Uber Visa Credit Card Details and Review

Barclaycard announced yesterday that they will be releasing a new Uber credit card on November 2, 2017. The question remains – is this a card we should care about? Let’s take a look at the card’s details and see what we come up with.

Details on the Bonus

Get a $100 bonus once you spend $500 within the first 90 days.

Earning Structure

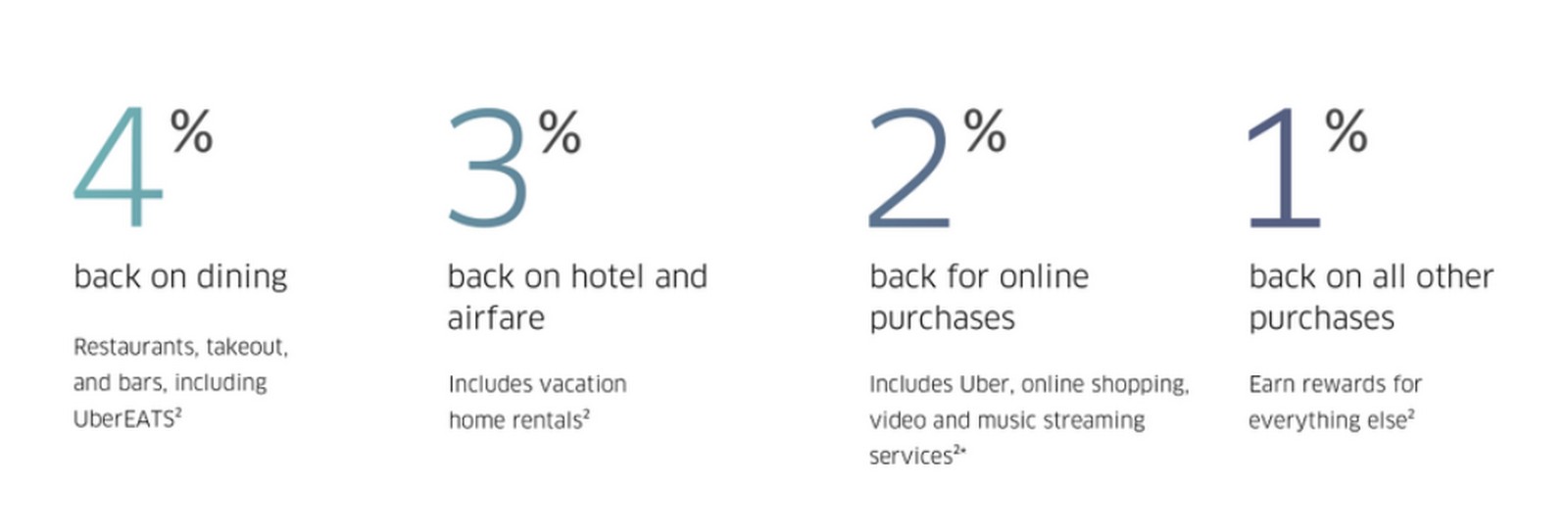

The card comes with a pretty enticing earning structure for a no annual fee credit card. The details are as follows:

- 4% back on dining. This includes UberEATS.

- 3% back on hotel and airfare purchases.

- 2% back for online purchases. This includes Uber rides.

- 1% back on everything else.

You can redeem your earnings as Uber credit, a statement credit, or via gift cards. For Uber credit you only need to have a minimum of $5 in rewards. You need a minimum of $25 in rewards for all other redemptions.

You can get more details on the earning structure by clicking HERE.

Cardmember Perks

There are a couple of valuable perks for this card, especially with it having no annual fee. They are as follows:

- Stream with a $50 subscription credit. Get up to a $50 credit for online subscription services after you spend $5,000 or more on your card per year.

- Mobile phone protection. Get up to $600 for mobile phone damage or theft when you pay your mobile phone bill with your card.

- Receive invites to exclusive events and offers in select U.S. cities.

- No foreign transaction fees.

Sign up Bonus Value – $100

Since there is no annual fee and the points are worth 1 cent each you get to keep the entire $100 value.

Analysis

The Uber credit card by Barclaycard is a pretty enticing card, especially with it having no annual fee. When this is released it could be the best no fee available to consumers.

Offering a 4% return on restaurant spend blows its competitors, other no fee cards, out of the water. It is better than the recently released Capital One Savor card’s 3% earning rate on restaurant spend. I am a little surprised the card does not earn better than 2% on Uber rides though. I think it should have been in the 3% category.

The $100 sign up bonus is pretty ho hum and almost not worth mentioning. The lack of an enticing sign up bonus will keep most people from adding it as a new account. It will be more likely for people to attempt to product change to the card.

A product change is intriguing because of the 4% earning at restaurants and the cardmember perks. Being able to get $50 in free streaming service is unique and a great idea to entice loyalty and encourage spend on the card, since you need to spend $5000 on the card to get the perk. The $600 in phone replacement coverage is also unique for a fee free card and will be tempting for anyone without an Ink card. Having no foreign transaction fees is also a nice touch.

Conclusion

The Uber Visa from Barclaycard is a very solid offering that has a better earning structure than pretty much every co-branded airline card. The lack of an enticing sign up bonus will keep some from applying for it though.

Where the card has a chance to shine is if Barclaycard allows people to product change to it. This will allow someone to get the great cardmember perks without the hard inquiry.

The 4% cash back on dining is an oustanding offer. While you may be able to get a better return from a card with an annual fee, like the Chase Sapphire Reserve or American Express Flexperks, the cards that beat 4% are few and far between.

This is a very strong offering from Uber and Barclaycard and I think it will end up in a lot of people’s wallets. If they would have come out with a stronger sign up bonus, like $250, then this would have been a slam dunk in my opinion.

[…] already has a SSN and credit history they would be better off getting something like the new Uber card. The Deserve Pro could be a possible product change option, from the Deserve EDU, since it offers […]

Just trying to be sure, can the points earned on this card be redeemed directly against my uber rides when charged to this card?

The Barclay Arrival Plus allows one to redeem its points on anything travel related over $100. If the Uber card worked similarly but will allow any price Uber ride to be redeemed then this card becomes a must have card. Do a little MS and you would ride free.

You have to have at least $5 in rewards to redeem them towards your Uber ride but yes you can.