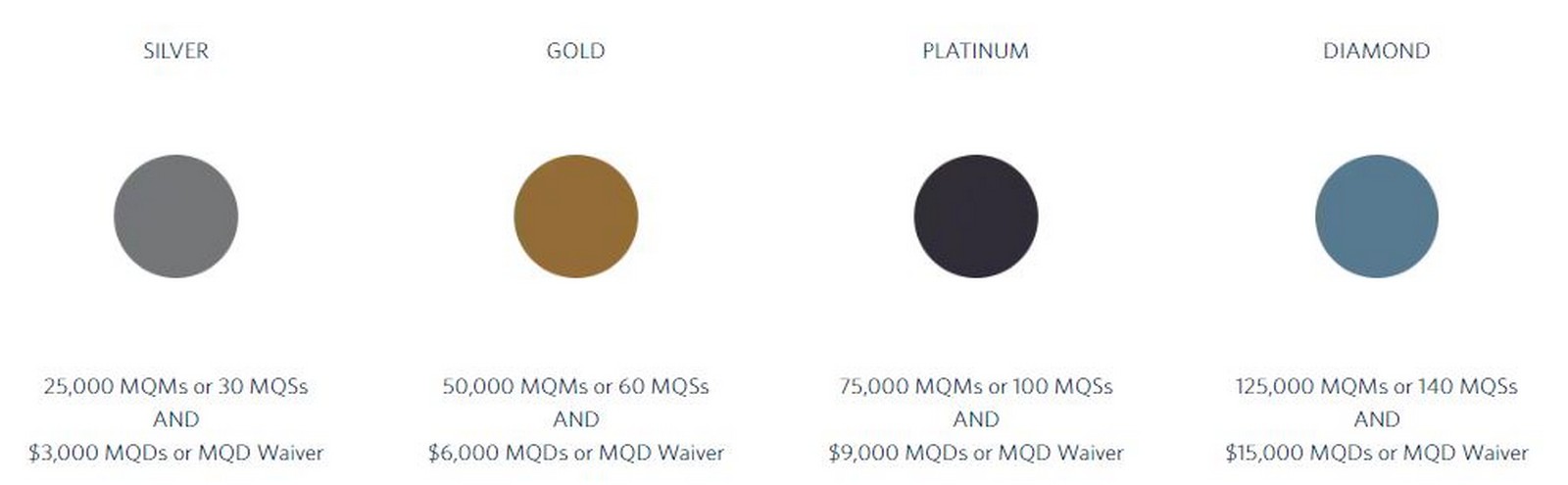

Delta Status MQD Requirements

Before we get ahead of ourselves let’s take a look at the MQD and MQM requirements for each tier of Delta status.

I, as well as many others, find it much easier to rack up MQMs versus MQDs. That is because MQM earnings are based on distance flown. So you can take cheap flights, with non direct routing, to rack them up quicker. Especially with the current bonus earning levels for 2021. There are also often MQM bonuses attached to some of the Amex Delta card welcome offers.

MQDs are a different story, a dollar is a dollar no matter how you slice it. The trick for MQDs, and MQMs for that matter, is to fly Delta partners on cheap fares in premium cabins. These calculations are different from Delta’s own metal when you credit it back to Delta’s frequent flyer program.

When you fly one of Delta’s Core Global Airlines Partners you earn MDQs based on distance flown instead of the cost of the ticket. So a “cheap” business class ticket to a far away place can rack you up those MQDs in bunches. For more info on the earning set up for their partners check here. This would be a great option for me normally, but with the pandemic and so many countries locked down etc. it isn’t really an option this year. Which leaves me with…

Should I Spend Towards Delta Status?

Since partner bookings are not something I am interested in right now that leaves me with the option of spending $25,000 on my Delta Reserve for the MQD waiver. At that point I might as well go to $30,000 for the 15,000 MQM bonus I could get. You can earn the 15K MQM bonus up to 4X per year on the card. If you maxed it out you would earn up to 60,000 MQM with $120,000 in spend. I would just be focusing on the waiver and the 15,000 MQMs myself though. I already have $5,000 in spend on the card from going after the welcome offer. That would leave me with an additional $25,000 in spend needed to hit both.

My Current Situation

So let’s dive into my current numbers. I am sitting on 29,000 MQMs right now, which is more than enough for Silver status. The problem is I only have $250 in MQDs though which is $2750 short of the $3,000 required for Silver status. I have that many MQMs because of last year’s roll over, a flight earlier this year and the bonus on my Delta Reserve card.

I have 3 flights booked currently on Delta for the remainder of the year and one is in first class to Anchorage. These flights should get me over the 50K in MQMs required for Gold status but just barely to the $3,000 in MQDs required for Silver status. I wouldn’t even be close to the $6,000 in MQDs required for Gold status. The 15,000 boost in MQMs at $30,000 in spend would give me an outside shot at Platinum status. It would require me booking a few more flights before the end of the year though, a decent possibility. If not I could roll over any MQMs earned over Gold status towards next year, so not a total loss.

Crunching The Numbers

How much would going after this spend cost me? Let’s break it down. Since I already have $5,000 in spend done I would need to spend $20,000 more for the MQD waiver and $25,000 more for the MQM bonus by the end of the year. Those numbers are doable for me but they would come at a cost.

I have a current spending opportunity where I am able to rack up 5% in rewards without any cost right now. I shared the details of this in our Diamond Lounge spending podcast last month. There is no telling if it will last long term or not but let’s assume it will last until the end of this required spending run.

If I started using my Delta Reserve card for that same spend I would net about 1% in value. Delta Skymiles hover just above 1 cent per mile valuation but I will say 1% to make it easy. That means I would be giving up 4% in real money for each dollar I spend to chase this status.

- $800 in cost for the MQD waiver

- $1000 in cost for the MQD waiver and the 15,000 MQM

That is a large chunk of change. Would I get more than that from the status? Probably, but it wouldn’t be a huge win.

Considering The Roll Over

I alluded to it earlier but one of the interesting options with Delta status is the MQM rollover. Here is what Delta’s site says about it:

In a typical year, the Medallion Qualification Miles (MQMs) you earn above your Medallion Tier will roll over to the next qualification year to give you a jump start on earning Status again. Delta is the only airline to offer this benefit and it is only for Medallion Members. Plus, at each Tier, you earn more miles from your flights to help you get to your next vacation faster.

That is a pretty cool perk of Delta status. You have to earn at least Silver status to take advantage of it. I should hit that status with my current lineup of flights but I would have more than enough MQMs to earn Gold status. So I should be able to roll over all of the MQMs above Silver status to next year, which should be in the 30K plus range. That would give me a huge jump on next year’s status chase.

I would start of the year with enough MQMs to have Silver status right off the bat. It would also give me an entire calendar year to complete the $30,000 in spend should I choose to do it. But more importantly I should be traveling a lot more next year, and the year following, where the status would be more beneficial. Throw in the fact that international travel should (hopefully) be more open next year and you can throw partner bookings for MQDs into the mix. I think all of that together seems like the best option for me.

Spend Towards Delta Status – Final Thoughts

I am leaning towards hitting Delta Silver status and rolling over a ton of MQMs for next year versus trying to max out my status this year. I think it would be more beneficial to me to have higher tier status in 2022 and 2023 versus the rest of 2021 and all of 2022. But I am open to your thoughts too. Am I missing anything? Should I just go ahead with the spending this year to try to shoot for Platinum status? Let me know what you think in the comments.

Everyone’s situation is different but if you fly Delta the reserve is a much better card. I currently have both cards. I usually fly out of JFK. If you have Delta status you can drop off your bag without waiting in line, glide through TSA precheck, and cruise into Centurion or Delta lounge. I often fly to Punta Cana. They only have priority pass lounges. Delta reserve doesn’t give priority pass. Thinking of dropping platinum and going with Hilton surpass which gives you 10 lounge visits for $95 annual fee.

I think the Surpass is heavily underrated for PP access since those 10 visits can be used for as many people as you want to. No 2 guest limit etc. when using them.

This year you will get 18750 MQMs instead of 15K for the $30K spend and 1.75x for premium flights. I’m not sure if that changes your decision but it did for my situation.

That is a good point Nick.