Chase United MileagePlus Explorer 75K + $50 & More

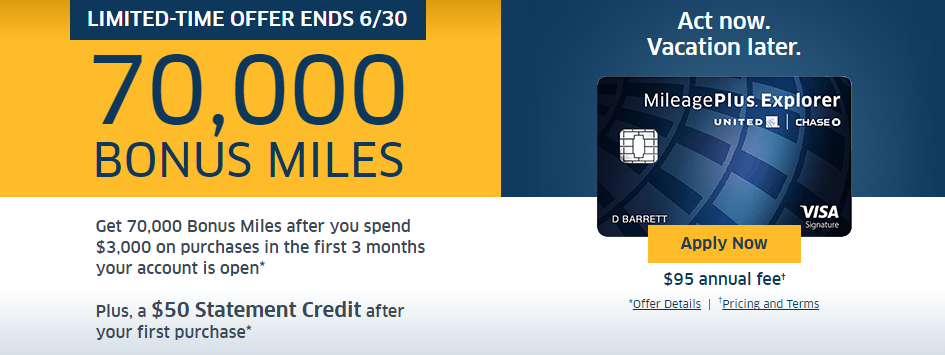

Last week I covered a targeted 70K “best ever” bonus on the United MileagePlus Explorer card. I wasn’t targeted and neither were many of you, but thankfully there is still hope. Chase & United have now rolled out two additional increased bonus offers on the cards. Let’s take a look.

The Three Offers

With each of these offers the $95 annual fee is not waived the first year and they all expire on June 30, 2016.

- Offer 1: 50K after $3K spend + 5K for an authorized user. (Public)

- Offer 2: 70K after $3K spend + 5K for an authorized user. (The targeted offer I wrote about last week.)

- Offer 3: 70K after $3K spend + 5K for an authorized user + $50 statement credit after 1st purchase. (Targeted)

Note: This product is available to you if you do not have this card and have not received a new Cardmember bonus for this card in the past 24 months.

Targeted For One But Not the Other & 5/24

I was not targeted for last week’s offer without the statement credit, but surprisingly I was credited with the new 75K + $50 offer so it pays to check both. I am tempted to apply for this given the value of the bonus and considering the statement credit essentially knocks the annual fee down to $45 the first year. I am clearly well over 5/24, but there is some evidence that targeted offers don’t count towards 5/24 and evidence of people being approved for this card over 5/24.

How to Get the Offers

The 55K offer is a direct public link while the 75K offers will require you to login to your MileagePlus account to see if you have been targeted.

- Offer 1: Direct Application Link

- Offer 2: Click this link and login to see if you have been targeted.

- Offer 3: Click this link and login to see if you have been targeted.

Card Benefits

As a reminder, here are some of the benefits of the MileagePlus Explorer card:

- Earn 2 miles per $1 spent on tickets purchased from United.

- Earn 1 mile per $1 spent on all other purchases.

- Free first checked bag.

- Priority boarding.

- No fees on foreign transactions.

- 2 United Club passes each year for your travel.

Chase Bonus Match

While I have not seen any confirmations of Chase matching the higher 55K or 75K bonuses, in the past they have generally been good about matching public offers. Since the 75K offer is targeted, they may not match that, but it definitely can’t hurt to try. I always send a Secure Message via Chase’s website to ask for matches when a bonus goes up within 90 days of me opening a new account.

Conclusion

The Chase United MileagePlus Explorer 75K + $50 offer is super tempting for me and I may just apply. While United miles aren’t as valuable as they once were, 75K can still get you very far (especially in coach) and given that this is the highest bonus we have ever seen for this card, it seems like now may be a good time to get it again. If I do apply I’ll let you know the results and feel free to share your thoughts and/or experiences with these offers in the comments!

HT: Doctor of Credit

[YMMV] Chase United MileagePlus Explorer 75,000 Miles + $50 Statement Credit

[…] this sign-up has the best overall value given the waived annual fee and 5,000 point bonus. If the United MileagePlus Explorer 75K + $50 offer was public and not targeted, that would have been my choice, but that isn’t the […]

I forgot to mention that it has been 24 months since the last sign up bonus.

Thanks for the post! I currently have a UA card but was targeted for 70k+5K+$50 with a deadline of 6/30. If I cancel the card I am holding, will I qualify to apply again before its deadline? Thanks.

I’m running into problems getting matched as well. I got a similar message at first, so I SMed again with a screenshot. Then I got this:

Thank you for contacting Chase about the enrollment bonus

associated with your United MileagePlus® credit card

account.

I appreciate you sharing this with us. Please understand

that the United MileagePlus Explorer card with 70,000

bonus miles and a $50.00 statement credit has been an

available offer through United.com within the purchase

path. Chase and United have various offers within the

marketplace. In order to receive the applicable offer,

one must apply through that particular channel.

Further, please be advised that we are unable to match the

new 70,000 bonus mile offer to existing accounts. This

new offer is only available by applying through a United

purchase path.

If you need any other assistance, you can send us a secure

message. We appreciate your business and thank you for

choosing Chase.

I would ask that it is escalated to a supervisor who is empowered to help. I have had success doing that in the past, but not specifically with a targeted offer like this.

Thanks for the suggestion! However, I got another negative reply (below). I’m going to assume its because I am beyond the 90 day limit. When I first sent the match request, I was at 84 days since being approved but at 108 days since applying. I wasn’t sure when the clock starts, so I thought I’d push it a bit. I gave it three tries and struck out.

Reply:

Thank you for your recent inquiry regarding the enrollment

offer for your United MileagePlus® Explorer credit card

account.

Since you have opened an Explorer card with different

terms and conditions prior to receiving the 70,000 mile

bonus offer, we regret that we are unable to match that

offer to your current account.

Because your active account is receiving the first year

annual fee waiver and the newer promotion does not include

this bonus, the promotional offers cannot be matched. In

addition, we are unable to bill the annual fee to your

current account.

In order to qualify for the new 70,000 bonus mile

promotion you would need to be a first time Explorer

member and apply using the link provided in your

personalized offer.

Please accept our apology for any previous

misunderstanding or information you may have received.

Please contact us anytime with questions or concerns. We

are here to help and are committed to providing you

excellent service.

I got the card at 50k bonus just 5 weeks ago and yesterday I logged and saw the 70k plus $50 offer. So I emailed chase with the JPG of the screenshot of the offer for a match for additional $1000 spend. Today I get an email saying that there is no such offer ‘by United’ so they can’t do anything.

The wording is curious. It would not be a United offer but rather be an offer from Chase? I mean I do qualify for the highrr offer under my United account number… Should I write them again? Or is chase going to stand their ground??

I was targeted for both 70,000 mile offers, but unfortunately received the last bonus 20 months ago. I’ve been wanting to apply for the business card, but when I looked for that, the offer was only 30,000 miles. I wonder if they’ll match for the business account? but then why wasn’t it offered in the first place?

woohoo! the 3rd link gave me 75K + $50 statement credit. What’s another must-not-missed card/bonus should I considered at the same time?

On the topic of co-branded cards, I have a question. How long has Chase had relationships with United, Marriott, Southwest, etc.? Is it safe to assume that these companies will eventually end their relationships with Chase and co-brand with other banks? I’m asking this because 1) I don’t have a whole lot of experience with co-branded cards, and 2) I’ve been approved for over five cards (different banks) over the past 24 months, so I’m sure Chase is going to start turning me down for these good offers soon.

@ David R,

I’d say it’s not safe to assume that United, Marriot, Southwest, etc. will eventually end their relationships with Chase and co-brand with other banks. I certainly wish they would, but for some reason, Chase has maintained these relationships for years. United and Southwest have been with Chase as long as I can remember, as well as American with Citi, and Delta with AMEX.

Does anyone else have any insight as to why Chase is such a big player in the co-branding field?

Very tempted to apply for the 75k + $50 statement credit!

I had such a card in 2013 and cancelled it in July 2015. I think the 5/24 rule does not apply to me since I have not received the bonus in the past 24 months. Could someone advise on my situation? I really appreciate it

Sunny

That is correct, Sunny. As long as it’s been 2 years since you ‘received’ your bonus.

I’m going for the 75k myself. I originally signed up for the 30k in March because I wasn’t targeted for 50k. Then in May I was targeted to 50k, so I had it matched. And now it’s June and I’m targeted for 70k, so going for another match. Hoping it all works out =]

Thanks Corey for ypur reply. Best luck to you too.

Sunny

how did you match? I literaly applied for the 30k this morning and using your links, was able to get the targeted 50k. Son of a….

Send them a message on Chase site. They should match

Is the 24 month churn period between the time you got the signup bonus and when you signup for the new card or is it between when you closed the previous card and opened the new one?

It has to have been 24 months since you received the bonus and you cannot currently be a cardholder of that product.