Update: Chase has updated their interface since this was posted to make things easier. I documented how to track your spending on the updated site here.

Tracking 5X Spend with Chase Ink Business Cards

The Chase Ink Plus & Ink Cash cards both earn 5X Ultimate Rewards points at office supply stores and on cellular phone, landline, internet and cable TV services. For the Chase Ink Plus, your 5X earnings are capped at $50,000 in spend per year while the Ink Cash is capped at $25,000 in spend. Since you’ll want to know when you have hit this threshold and begin earning only 1X, it is important to track your spending.

Thankfully chase has made it easy to track Chase Ink 5X spending. Let me show you how.

How to Track Chase Ink 5X Spending

Login to your Chase Ink account and click to go to the Ultimate Rewards site.

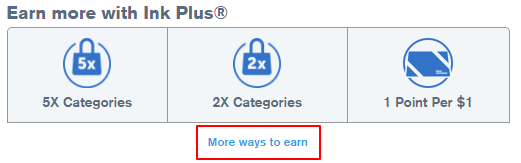

Once on the site, choose the Chase Ink card that you would like to look at from the list of all of your Ultimate Rewards earning cards. Once you have selected your card, click “More Ways to Earn” as shown below.

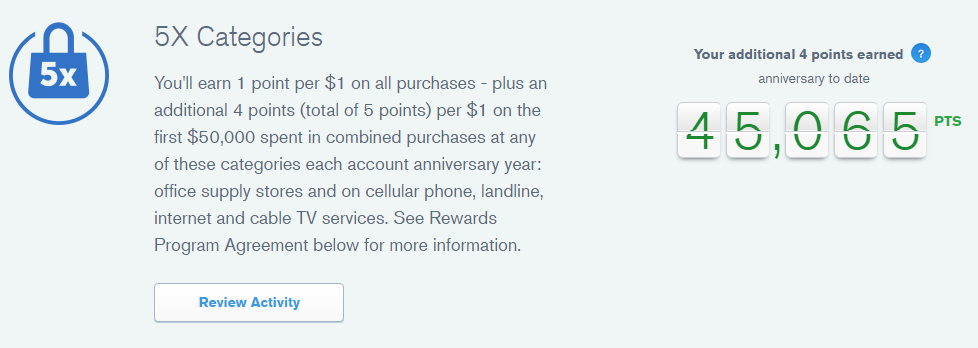

You will now see an accounting of the points you have earned in 1X categories, 2X categories and 5X categories. You are interested in the 5X categories. The website displays only your bonus points earned which are 4 per dollar on top of the normal 1 you earn.

To find out how much you have spent towards your total, simply divide the number by 4. For example, on this card I have spent $11,266 in 5X categories thus far in this cardmember year. That means I still have quite a long way to go before maxing out the $50,000 spend.

Tracking 5X Spend Ink Cash

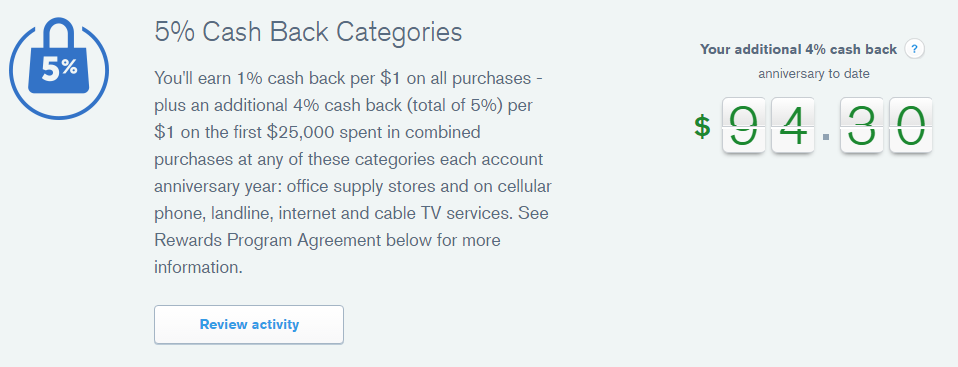

With the Ink Cash things look slightly different since amounts will be displayed as dollars. This is because technically each point is only worth $.01 since the Ink Cash is not a premium card. If you have another Chase Premium card such as the Sapphire Preferred, Ink Business Preferred, Sapphire Reserve or Ink Plus, you can transfer these points over to that account and they become full Ultimate Rewards points.

This card just had its anniversary so I haven’t used it very much in 5X categories. To figure out my spend, I can convert the dollar amount to points by multiplying by 100. $94.30 = 9,430 points. Now I can divide that by 4 just like above and come to the conclusion that I have only spent $2,357 in 5X categories so far this cardmember year. I better get to work.

Finding Out Your Cardmember Anniversary Date

As far as I know, Chase doesn’t display your cardmember anniversary date online anywhere. Many people track this information in their own spreadsheet and if you have a premium card it will often be the date you are charged the annual fee. If you have a no annual fee card like the Ink Cash or just are curious, Chase should be able to give you the exact anniversary date if you ask via secure message.

Conclusion

Chase makes it super easy to track your bonus category spend on your Chase Ink business cards. In addition to the 5X bonus tracking I shared above, you can also track the 3X bonus category spend on the Ink Business Preferred and 2X bonus category spend on both the Ink Cash and Ink Plus exactly the same way. With all of the deals we have seen lately, now may be the time to figure out how much 5X bandwidth you have left so you can take advantage!

Still a useful overview, even as the details have changed much… Have you updated this post somewhere Shawn.? Some improvements yes, but still a bit wild, uncertain…. (like trying to know how much of your purchases were 5x in which sub-category…. (office supply, vs. wireless, etc.) The process remains anything but super easy……. (still a LOT better than the new Wyndham Business Earners card…. which gives you no idea whatsoever…. you have to cross check everything …. by hand)

I applied for 8 cards in the last 2 years before Chase came out with the 5 card rule. Anyway I can clean this up as it keeps me from applying for other cards?

thanks much for this. I had to call CS to ask the same question and they told me over the phone with no acknowledgement of the online (account page) option.

On a different but somewhat related note Shawn, the biggest complaint I have with the Ink card is that their year end summary of charges statement does NOT break down by category spend like my Chase United card and AMEX Surpass, and those are regular personal credit cards. You would think as a BUSINESS card, Ink would do this but for whatever reason, they don’t…only separating charges by authorized card holders (which have a different number). It make tracking and tabulating accurate business expenses a real pain. Complained to CS but they really cant do anything.

Are you sure it’s divided by 4, Shawn? There was a similar post on another blog about a month ago, maybe DEM Flyers? And I remember the post mentioning to look at 250k UR points as the max, which would suggest dividing by 5…

Of course, going by the language on the page, 4 makes more sense, which would mean 200k UR points annually.

Okay now Shawn, how do you only have $11K worth of 5x spend ten months into the year?!? Makes me think you’re holding out on us. Time for another Vegas meet-up so we can share. Voted for you several times on USA today. Keep up the good work buddy!

its because hes smart with multiple INKs and doesnt want to become ShutDownPerDay.com…