The Best Ways To Fly To India On Points So You Can See The Taj Mahal

If you want to visit India to see the Taj Mahal (among its many amazing sights), these are the best ways to fly to India on points and miles. The Taj Mahal is a world-famous UNESCO site. It’s one of the 7 Wonders of the World. It’s on many people’s “bucket lists”. Here are the best ways to fly to India in economy and business class. We’ll also look at how to earn these miles & points, so you can redeem for free flights to get yourselves there.

What’s In This Article?

Here’s what we will cover today:

- Best Ways To Fly To India in Economy

- Best Ways To Fly To India in Business Class

- How Do I Earn These Miles?

- A Note On Taxes

- Final Thoughts

Best Ways To Fly To India in Economy

If you’re looking for the best ways to fly to India in economy, the miles you need might change depending on where you live. This is because some airlines use distance to calculate mileage requirements. Others consider “zones”, where all of the continental U.S. might be the same zone. Depending on the reward program you’re using, you might go across the Atlantic or across the Pacific. Here are the best options for economy flights round-trip to India.

Another important item to consider is how much you’ll pay in taxes and fees. Taxes are required by law. Some airlines add on excessive “carrier-imposed fees” while others don’t. It’s worth remembering how to avoid those fees when booking, so you can reduce costs. With that said, here are your best options for flights to India with points & miles.

British Airways Flying Club

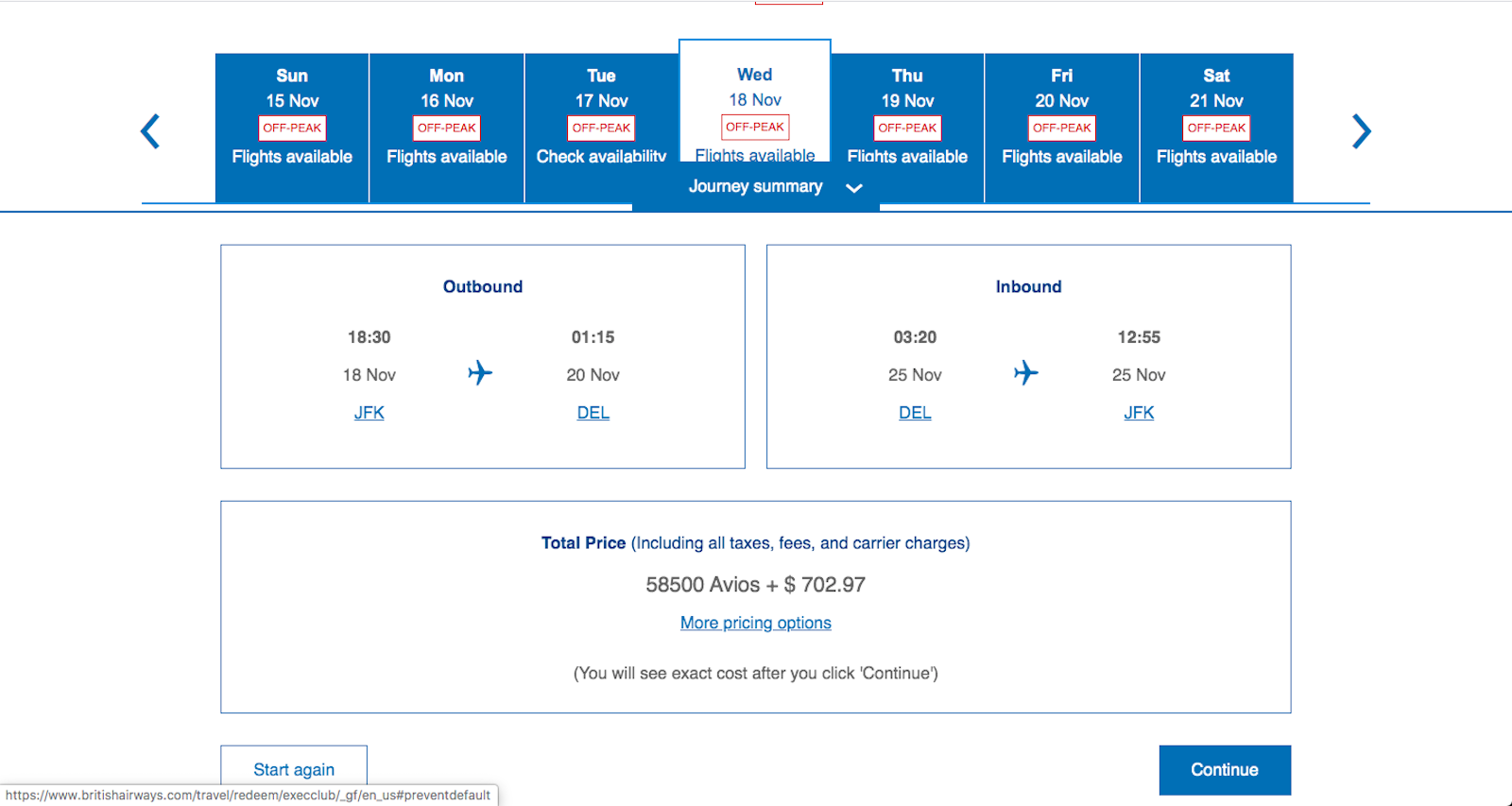

At only 58,500 miles round-trip from the East Coast and 65,000 from the West Coast, using Avios for flights operated by British Airways is the best points option for fewest points required. It’s worth remembering that British Airways has peak and off-peak pricing structures. Traveling during busy periods will require more miles. For British Airways, peak time is roughly the Christmas/New Year holidays and summer times when kids are off school.

British Airways charges heavy fees and taxes for passing through London. The lowest points requirement is using their own British Airways flights, but those are the options with the highest taxes & fees. $702.97 is a lot of cash for a “free” flight in economy. You might find a great deal to buy a cash ticket for something comparable and save your points. The taxes are the same whether flying from the East Coast or West Coast. If you want to reduce the cash requirements by $300, you can use around 40% more points to fly via Hong Kong or Tokyo. British Airways becomes a good option because of this flexibility to trade cash for points or points for cash.

British Airways is a transfer partner of Chase Ultimate Rewards, American Express Membership Rewards, and Marriott Bonvoy (3:1 transfer ratio + 5,000 bonus miles for each 60,000 Marriott points you send).

Delta SkyMiles

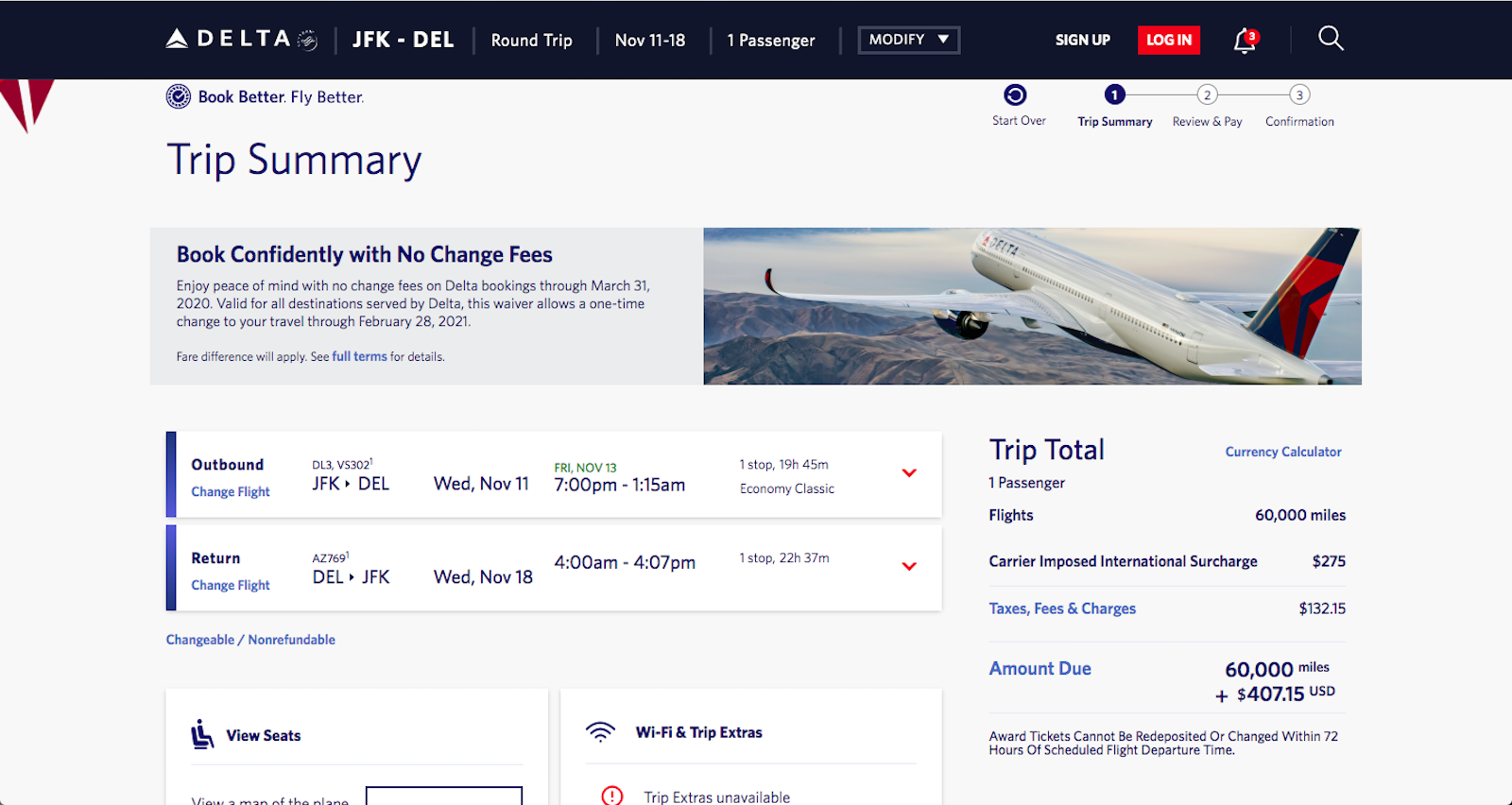

Delta is a great option for flying to India no matter where you are in the U.S. Because Delta has dynamic pricing (more points needed on more popular dates), being flexible with your travel dates really comes in handy. 60,000 miles can get you from any city in the lower 48 to Delhi in economy. From JFK in New York, you’ll need $407.15 for taxes and fees. From LAX, you’ll need $703.75 for the round-trip ticket. Again, you might find a cash deal for that price and save your points.

Delta is a transfer partner of American Express Membership Rewards and Marriott Bonvoy (3:1 transfer ratio + 5,000 bonus miles for each 60,000 Marriott points you send).

Air France

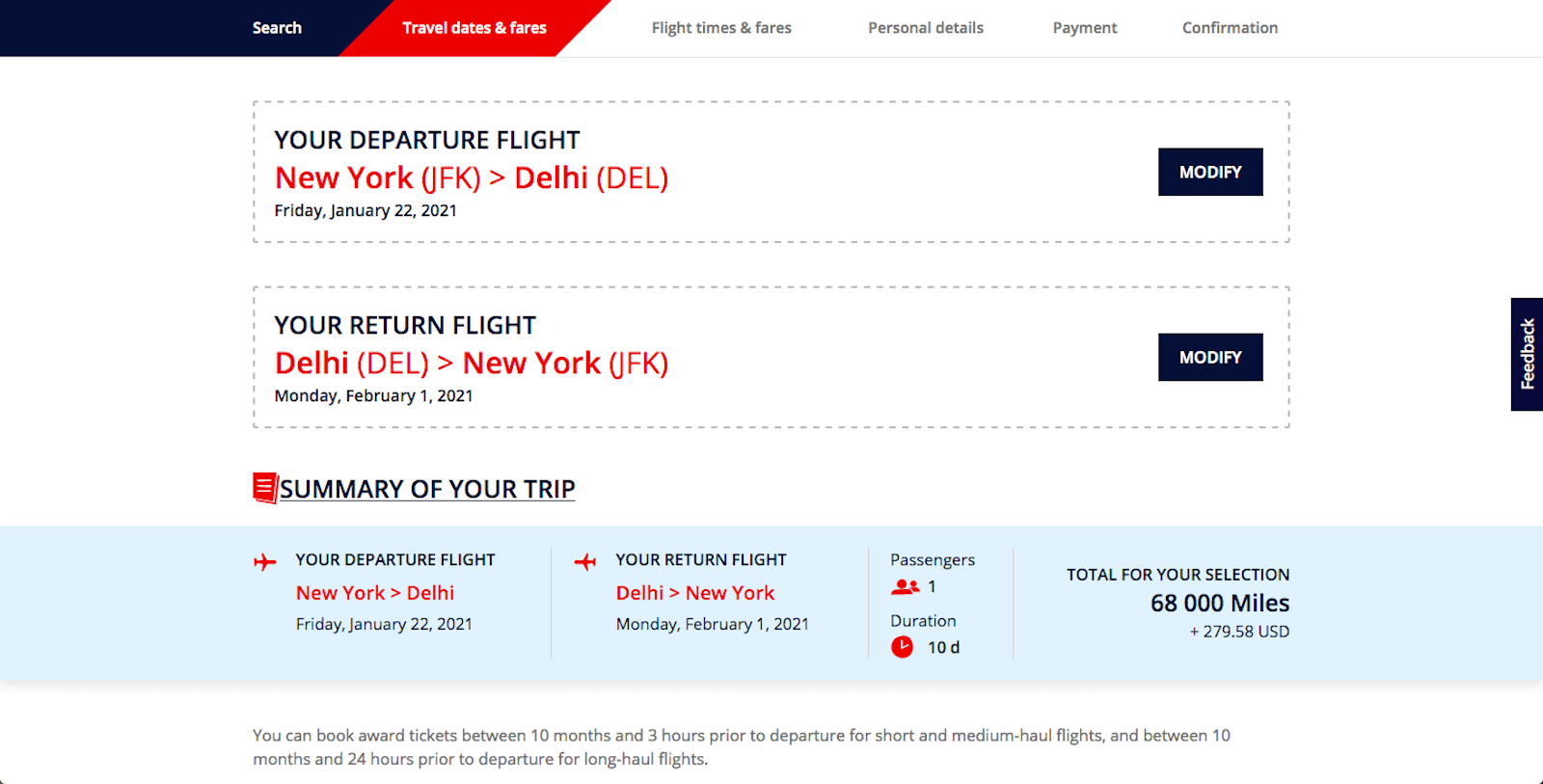

Another SkyTeam member with dynamic pricing can be good for those traveling in low season or on less popular dates. With Air France’s Flying Blue program, you can find flights for as low as 68,000 miles. Taxes and fees are $279.58 from the East Coast. From the West Coast, booking as far ahead as the calendar allows, I still found flights for 68,000 miles round-trip. Taxes totaled $282.53 from the West Coast. While this is 8,000 more points than Delta, the taxes and fees are significantly lower. I’d take this trade — ESPECIALLY for the West Coast prices.

The great thing about Air France is that it’s a transfer partner of everything. You can send over points & miles from Chase Ultimate Rewards, American Express Membership Rewards, Citi ThankYou Points, Barclays (1.4:1 transfer ratio), Capital One Rewards (2:1.5 transfer ratio), and Marriott Bonvoy (3:1 transfer ratio + 5,000 bonus miles for each 60,000 Marriott points you send).

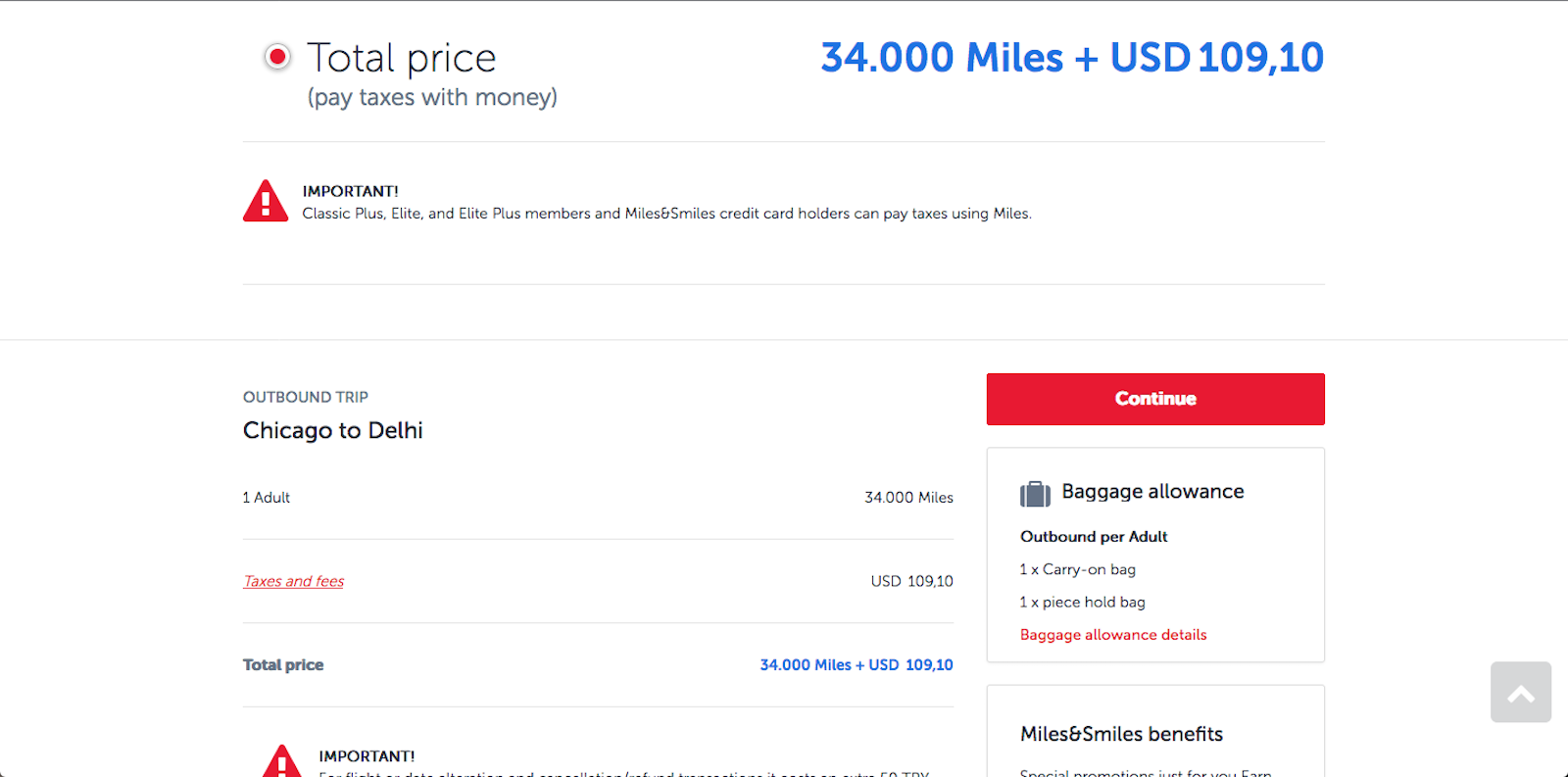

Turkish Airlines Miles & Smiles

The Miles & Smiles program from Turkish Airlines lists their award chart here. From the U.S. (which is in the “North America” zone, so Canada and Mexico are included), you’ll need 68,000 miles round-trip to India in economy. Remember that they will add some pretty serious fees and taxes, though. Also, I could not get Turkish to pair my flights together in a round-trip ticket while giving me saver space. I’d need separate bookings. For 68,000 miles and $307.05 in cash, the effort could be worth it.

Turkish Airlines is a transfer partner of Citi ThankYou Points and Marriott Bonvoy (3:1 transfer ratio + 5,000 bonus miles for each 60,000 Marriott points you send).

American Airlines AAdvantage

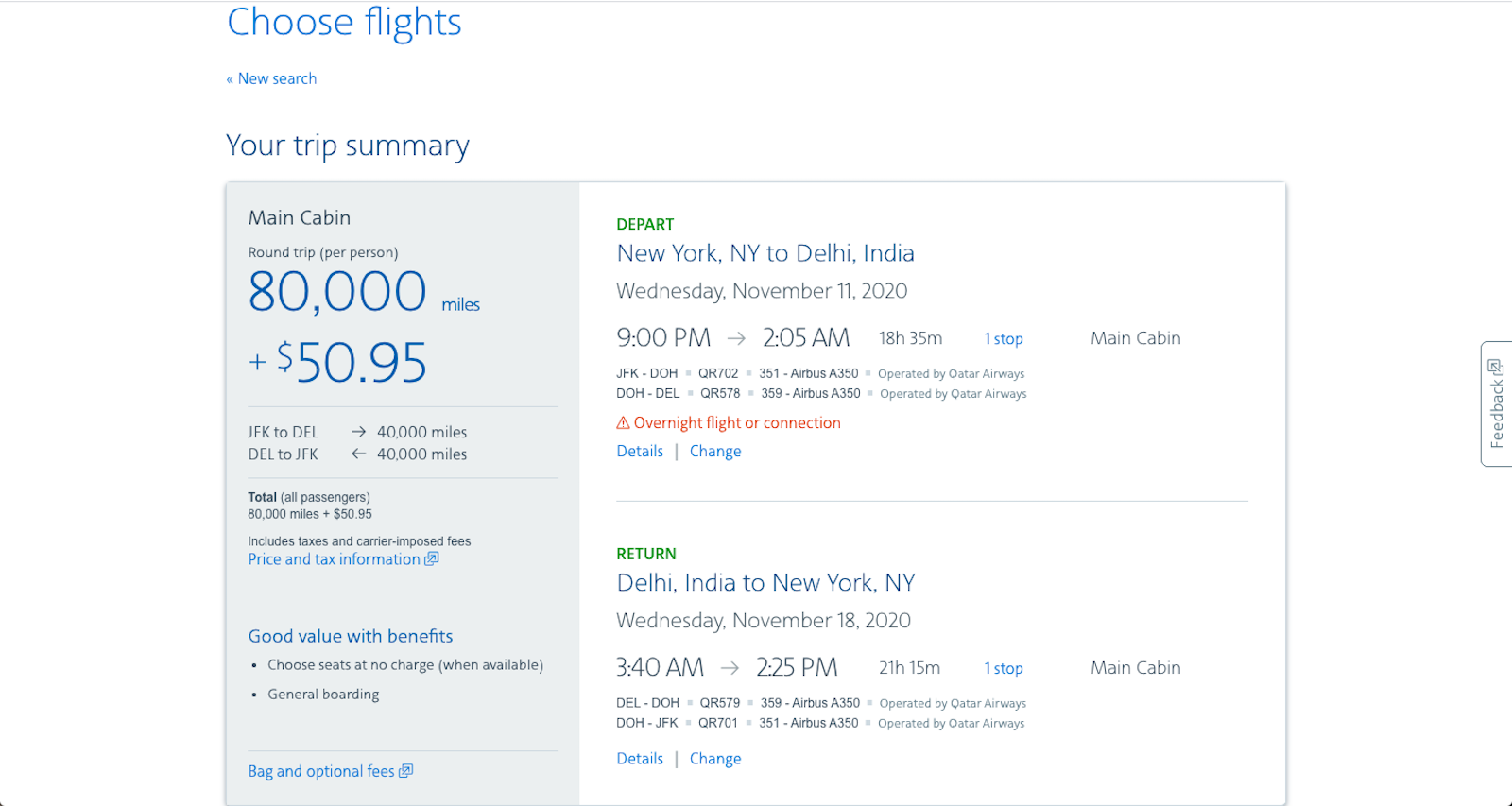

Another oneworld partner that is one of the best ways to fly to India with miles & points is American Airlines. The AAdvantage program requires more miles than others for those coming from the East Coast. However, the mileage requirements are even better if you’re on the West Coast. Regardless of where you live in the continental U.S., you’ll need only 80,000 miles. The taxes and fees are also MUCH better. 80,000 miles for a round-trip ticket from the U.S. to India routing through Doha with Qatar Airways is your best bet. Cash requirement? $50.95.

American Airlines is a transfer partner of Marriott Bonvoy (3:1 transfer ratio + 5,000 bonus miles for each 60,000 Marriott points you send). American Airlines also has co-branded credit cards from Barclays and Citi to help you quickly earn their miles through welcome offers. The CitiBusiness AAdvantage card offers 65,000 miles after spending $4,000 within the first 3 months. The Barclays AAdvantage Aviator card has a welcome offer of 60,000 miles after you make your first purchase within 90 days and pay the $95 annual fee.

A Note About Virgin Atlantic and ANA

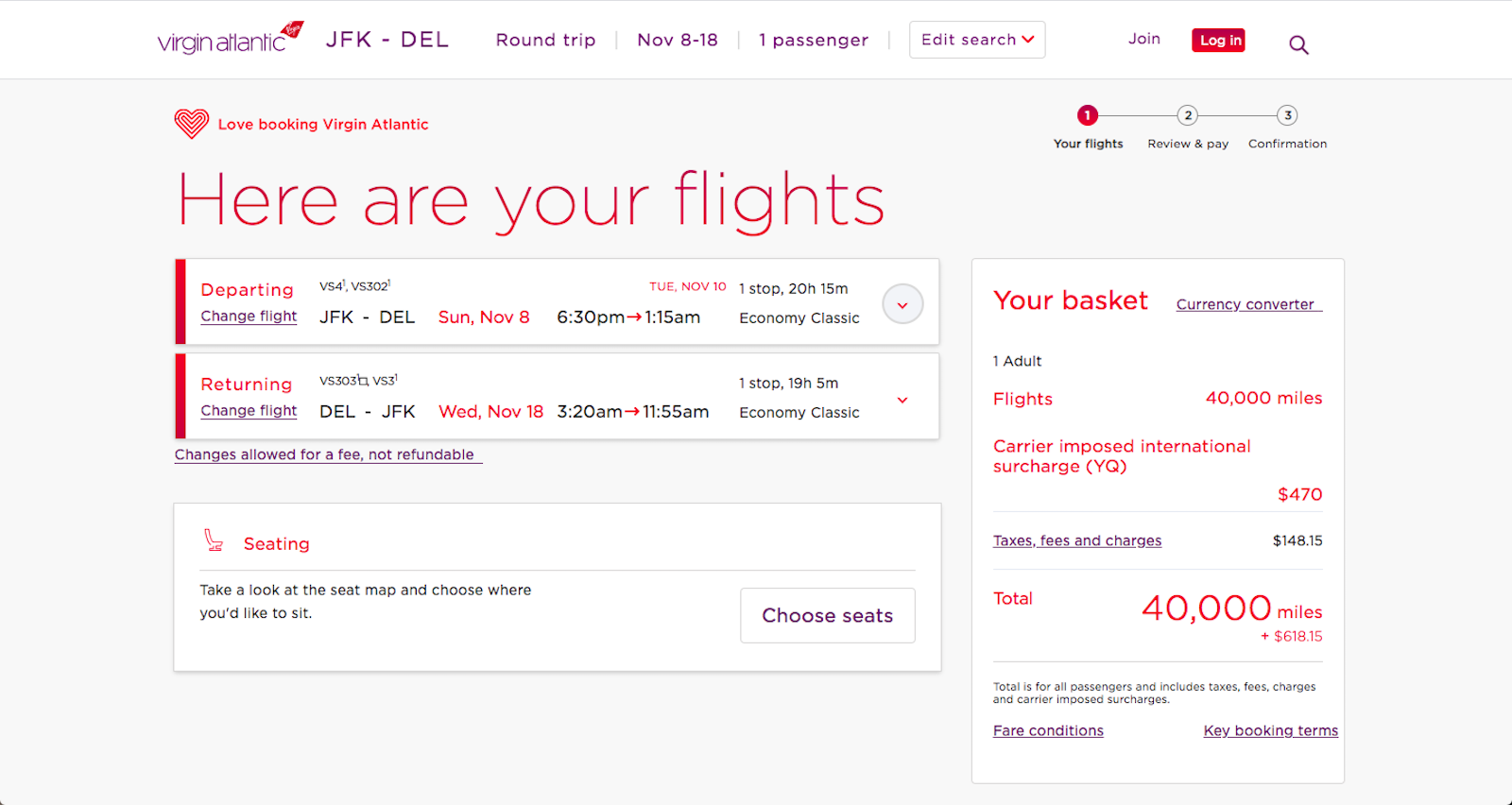

I’d be remiss to not mention Virgin Atlantic’s Flying Club program or ANA Mileage Club. They have some low points requirements, but I don’t consider them one of the best ways to fly to India on miles & points. Why? While the points look good, the fees are awful.

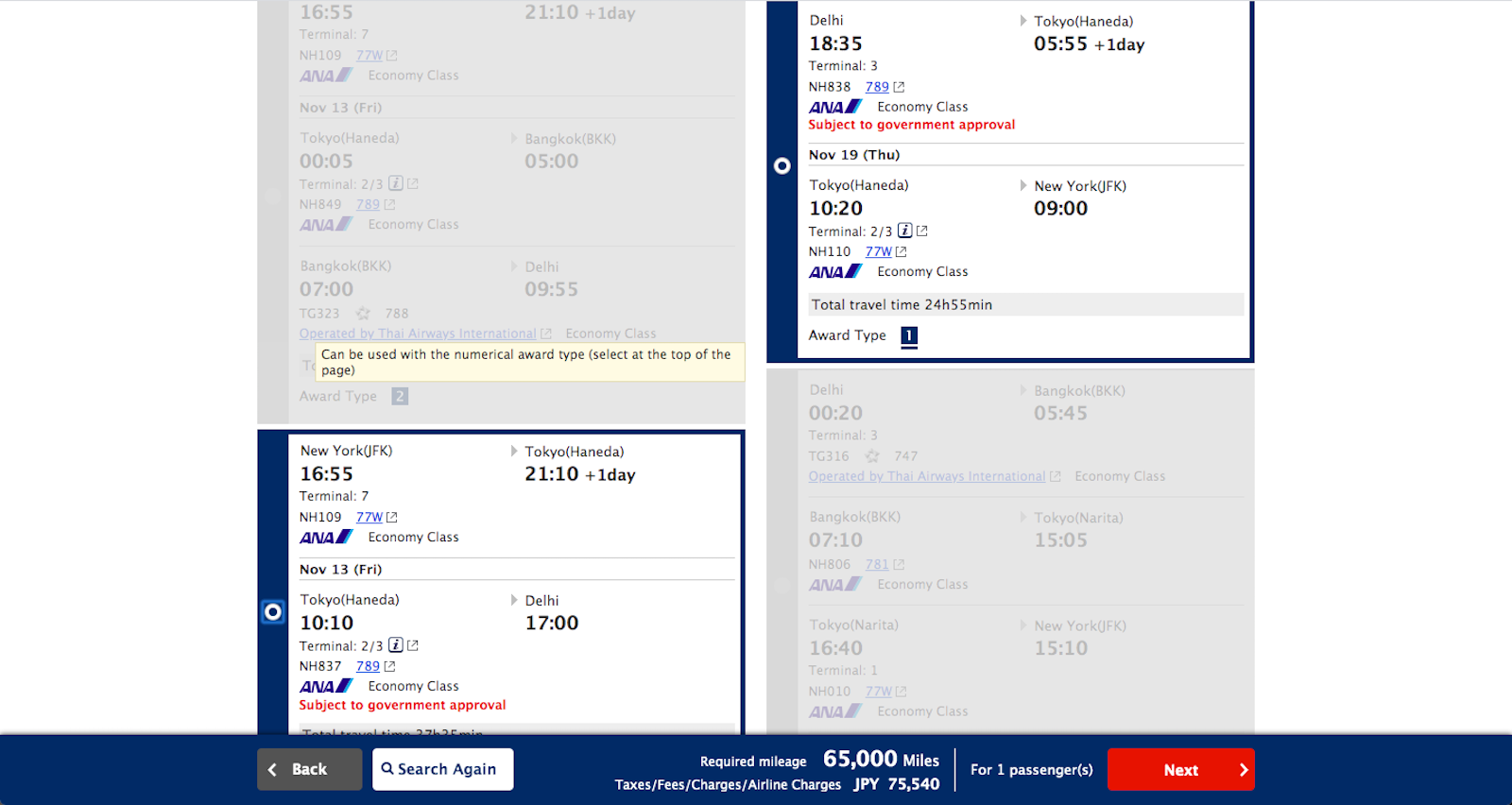

Virgin Atlantic wants 40,000 miles + $618.15 in taxes and fees. Look at the booking page. A full $470 of that is “fees”. Another bad one is ANA. While Japan is one of the countries that prohibits excessive fees for flights departing from there, this doesn’t help on transit. ANA wants 65,000 miles PLUS $723 in cash. No thanks.

Best Ways To Fly To India in Business Class

If you’re looking for more comfort or have extra miles padding your accounts, there are great options for flying to India in business class. Again, we’ll look at different options for West Coast vs. East Coast and differentials in taxes + fees charged by different airlines.

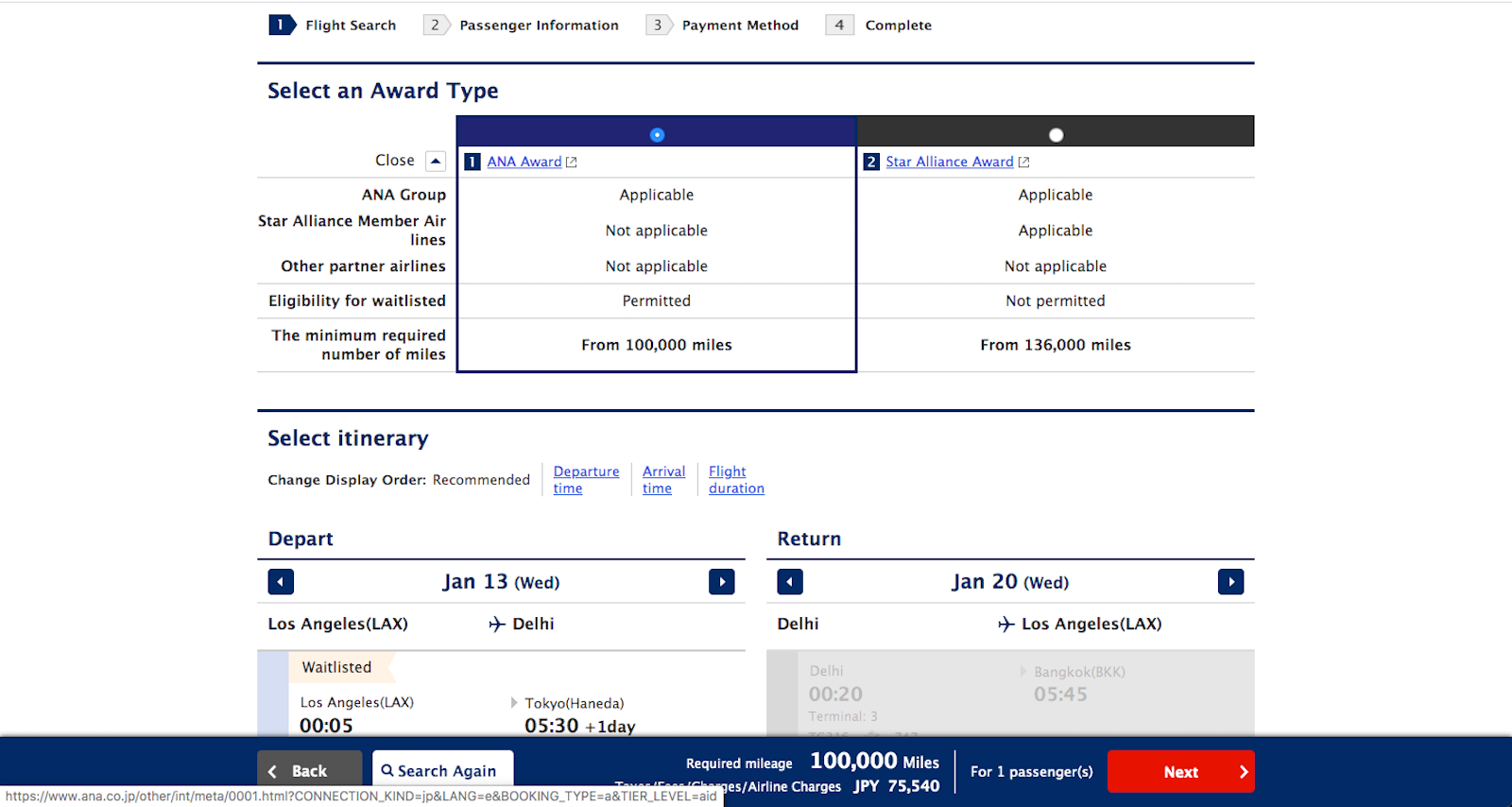

ANA Mileage Club

We can find the ANA mileage requirements here. To go from North America to the Middle East, you’ll need 100,000 miles for a round-trip business class ticket from the West Coast and flying on ANA planes. Notice that you’ll need 136,000 miles if you’re flying on Star Alliance partner flights. The taxes and fees are the same $723 in cash I scoffed at above. I find this more tolerable for a one-stop business class trip on ANA than flying in economy. It’s still not great, though, but it’s offset by the great points requirement.

ANA is a transfer partner of American Express Membership Rewards and Marriott Bonvoy (3:1 transfer ratio + 5,000 bonus miles for each 60,000 Marriott points you send).

Turkish Airlines Miles & Smiles

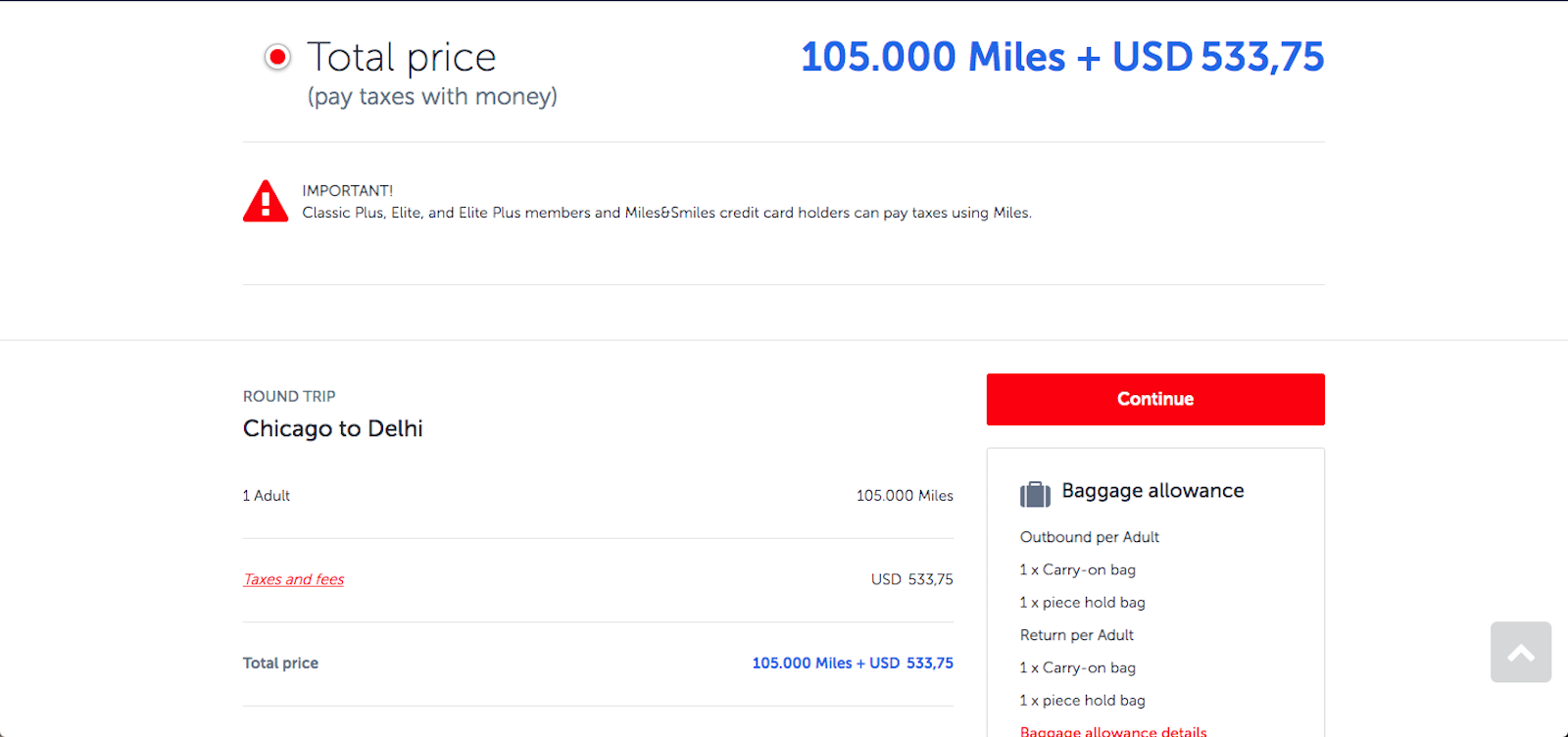

Again, the Miles & Smiles program from Turkish Airlines lists their award chart here. They have low points requirements for business class between North America and India. You’ll need only 105,000 miles round-trip, so this is one of the best ways to fly to India with points. Remember that they will add carrier-imposed fees, though. Also: finding saver award space isn’t the easiest on their long-haul flights out of the U.S. Book early or be very flexible.

Turkish Airlines is a transfer partner of Citi ThankYou Points and Marriott Bonvoy (3:1 transfer ratio + 5,000 bonus miles for each 60,000 Marriott points you send).

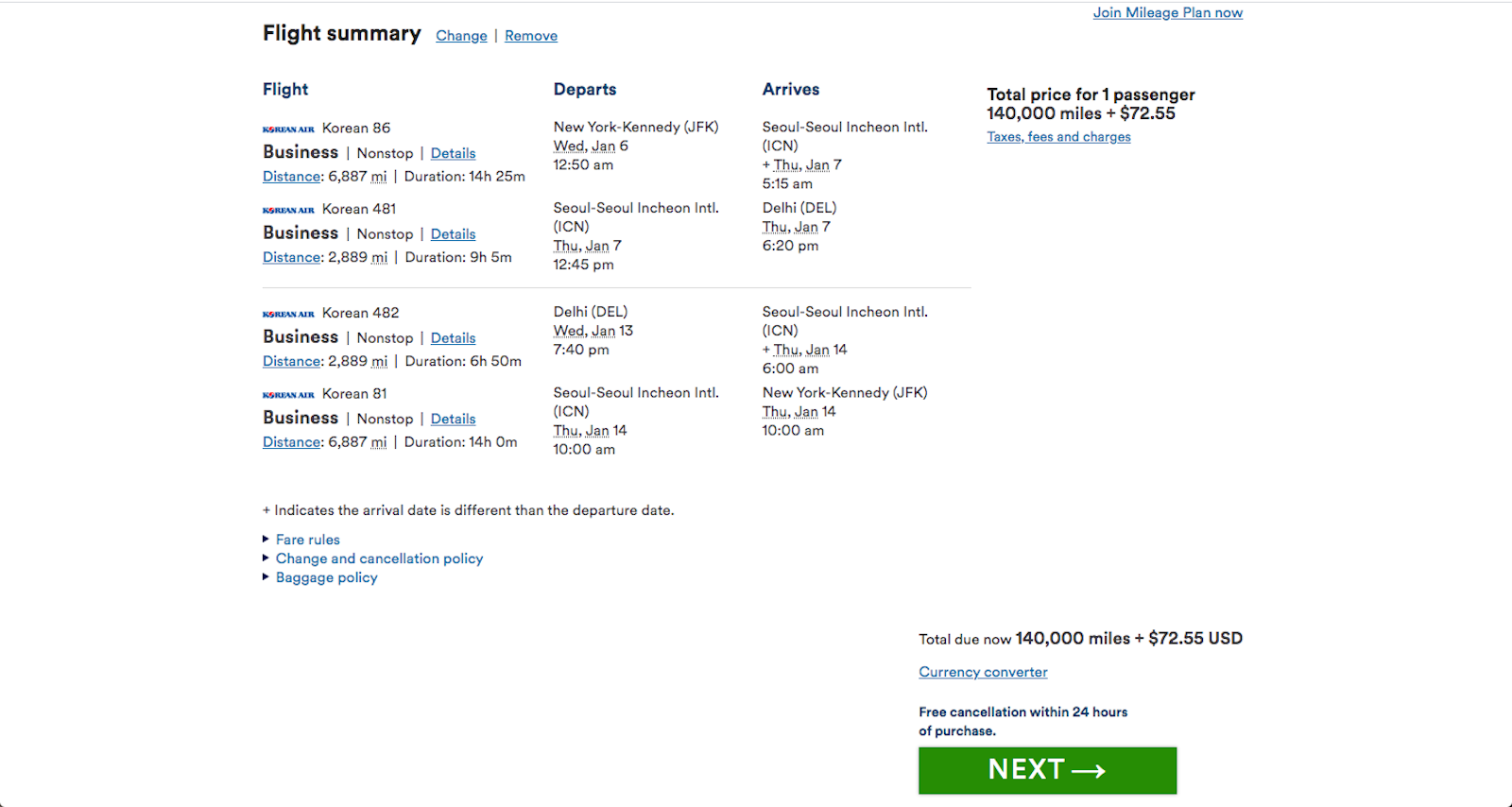

Alaska Mileage Plan

Using Alaska’s Mileage Plan for an award booking is another solid option for business class flights to India. You’ll need 140,000 miles for a round-trip award ticket in business class. The best part of this booking is that the taxes and fees are only $72.55. That’s full business class, not “mixed cabin”, and applies to flights departing from the East Coast or West Coast. I found TONS of availability. This routing is a one-stop in Seoul, South Korea flying the whole way on Korean Air.

Alaska Airlines miles aren’t as easy to come by as they used to be. However, Alaska Airlines is a transfer partner of Marriott Bonvoy (3:1 transfer ratio + 5,000 bonus miles for each 60,000 Marriott points you send). Alaska Airlines also has a personal and a business credit card from Bank of America. The Alaska Airlines Business Card and the personal card currently have the same welcome offer: 40,000 Alaska miles after spending $2,000 in 90 days. The annual fee on either card is $75.

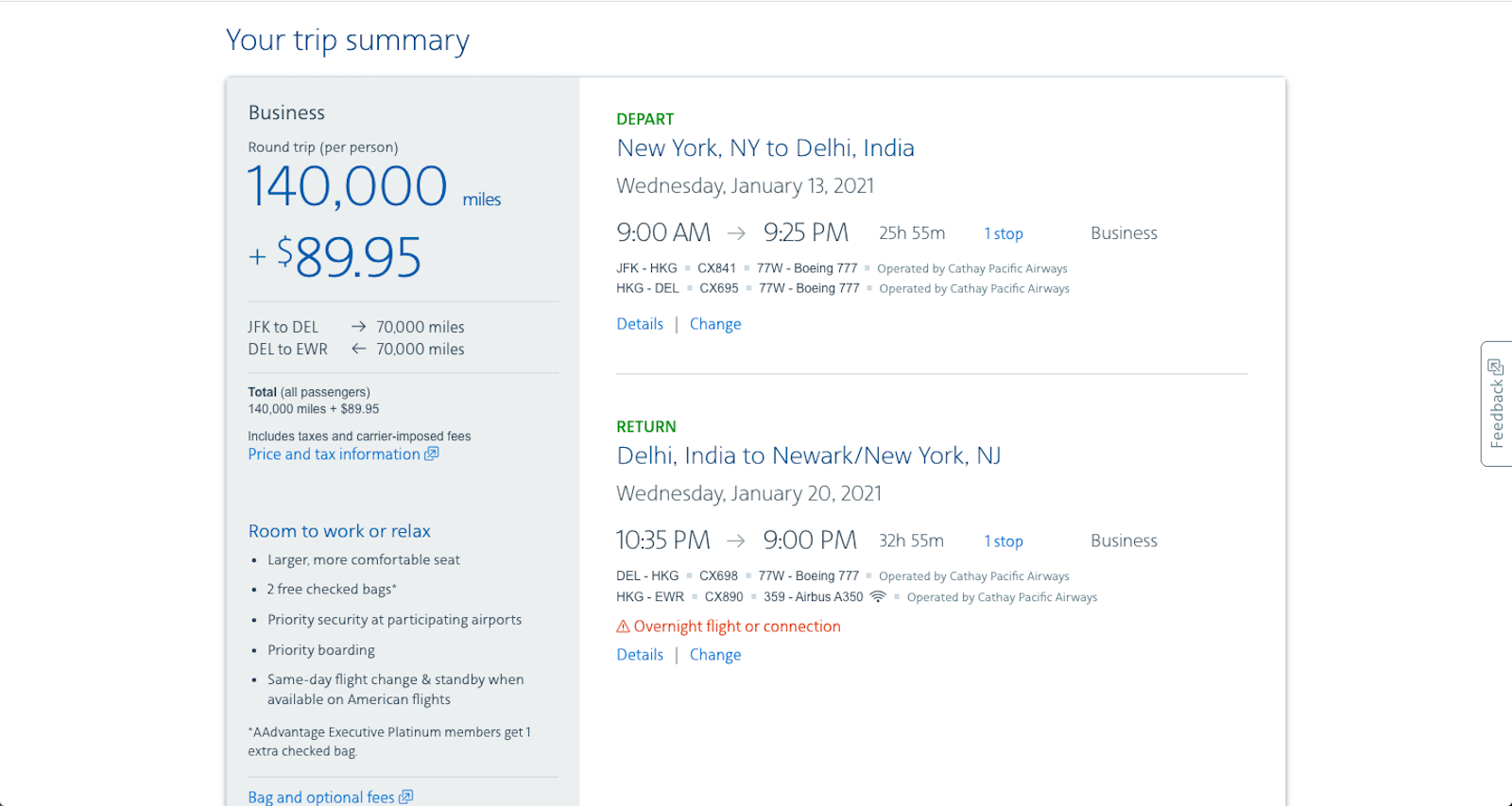

American Airlines AAdvantage

American Airlines’ AAdvantage program one of the best ways to fly to India with miles & points. Regardless of where you live in the continental U.S., you’ll need only 140,000 miles. The taxes and fees are incredibly low if you route through Tokyo (Japan Airlines) or Hong Kong (Cathay Pacific), rather than going through London (British Airways) on partners. 140,000 miles for a non-stop, round-trip ticket in business class from New York to Delhi on Cathay Pacific. Cash requirement? $89.95 only.

American Airlines is a transfer partner of Marriott Bonvoy (3:1 transfer ratio + 5,000 bonus miles for each 60,000 Marriott points you send). American Airlines also has co-branded credit cards from Barclays and Citi to help you quickly earn their miles through welcome offers. The CitiBusiness AAdvantage card offers 65,000 miles after spending $4,000 within the first 3 months. The Barclays AAdvantage Aviator card has a welcome offer of 60,000 miles after you make your first purchase within 90 days and pay the $95 annual fee.

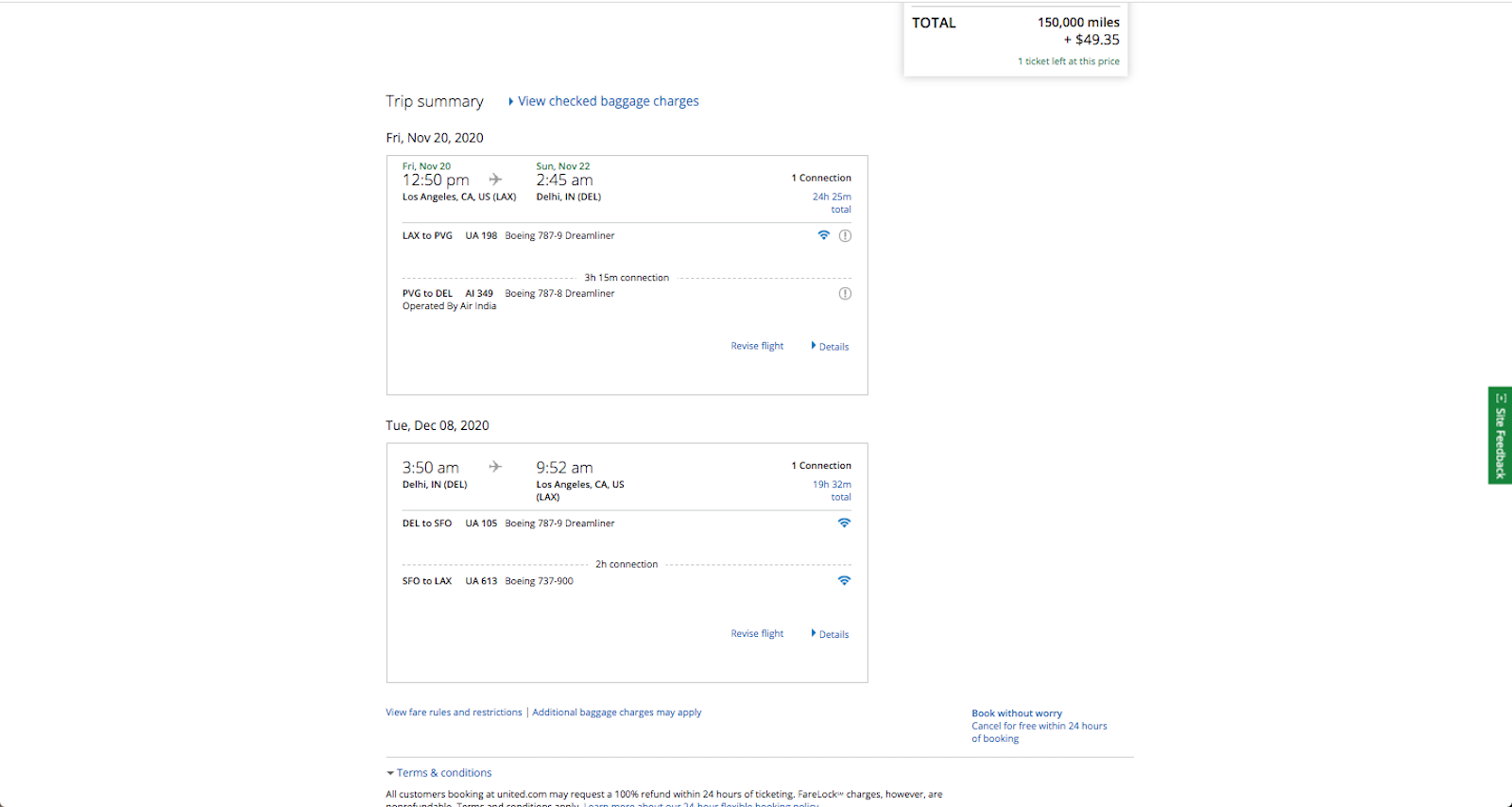

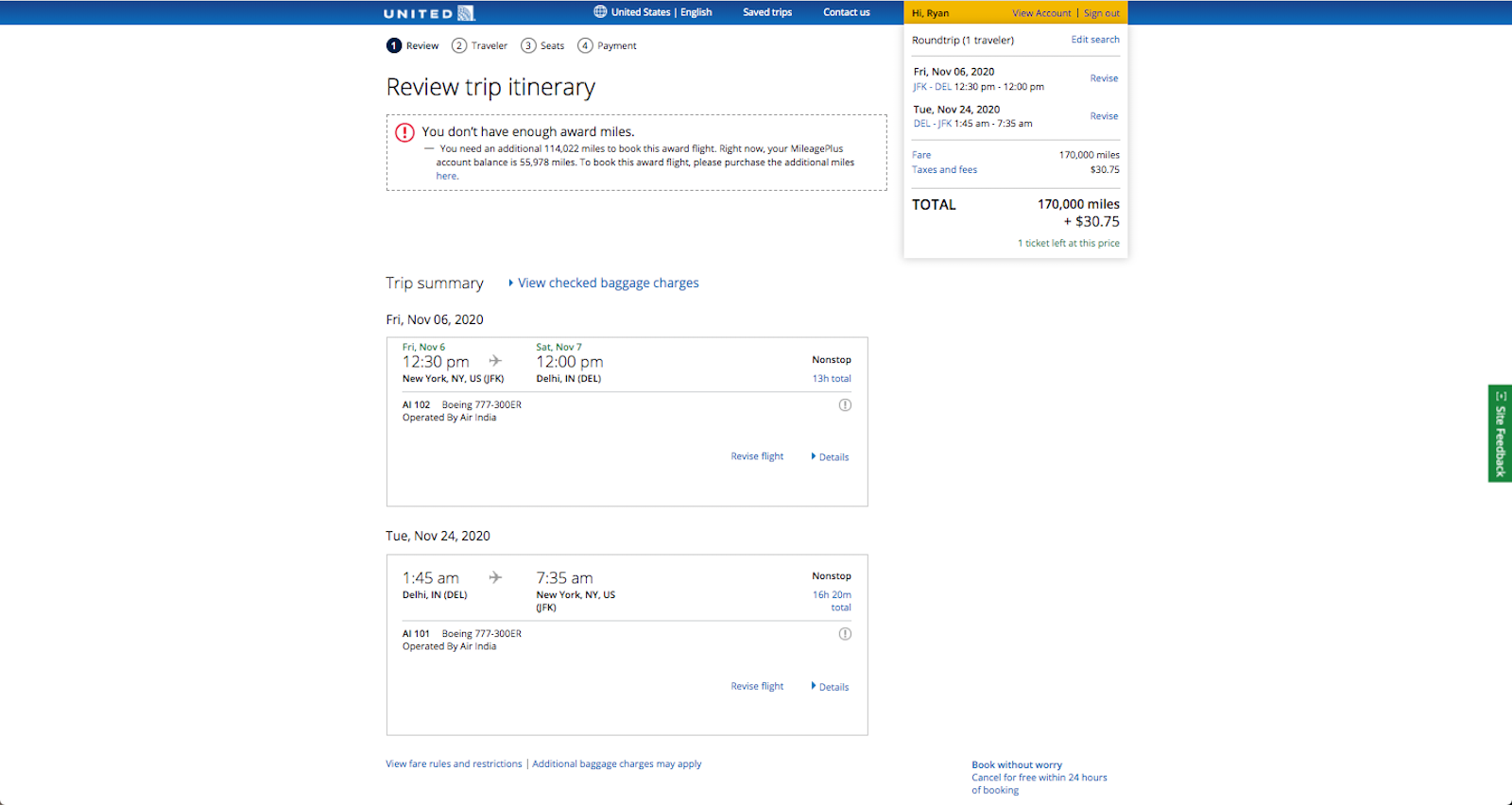

United MileagePlus

While United’s 150,000 MileagePlus miles for a business class round-trip ticket to India comes in at the higher end (Aeroplan, Asia Miles, and Avianca are roughly the same), I’ve included United for 2 reasons. First, we can add extra value with the excursionist perk. Second, the miles are pretty simple to come by through transferring from Chase and welcome offers from United’s co-branded credit cards. United will be a “love it or hate it” option here. Let’s look.

From the West Coast, you’ll need 150,000 miles and only $49.35 for this ticket. One of the reasons people like United is that they won’t charge you extra carrier-imposed fees. This will include United Polaris business class flights with a connection, China in this case. You can reduce the taxes and fly direct if you go on Air India. People have…mixed reviews…on Air India’s business class.

From the East Coast, the points requirements go up to 170,000 miles. That’s not a huge jump, but it can become significant if there’s more than 1 person on the trip. Taking the direct flight from New York JFK to Delhi on Air India requires only $30.75 in taxes for the round-trip booking, plus 170,000 miles.

United is a transfer partner of Chase Ultimate Rewards and Marriott Bonvoy (3:1.1 transfer ratio + 5,000 bonus miles for each 60,000 Marriott points you send). The Marriott transfers give a 10% bonus compared to other airlines, due to the agreement with Chase. United Airlines also has co-branded credit cards from Chase, including some increased welcome offers.

How Do I Earn These Miles?

Now that we know what the best ways to fly to the Middle East, we need to get the required miles. A great way to earn the required miles is through credit card welcome offers. Depending on the points you are looking to earn, these are some great options.

These Offers May Have Ended Or Changed

Chase Ultimate Rewards

Chase has numerous credit cards that can earn their coveted Ultimate Rewards points. Here are some current offers.

- Chase Sapphire Preferred – 60,000 Ultimate Rewards points with a $95 annual fee after spending $4,000 within the first 3 months. The perfect starter card and it offers a ton of value the first year.

- Chase Sapphire Reserve – 50,000 Ultimate Rewards points with a $450 annual fee after spending $4,000 within the first 3 months. The best perks card in the Chase program and a great card for road warriors.

- Ink Business Preferred – 80,000 Ultimate Rewards points with a $95 annual fee after spending $5,000 within the first 3 months. The largest UR points offer Chase has.

These Offers May Have Ended Or Changed

American Express Membership Rewards

If you’re looking to earn Membership Rewards, these cards have excellent welcome offers. There are also targeted offers for the Platinum Card, including 100k or 125k points.

- Business Platinum Card from American Express – Earn 50,000 Membership Rewards points after spending $10,000 within the first 3 months. Earn an additional 25,000 points after spending and additional $10,000 within the first three months. The card comes with a $595 annual fee and an array of travel and business perks.

- American Express Gold Card – Earn 40,000 Membership Rewards points after spending $4,000 within the first 3 months. The card has a $250 annual fee. The Amex Gold earns 4x at US supermarkets and restaurants plus offers dining and airline credits.

- American Express Green Card – Recently revamped, you can earn 30,000 Membership Rewards points after spending $2,000 within the first 3 months with a $150 annual fee. The card earns 3x on travel and dining.

These Offers May Have Ended Or Changed

Citi ThankYou Points

If you’re looking to earn Citi’s ThankYou Points, several cards have strong welcome offers. There’s also the DoubleCash card that has their best overall earning ratio for daily spend.

- Citi Prestige – 50,000 ThankYou points with a $495 annual fee thereafter after spending $4,000 within the first 3 months. The card has a $250 annual travel credit, Priority Pass membership, and earns 5x ThankYou points on air travel and at restaurants.

- Citi Premier – 60,000 ThankYou points with a $0 intro annual fee ($95 annual fee thereafter) after spending $4,000 within the first 3 months. It is the best starter Citi ThankYou card in my opinion. Earns 3x points on travel and gas.

- Citi Rewards+ – 15,000 ThankYou points with no annual fee after spending $1,000 within the first 3 months. Card earns 2x at grocery stores and gas stations. The most unique feature is the “round up” benefit to the nearest 10 points per transaction.

- Citi Double Cash – No current welcome offer (supposedly a $100 statement credit offer is available in-branch). Card earns 2%/2x (cash back can convert to ThankYou points) on all purchases, 1% after purchase and 1% after the purchase is paid off. No annual fee.

Capital One Rewards

For those looking to earn Capital One Rewards, several cards have strong welcome offers. They also offer strong earning on daily spend to help you rack up the points you need for your trip.

- Capital One Venture – 50,000 Venture Miles with a $0 intro annual fee ($95 annual fee thereafter) after spending $3,000 within the first 3 months. Earns unlimited 2x points on everything.

- Capital One Spark Miles For Business – 50,000 Spark Miles with a $0 intro annual fee ($95 annual fee thereafter) after spending $4,500 within the first 3 months. Earns 5x on rental cars and hotels booked through Capital One, plus unlimited 2x points on everything.

A Note On Taxes

All award tickets will have taxes. That’s a guarantee. As I recently mentioned, using the best card for your purchase nets more miles. So does using shopping portals and cash back sites.

I would use an American Express Platinum Card as my first option. That would give me 5 Membership Rewards points per $1 when paying the taxes. The 2nd option would be Chase Sapphire Reserve or American Express Gold Card. Either of those will give me 3 points per $1 (Chase Ultimate Rewards or Amex Membership Rewards).

Final Thoughts

Today, we looked at the best ways to fly to India using miles and points. If you’re looking to visit the Taj Mahal or just interested in the amazing history & culture India has to offer, now we know some great ways to get there. This article looked at flight options in economy and business class. We talked about reducing taxes and fees by choosing different layover airports and different mileage programs. We also talked about earning a good return on your taxes/fees payment by using the best card available. If you’re heading to the Taj Mahal, enjoy it. And remember to get there early to beat the crowds!

All information about American Express cards in this post has been collected independently by Miles to Memories. Some offers mentioned in this post have expired.

In my opinion the best way to travel to India in Economy is to just use Chase Portal with a Chase Reserve redeemed at 1.5x. This will allow you to find the fastest routes and minimize taxes. Also surprised you didn’t include United for the economy. Often times the saver awards could be found for 42.5K one way with $5.6 in fees. Beats other options on taxes.

42.5k one-way means 85k round-trip with United, which is a ton more points than the other options. Sure, it can win on taxes, so this depends on what points you’re trading and the trade-off rate.

Doing a CPM calculation in your example shows that United easily beats British Airways. Cash ticket for BA in your example is $1149 giving it a CPM of 0.76; Cash ticket for United of those same dates is $786 which is almost the same amount as fees on BA. CPM for United even with higher RT points usage is 0.91. As mentioned earlier, I believe the best option is using Chase Travel Portal. Even with Sapphire Preferred rate of 1.25, you’re better off. Not to forget you earn miles which is an additional benefit. I think this is a good article but really believe to make a better comparison and demonstrate an objective picture of the best way to travel somewhere would be normalize everything using CPM.

That’s only a small part of the picture. If you only have miles A, are you going to not book the ticket because miles B would be a better return? No. You’re going to book the best option with what you have.

I mentioned several times in the article that some of these deals aren’t that great and it can be better to just buy a cheap cash fare. I’m not sure what else you’re looking for, but thanks for sharing your ideas.

I agree and hence I was surprised that you didn’t even mention United in the economy section. MileagePlus probably gives you a better value than most other options listed and also gives you multiple non-stop routes using United and/or Air India. All I am trying to convey is that in my opinion this article doesn’t truly demonstrate the best method to get to India.